1099 Form For 2025

Are you ready for tax season in 2025? One important document you might need to keep an eye out for is the 1099 form. This form is used to report income other than wages, salaries, and tips.

Whether you’re a freelancer, contractor, or small business owner, receiving a 1099 form means you’ve earned income that needs to be reported to the IRS. It’s essential to keep track of these forms and make sure they are included in your tax filing.

1099 Form For 2025

1099 Form For 2025

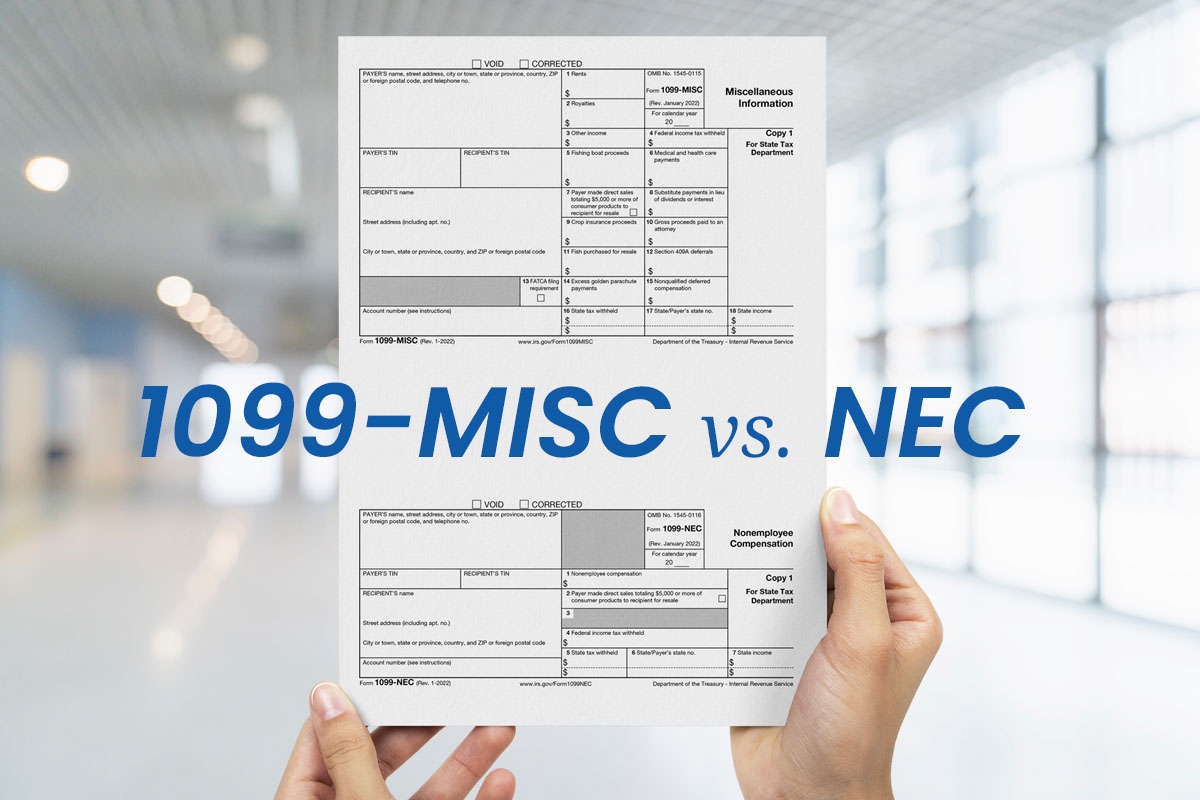

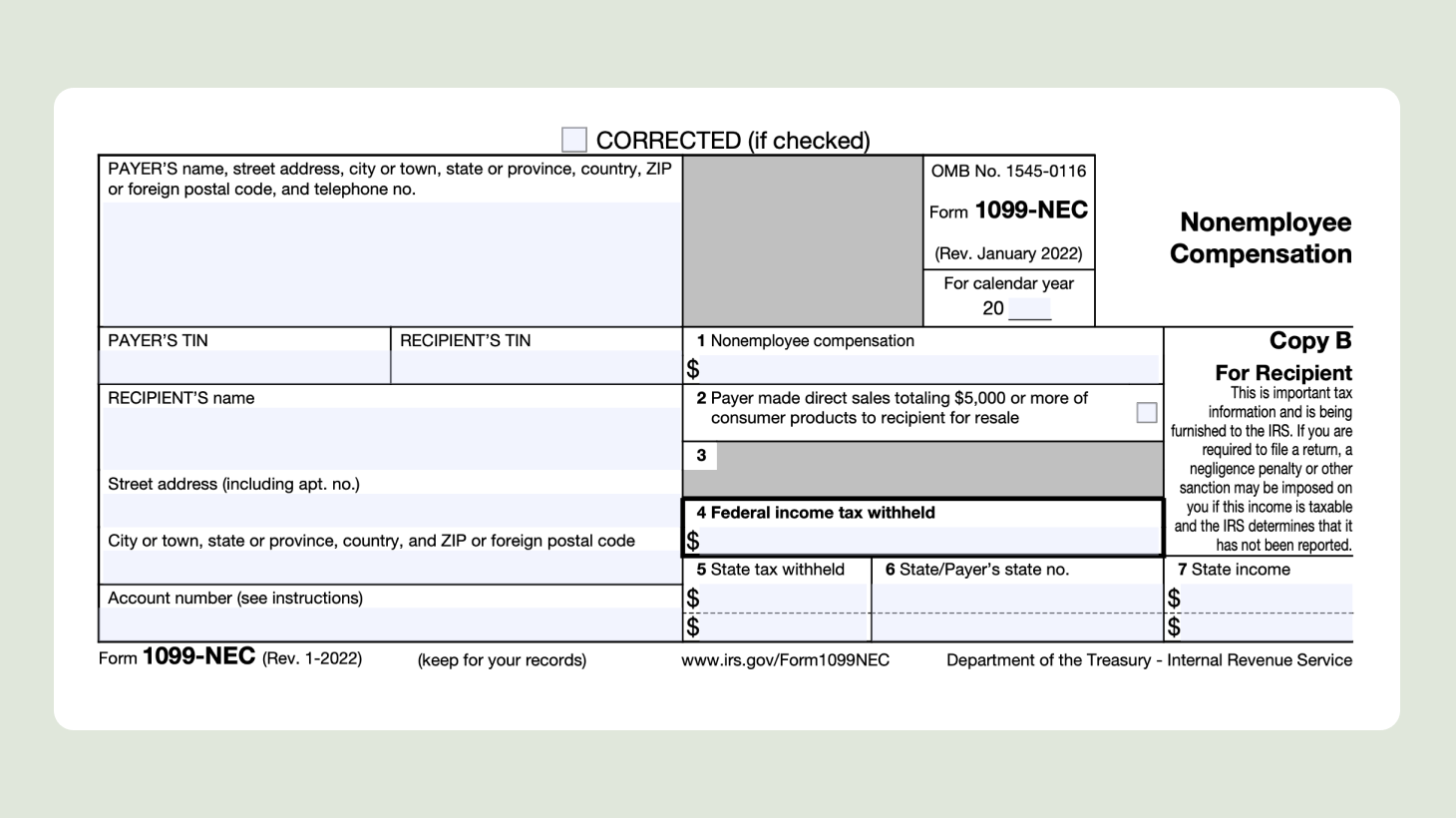

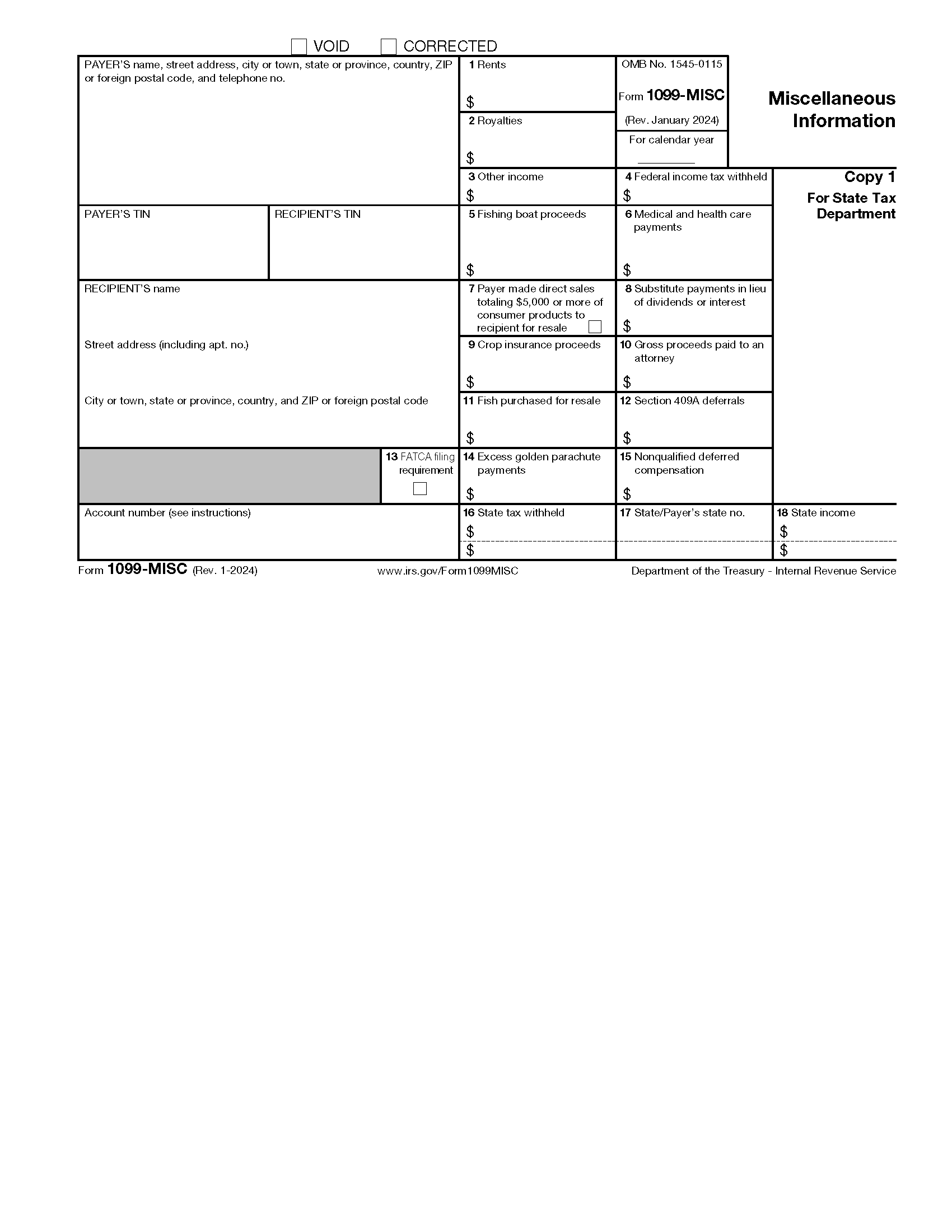

The 1099 form comes in various types, such as 1099-MISC, 1099-NEC, and 1099-K, depending on the source of income. Make sure to review each form carefully and report the income accurately on your tax return.

If you’re a freelancer or contractor, you may receive multiple 1099 forms from different clients or companies. It’s crucial to gather all these forms and organize them to ensure you don’t miss any income when filing your taxes.

Remember, failing to report income from 1099 forms can lead to penalties and interest charges from the IRS. Take the time to review all your forms and seek help from a tax professional if you’re unsure about how to report certain types of income.

As tax season approaches, make sure to keep an eye out for any 1099 forms that may be coming your way. Stay organized, report your income accurately, and don’t hesitate to seek help if you need it. By staying on top of your tax responsibilities, you can avoid any potential issues with the IRS.

Itemize Deductions Or Take The Standard Deduction Which Is Right For You

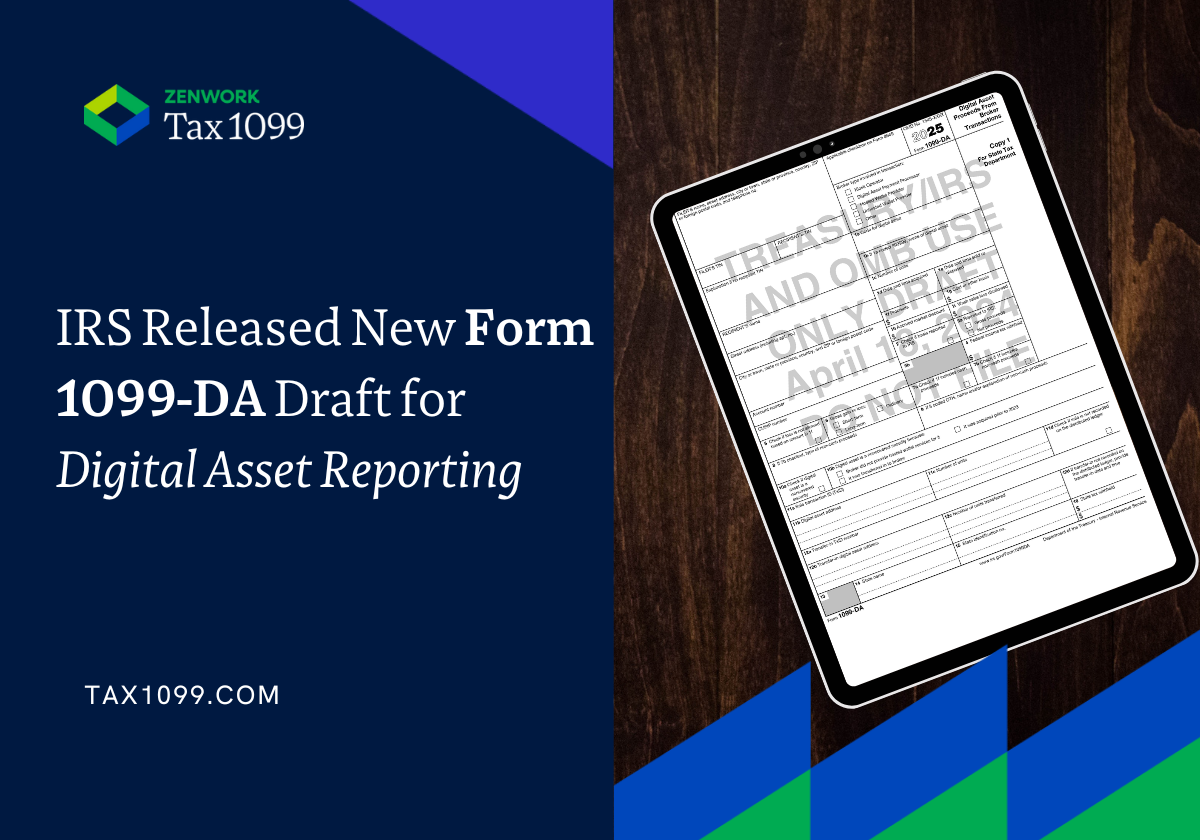

IRS Released New Form 1099 DA Draft For Digital Asset Reporting Tax1099 Blog

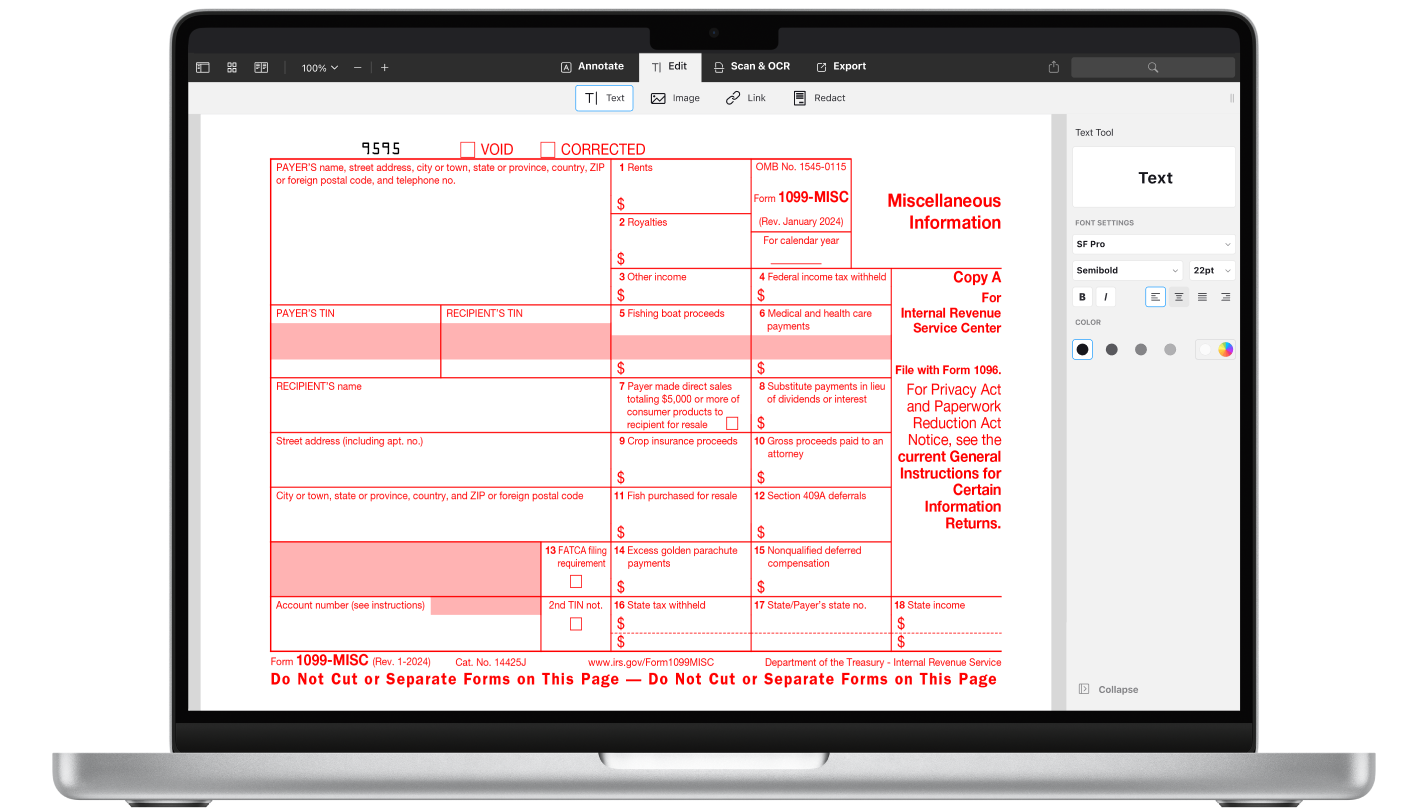

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

An Overview Of The 1099 NEC Form

Free IRS Form 1099 MISC PDF EForms