1099 Forms Deadline 2025

Are you a freelancer or independent contractor who receives 1099 forms for your income? If so, it’s essential to be aware of the upcoming deadline for filing your 1099 forms in 2025. Missing this deadline could result in penalties and fines, so mark your calendar now!

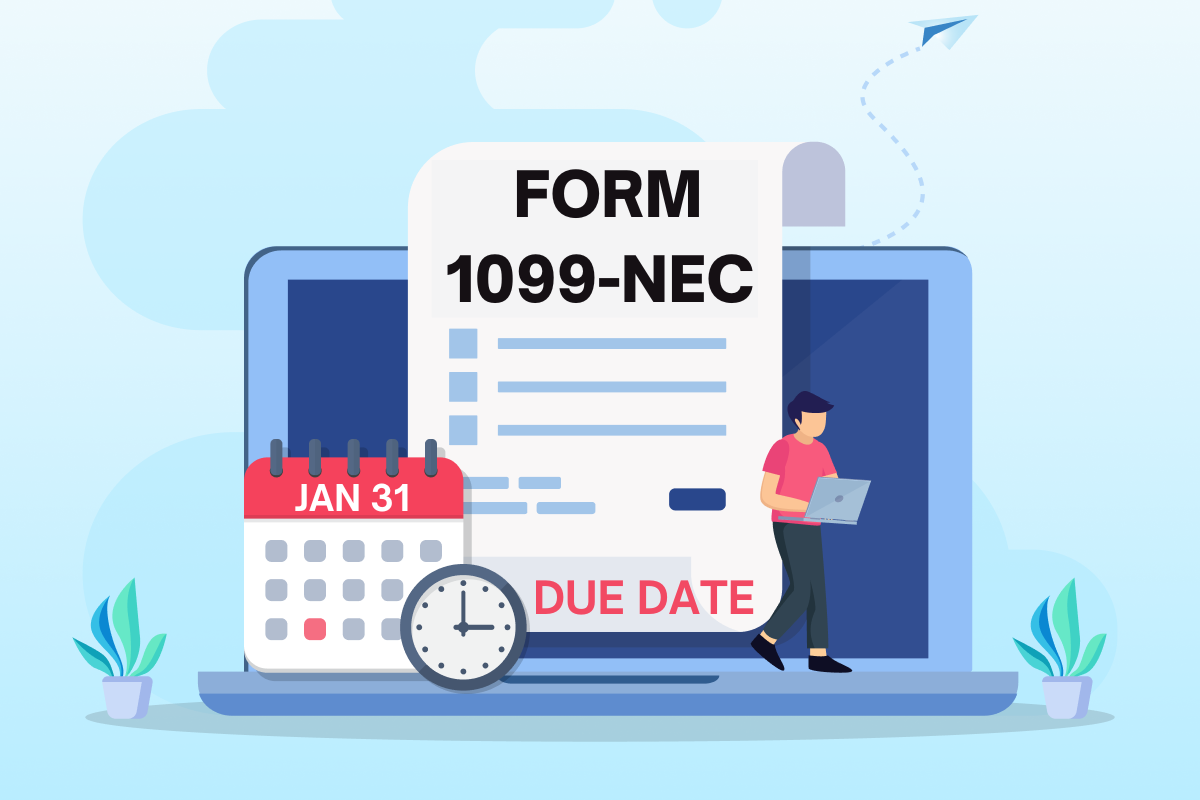

As a freelancer, you likely receive 1099-MISC or 1099-NEC forms from clients who have paid you more than $600 during the tax year. These forms report your earnings to the IRS and are crucial for accurately reporting your income and taxes. The deadline for filing these forms is usually January 31st each year.

1099 Forms Deadline 2025

1099 Forms Deadline 2025

For the 2025 tax year, the deadline for filing 1099 forms is January 31st, 2026. Make sure to gather all your 1099 forms from clients and submit them to the IRS by this date to avoid any penalties. Remember to keep copies of these forms for your records as well.

If you’re unsure about how to file your 1099 forms or have any questions about the process, consider consulting with a tax professional or using tax preparation software. They can help ensure that your forms are filed correctly and on time, giving you peace of mind during tax season.

Don’t wait until the last minute to gather your 1099 forms and file them. Start now to avoid any potential delays or issues that could arise. By staying organized and proactive, you can make the process of filing your 1099 forms smooth and stress-free.

Remember, the deadline for filing 1099 forms for the 2025 tax year is January 31st, 2026. Take the necessary steps now to ensure that you meet this deadline and avoid any penalties. Stay on top of your tax responsibilities and start the new year off right!

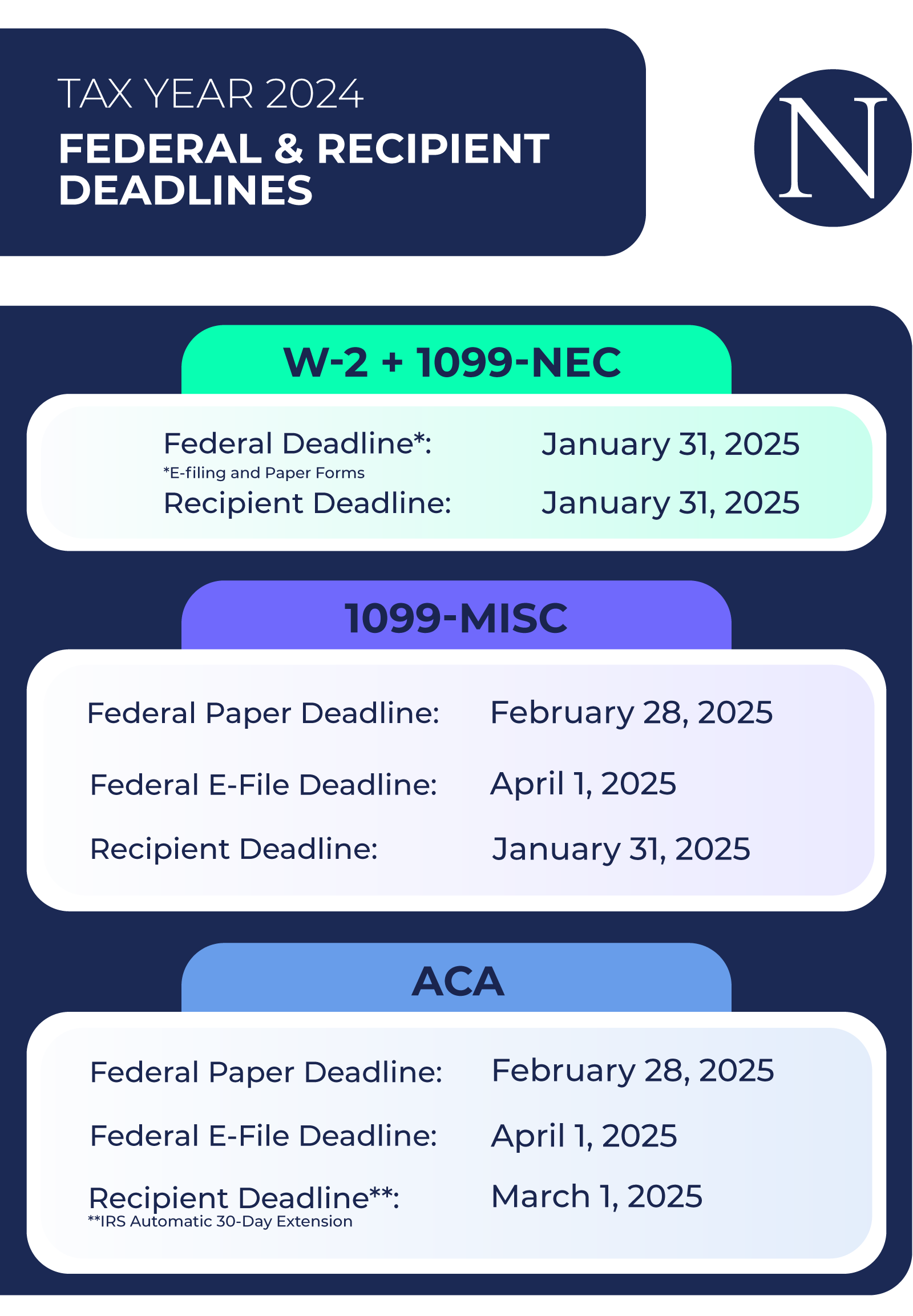

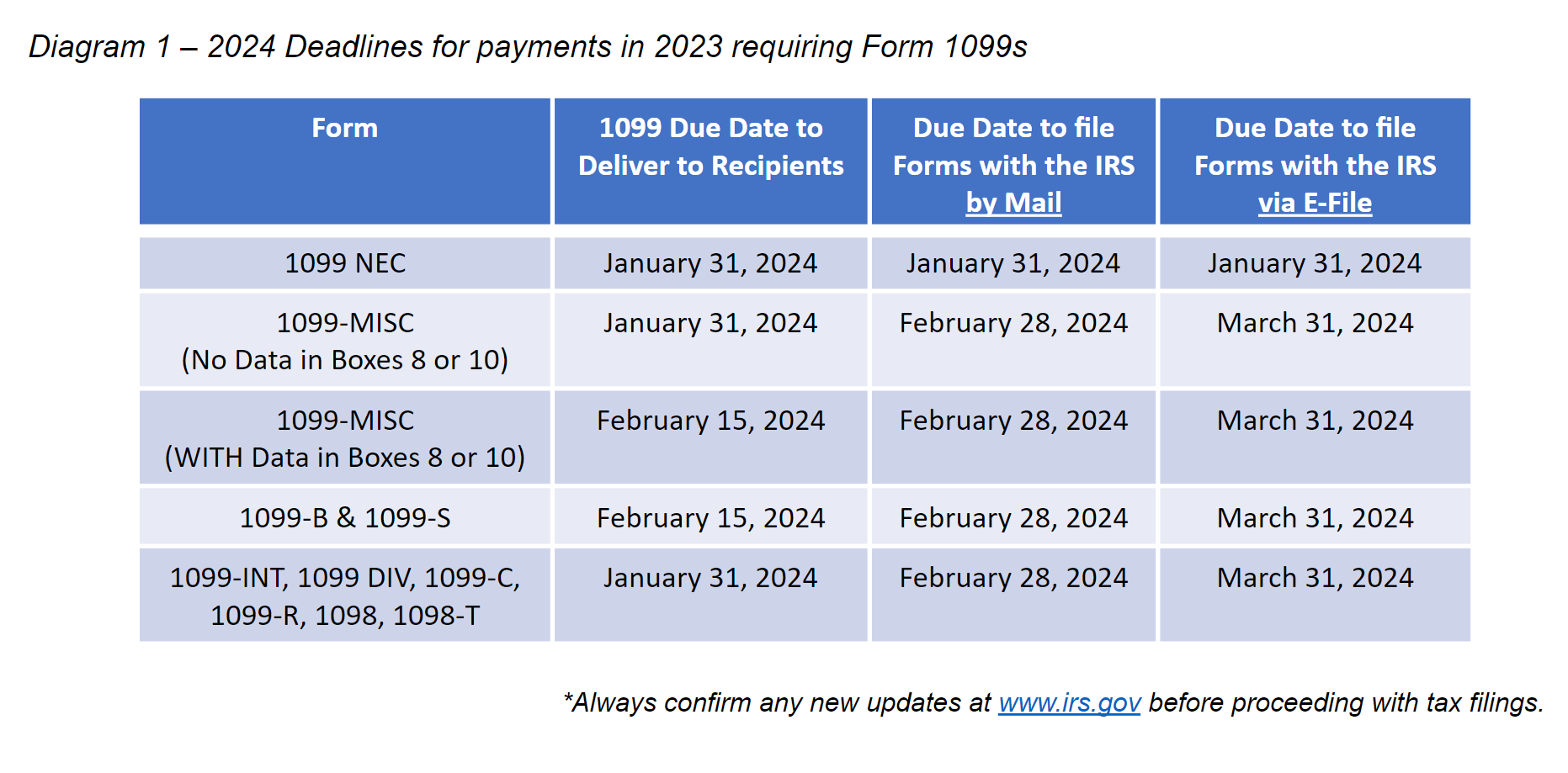

Essential Tax Deadlines For Your Business In 2024 NelcoSolutions

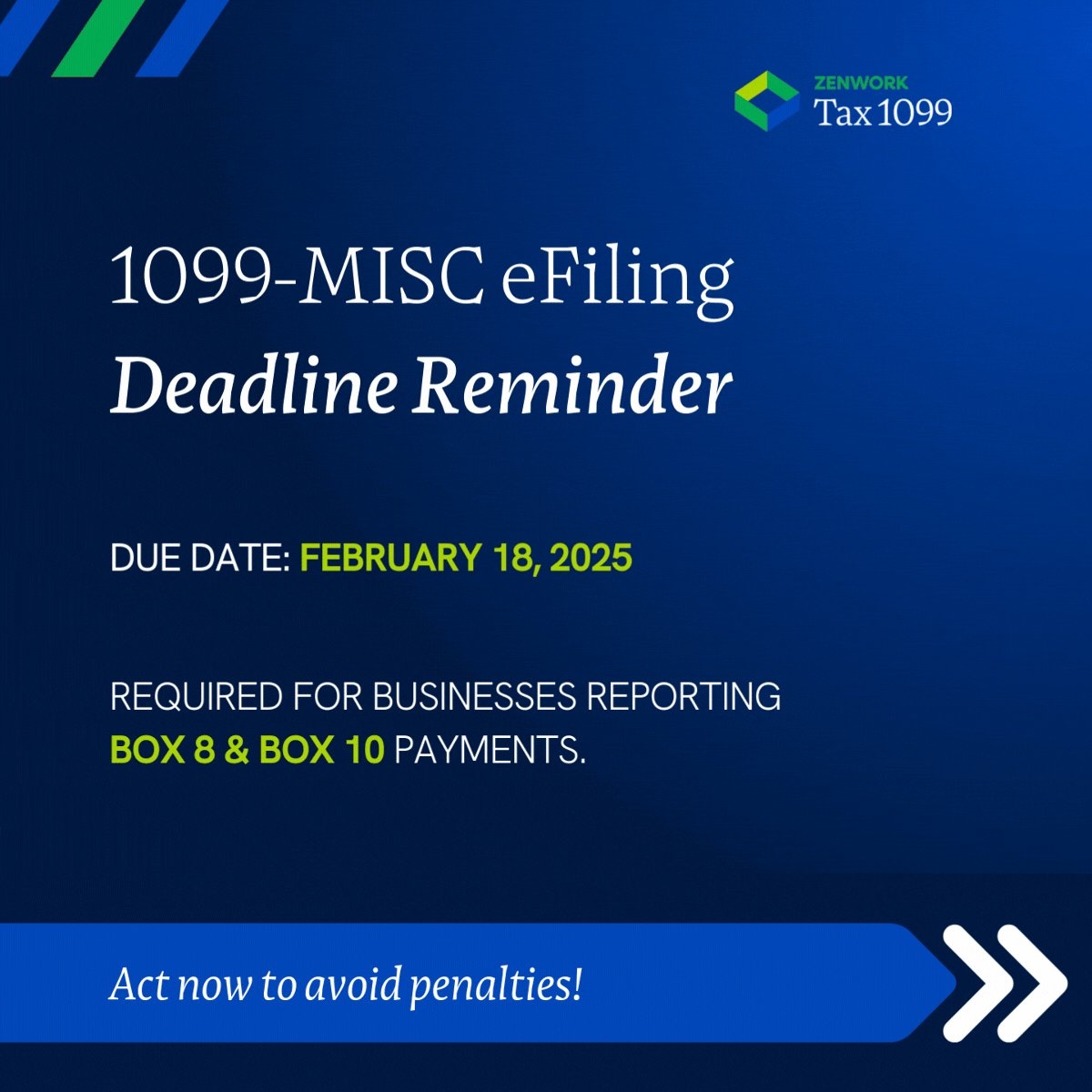

IRS Form 1099 NEC Due Date 2024 Tax1099 Blog

Key Deadlines For 2025 1099 Forms

Itemize Deductions Or Take The Standard Deduction Which Is Right For You

1099 Requirements For Business Owners In 2025 Mark J Kohler