1099 Forms 2025

Are you a freelancer or independent contractor who receives 1099 forms for your work? If so, you’ll want to stay informed about the latest updates and changes to the 1099 forms for the year 2025.

Keeping up with these changes is crucial to ensure you’re reporting your income accurately and complying with tax laws. Let’s dive into what you need to know about the 1099 forms for 2025.

1099 Forms 2025

Key Changes to 1099 Forms 2025

One of the significant updates to the 1099 forms for 2025 is the introduction of a new box for reporting cryptocurrency transactions. If you receive payments in cryptocurrency, you’ll need to include this information on your 1099 form.

Additionally, there may be changes to the thresholds for reporting income on certain types of 1099 forms. It’s essential to familiarize yourself with these thresholds to ensure you’re reporting all income accurately.

Furthermore, the IRS may introduce new requirements for electronic filing of 1099 forms in 2025. Be sure to stay updated on these requirements to avoid any penalties or fines for non-compliance.

Overall, staying informed about the changes to the 1099 forms for 2025 is crucial for freelancers and independent contractors. By understanding these updates, you can ensure you’re accurately reporting your income and avoiding any potential issues with the IRS.

As always, it’s recommended to consult with a tax professional or accountant to ensure you’re meeting all requirements and staying compliant with tax laws. By staying informed and proactive, you can navigate the changes to the 1099 forms for 2025 with ease.

An Overview Of The 1099 NEC Form

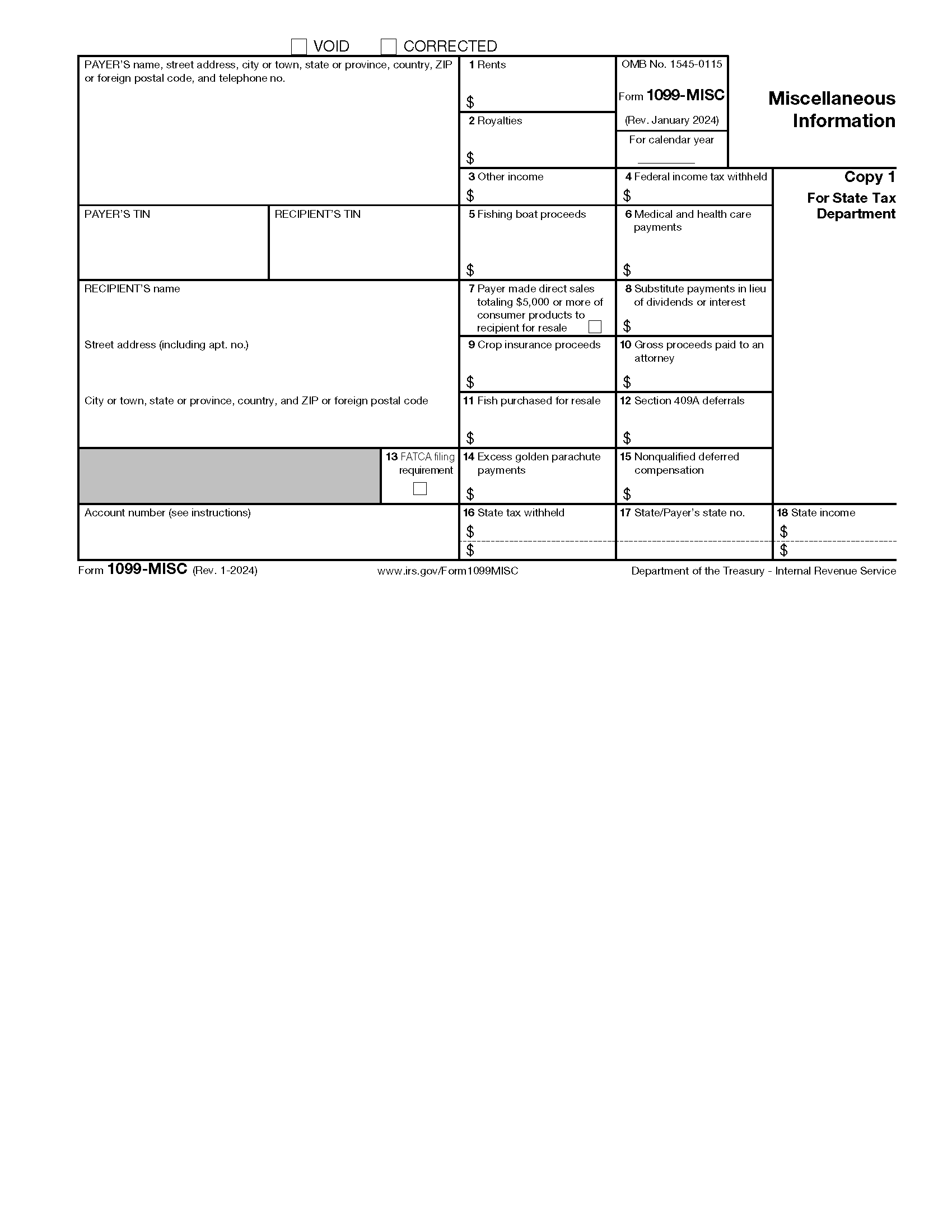

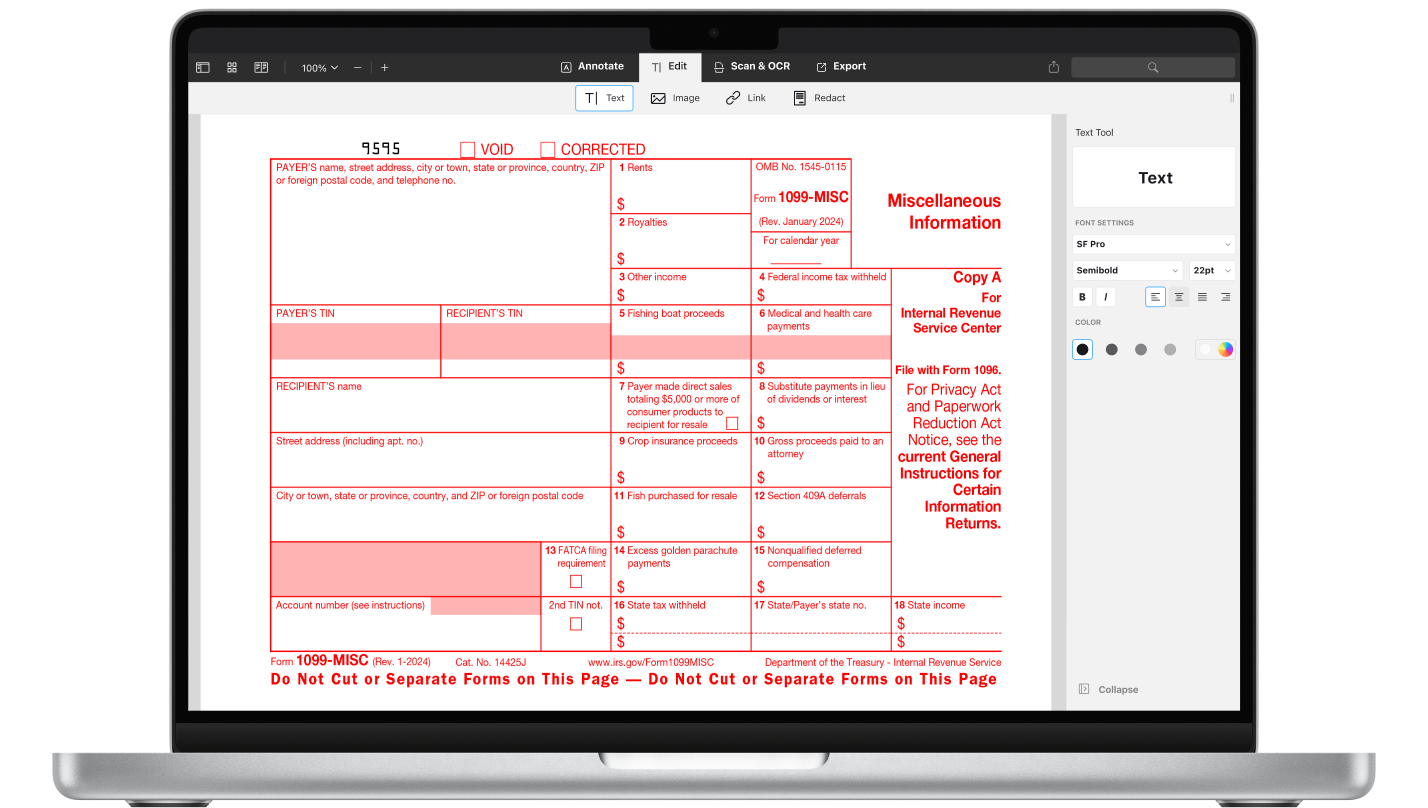

Free IRS Form 1099 MISC PDF EForms

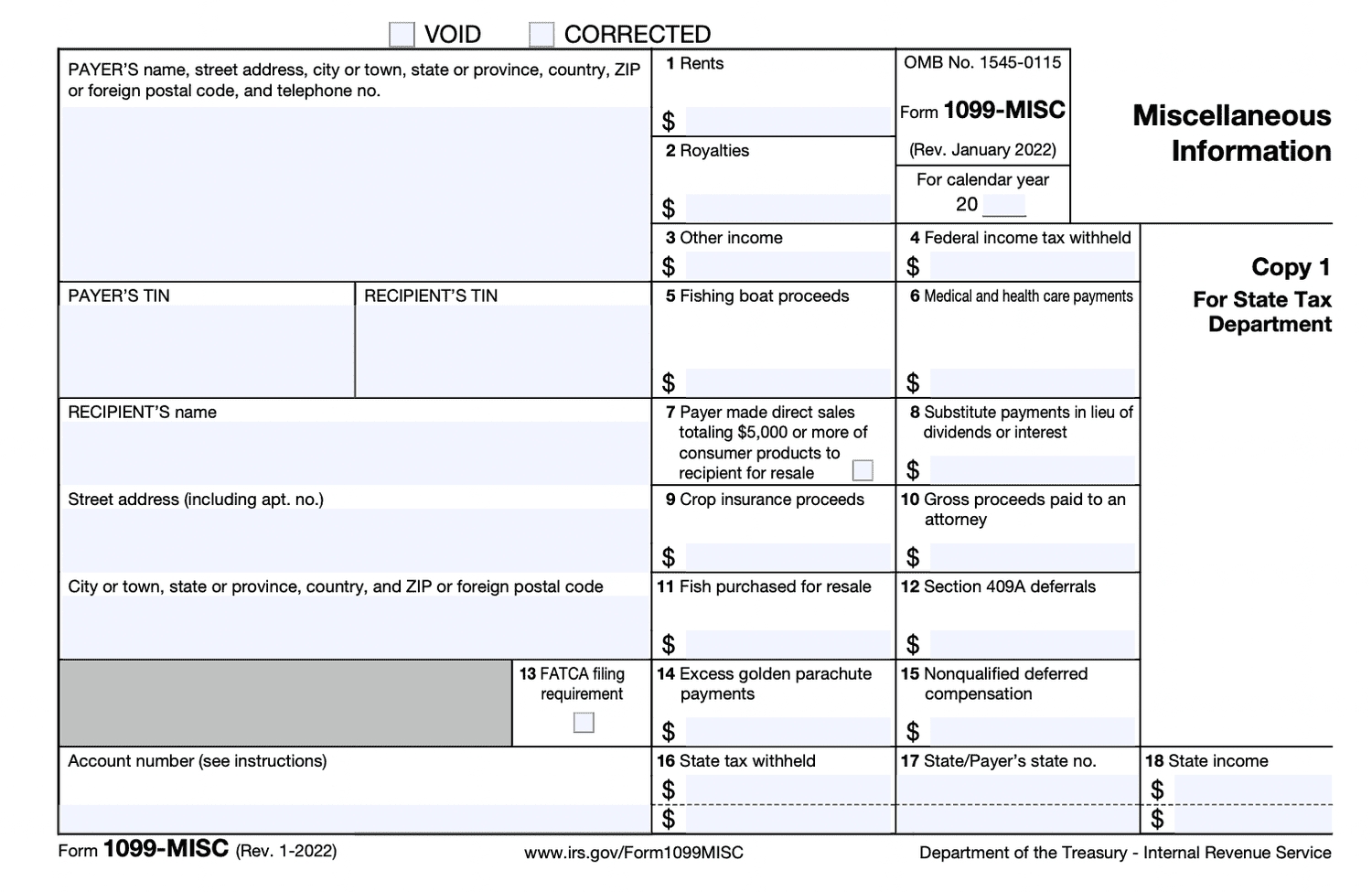

Form 1099 Reporting Non Employment Income

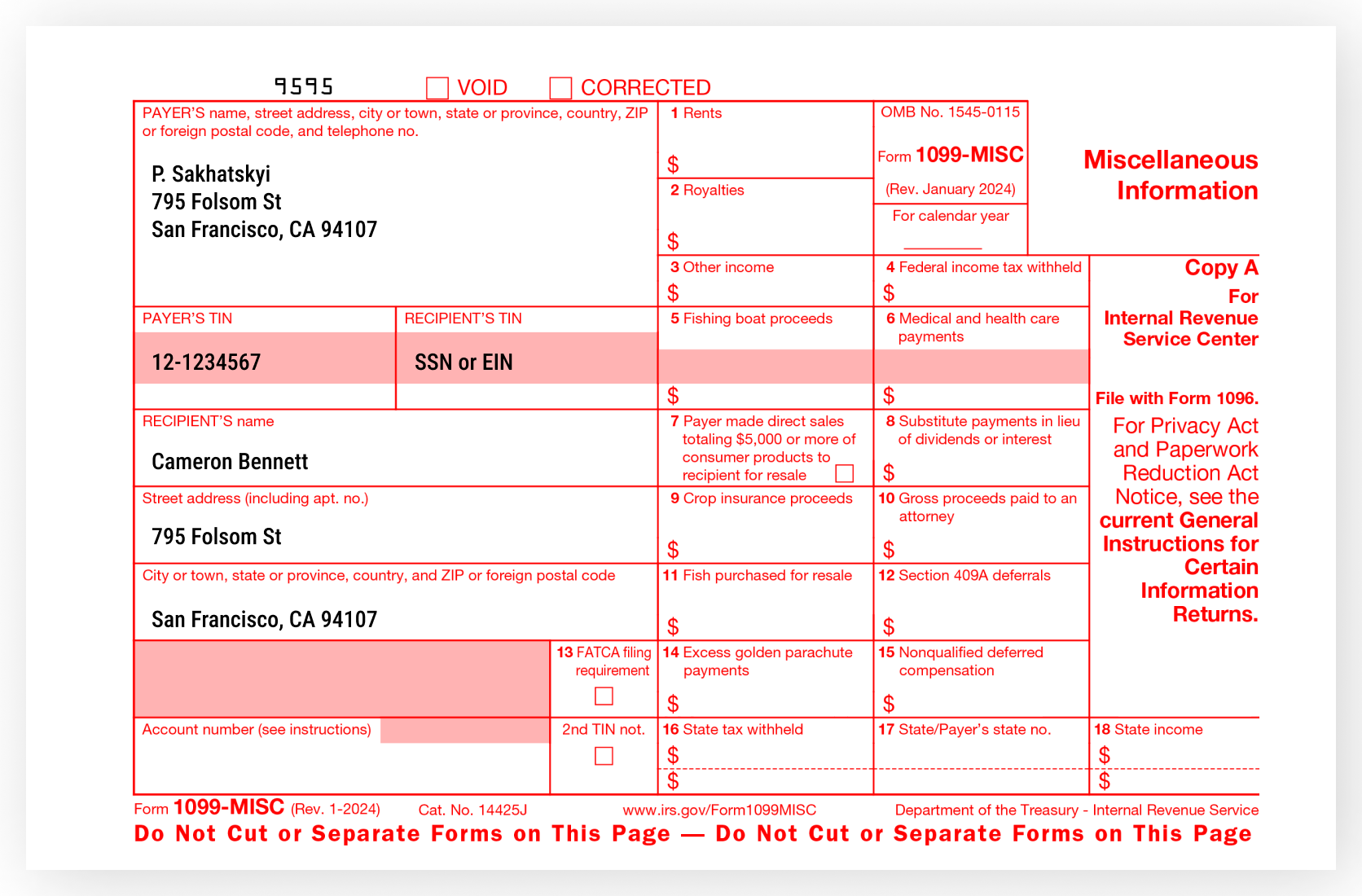

Das IRS Formular 1099 MISC F r 2025 Als PDF Ausf llen

Das IRS Formular 1099 MISC F r 2025 Als PDF Ausf llen