1040-ES Form 2025

Are you a self-employed individual or small business owner looking to stay on top of your estimated tax payments? The 1040-ES Form 2025 is here to help you do just that. Filing this form ensures you’re meeting your tax obligations throughout the year, avoiding any surprises come tax season.

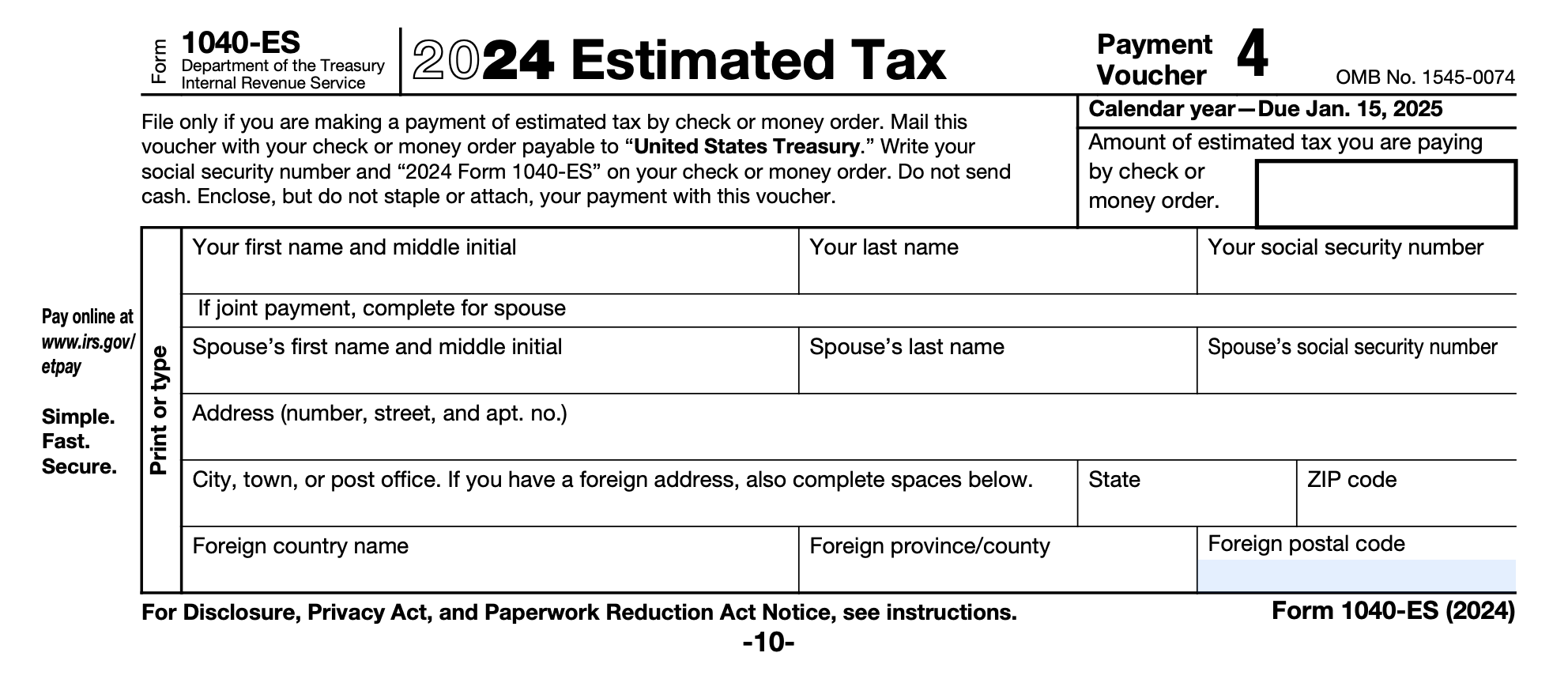

When you fill out the 1040-ES Form 2025, you’re essentially calculating how much you owe in taxes for the current year and making payments towards that amount. This can help you avoid penalties and interest on underpaid taxes, keeping your finances in good standing with the IRS.

1040-ES Form 2025

Stay Ahead with the 1040-ES Form 2025

To determine your estimated tax liability, you’ll need to consider factors like your income, deductions, credits, and any other relevant financial information. The 1040-ES Form 2025 provides clear instructions on how to calculate your estimated tax payments, making the process straightforward and manageable.

By staying ahead with your estimated tax payments using the 1040-ES Form 2025, you can avoid the stress and financial burden of having to pay a large sum all at once during tax season. This proactive approach can help you budget effectively and maintain compliance with the IRS.

Don’t wait until the last minute to address your tax obligations. Take control of your finances by utilizing the 1040-ES Form 2025 to stay on track with your estimated tax payments throughout the year. By doing so, you’ll be better prepared for tax season and can focus on growing your business with peace of mind.

What Is IRS Form 1040 ES Estimated Tax For Individuals TurboTax Tax Tips Videos

2025 Tax Guide Key Documents And Steps To File Your 2024 Taxes Marca

Form 1040 U S Individual Tax Return Definition Types And Use

Estimated Tax Payment Schedule For 2025

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting