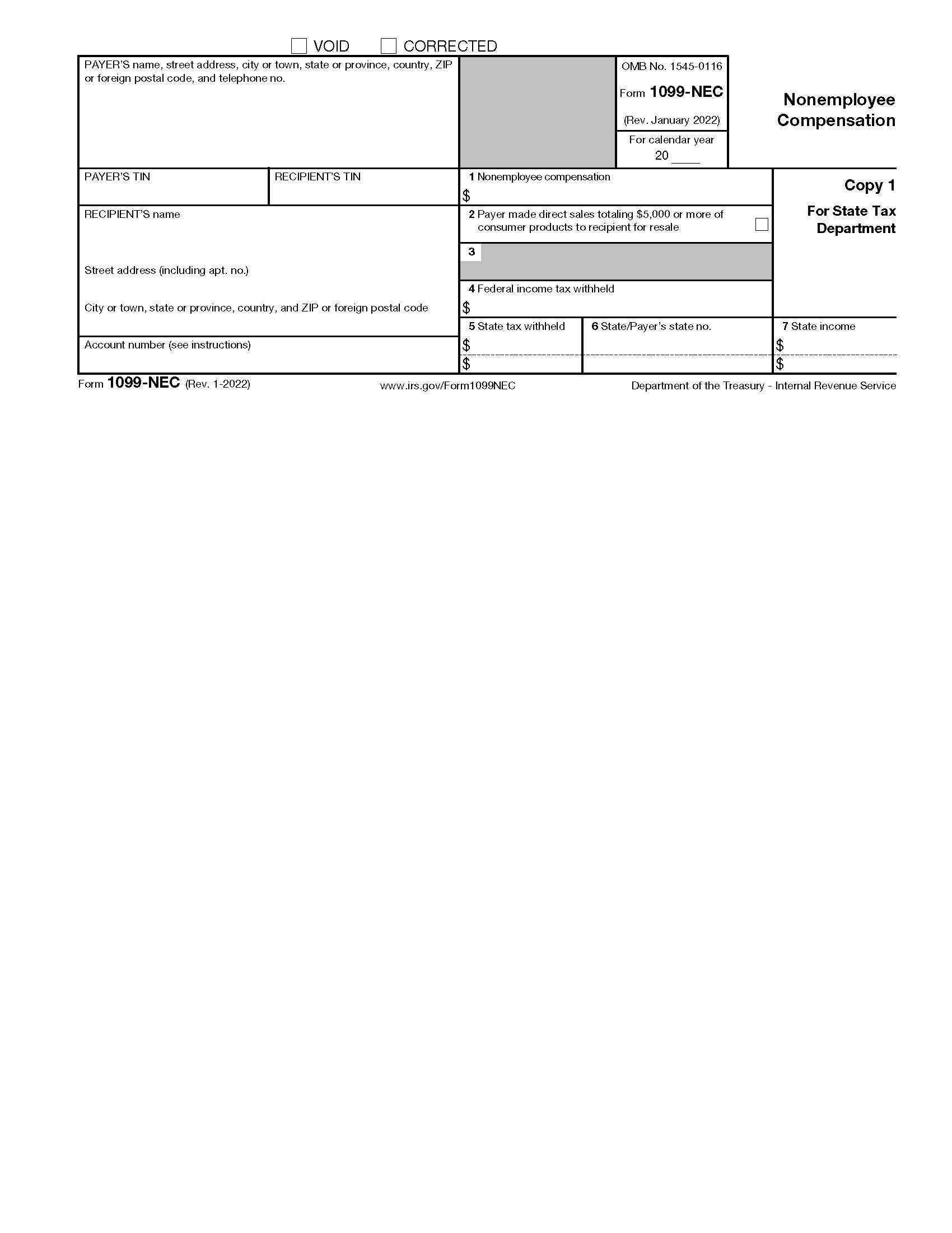

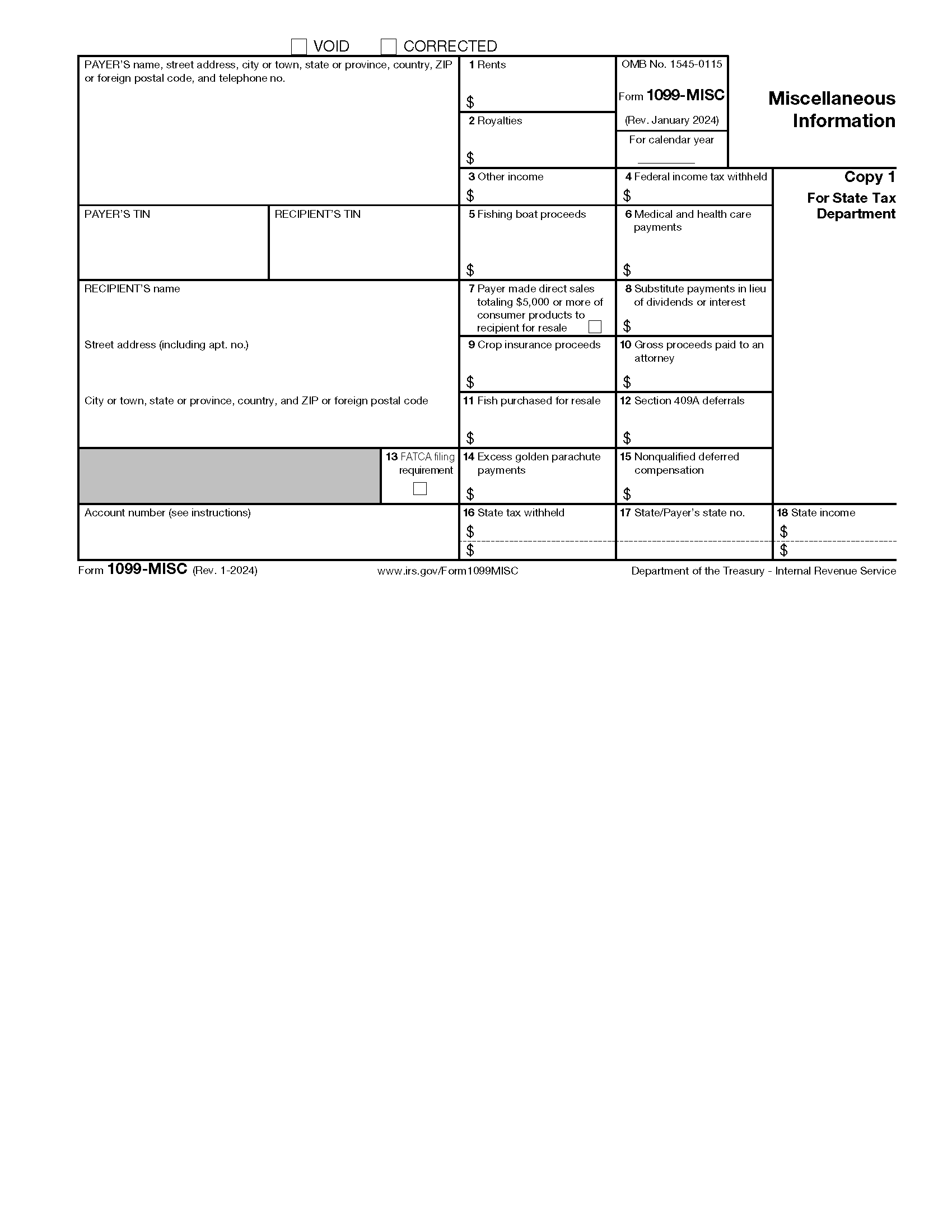

1099 Form IRS 2025

Are you ready for tax season? Understanding the ins and outs of tax forms can make a big difference in your filing process. One important form to be familiar with is the 1099 Form IRS 2025.

When it comes to taxes, the 1099 Form IRS 2025 is used to report income other than wages, salaries, and tips. This form is typically used by freelancers, independent contractors, and self-employed individuals.

1099 Form IRS 2025

What to Know About the 1099 Form IRS 2025

It’s crucial to accurately report all income on your tax return, including income reported on the 1099 Form IRS 2025. Make sure to keep track of all your 1099 forms, as they are essential for filing your taxes correctly.

When you receive a 1099 Form IRS 2025, the payer will also send a copy to the IRS. It’s essential to review the information on the form to ensure it is accurate. If you notice any errors, contact the payer immediately to have them corrected.

Remember, failing to report income from a 1099 Form IRS 2025 can lead to penalties and interest. Stay on top of your tax obligations by keeping thorough records and consulting with a tax professional if needed.

As tax season approaches, take the time to familiarize yourself with the 1099 Form IRS 2025 and its implications for your tax filing. By understanding this form and its requirements, you can ensure a smooth and stress-free tax season.

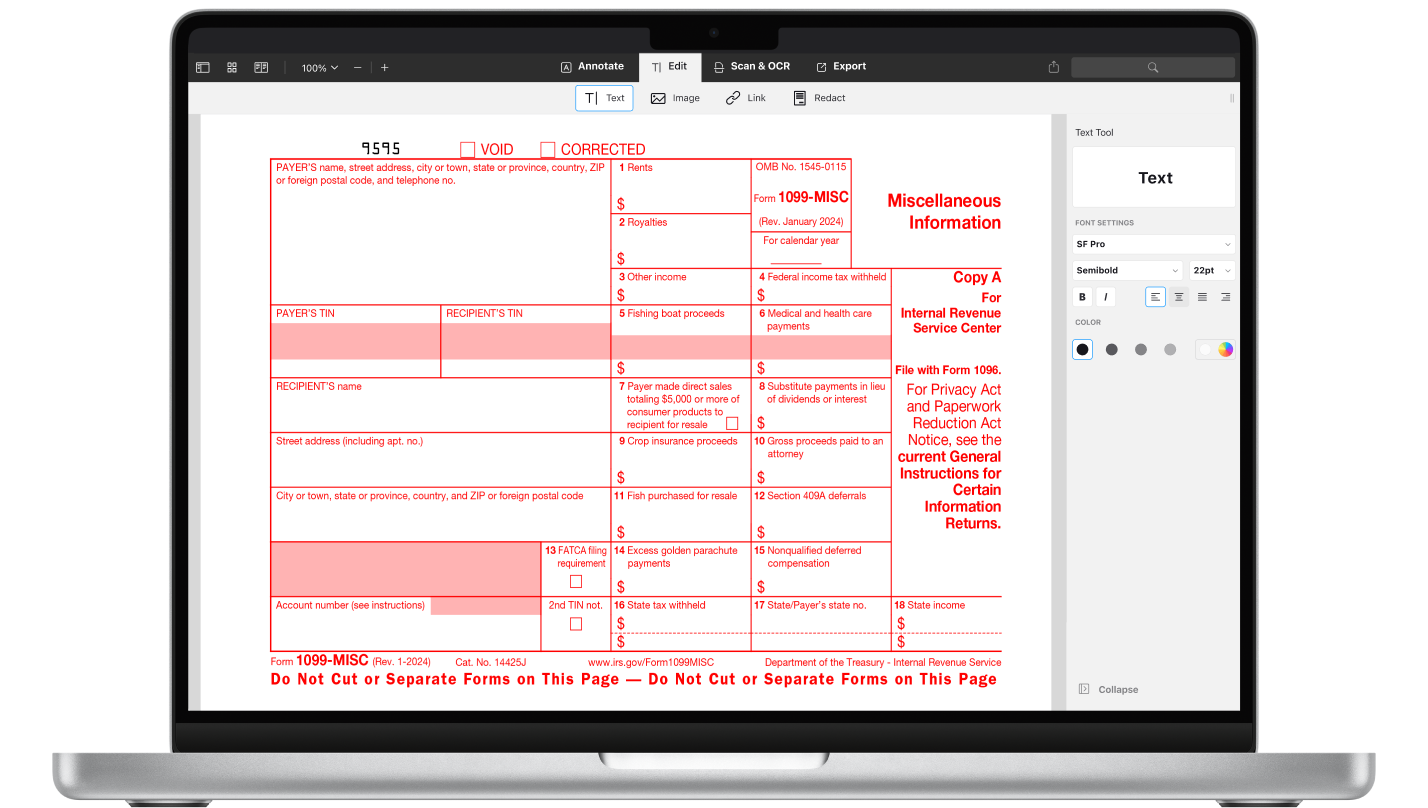

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

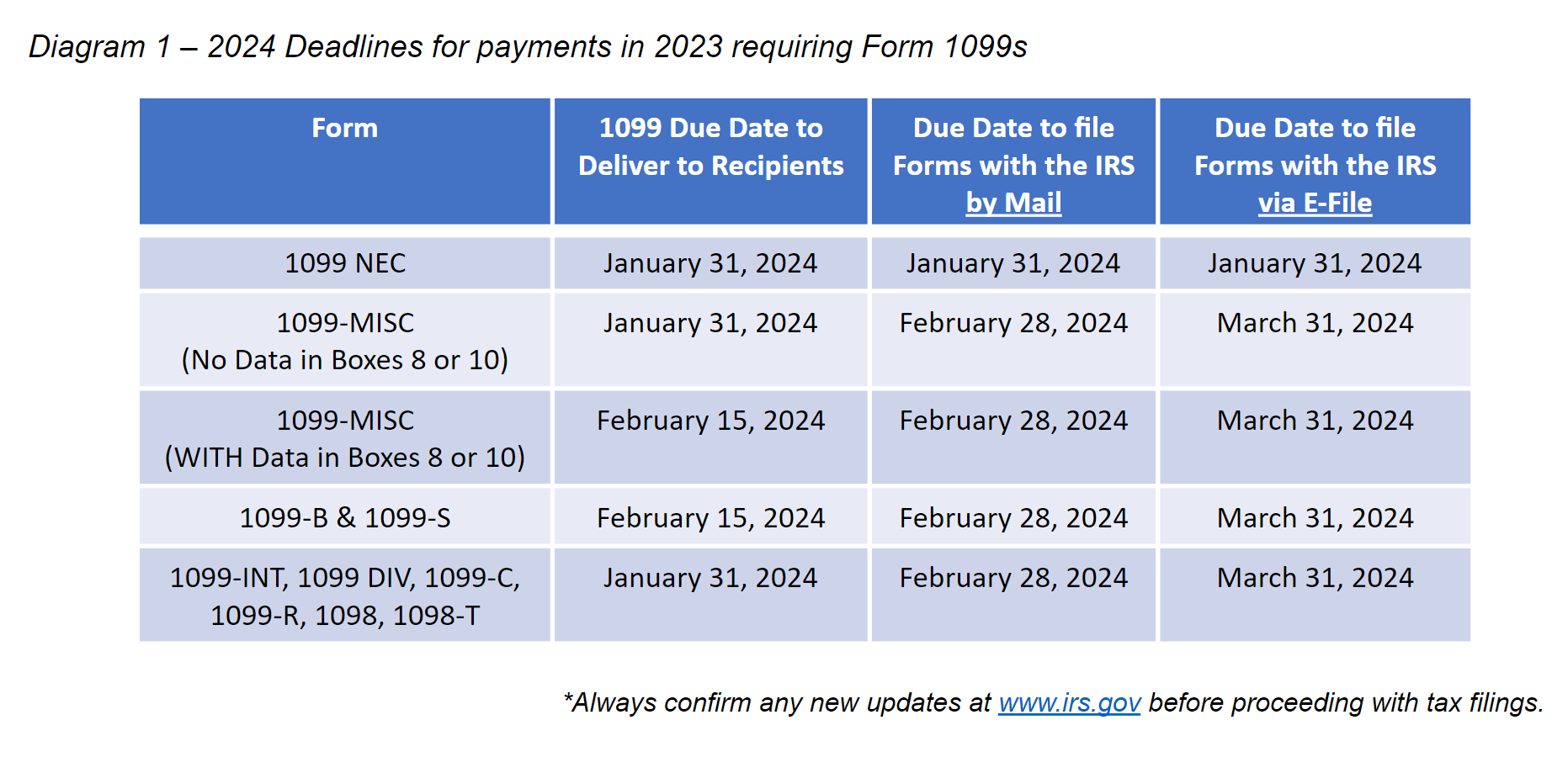

1099 Requirements For Business Owners In 2025 Mark J Kohler

Form 1099 Reporting Non Employment Income

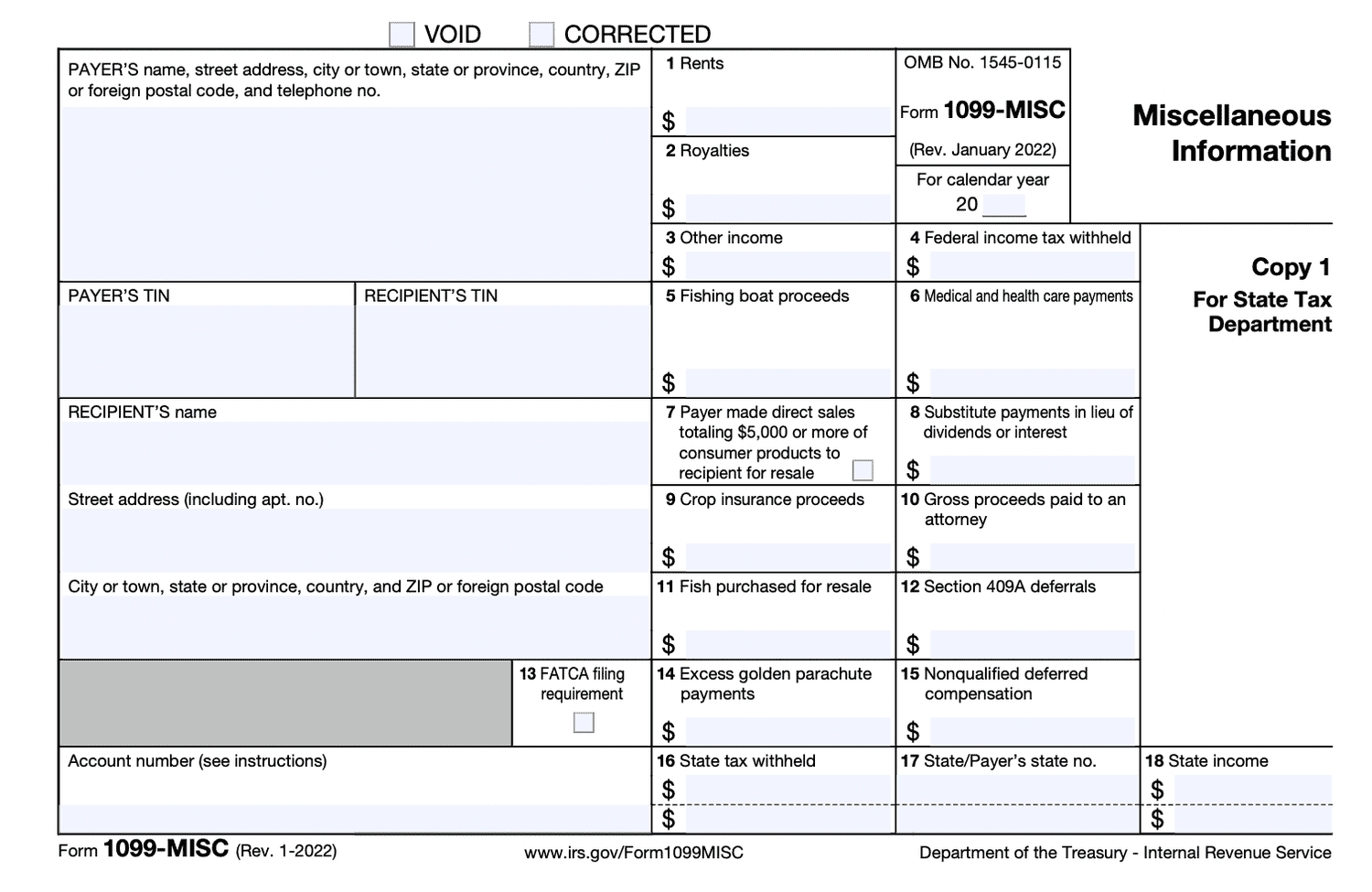

Free IRS 1099 Form PDF EForms

Free IRS Form 1099 MISC PDF EForms