1040 Form 2025

Preparing your taxes can be a daunting task, but understanding the 1040 Form 2025 is crucial for a smooth filing process. This form is the standard for individual income tax returns in the United States.

Whether you’re a seasoned taxpayer or new to the process, the 1040 Form 2025 is something you’ll encounter. It captures your income, deductions, credits, and tax liability for the year. Familiarizing yourself with its sections can make tax season less stressful.

1040 Form 2025

What to expect with the 1040 Form 2025

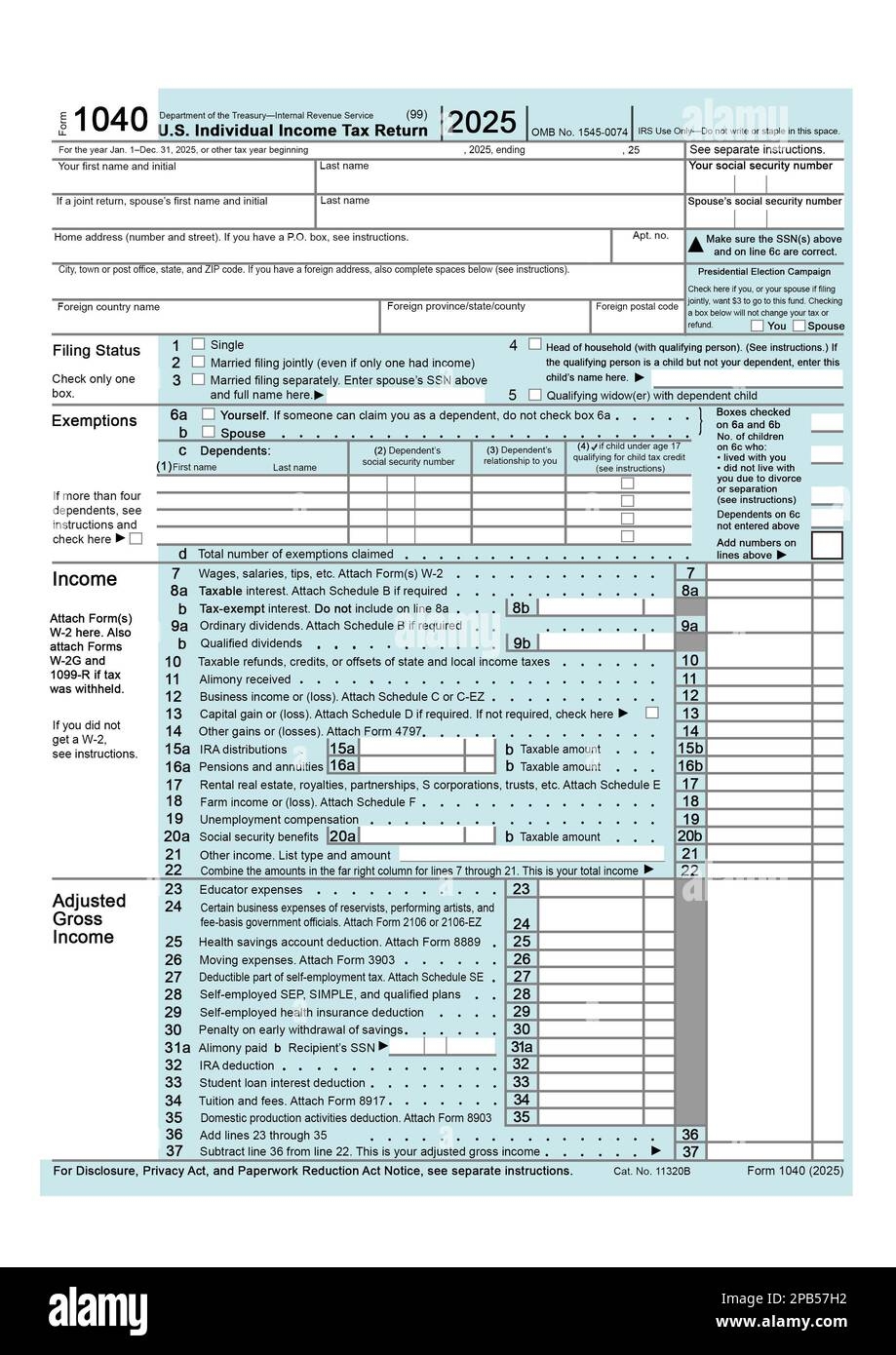

When filling out the 1040 Form 2025, you’ll need to provide personal information, such as your name, address, and Social Security number. You’ll also report your income from various sources, including wages, investments, and self-employment.

Deductions and credits play a significant role in reducing your tax liability. Be sure to include any eligible deductions, such as mortgage interest or charitable contributions. Additionally, consider tax credits like the Child Tax Credit or Earned Income Tax Credit to lower your tax bill.

Once you’ve completed the 1040 Form 2025, double-check for accuracy before submitting it to the IRS. Mistakes can delay your refund or trigger an audit. If you’re unsure about any section, seek guidance from a tax professional to ensure compliance with tax laws.

Understanding the 1040 Form 2025 is essential for every taxpayer. By familiarizing yourself with its sections and requirements, you can navigate the tax filing process with confidence. Remember to keep records of your financial transactions throughout the year to streamline tax preparation.

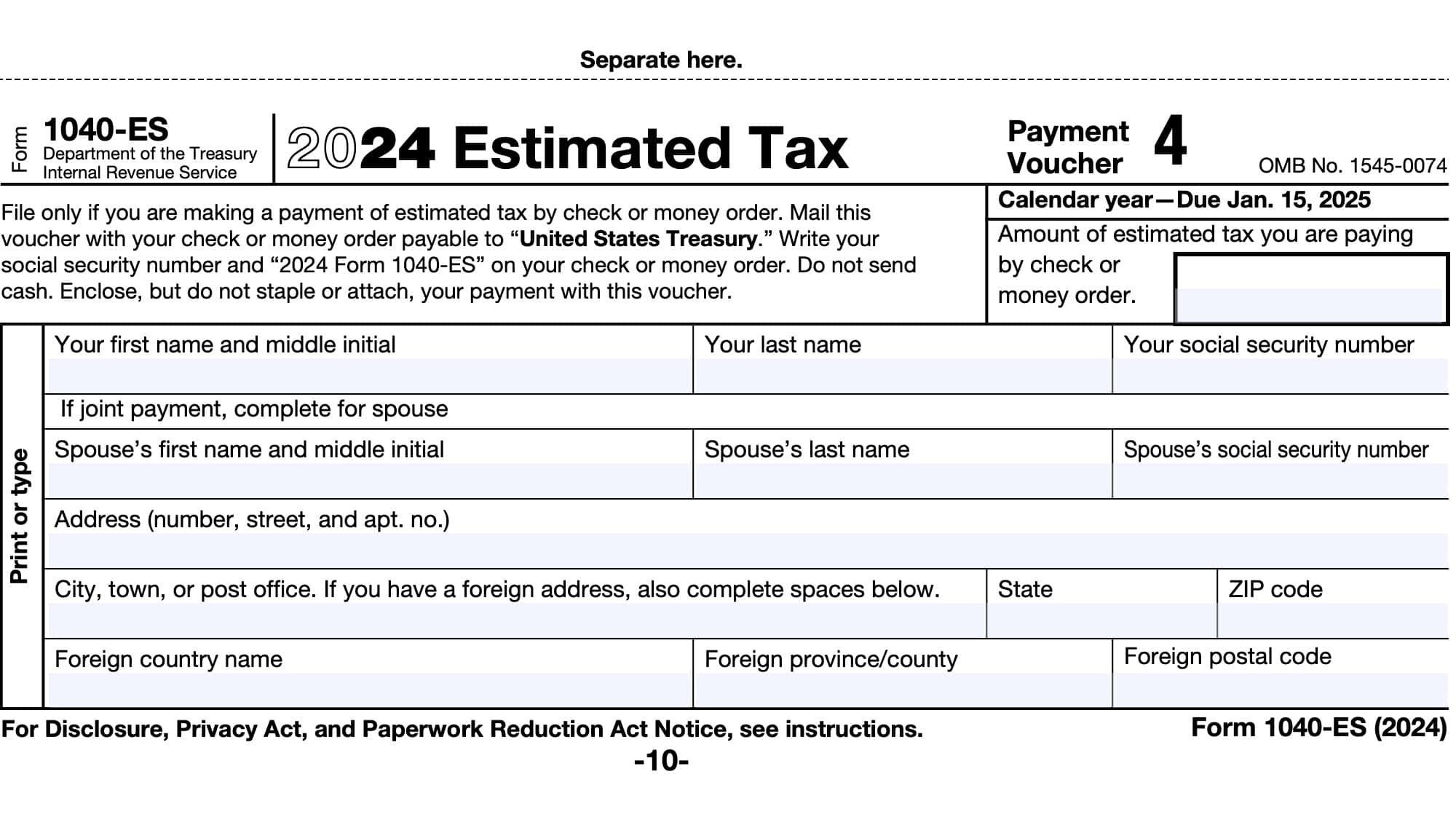

IRS Form 1040 ES Instructions Estimated Tax Payments

Form 1040 U S Individual Tax Return Definition Types And Use

Illustration Of Tax Form Business And Finance Concept Stock Photo Alamy

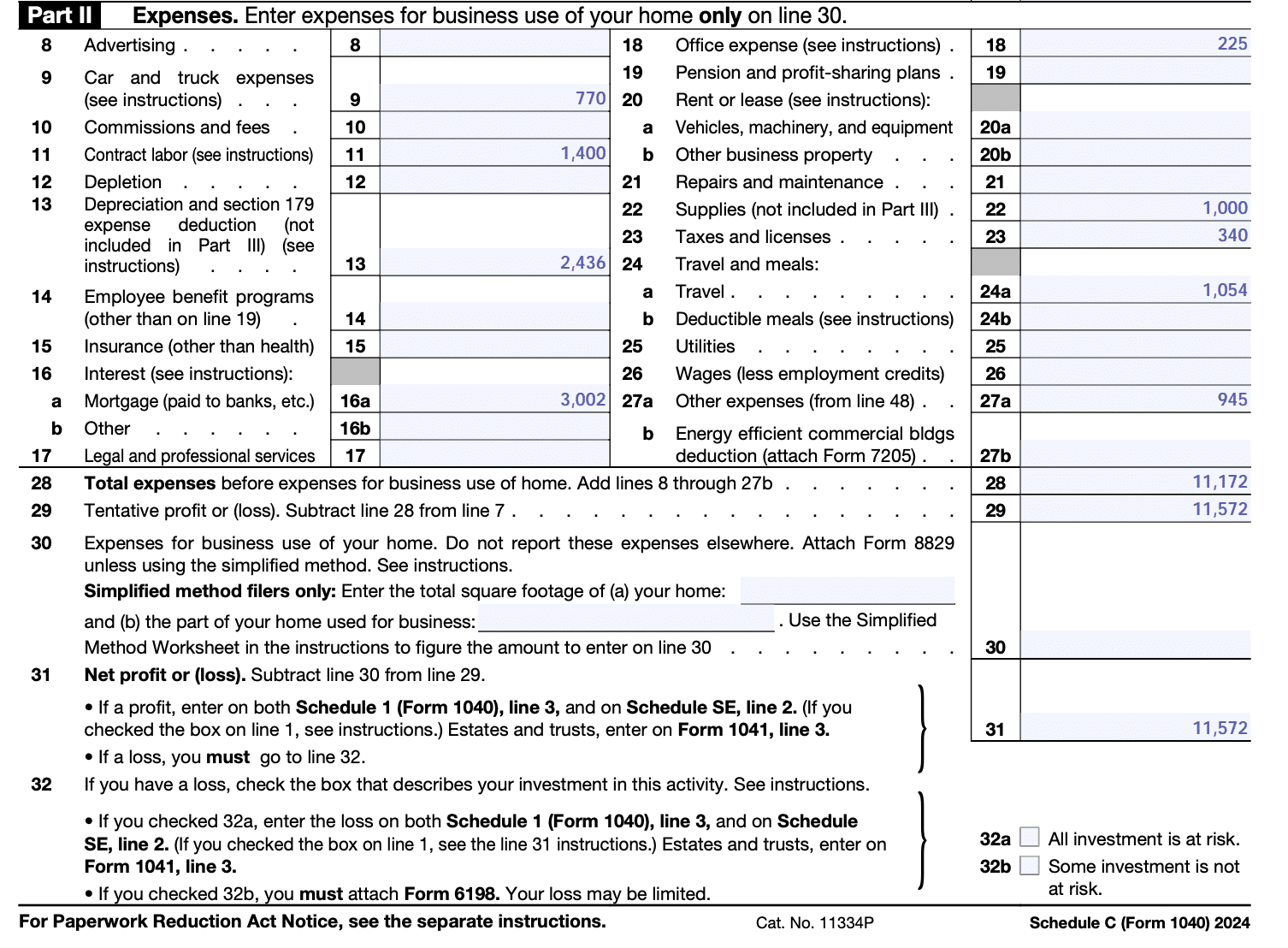

How To Fill Out Schedule C In 2025 With Example

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor