1040 Tax Form For 2025

Are you ready for tax season? Filing your 1040 tax form for 2025 doesn’t have to be daunting. With a little preparation and understanding, you can breeze through the process and make sure you’re all set with the IRS.

For many, the 1040 tax form is the standard document for reporting your income, deductions, and credits to the government. It’s essential to fill out this form accurately to avoid any penalties or audits down the line. Let’s dive into the key points you need to know for the 2025 tax year.

1040 Tax Form For 2025

1040 Tax Form For 2025

When filling out your 1040 tax form for 2025, you’ll need to gather all your income sources, including wages, self-employment earnings, investments, and any other financial activities. Make sure to report all income accurately to avoid any discrepancies.

Next, you’ll deduct any eligible expenses, such as mortgage interest, charitable contributions, and medical expenses. These deductions can reduce your taxable income, potentially lowering your overall tax liability. Be sure to keep accurate records and receipts to support your claims.

After calculating your income and deductions, you’ll determine your tax liability based on the current tax brackets. Make sure to check for any changes in tax laws or credits that may apply to the 2025 tax year. Double-check your calculations to ensure accuracy before submitting your form.

In conclusion, filing your 1040 tax form for 2025 doesn’t have to be stressful. By staying organized, understanding the process, and seeking help when needed, you can navigate tax season with confidence. Remember to file on time and accurately to avoid any issues with the IRS. Good luck!

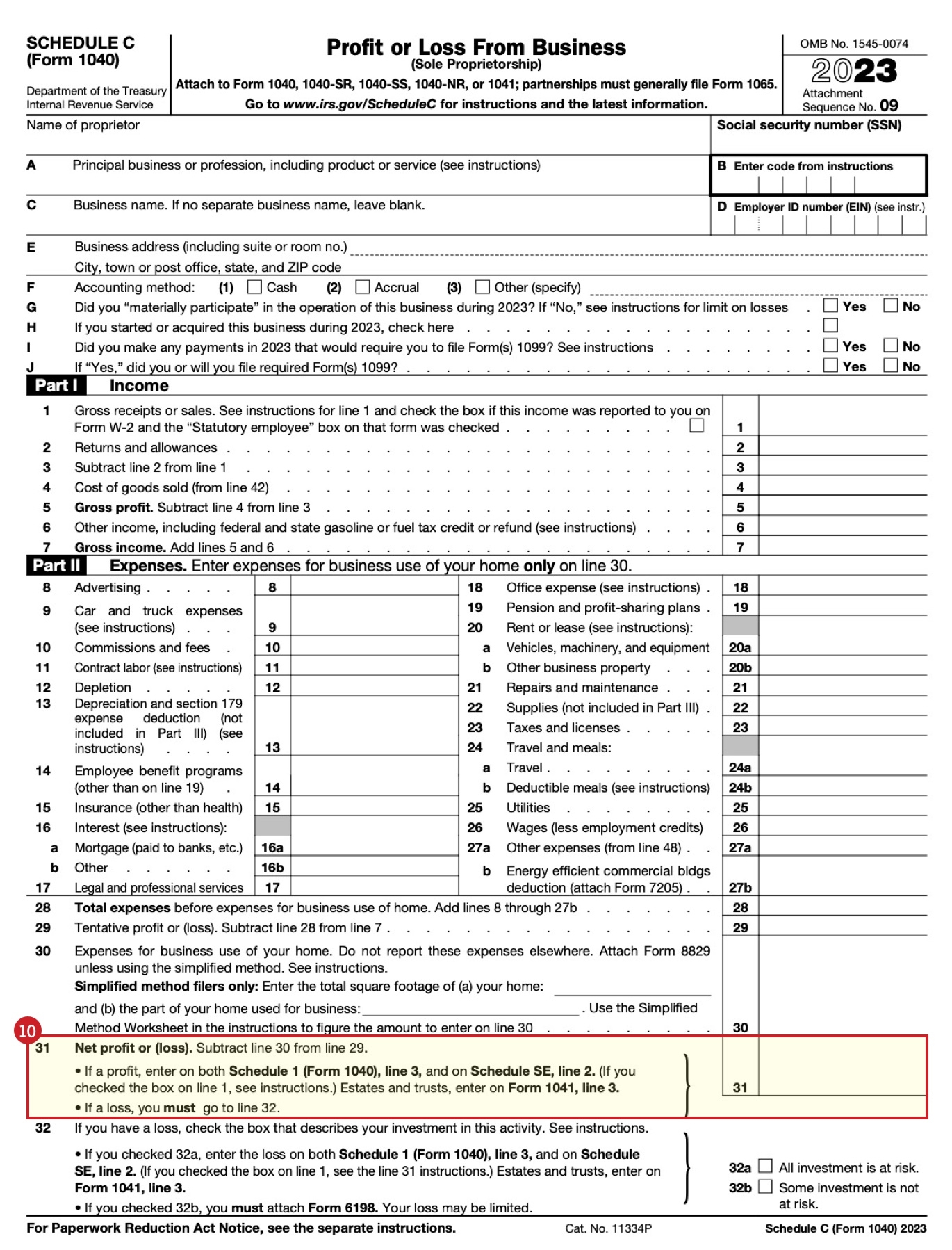

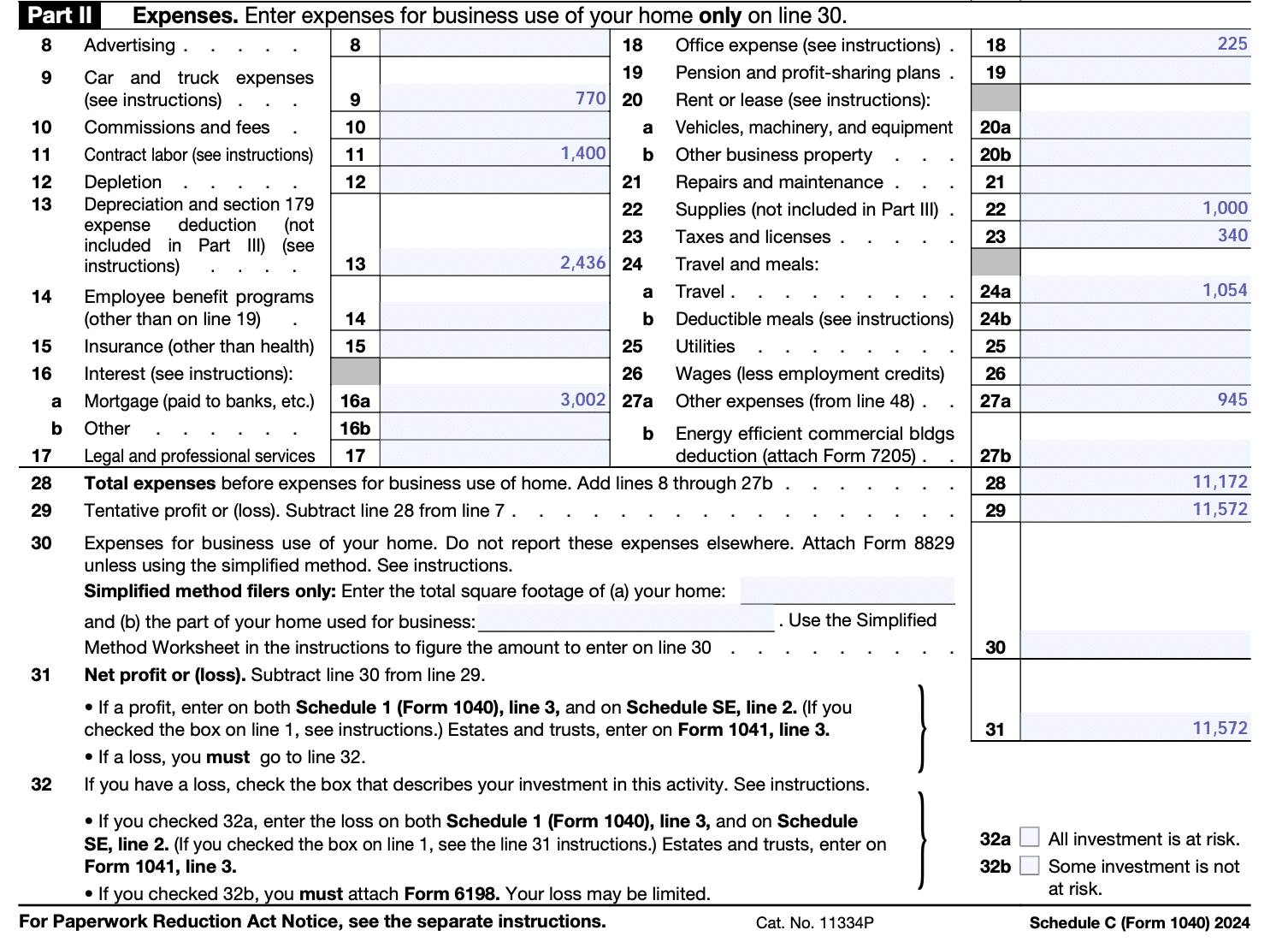

How To Fill Out Schedule C In 2025 With Example

Form 1040 U S Individual Tax Return Definition Types And Use

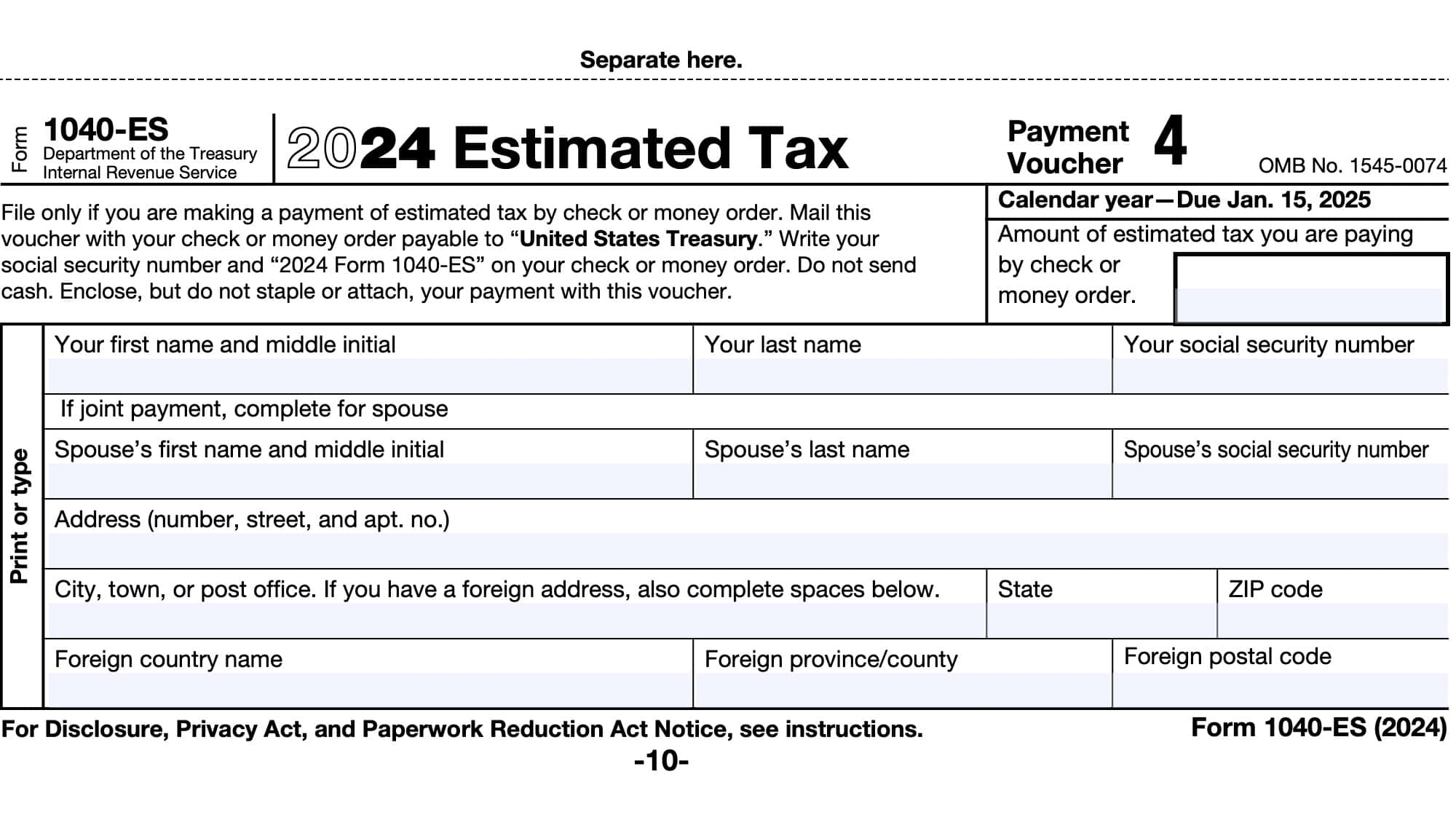

IRS Form 1040 ES Instructions Estimated Tax Payments

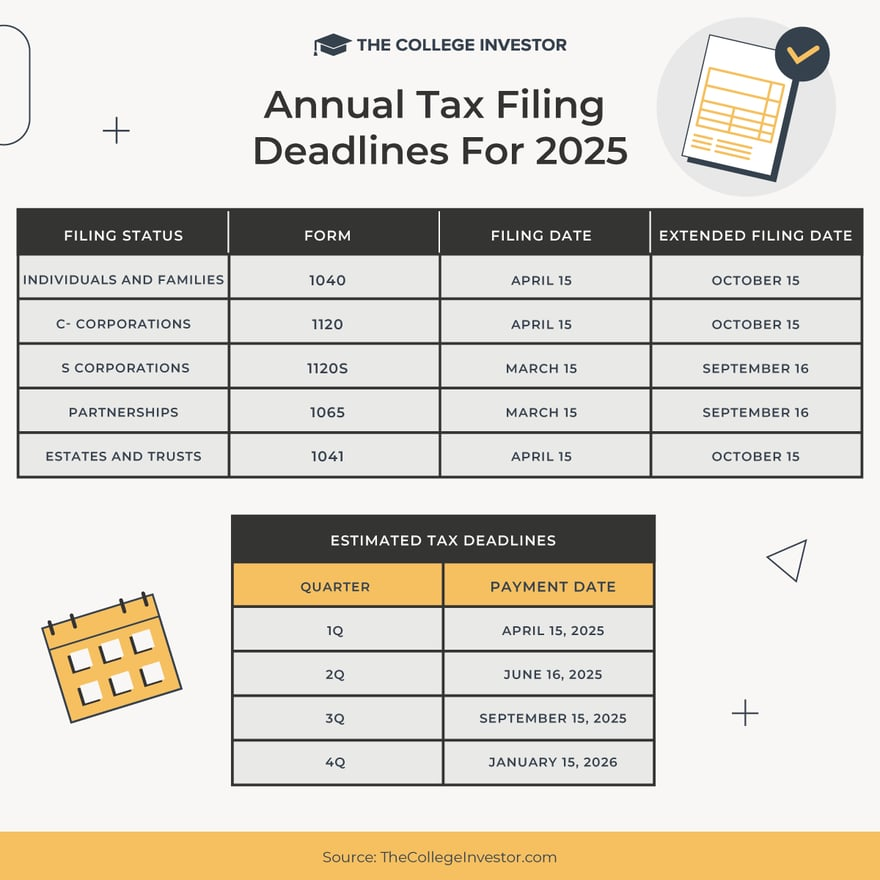

When Are Taxes Due In 2025 Including Estimated Taxes

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor