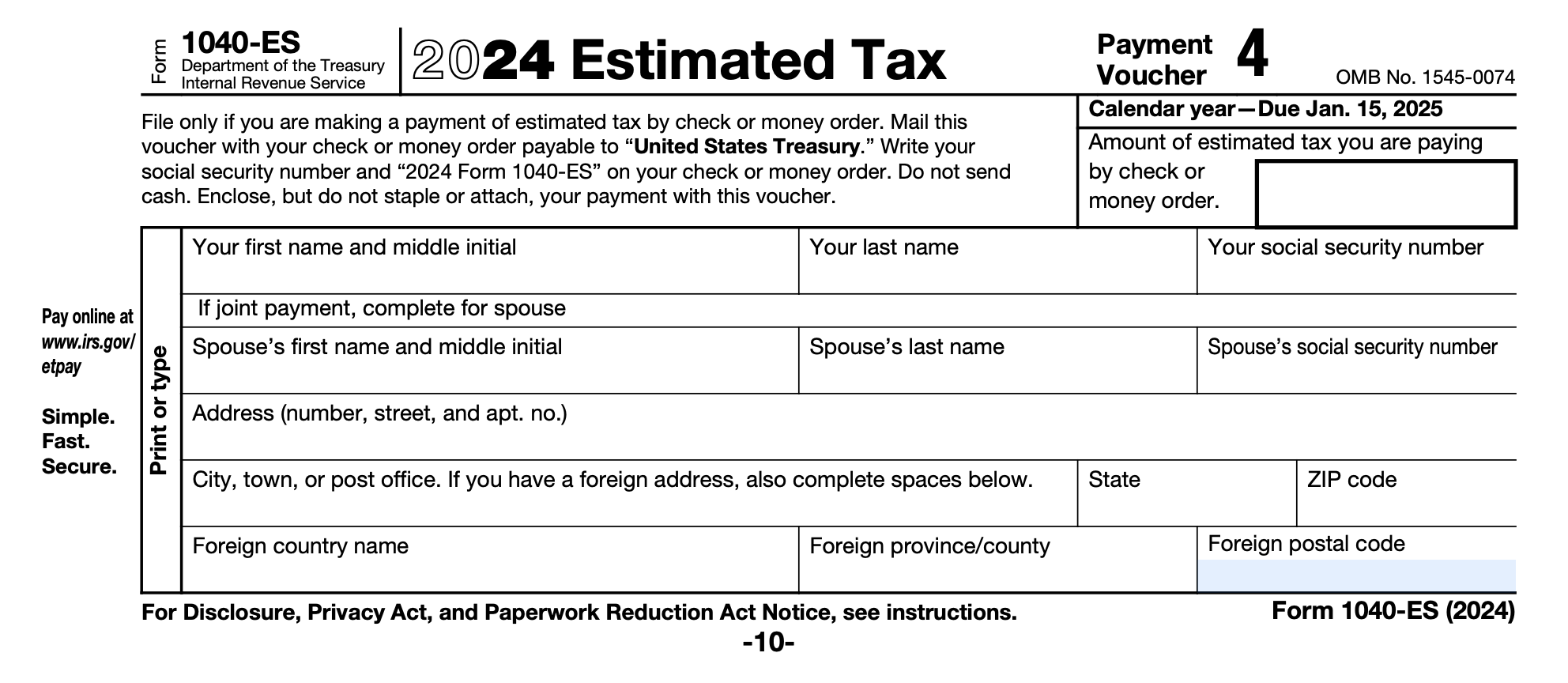

1040-ES 2025 Form

Planning for your taxes can be overwhelming, but with the right tools and knowledge, you can breeze through the process. One essential form to consider is the 1040-ES 2025, which helps you estimate and pay your quarterly taxes.

Understanding the 1040-ES 2025 Form is crucial for self-employed individuals, freelancers, and others with income not subject to withholding. By accurately completing this form, you can avoid penalties and ensure you’re meeting your tax obligations throughout the year.

1040-ES 2025 Form

Key Information on the 1040-ES 2025 Form

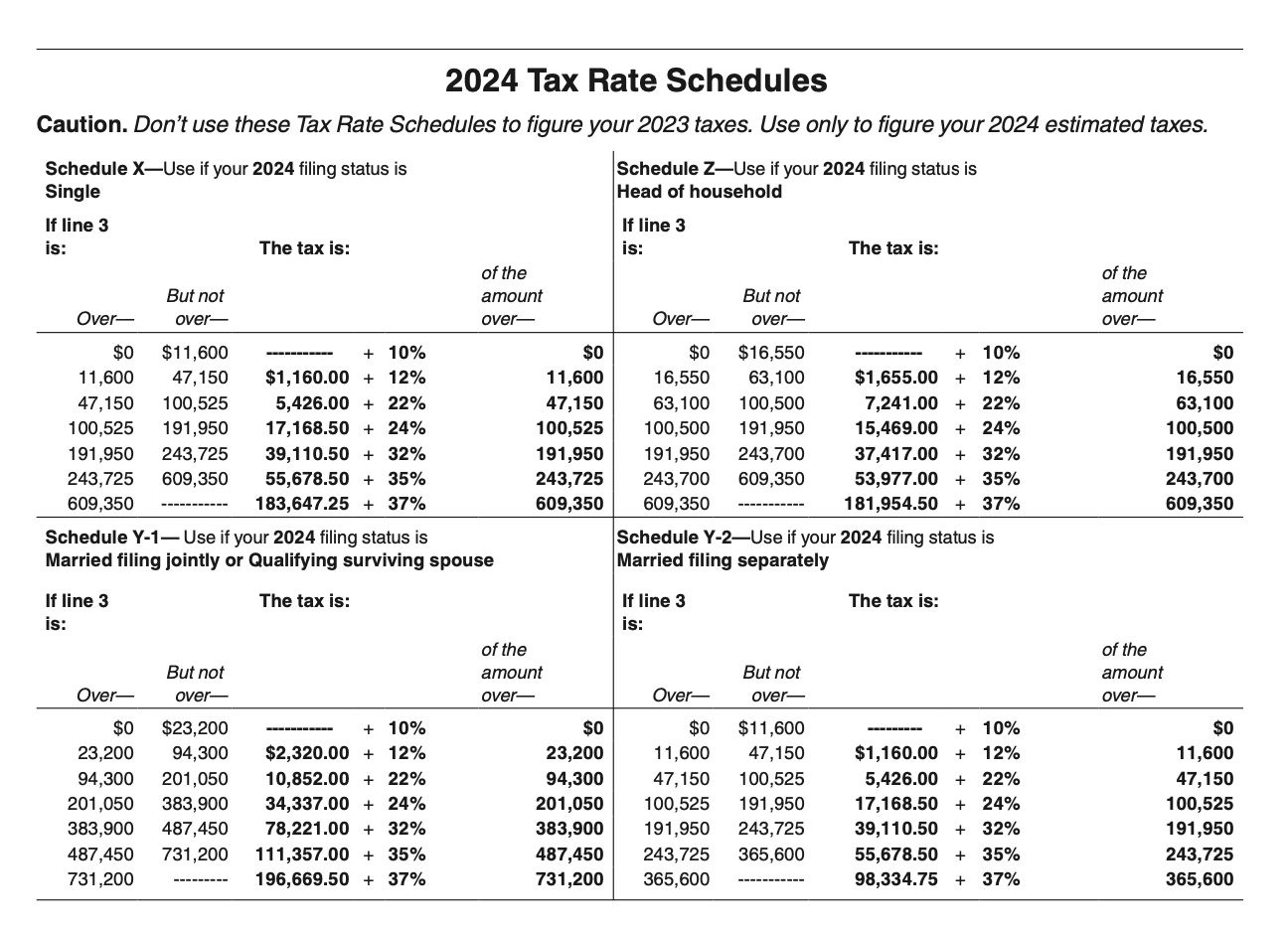

The 1040-ES Form helps you calculate how much you owe in quarterly taxes based on your expected income. It breaks down your estimated tax liability into four quarterly payments, with due dates typically falling in April, June, September, and January.

When filling out the 1040-ES 2025 Form, be sure to consider any deductions or credits you may be eligible for to reduce your tax liability. Keep accurate records of your income and expenses to ensure your estimates are as precise as possible.

If your income fluctuates throughout the year, you may need to adjust your quarterly payments accordingly. The 1040-ES 2025 Form allows you to make updates as needed, helping you avoid underpayment penalties or overpaying your taxes.

In conclusion, staying on top of your taxes with the 1040-ES 2025 Form can help you manage your finances more effectively and avoid unexpected tax bills. By estimating your quarterly payments accurately and making adjustments as necessary, you can navigate the tax season with confidence.

2025 Tax Guide Key Documents And Steps To File Your 2024 Taxes Marca

What Is IRS Form 1040 ES Estimated Tax For Individuals TurboTax Tax Tips Videos

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting

Form 1040 U S Individual Tax Return Definition Types And Use

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting