The Latest Tax Forms Resource

Welcome to our Tax Forms resource, your one-stop destination for all essential tax documents for the United States. We understand that tax season can be stressful, but we’re here to make it easier with quick access to the forms you need. Whether you’re filing your personal income tax with Form 1040, 1040EZ, or 1040A, or managing your business taxes with Form 941 or Form 720, we have everything readily available. Our goal is to simplify the process, so you can focus on what matters most-completing your taxes accurately and on time.

Beyond the standard forms, we also provide access to specialized documents like Form 1099, Sale Tax Returns, Form 8862, and more. From freelancers needing Form 1099-NEC to those seeking extensions with Form 4868, our easy-to-navigate website ensures you find exactly what you’re looking for. Save time and reduce stress by downloading the forms you need right here, hassle-free!

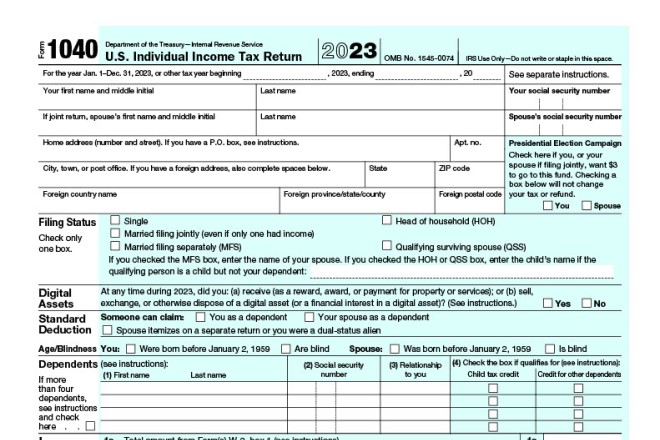

Tax Form 1040

Form 1040 is the standard federal income tax form used by U.S. taxpayers to report their income and calculate taxes owed.

It covers a wide range of income types, deductions, and credits. Filing Form 1040 ensures accurate tax reporting and helps you claim available tax benefits.

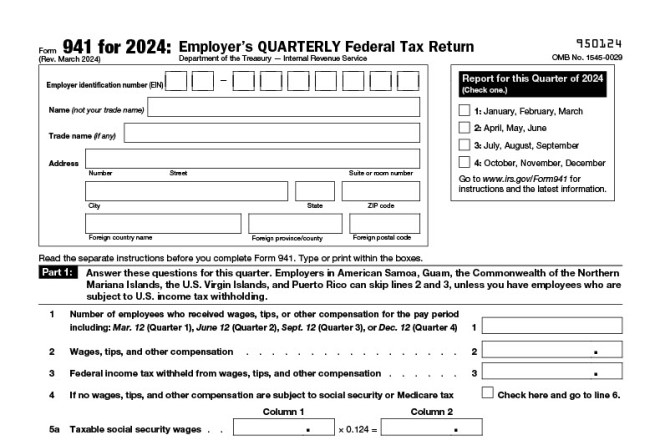

DownloadTax Form 941

Form 941 is used by employers to report income taxes, Social Security, and Medicare taxes withheld from employees’ paychecks.

This form also calculates the employer’s portion of Social Security and Medicare taxes. Employers file it quarterly with the IRS.

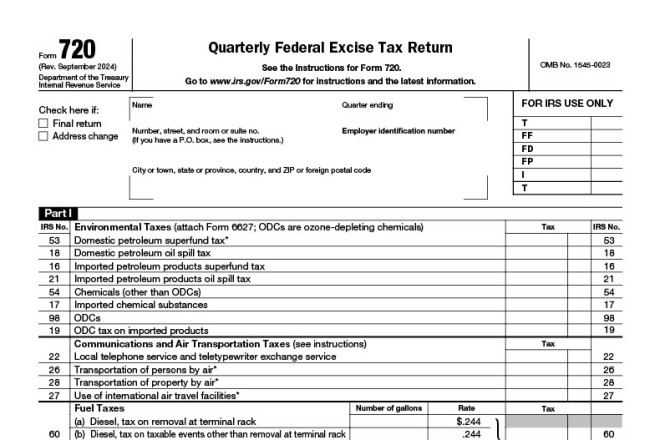

DownloadTax Form 720

Form 720 is the federal excise tax form, required for businesses that deal with certain goods and services.

It reports taxes on items like fuel, environmental fees, and air transportation. Filing Form 720 helps businesses comply with excise tax regulations.

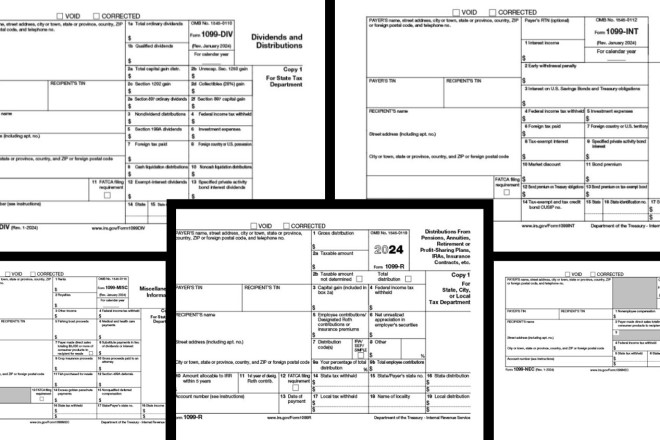

DownloadTax Form 1099

Form 1099 is an essential IRS document used to report various types of income received outside of traditional employment.

There are different versions of Form 1099 depending on the type of income, such as 1099-NEC for contractor earnings, 1099-MISC for miscellaneous income, and 1099-DIV, 1099-INT, or 1099-R for investment dividends, interest, or retirement distributions.

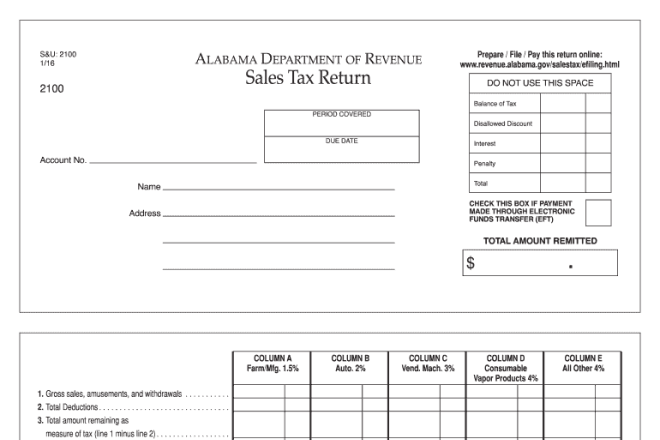

DownloadSale Tax Returns

Sales Tax Returns are filed by businesses to report and remit the sales tax collected from customers. This ensures that companies pay the correct amount of sales tax to state and local governments, helping them avoid penalties and stay compliant with regulations.

Read more to access links for filing sales tax returns in each state.

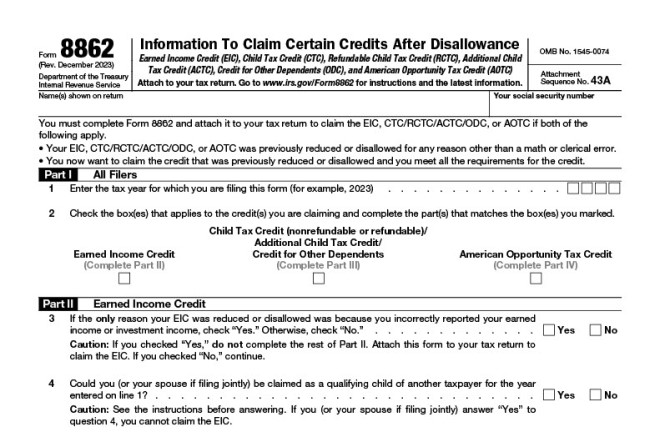

Tax Form 8862

Form 8862 is required if your Earned Income Credit (EIC) was denied or reduced and you want to claim it again.

Filing this form helps the IRS review your eligibility for the EIC and ensures compliance with the credit’s rules.

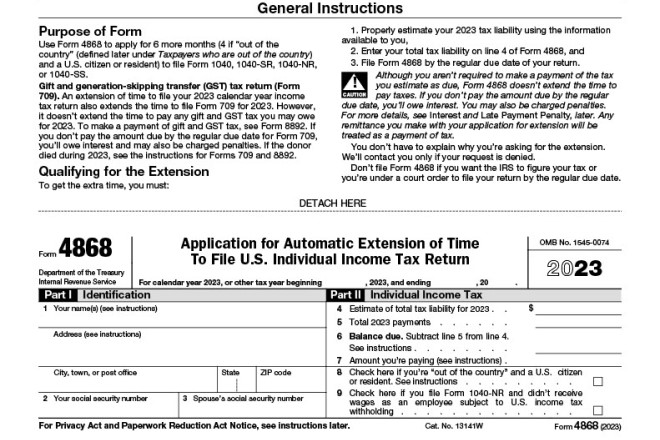

DownloadTax Form 4868

Form 4868 is the application for an automatic six-month extension to file your federal income tax return.

It extends the filing deadline but does not extend the time to pay any taxes owed. Filing Form 4868 helps avoid late filing penalties.

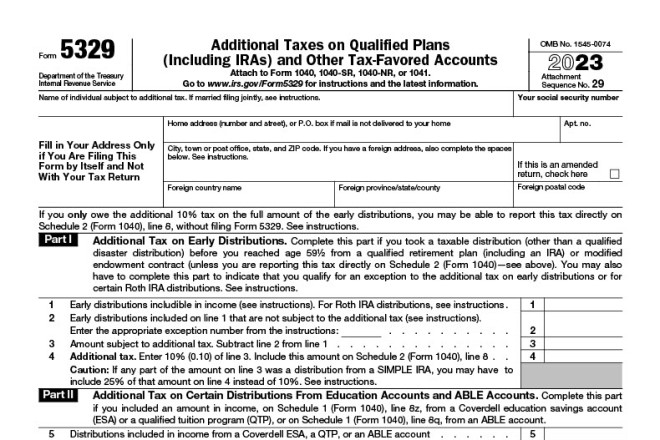

DownloadTax Form 5329

Form 5329 is used to report additional taxes on qualified retirement plans and other tax-favored accounts, such as IRAs.

It addresses early withdrawals, excess contributions, and required minimum distributions. Filing helps avoid penalties for improper account usage.

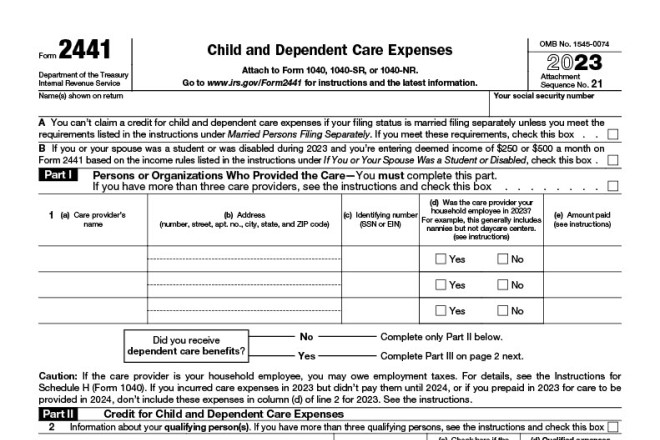

DownloadTax Form 2441

Form 2441 allows taxpayers to claim the Child and Dependent Care Credit for expenses incurred to care for dependents while working.

This form helps reduce your tax liability and supports working families. It’s filed along with your annual tax return.

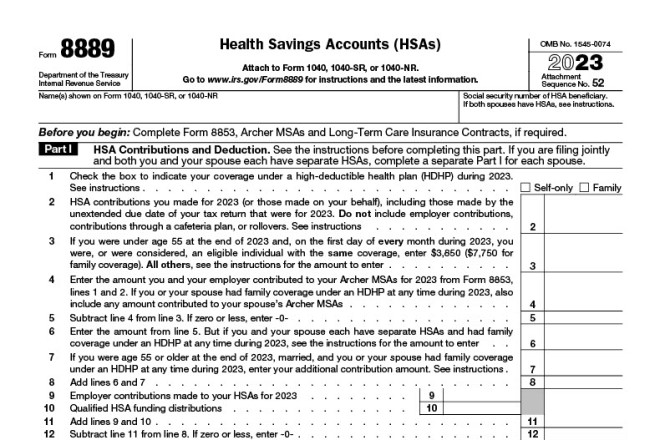

DownloadTax Form 8889

Form 8889 is used to report contributions to a Health Savings Account (HSA), claim deductions, and report distributions from the account.

