2025 1040 Forms

Are you ready for tax season in 2025? It’s never too early to start thinking about your 1040 forms and getting your financial documents in order. With a little preparation, you can make the process of filing your taxes much smoother and stress-free.

As the deadline looms closer, many people start to feel overwhelmed by the thought of sorting through receipts and figuring out deductions. But with a bit of organization and planning, you can tackle your taxes with confidence and ease.

2025 1040 Forms

Preparing for 2025 1040 Forms

Start by gathering all your income statements, W-2s, 1099s, and any other relevant documents. Keep them in a designated folder or file so you can easily access them when it’s time to file. This will save you time and prevent last-minute scrambling.

Next, review your expenses and receipts from the past year. Make note of any deductible expenses such as medical bills, charitable donations, or business expenses. Keeping track of these throughout the year can help you maximize your deductions and lower your tax bill.

If you have investments, don’t forget to gather your statements and records of any transactions. Capital gains and losses can have a significant impact on your tax liability, so it’s important to have accurate and up-to-date information.

Finally, consider consulting with a tax professional if you have complex financial situations or if you’re unsure about any aspect of your taxes. They can provide guidance and ensure that you’re taking advantage of all available deductions and credits.

By starting early and staying organized, you can make the process of filing your 2025 1040 forms a breeze. With a little effort and preparation, you’ll be well on your way to a stress-free tax season.

TAX SEASON 2025 IS OPEN CR Accounting Consulting LLC

Printed Tax Forms Are Now Available At The Library Franklin Township Public Library

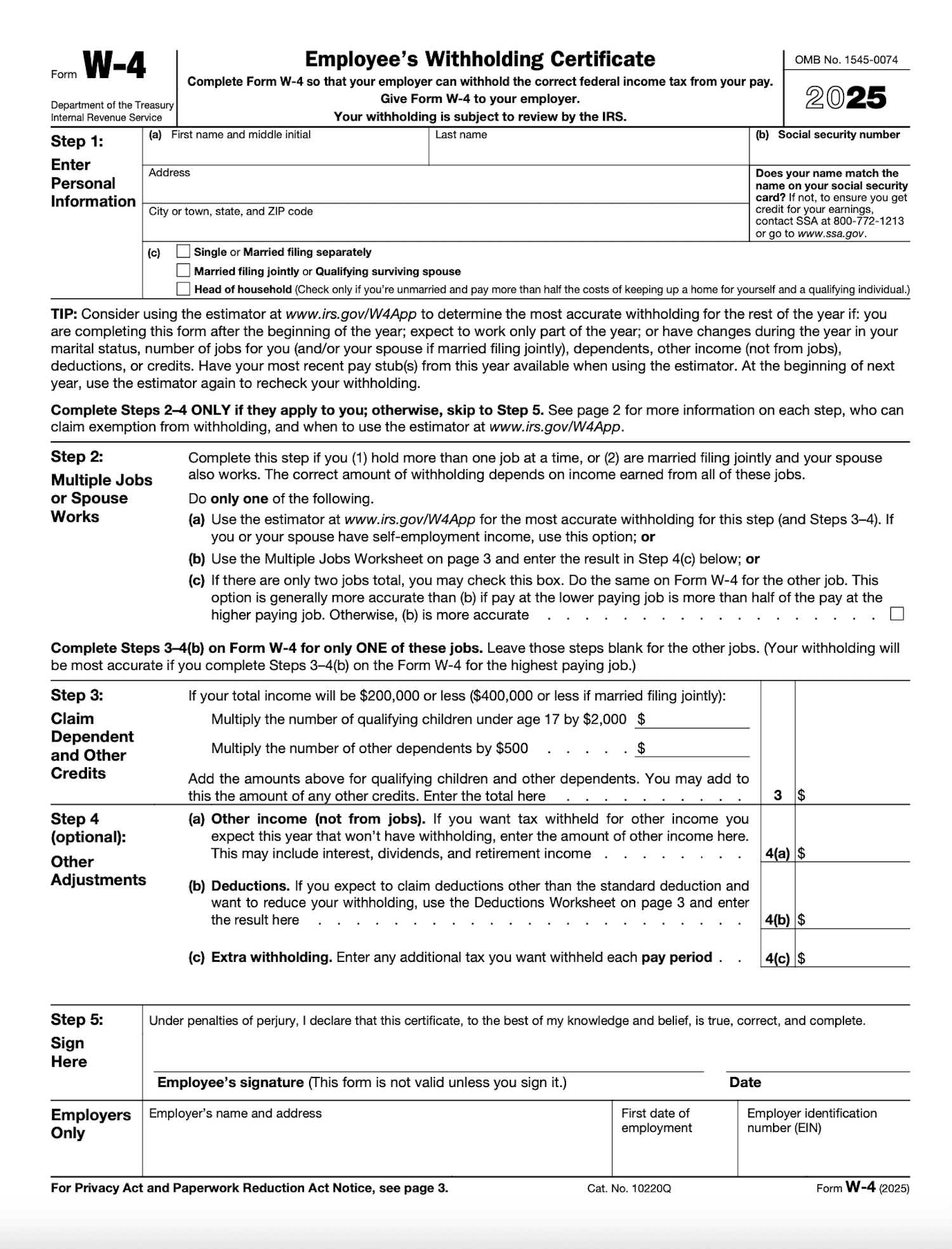

W 4 How To Fill Out The 2025 Tax Withholding Form

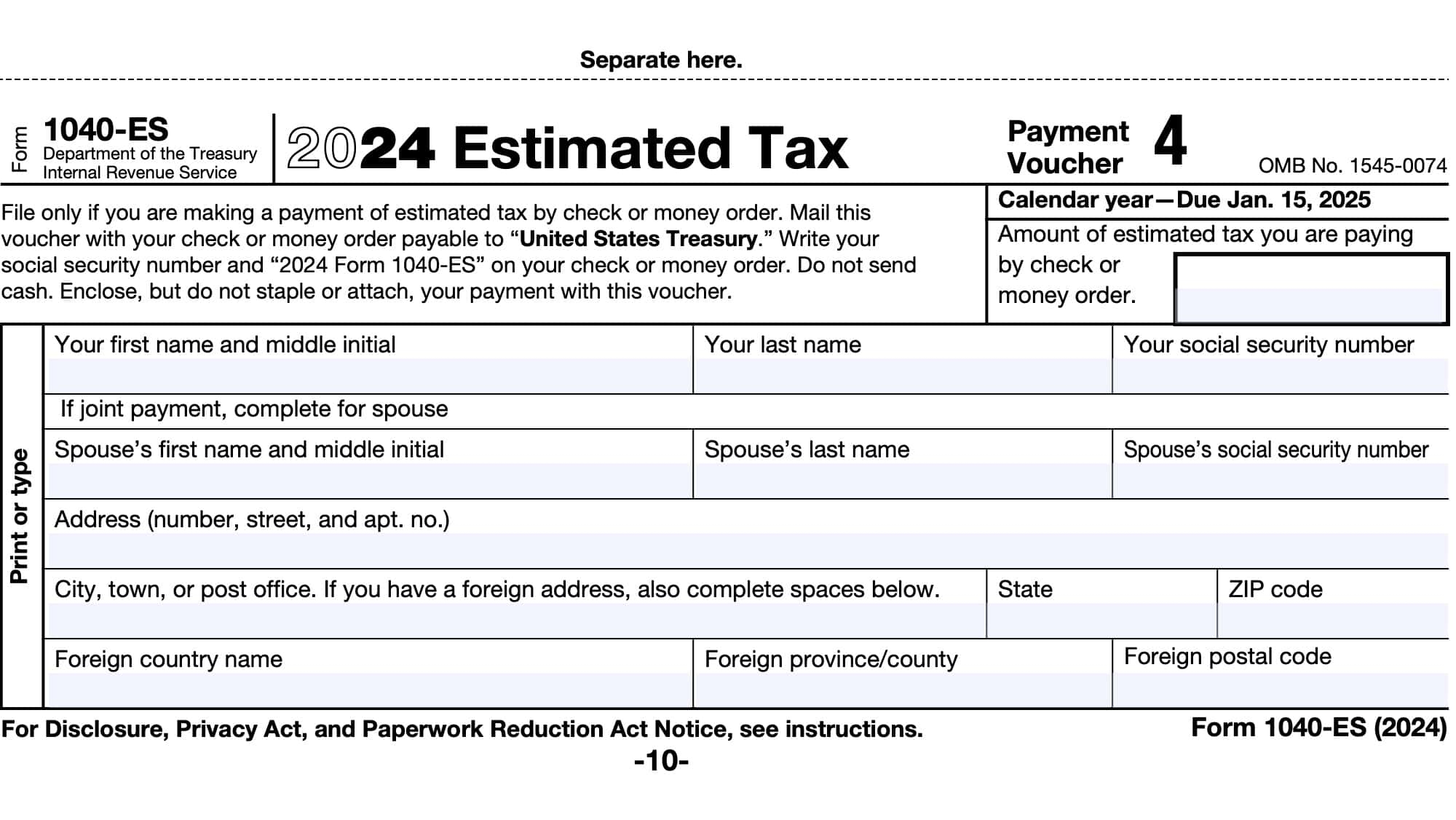

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor