1099 Tax Form 2025

Are you a freelancer or independent contractor wondering about the 1099 Tax Form for 2025? Don’t worry, we’ve got you covered with all the information you need to know. Tax time can be stressful, but understanding the basics can make it a bit easier.

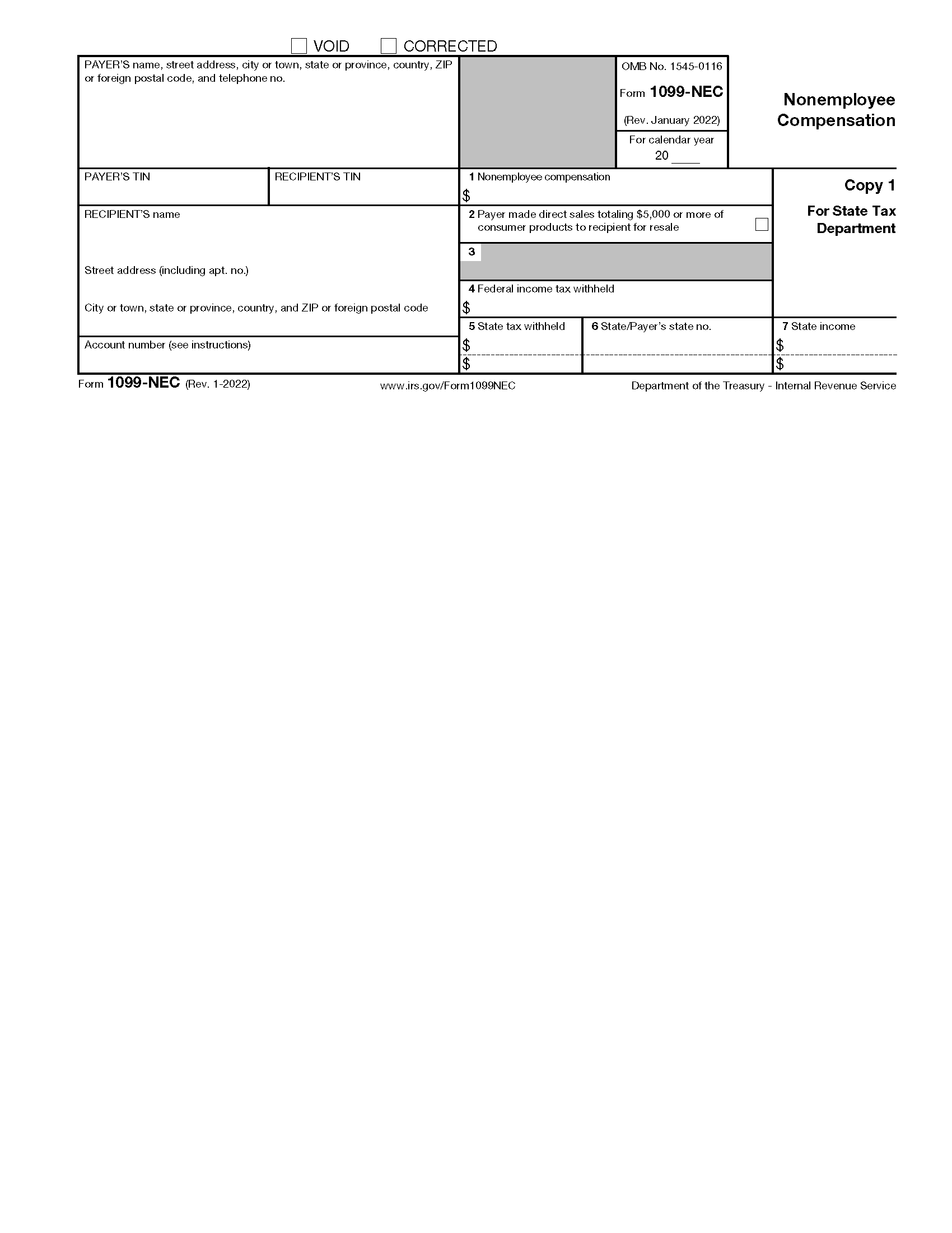

When you receive a 1099 form, it means you’ve earned income as a contractor or freelancer. This form is used to report your earnings to the IRS. It’s important to keep track of all your 1099 forms and report them accurately on your tax return to avoid any issues.

1099 Tax Form 2025

What to Expect with the 1099 Tax Form 2025

In 2025, the 1099 form will still be used to report income earned as a freelancer or contractor. Make sure to keep all your records organized throughout the year to make tax time a breeze. Remember to report all your income, even if you don’t receive a 1099 form.

As a freelancer, you may be responsible for paying self-employment taxes in addition to income taxes. It’s essential to understand your tax obligations and plan accordingly. Consider working with a tax professional to ensure you’re meeting all your tax requirements and maximizing your deductions.

Don’t wait until the last minute to gather your tax documents and start preparing your return. Being proactive can help you avoid stress and potential penalties for filing late. Keep track of all your expenses, receipts, and income throughout the year to make tax season a smooth process.

So, whether you’re a seasoned freelancer or just starting out, understanding the 1099 Tax Form for 2025 is crucial for your financial well-being. Stay organized, stay informed, and don’t hesitate to seek help if you need it. Happy filing!

Itemize Deductions Or Take The Standard Deduction Which Is Right For You

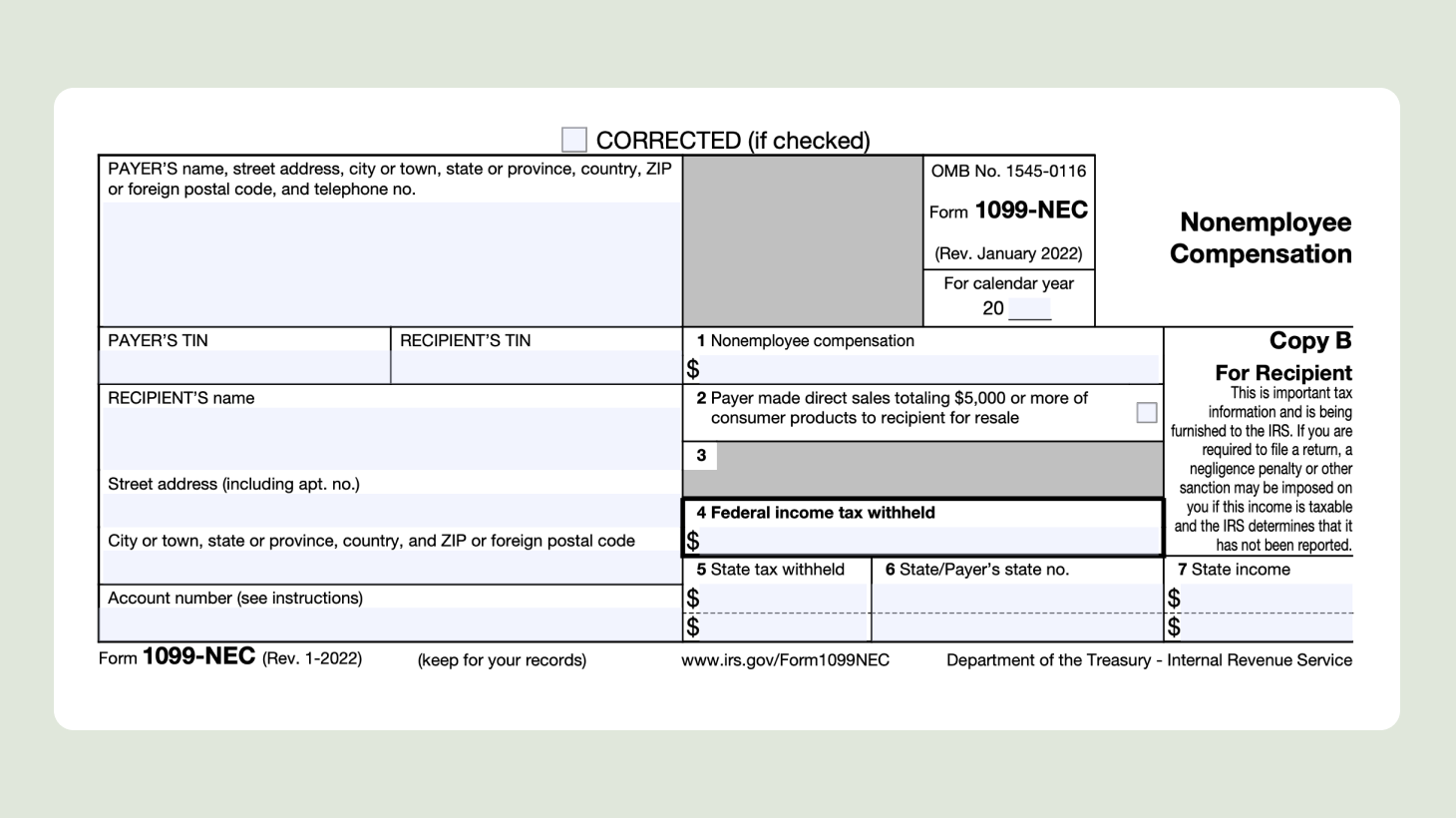

An Overview Of The 1099 NEC Form

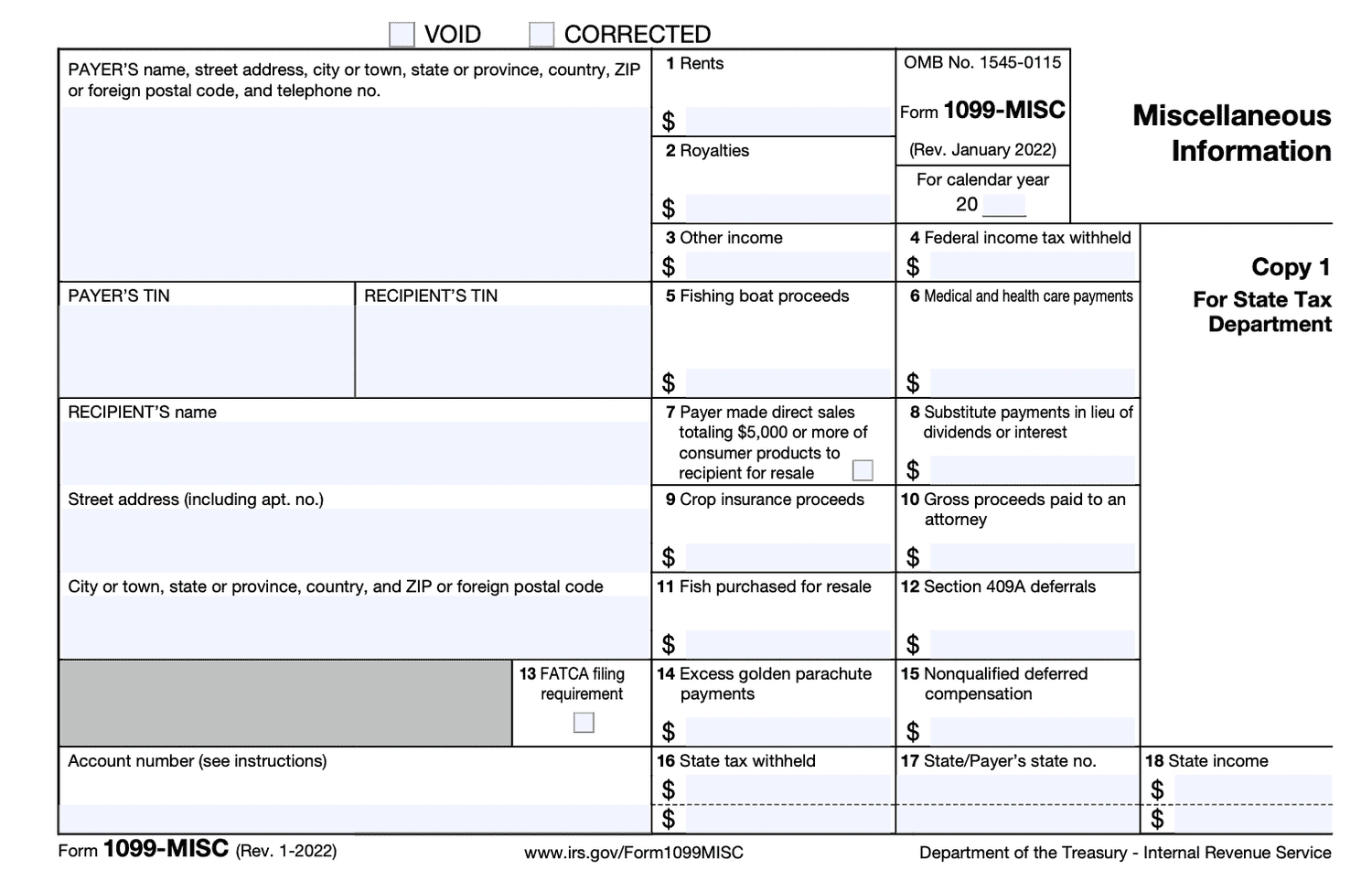

Free IRS Form 1099 MISC PDF EForms

Form 1099 Reporting Non Employment Income

Free IRS 1099 Form PDF EForms