1040 2025 Tax Form

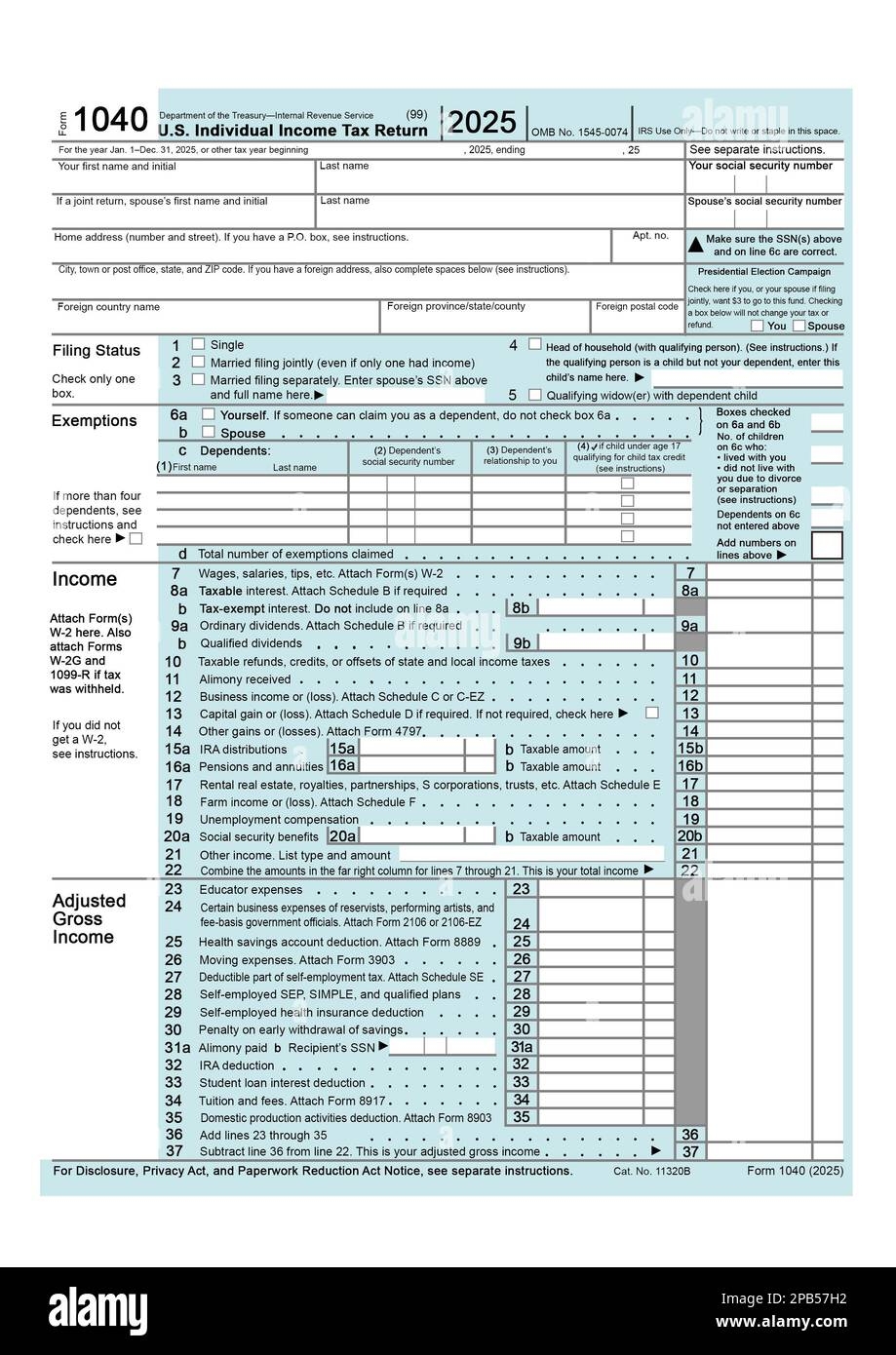

Are you familiar with the 1040 2025 tax form? It’s an essential document for filing your taxes each year. Understanding how to complete this form can save you time and stress during tax season.

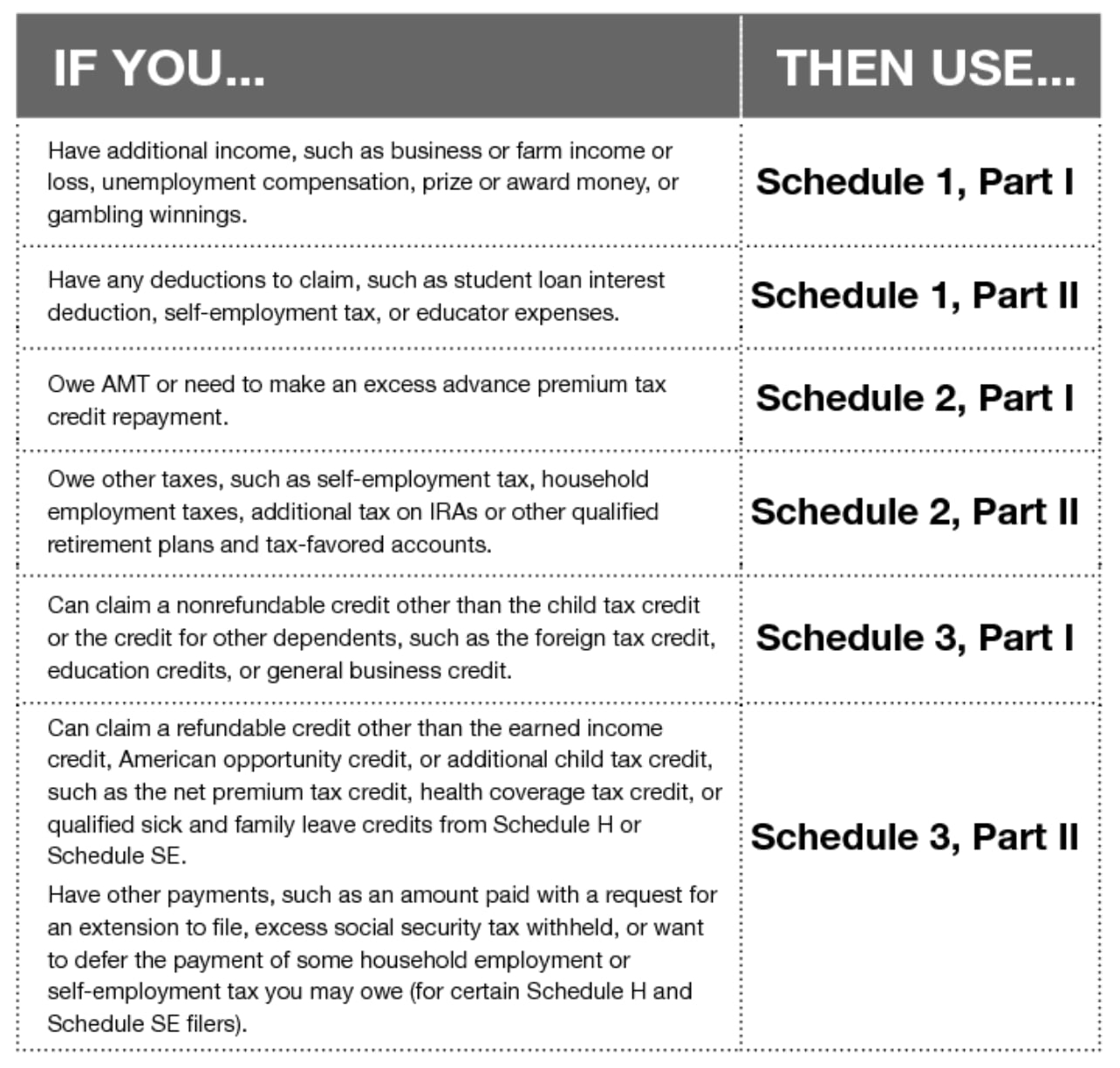

The 1040 2025 tax form is used by individuals to report their annual income and calculate the amount of taxes owed to the government. It includes sections for personal information, income sources, deductions, and credits.

