1040 Form For 2025

Are you ready for tax season? The IRS has released the new 1040 form for the year 2025, and it’s time to start preparing. Filing your taxes can be a daunting task, but with the right information, you can make it a smooth process.

Understanding the 1040 form for 2025 is crucial for accurately reporting your income, deductions, and credits. This form is the standard tax form that most individuals use to file their annual income tax returns. It includes important sections for personal information, income sources, deductions, and tax credits.

1040 Form For 2025

1040 Form For 2025

When filling out the 1040 form for 2025, make sure to gather all necessary documents, such as W-2s, 1099s, and receipts for deductions. Double-check your entries to avoid errors that could lead to delays or audits. Consider seeking professional help if you have complex tax situations.

One important change for the 2025 tax year is the updated income brackets and tax rates. Be sure to review the latest tax laws and regulations to ensure you are calculating your tax liability correctly. Keep in mind any changes in deductions or credits that may affect your tax return.

As you complete your 1040 form for 2025, remember to sign and date it before submitting it to the IRS. If you are filing electronically, follow the instructions carefully to avoid any technical issues. Once you have filed your taxes, keep a copy of your return for your records.

In conclusion, preparing and filing your taxes can be a manageable task with the right knowledge and resources. Take the time to understand the 1040 form for 2025 and gather all necessary documents to ensure a smooth tax-filing process. Remember to file on time to avoid penalties and stay compliant with tax laws.

Form 1040 U S Individual Tax Return Definition Types And Use

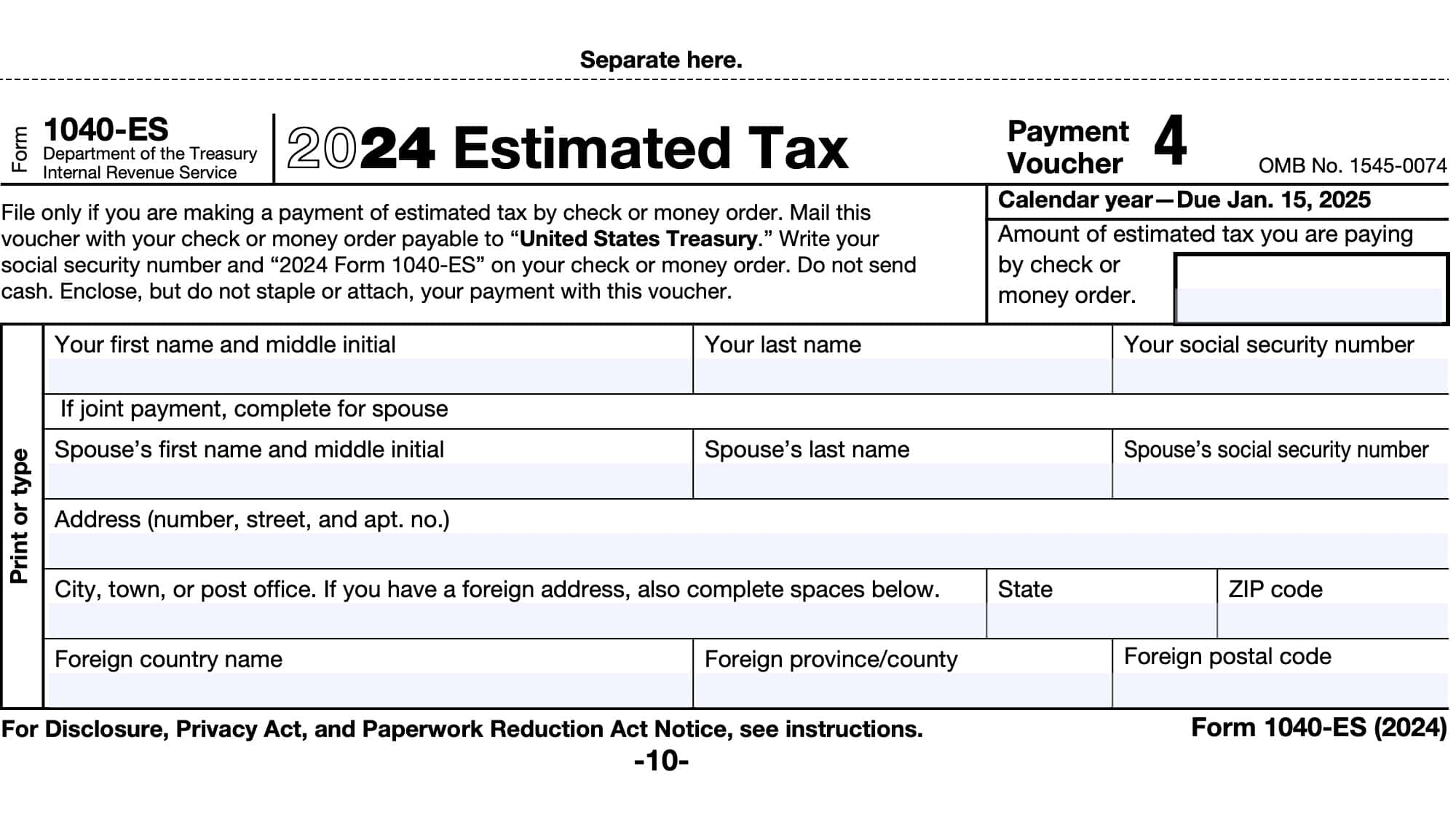

IRS Form 1040 ES Instructions Estimated Tax Payments

Illustration Of Tax Form Business And Finance Concept Stock Photo Alamy

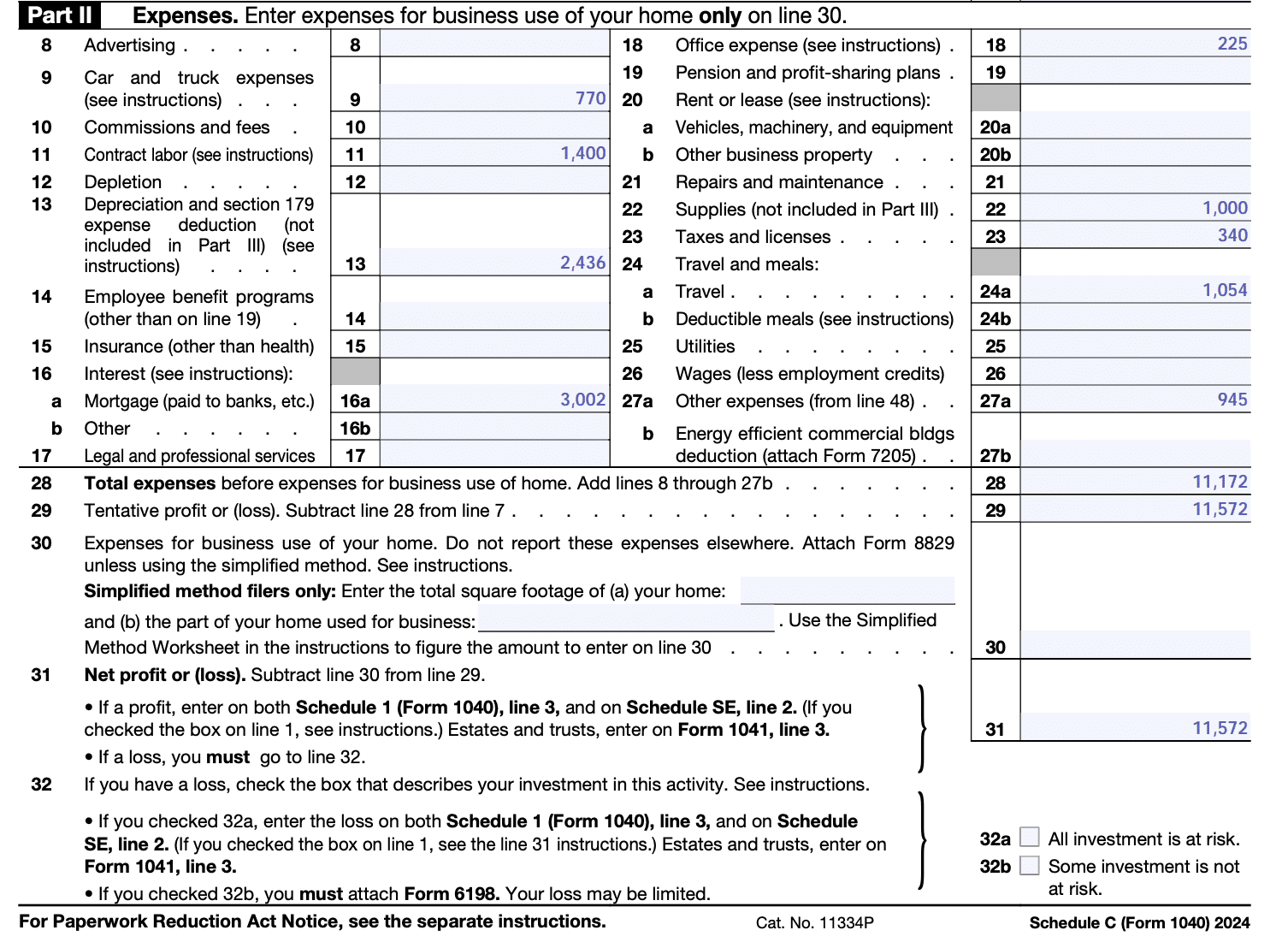

How To Fill Out Schedule C In 2025 With Example

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor