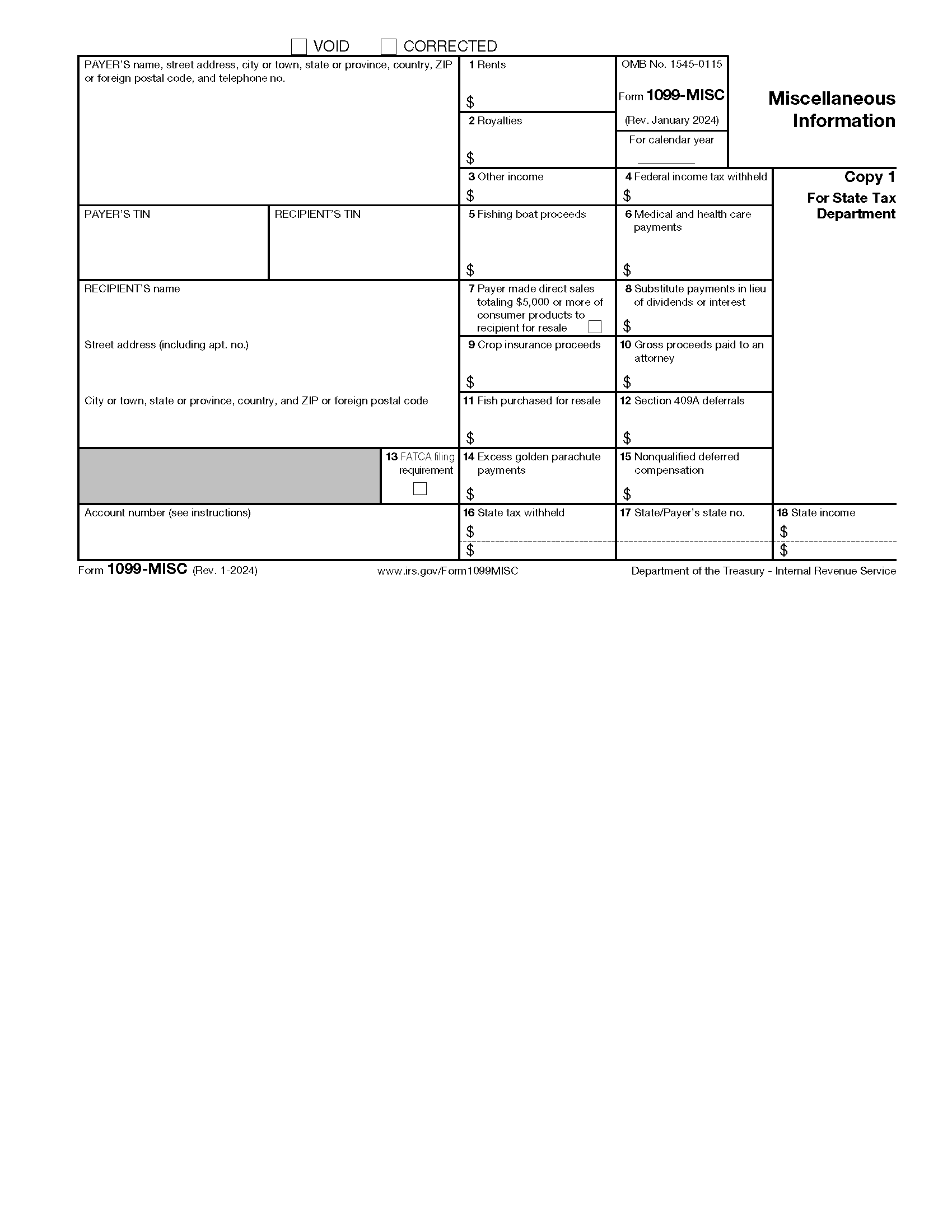

1099 2025 Form

Are you ready for tax season? The 1099 2025 form is an important document that you may need to fill out if you’re an independent contractor or freelancer. It’s crucial to understand the requirements and deadlines to avoid any penalties.

When it comes to the 1099 2025 form, accuracy is key. Make sure to report all your income accurately and timely to avoid any issues with the IRS. Keep track of all your earnings throughout the year to make the process smoother.

1099 2025 Form

Understanding the 1099 2025 Form

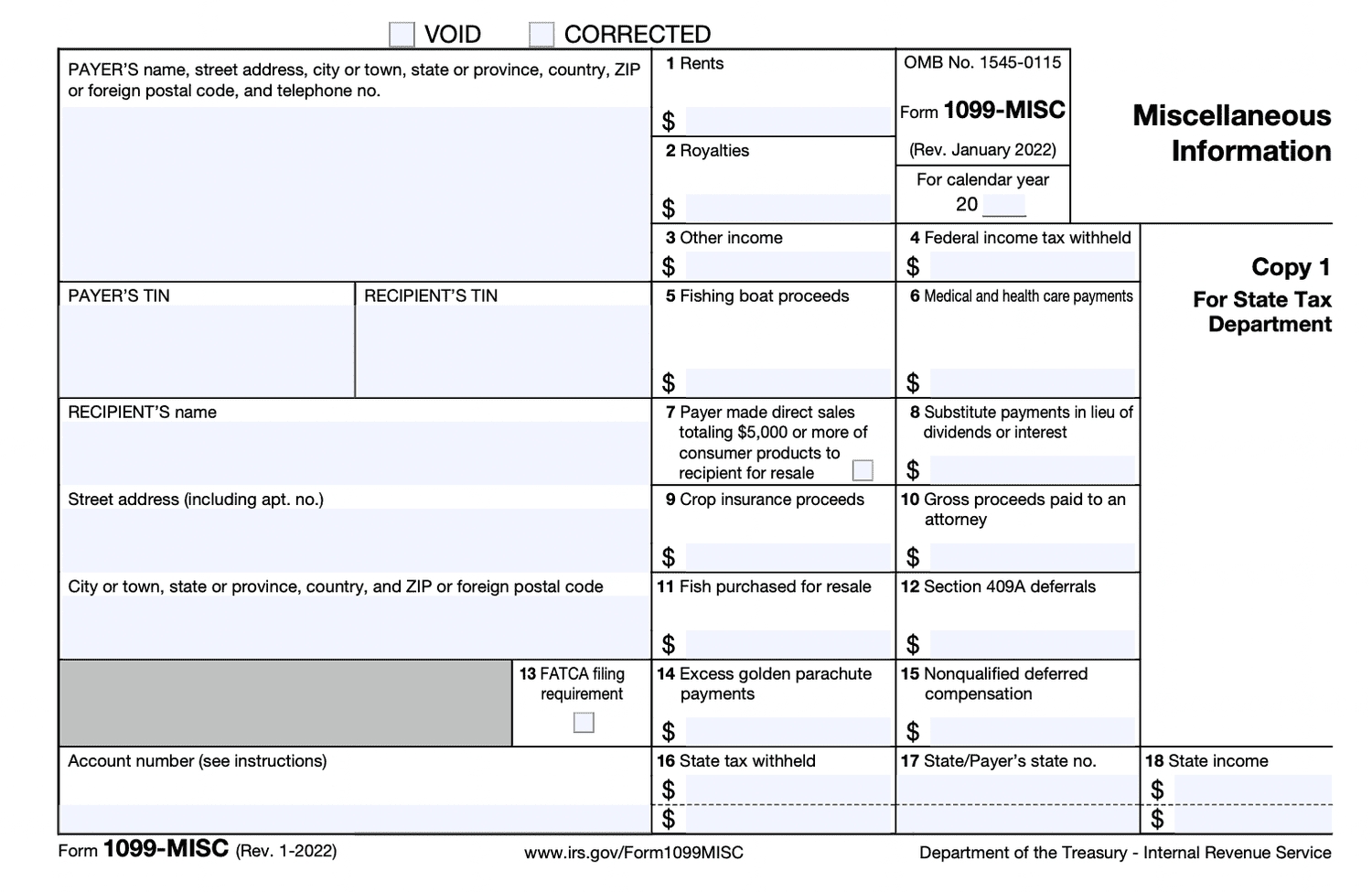

The 1099 2025 form is used to report income earned from sources other than traditional employment. This includes freelance work, rental income, and other types of self-employment. It’s crucial to report all income sources to ensure compliance with tax laws.

As a freelancer or independent contractor, you may receive multiple 1099 forms from different clients or sources. Make sure to keep all these forms organized and report them accurately on your tax return. Failure to do so could result in penalties or audits.

Remember, the deadline for filing the 1099 2025 form is typically January 31st of the following year. Be sure to gather all necessary information and submit your forms on time to avoid any late fees or penalties. If you have any questions or need assistance, don’t hesitate to reach out to a tax professional for guidance.

In conclusion, understanding the 1099 2025 form is essential for freelancers and independent contractors. By staying organized, reporting income accurately, and meeting deadlines, you can navigate tax season with confidence. Remember, it’s always better to be proactive and prepared when it comes to your taxes.

1099 NEC Forms 2023 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 38 108 Forms ONGULS

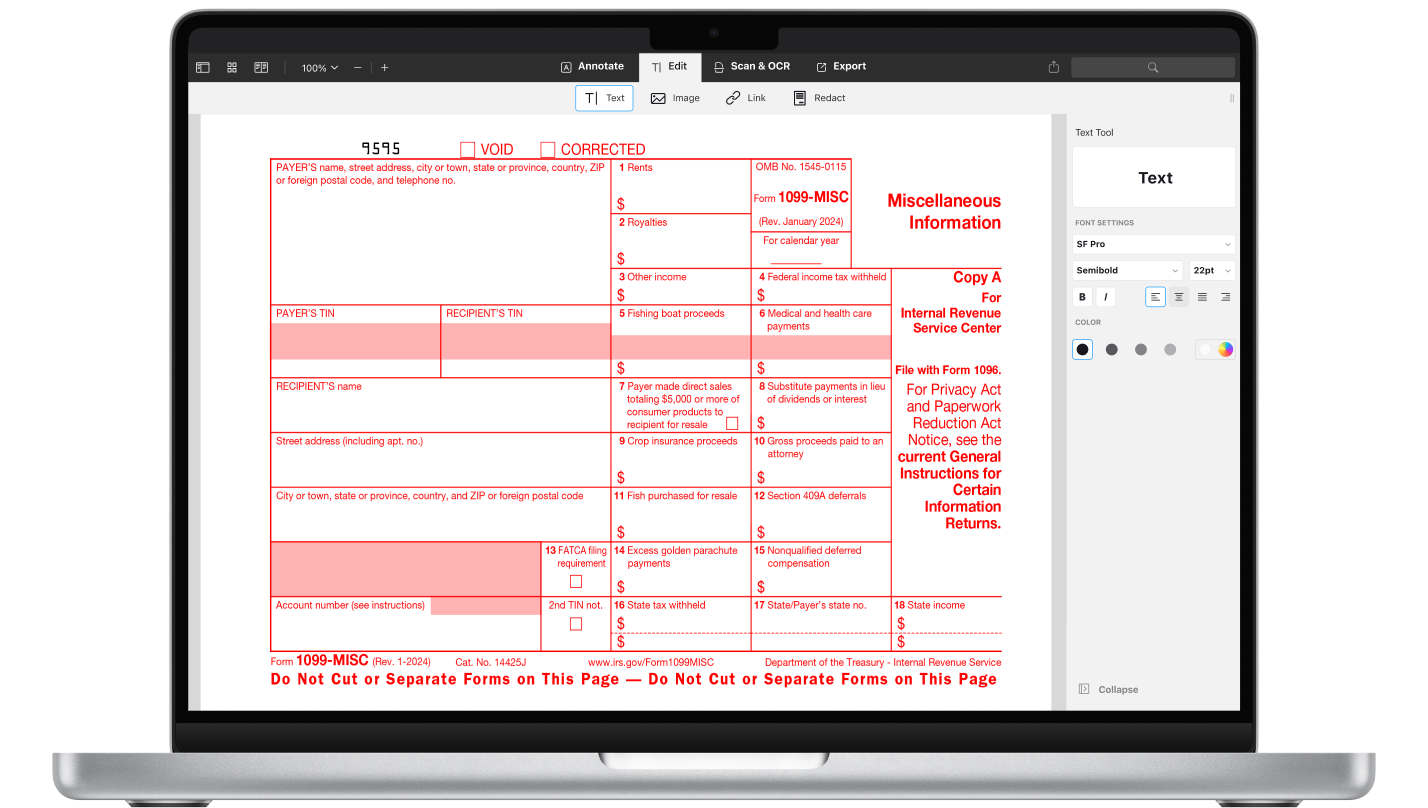

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

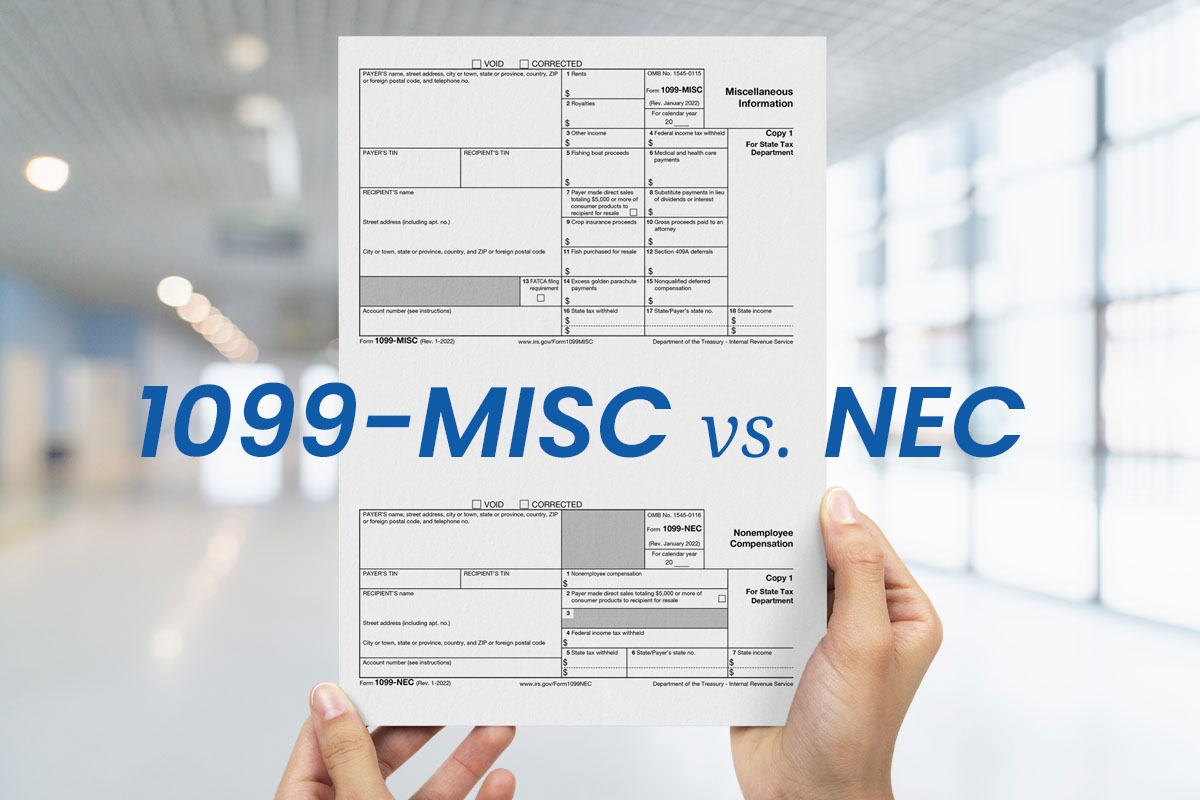

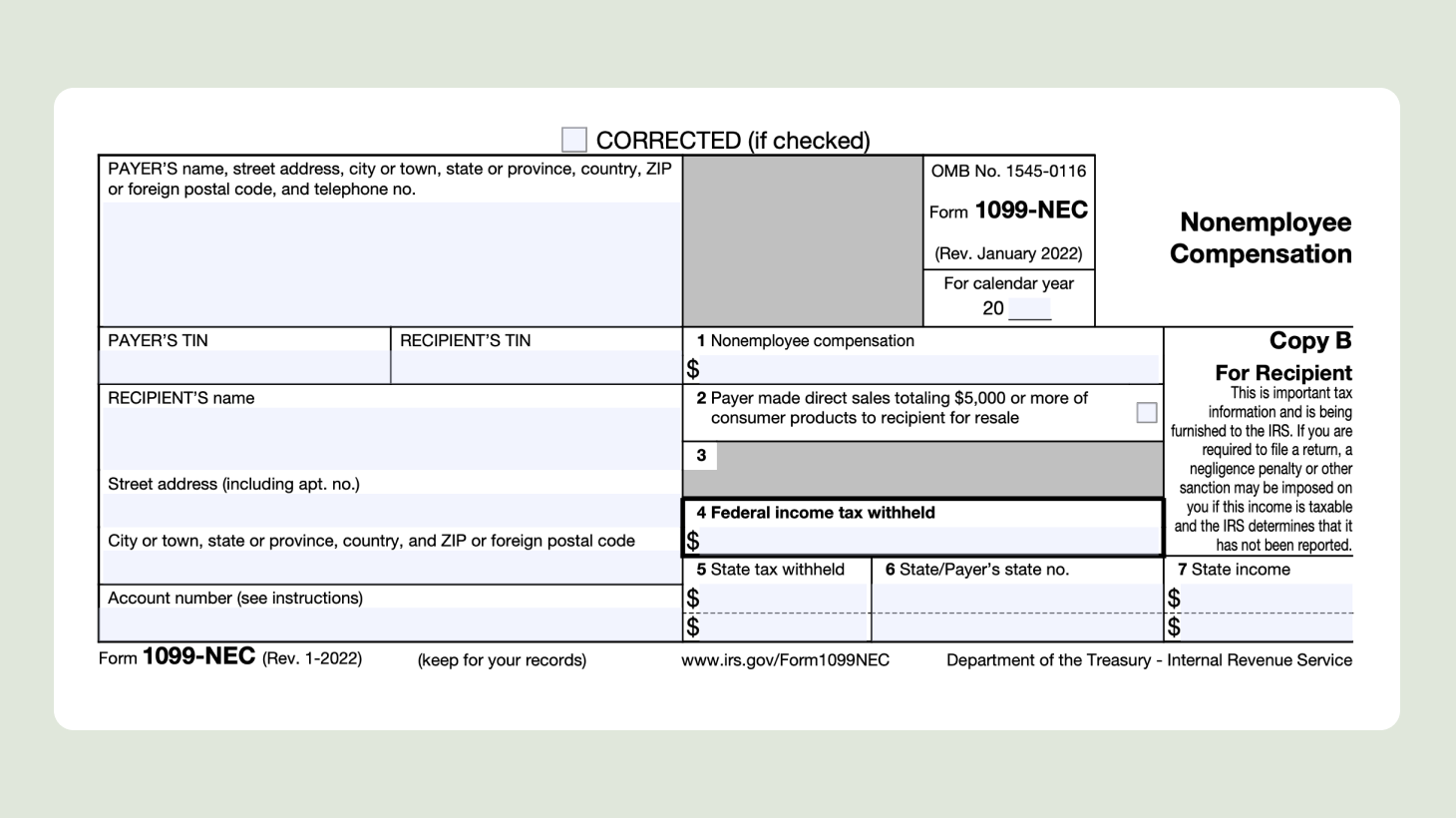

An Overview Of The 1099 NEC Form

Form 1099 Reporting Non Employment Income

Free IRS Form 1099 MISC PDF EForms