1040 2025 Tax Form

Maximizing deductions and credits on your 1040 2025 Tax Form

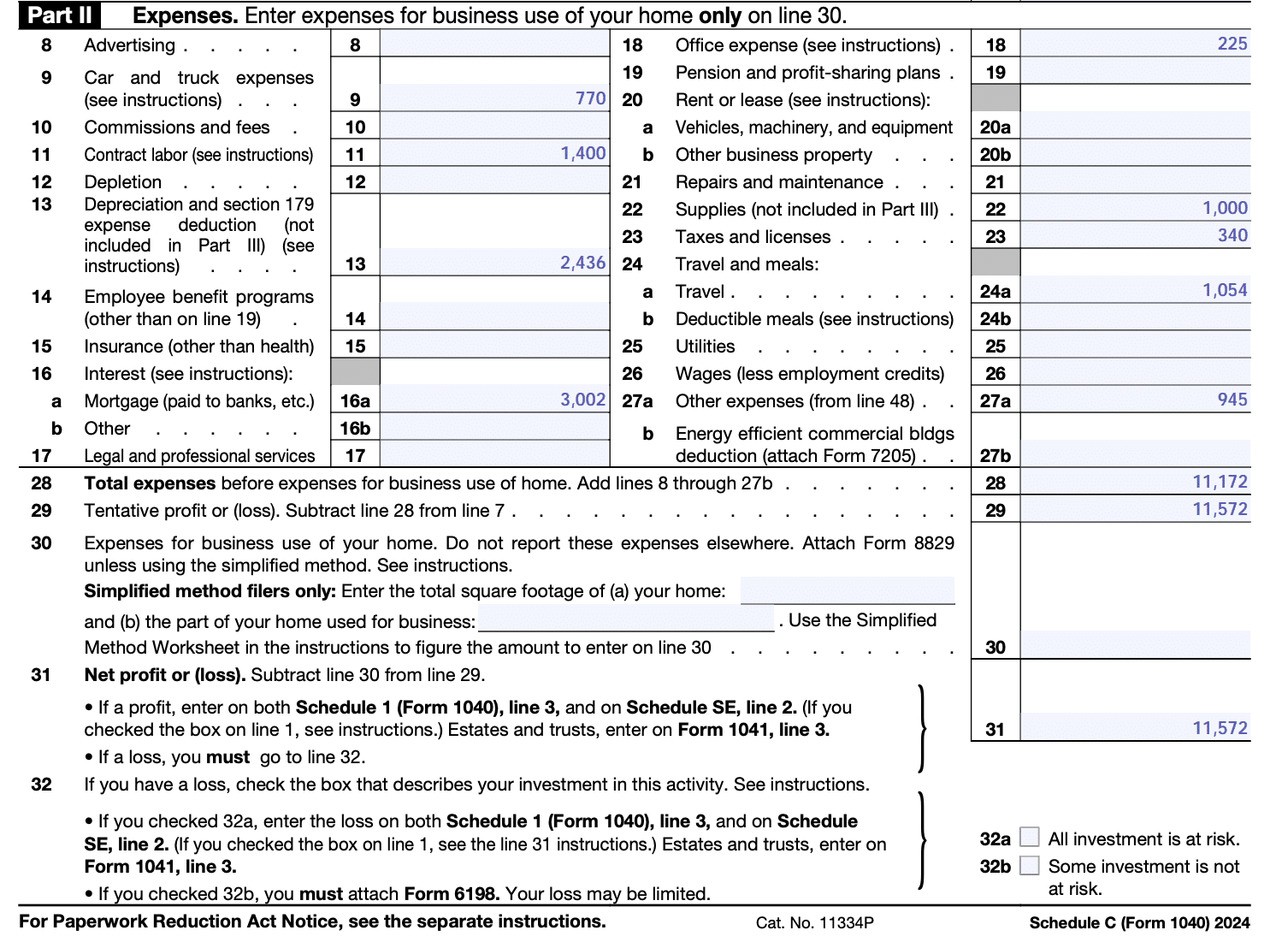

One key aspect of the 1040 2025 tax form is maximizing deductions and credits to lower your tax liability. Make sure to include all eligible expenses, such as mortgage interest, medical expenses, and charitable contributions.

Additionally, take advantage of tax credits, which directly reduce the amount of tax you owe. Common credits include the Child Tax Credit, Earned Income Tax Credit, and Education Credits. Be sure to review your eligibility for these credits carefully.

As you complete your 1040 2025 tax form, double-check all calculations and information to avoid errors. Mistakes can lead to delays in processing your return or even trigger an audit. Consider using tax software or consulting a professional for assistance if needed.

In conclusion, understanding the 1040 2025 tax form is crucial for accurately reporting your income and taxes each year. By maximizing deductions and credits, you can potentially lower your tax bill and keep more money in your pocket. Remember to file your taxes on time to avoid penalties and interest charges.

Form 1040 U S Individual Tax Return Definition Types And Use

Illustration Of Tax Form Business And Finance Concept Stock Photo Alamy

How To Fill Out Schedule C In 2025 With Example

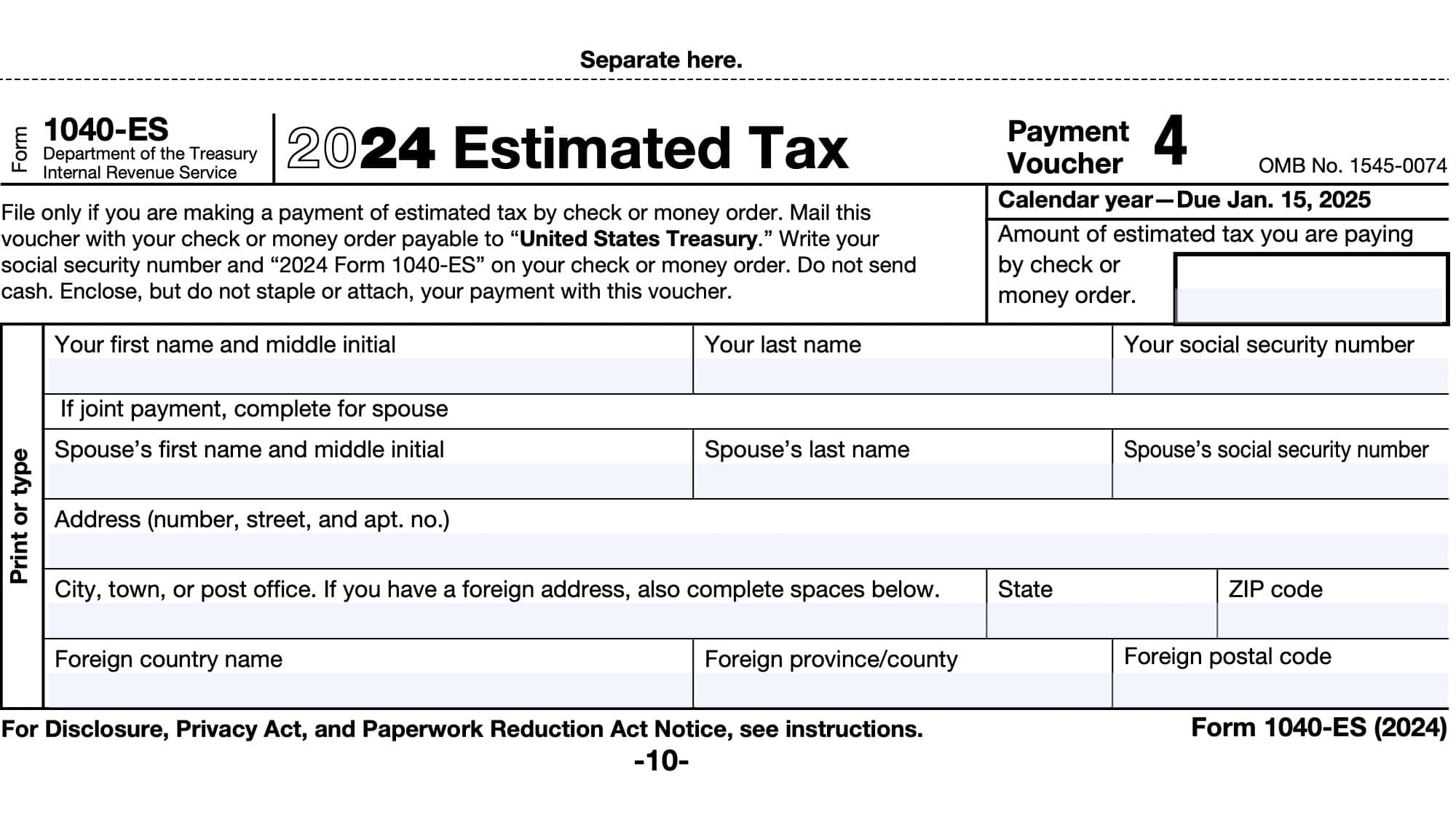

IRS Formular 1040 Ausf llen Infos Zum IRS Formular 1040 ES

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor