1040-ES 2025 Estimated Tax Form

Are you self-employed or have additional income not subject to withholding taxes? If so, you may need to file a 1040-ES 2025 Estimated Tax Form. It’s important to stay on top of your estimated tax payments to avoid penalties and interest.

When you file your taxes, you typically pay taxes throughout the year through withholding from your paycheck. However, if you don’t have taxes withheld or if the amount withheld is not enough, you may need to make estimated tax payments using Form 1040-ES.

1040-ES 2025 Estimated Tax Form

Understanding the 1040-ES 2025 Estimated Tax Form

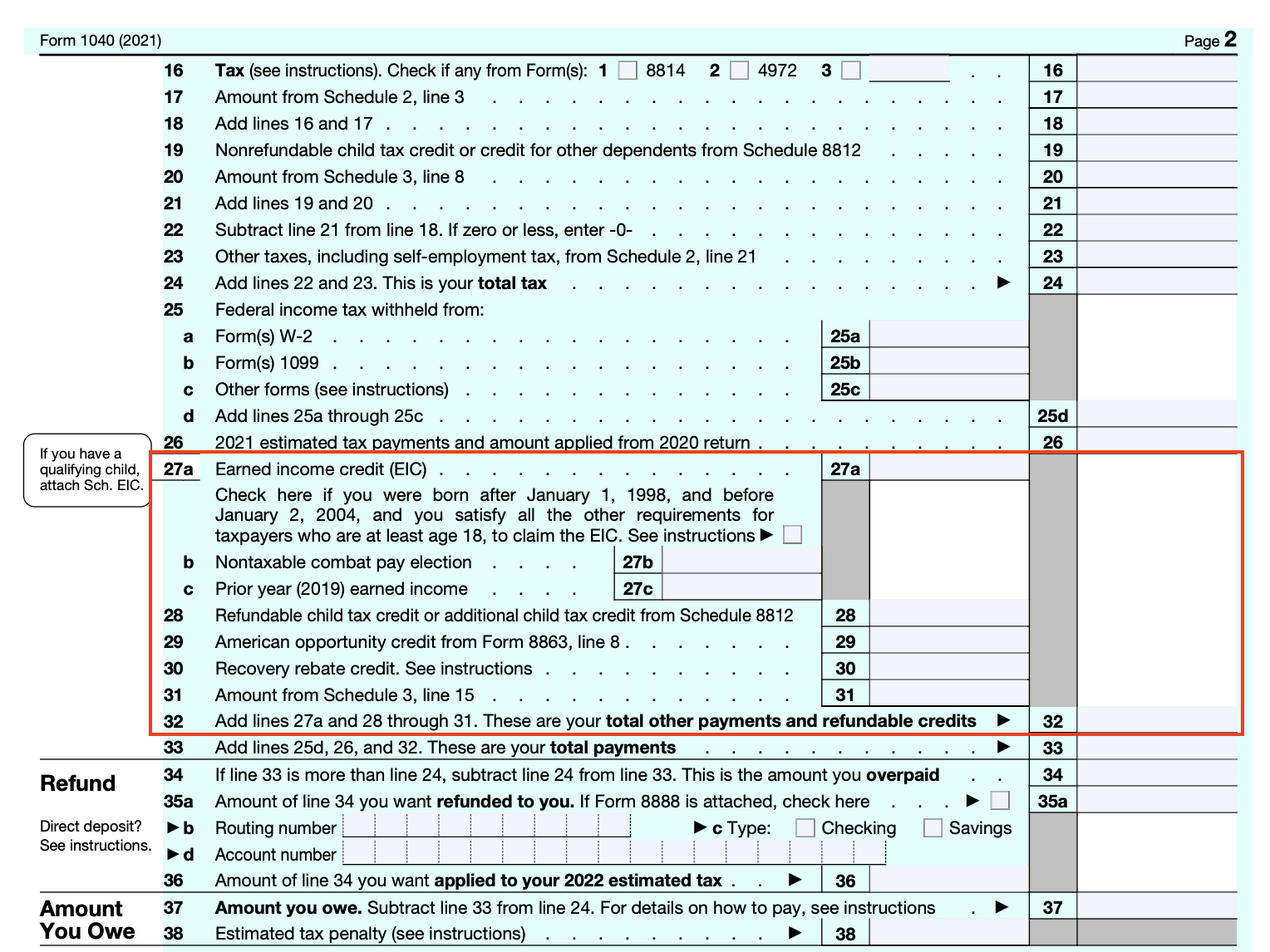

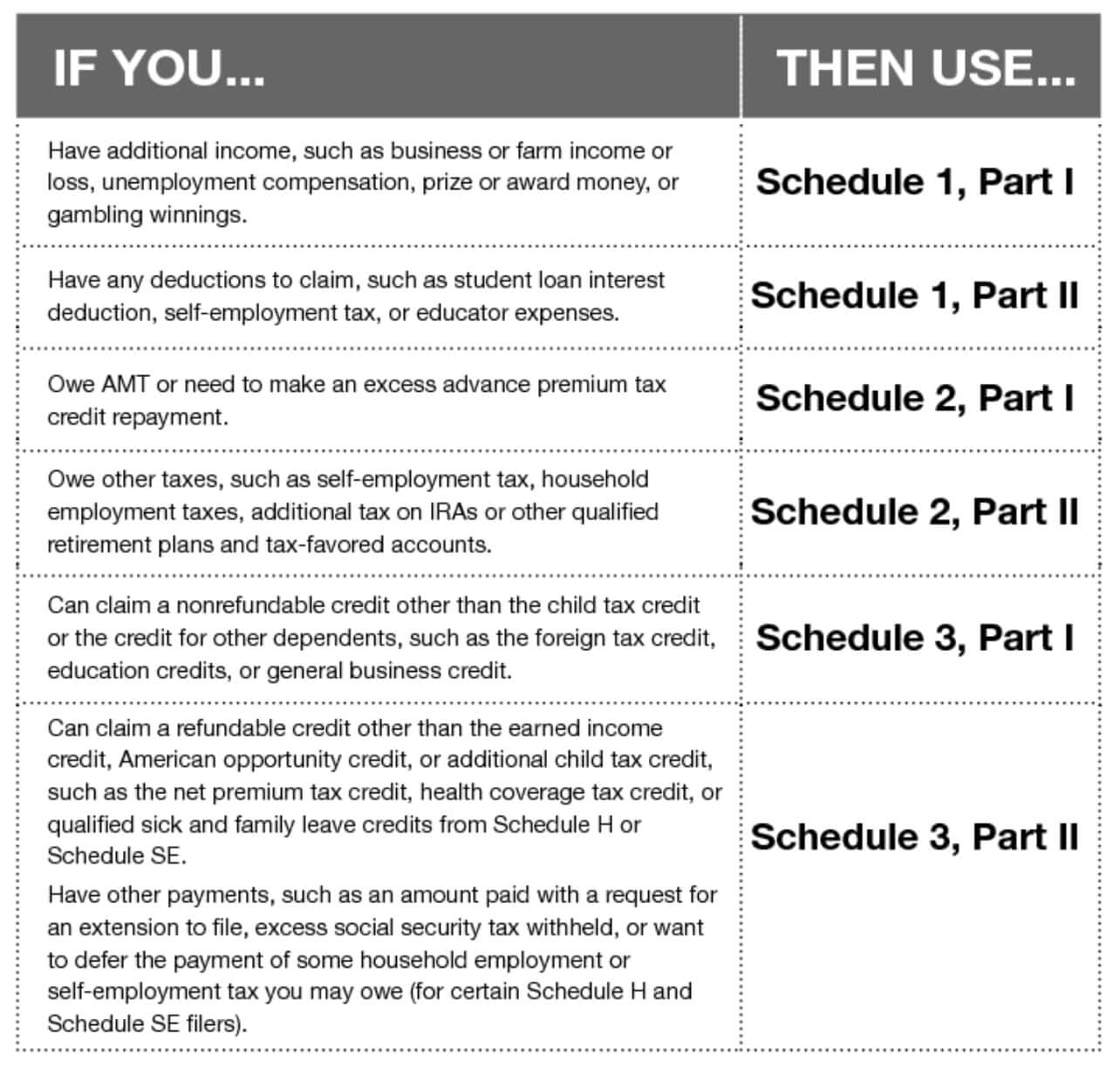

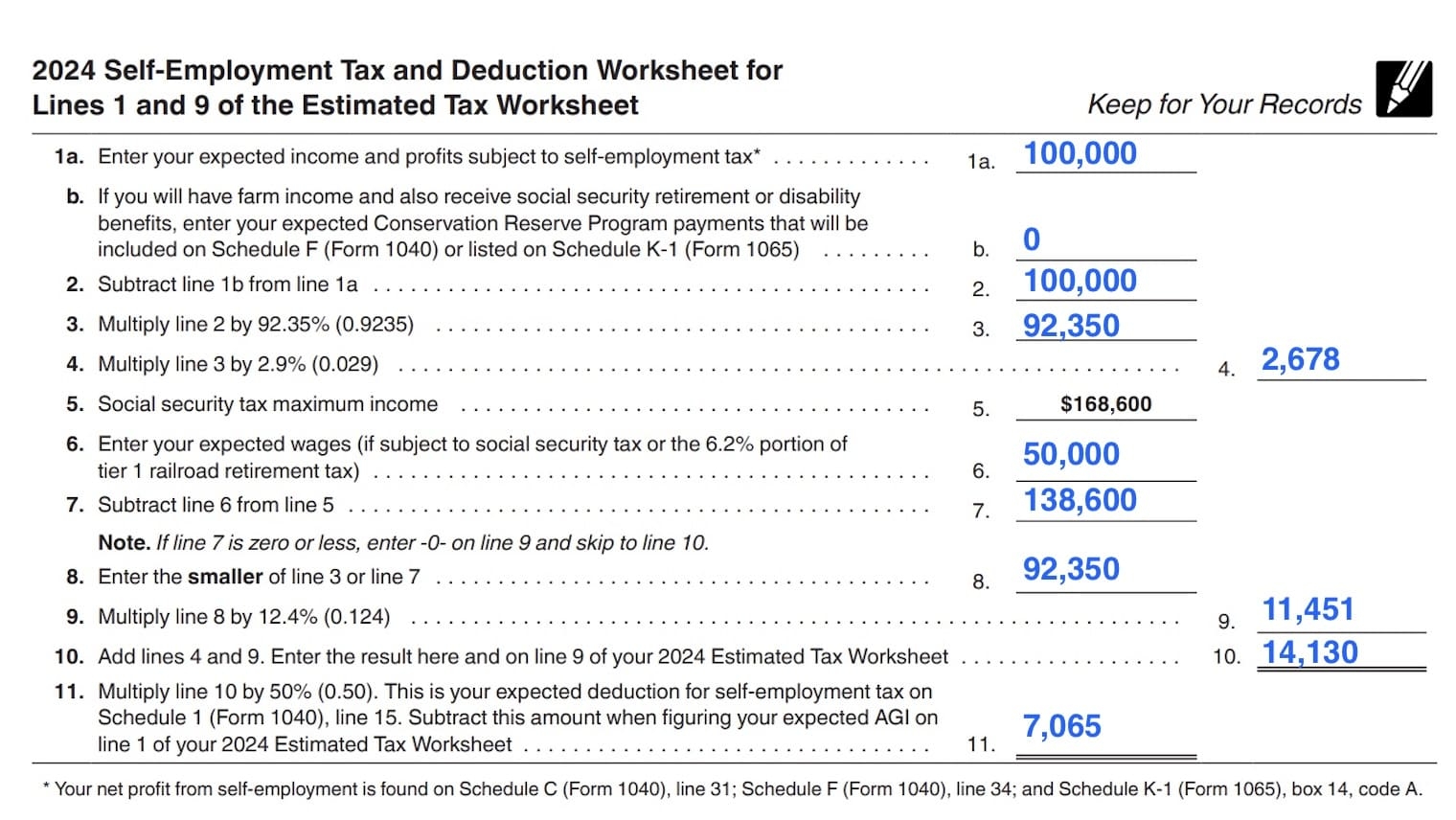

The 1040-ES form is used to calculate and pay estimated taxes on income that is not subject to withholding, such as self-employment income, rental income, investment income, and other sources of income. You must make estimated tax payments if you expect to owe $1,000 or more in taxes when you file your return.

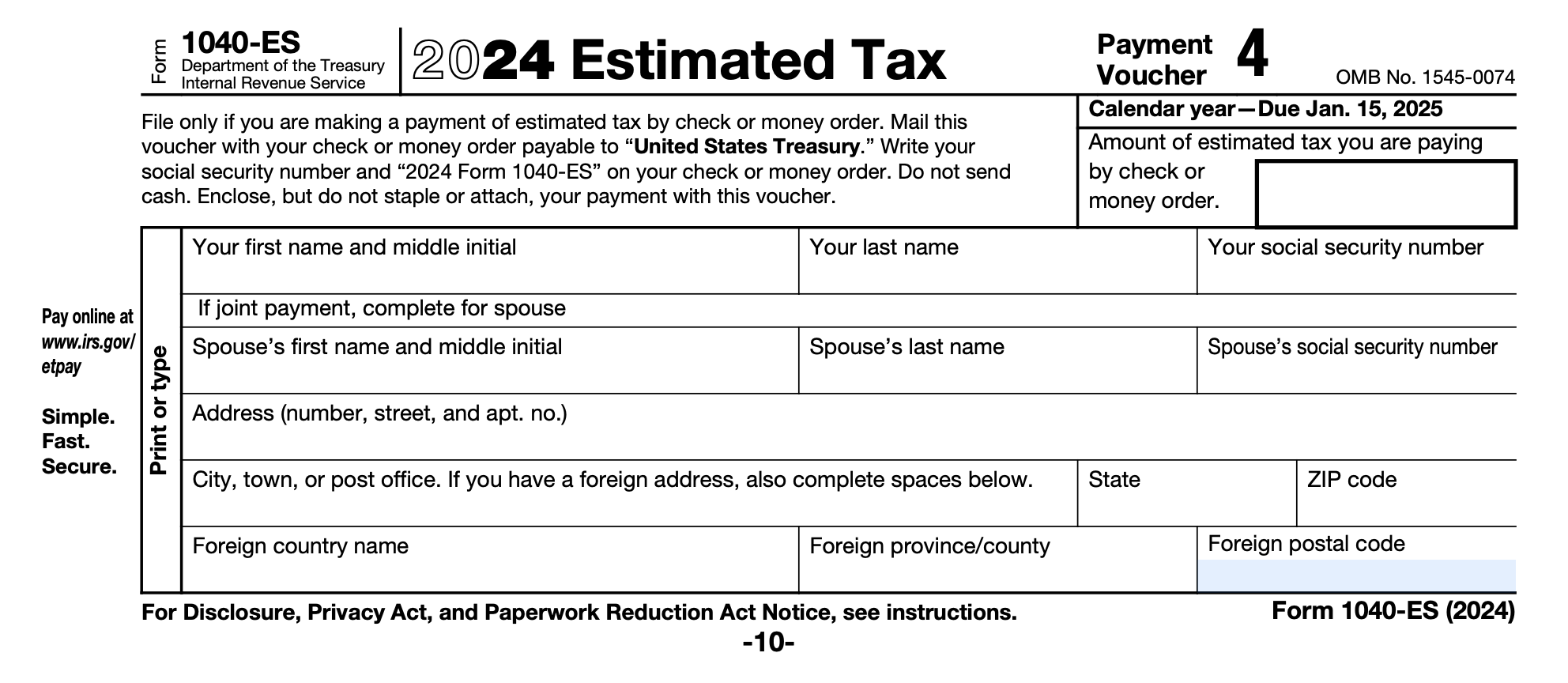

To fill out the 1040-ES form, you will need to estimate your income for the year, deductions, credits, and other tax information. Based on this information, you will calculate your estimated tax liability and make quarterly payments to the IRS.

It’s important to remember that failing to make estimated tax payments or underpaying can result in penalties and interest charges. By staying on top of your estimated tax payments and filing Form 1040-ES accurately and timely, you can avoid these penalties and ensure you are meeting your tax obligations.

So, if you have income not subject to withholding, don’t forget to file your 1040-ES 2025 Estimated Tax Form to stay compliant with the IRS and avoid any unnecessary penalties or interest charges. Stay on top of your estimated tax payments to keep your tax obligations in check!

What Is IRS Form 1040 ES Estimated Tax For Individuals TurboTax Tax Tips Videos

Form 1040 U S Individual Tax Return Definition Types And Use

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

IRS Form 1040 ES Instructions Estimated Tax Payments

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting