1099-NEC 2025 Form

If you’re a freelancer or independent contractor, you’re probably familiar with the 1099-NEC form. It’s the document used to report non-employee compensation to the IRS. As we look ahead to 2025, there are some important things to keep in mind.

One key change for the 2025 tax year is the deadline for filing 1099-NEC forms. Starting in 2025, the deadline will be January 31st. This means you’ll need to make sure you have all your paperwork in order earlier than in previous years.

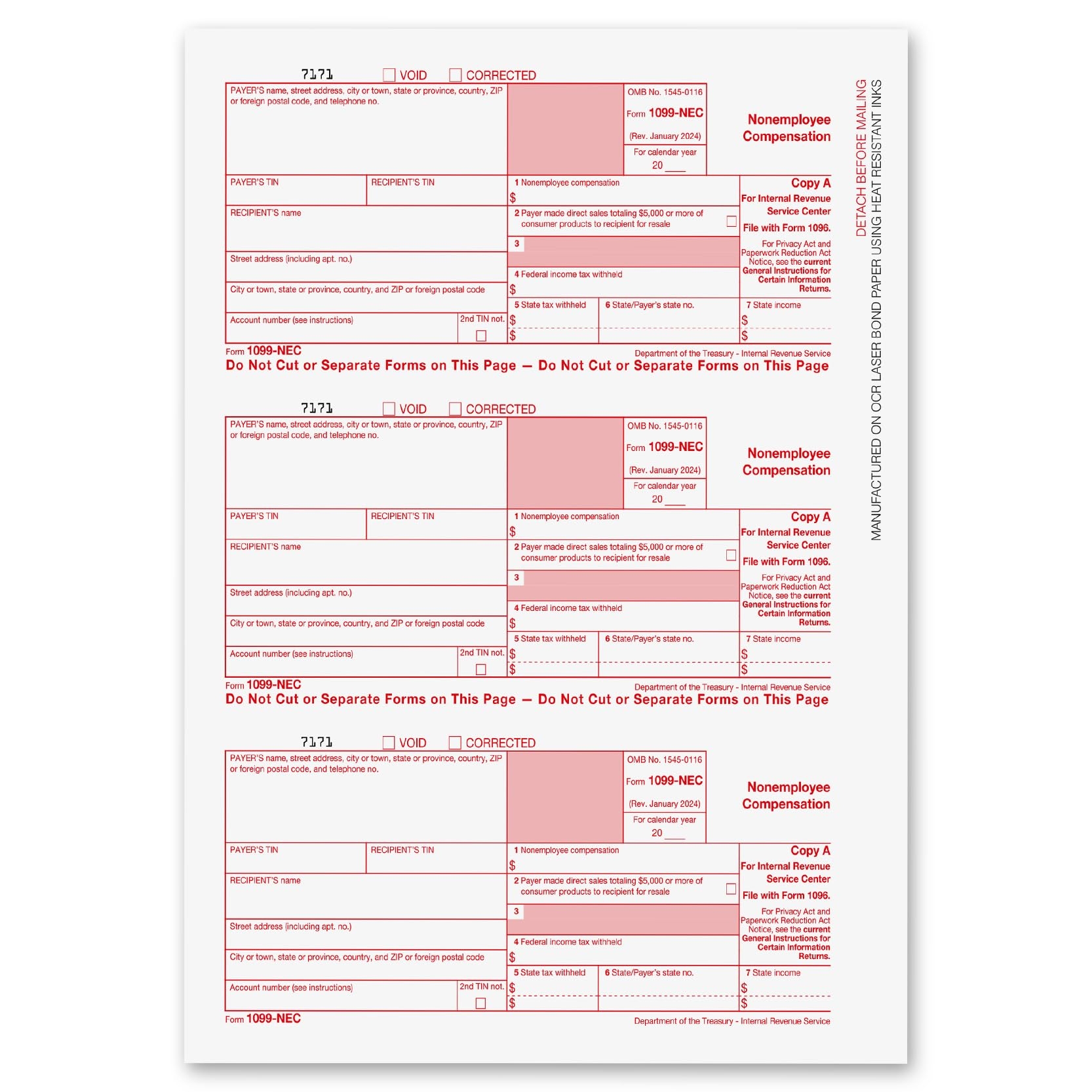

1099-NEC 2025 Form

1099-NEC 2025 Form

Another important update for 2025 is the increased penalties for late or incorrect filing of 1099-NEC forms. It’s crucial to double-check your information and file on time to avoid these penalties. Remember, accuracy is key when it comes to tax reporting!

As you prepare for the 2025 tax season, make sure you have a system in place for tracking your income and expenses throughout the year. This will make the process of filling out your 1099-NEC form much smoother and less stressful.

Don’t forget to keep detailed records of any deductions you plan to claim on your 1099-NEC form. Having this information organized and easily accessible will save you time and hassle when it’s time to file your taxes.

In conclusion, staying informed and organized is key when it comes to navigating the 1099-NEC form for the 2025 tax year. By being proactive and paying attention to deadlines and requirements, you can ensure a smooth and stress-free tax season.

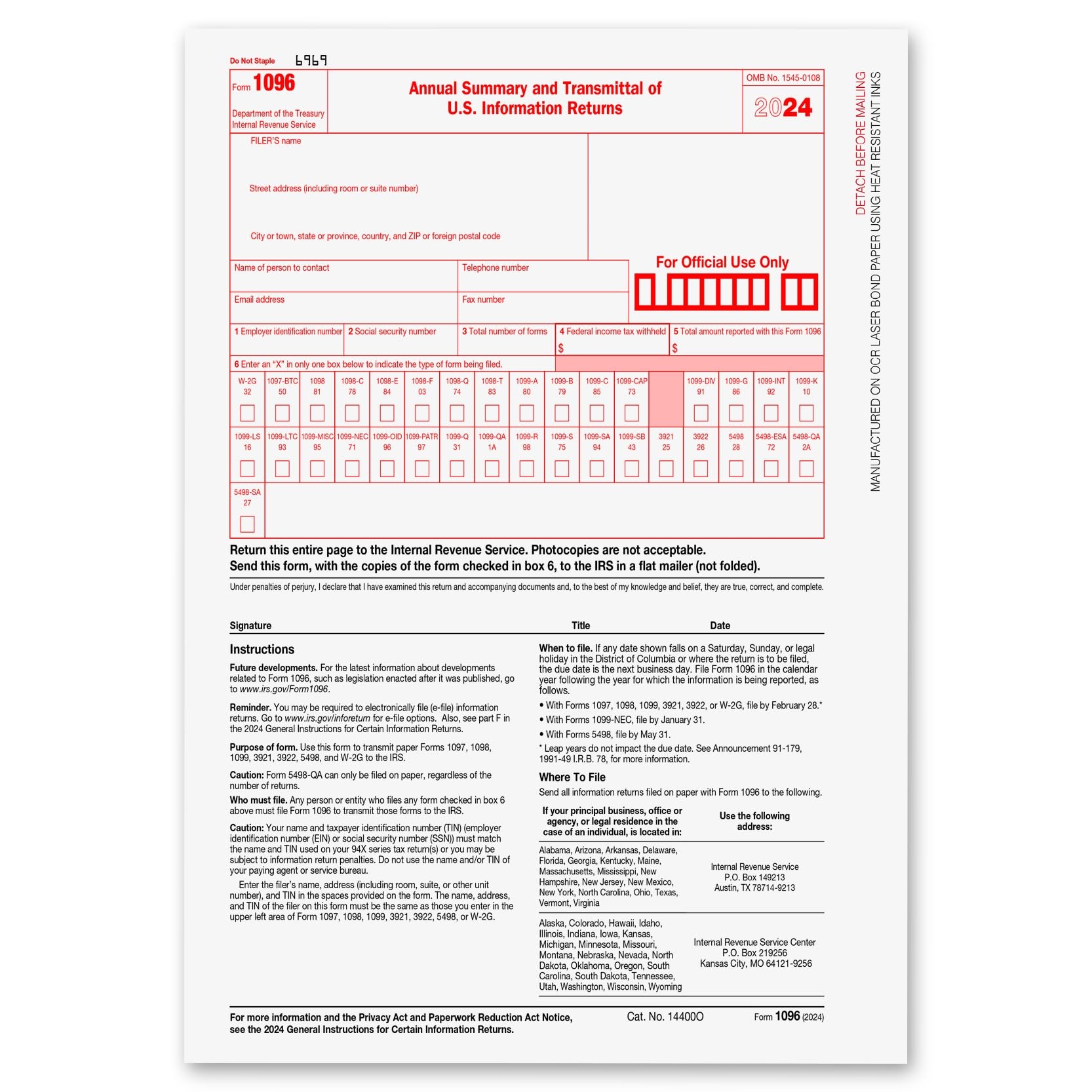

What Is Form 1099 NEC For Nonemployee Compensation

Amazon 1099 NEC Forms 2024 1099 NEC Laser Forms IRS Approved Designed For Quickbooks And Accounting Software 2024 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 38 108 Forms Office Products

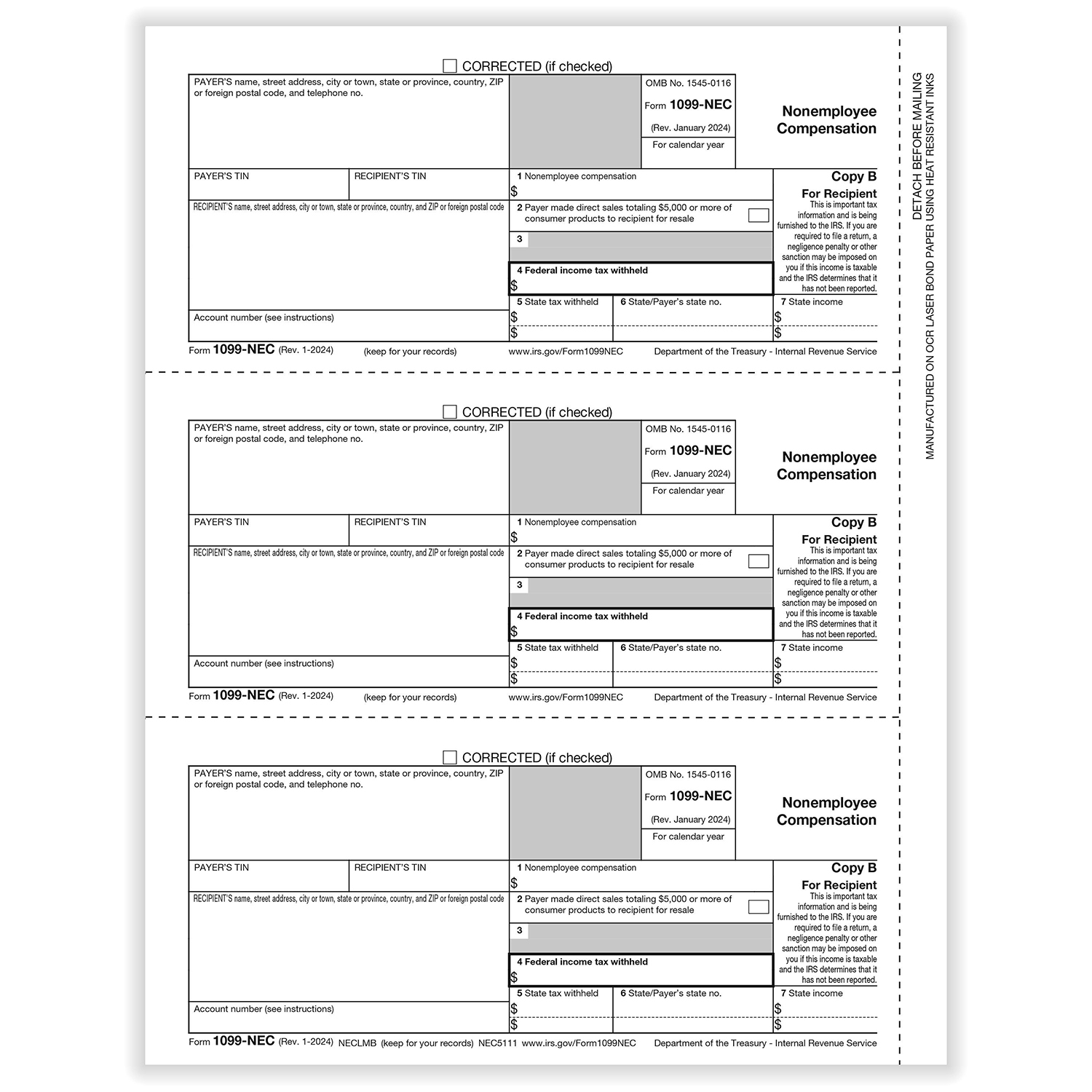

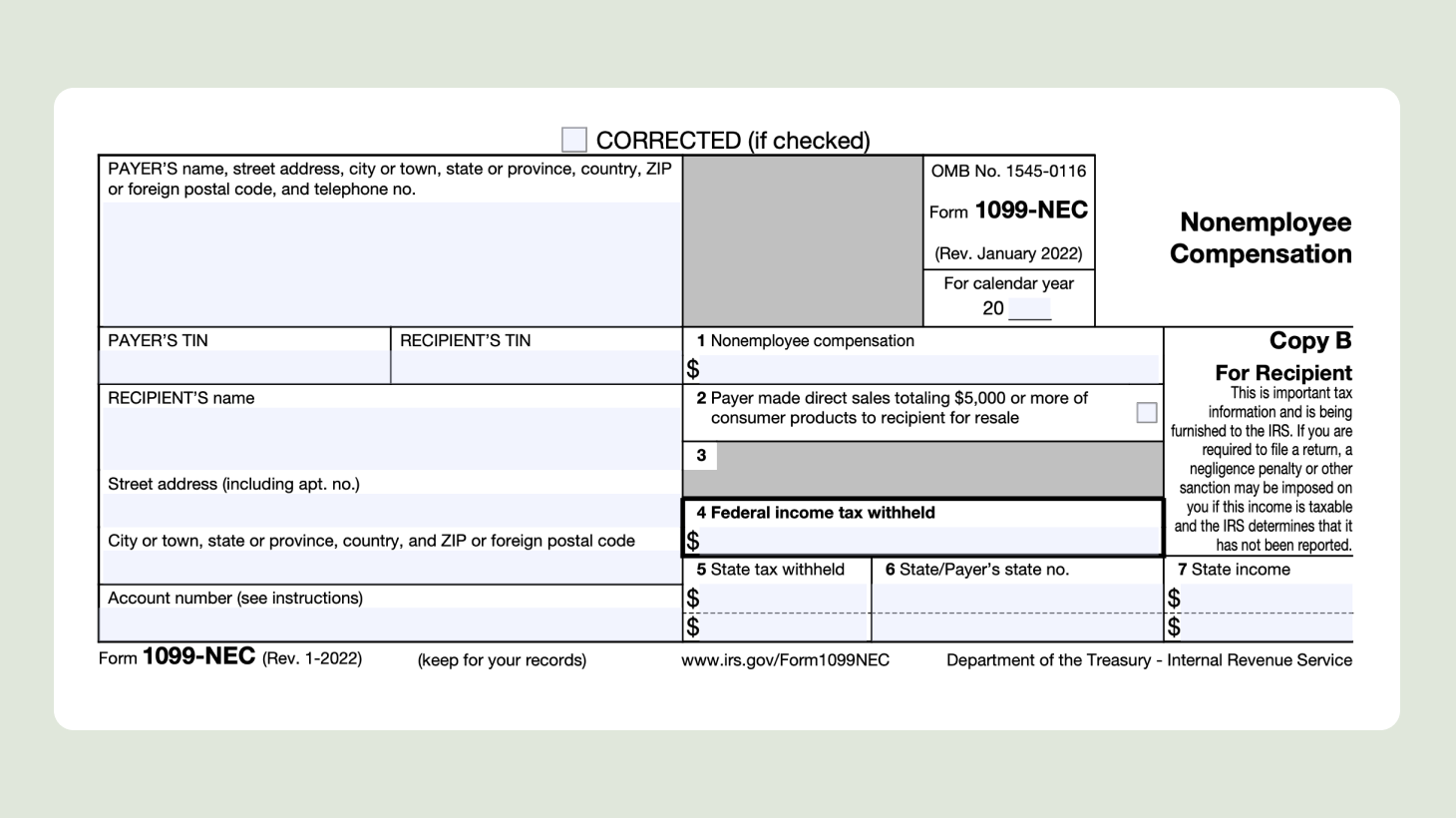

1099 NEC 3 Up Individual Recipient Copy B Formstax

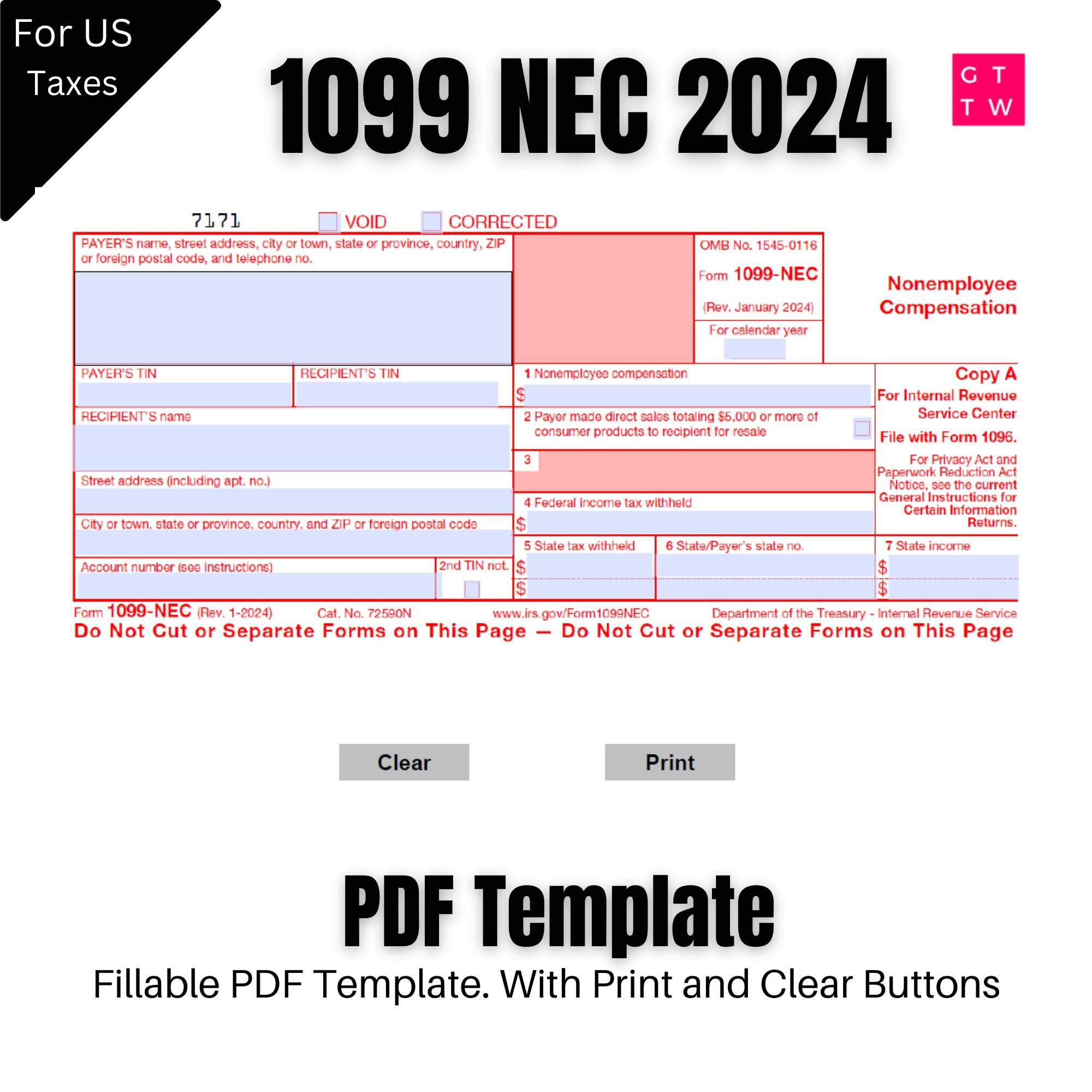

1099 NEC Editable PDF Fillable Template 2024 With Print And Clear Buttons Courier Font Etsy

An Overview Of The 1099 NEC Form