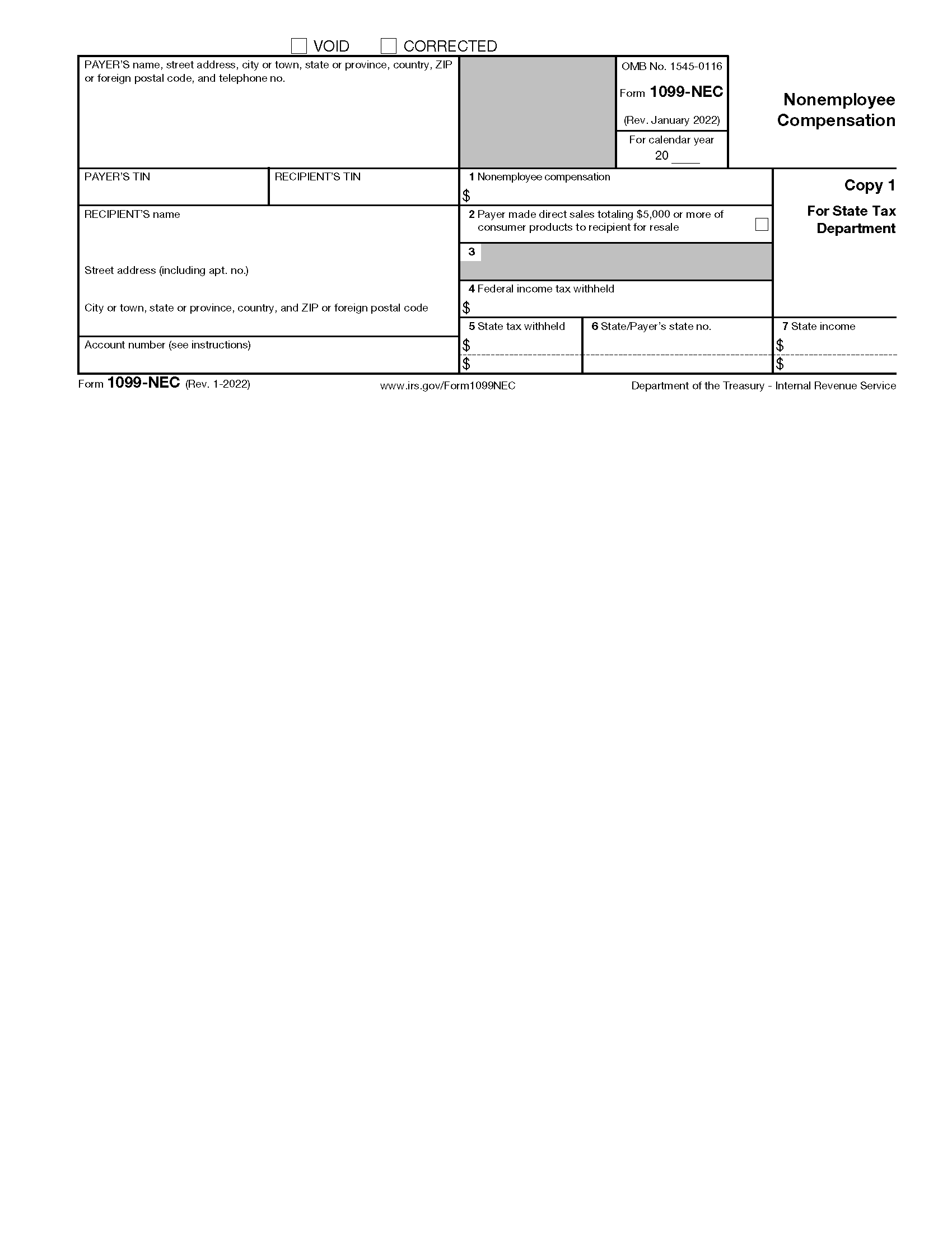

1099 IRS Form 2025

Are you a freelancer or independent contractor wondering about the 1099 IRS Form for the upcoming tax season in 2025? It’s essential to stay informed about tax requirements to avoid any surprises.

For those unfamiliar, the 1099 IRS Form 2025 is used to report income earned from self-employment, freelance work, or contract jobs. It’s crucial to accurately report all income sources to comply with tax laws.

1099 IRS Form 2025

Understanding the 1099 IRS Form 2025

When you receive a 1099 form, it means that a client has paid you $600 or more for your services during the tax year. This form is essential for accurately reporting your income and ensuring compliance with IRS regulations.

Make sure to keep detailed records of all your income sources throughout the year to make filling out the 1099 form easier. It’s always a good idea to consult with a tax professional if you have any questions or concerns about your tax obligations.

Remember, filing your taxes accurately and on time is crucial to avoid penalties or audits. Stay organized, keep track of your income and expenses, and seek help if needed to ensure a stress-free tax season.

As tax season approaches, take the time to gather all necessary documents, including the 1099 IRS Form 2025, to ensure a smooth filing process. By staying informed and proactive, you can navigate tax season with confidence and peace of mind.

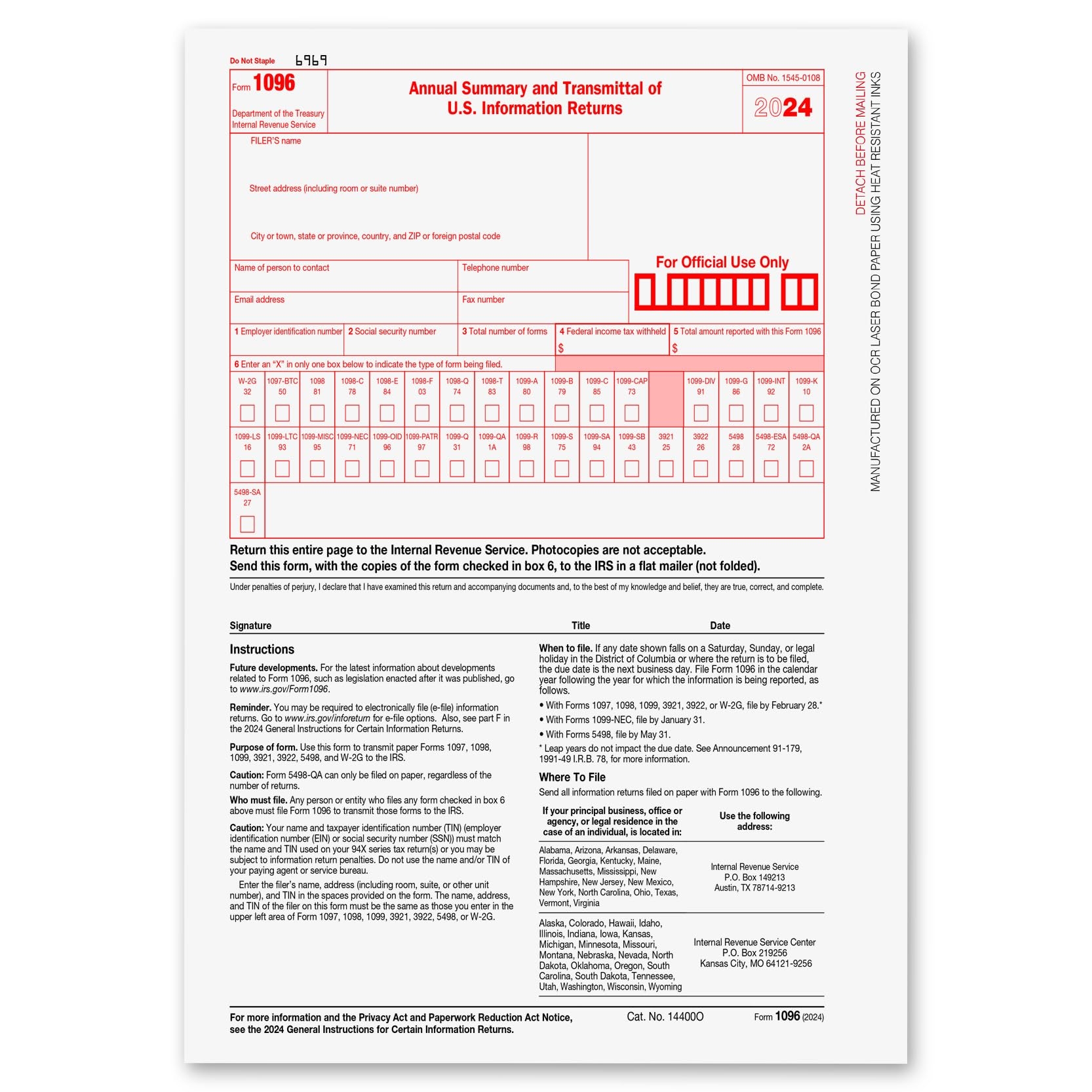

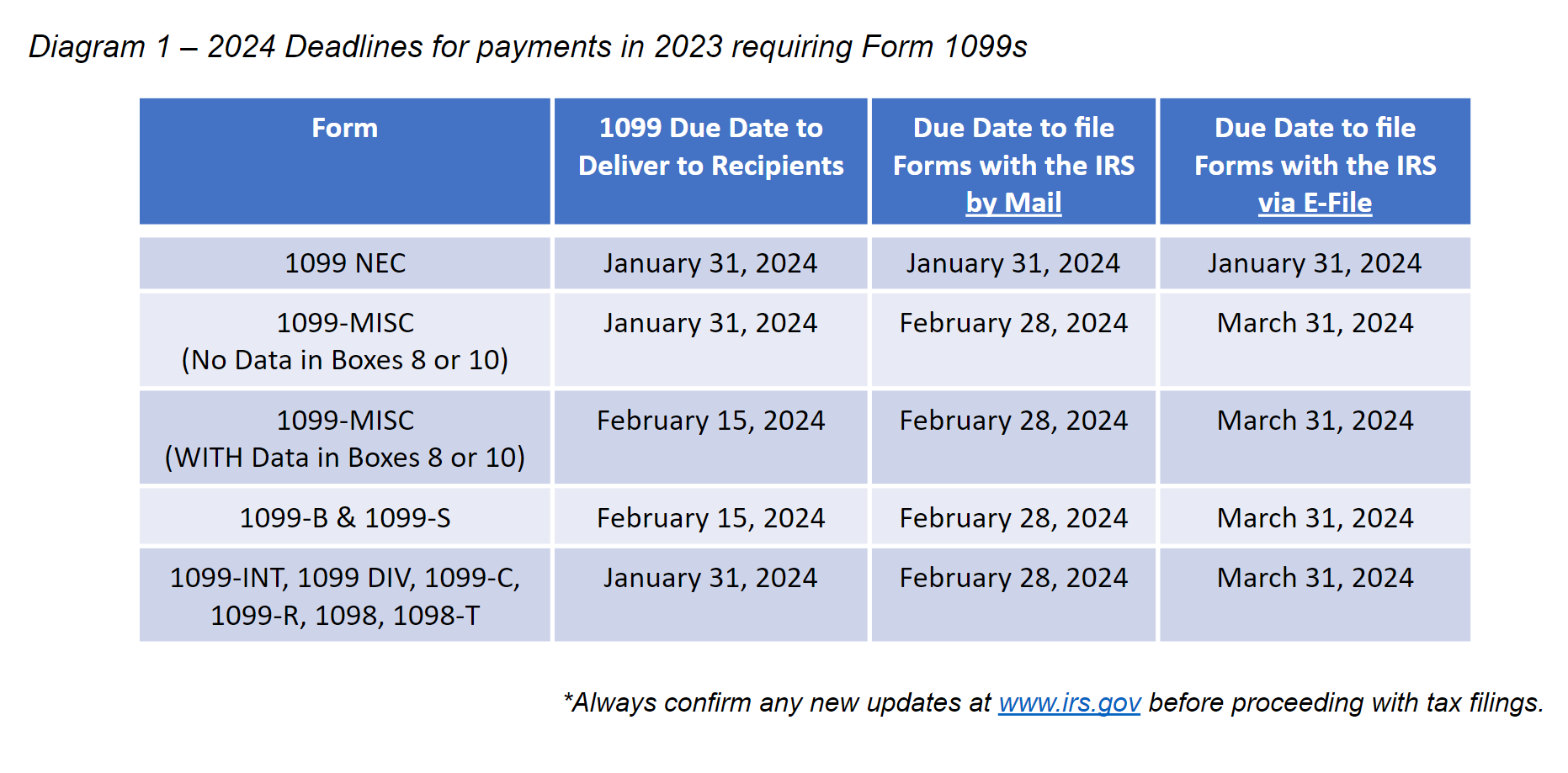

1099 Requirements For Business Owners In 2025 Mark J Kohler

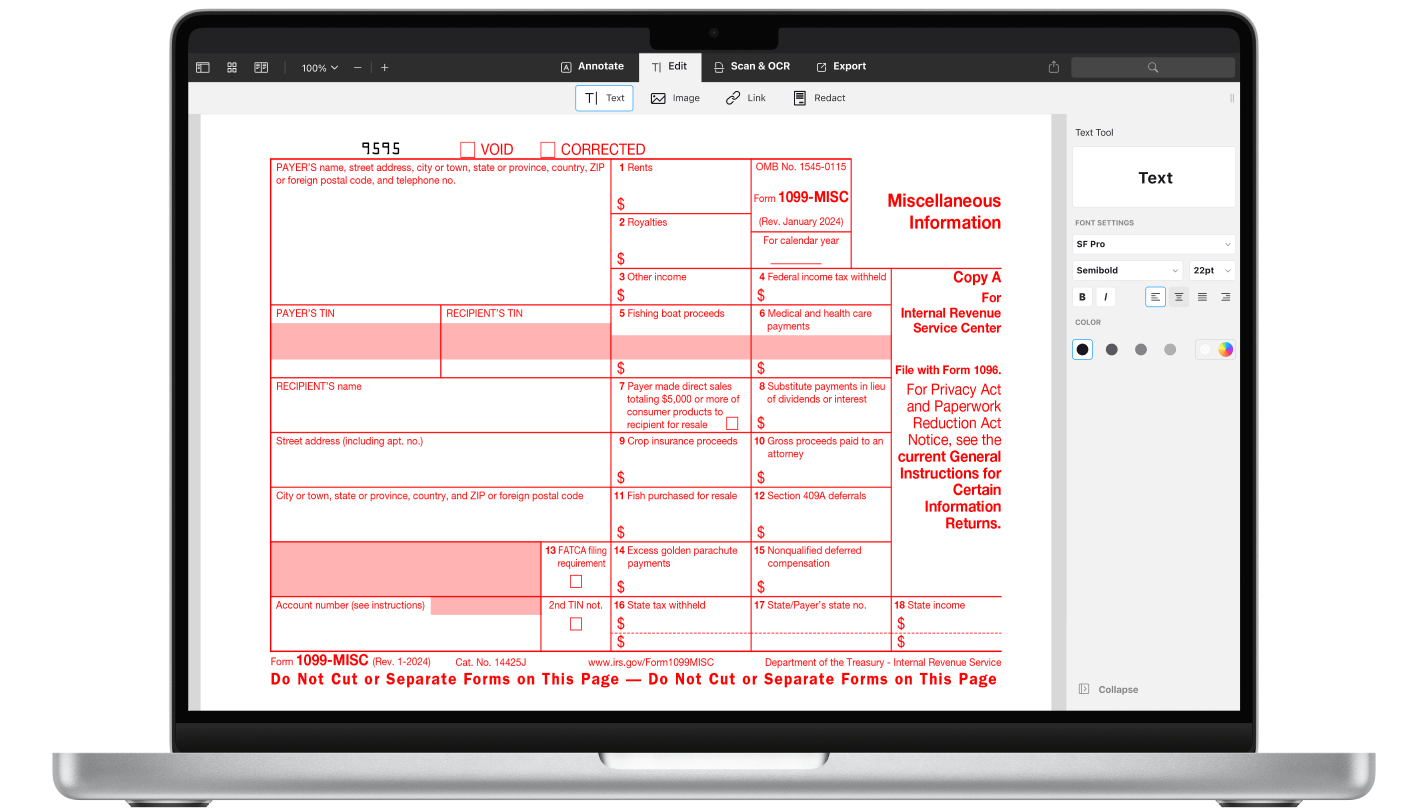

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

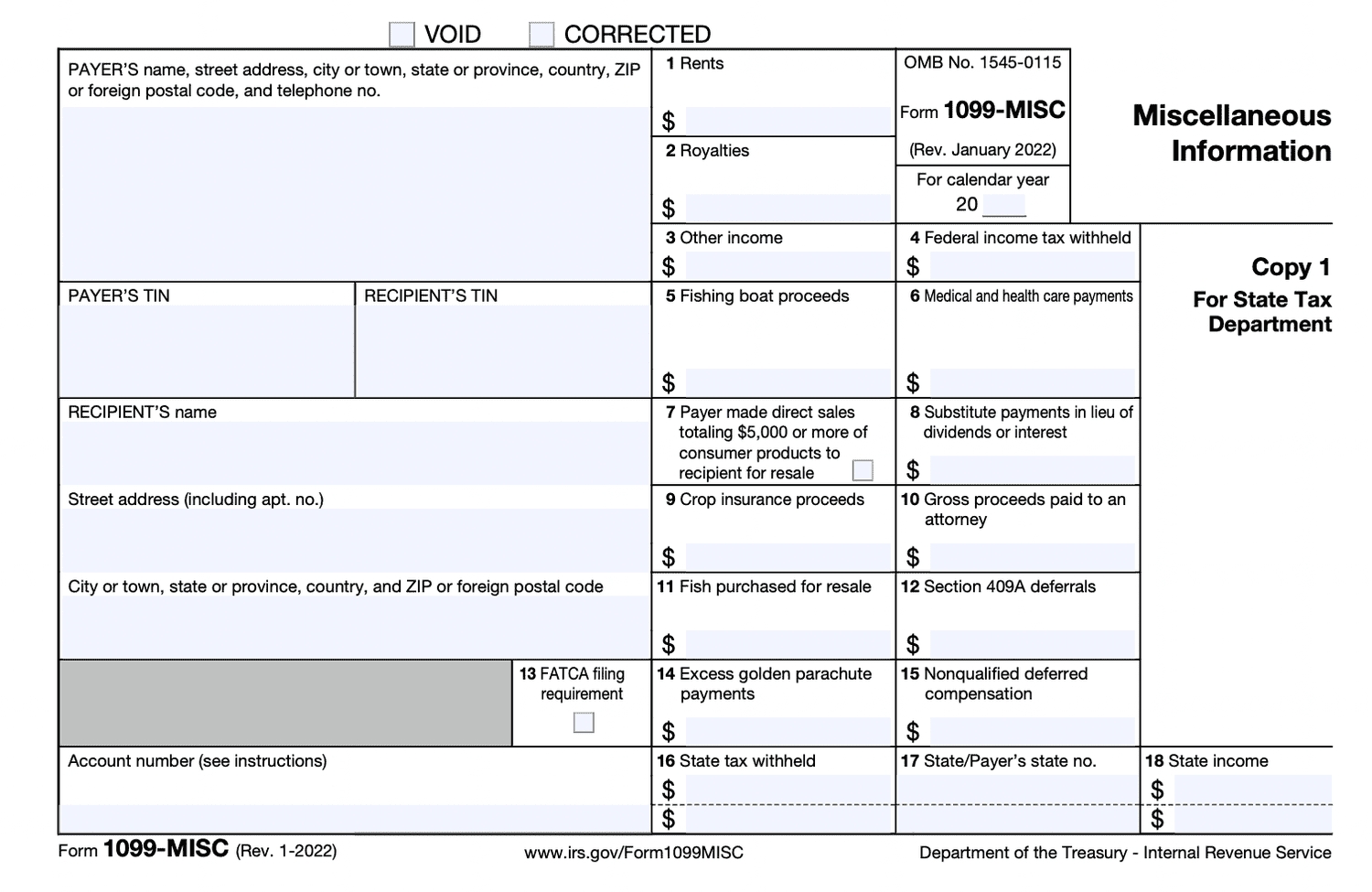

Form 1099 Reporting Non Employment Income

Free IRS 1099 Form PDF EForms

Free IRS Form 1099 MISC PDF EForms