It helps taxpayers maximize the tax advantages of HSAs and maintain compliance with IRS rules for these accounts.

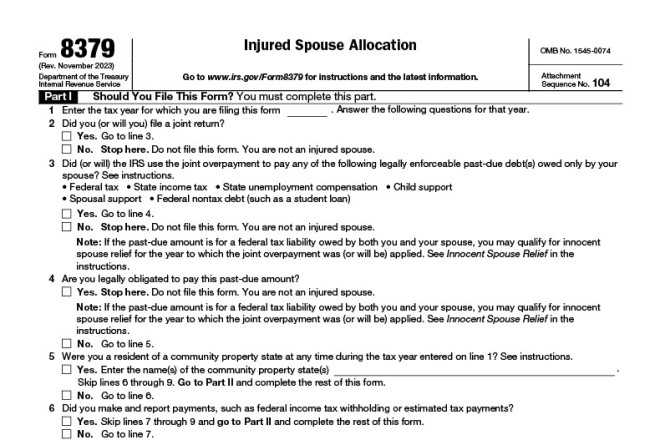

DownloadTax Form 8379

Form 8379 is filed by injured spouses seeking to recover their portion of a joint tax refund when the refund has been applied to their spouse’s past debts.

It helps protect the injured spouse’s share of the refund.

DownloadBenefits of Filing Taxes On Time and Risks of Delaying

Filing your tax forms on time comes with a lot of benefits. First, it helps you avoid any late fees or penalties that can quickly add up. By submitting your forms before the deadline, you also reduce the stress of last-minute filing and give yourself the opportunity to correct any mistakes before they become costly. Plus, if you’re expecting a refund, filing early gets that money back into your pocket faster!

On the flip side, delaying your tax filing or payment can lead to some serious downsides. Late filers can face penalties and interest on any taxes owed, which can turn a manageable tax bill into a much bigger problem. In some cases, you might even risk losing out on important tax credits or refunds if you wait too long. Staying on top of your tax obligations helps you keep your finances in order and avoid unnecessary headaches.

Filing Deadlines for Common U.S. Tax Forms

| Tax Forms | Filing Deadlines |

|---|---|

| Form 1040 | The standard deadline for filing your Form 1040 is April 15th of each year. If April 15th falls on a weekend or holiday, the deadline extends to the next business day. |

| Form 941 | Employers must file Form 941 quarterly. The due dates are typically April 30, July 31, October 31, and January 31 for the respective quarters. |

| Form 720 | This form is also filed quarterly, with deadlines on the last day of the month following the end of each quarter: April 30, July 31, October 31, and January 31. |

| Form 1099 | Form 1099 must be issued to recipients by January 31 for the previous tax year. Businesses must also file with the IRS by January 31 if reporting non-employee compensation (1099-NEC). |

| Sales Tax Returns | Sales tax return deadlines vary by state. Most states require these to be filed either monthly, quarterly, or annually. It’s crucial to check your specific state’s regulations. |

| Form 8862 | If you need to file Form 8862 to reclaim the Earned Income Tax Credit after it was denied, it must be submitted with your Form 1040 by April 15. |

| Form 4868 | This form allows you to apply for a six-month extension to file your federal tax return, moving the deadline to October 15. Remember, this does not extend the payment deadline. |

| Form 5329 | If you owe additional taxes due to retirement account issues, Form 5329 must be filed along with your Form 1040 by April 15. |

| Form 2441 | To claim the Child and Dependent Care Credit, file Form 2441 with your Form 1040 by April 15. |

| Form 8889 | For Health Savings Account (HSA) reporting, Form 8889 is due with your Form 1040 by April 15. |

| Form 8379 | If you’re filing Form 8379 (Injured Spouse Allocation) with your joint return, it should be submitted by April 15. |