2025 1099 Form

Are you ready for tax season in 2025? One important document to keep in mind is the 1099 form. This form is used to report various types of income you receive throughout the year.

Whether you’re a freelancer, gig worker, or independent contractor, the 1099 form is essential for reporting your earnings. It’s crucial to ensure all your income is accurately reported to the IRS to avoid any potential issues down the line.

2025 1099 Form

Understanding the 2025 1099 Form

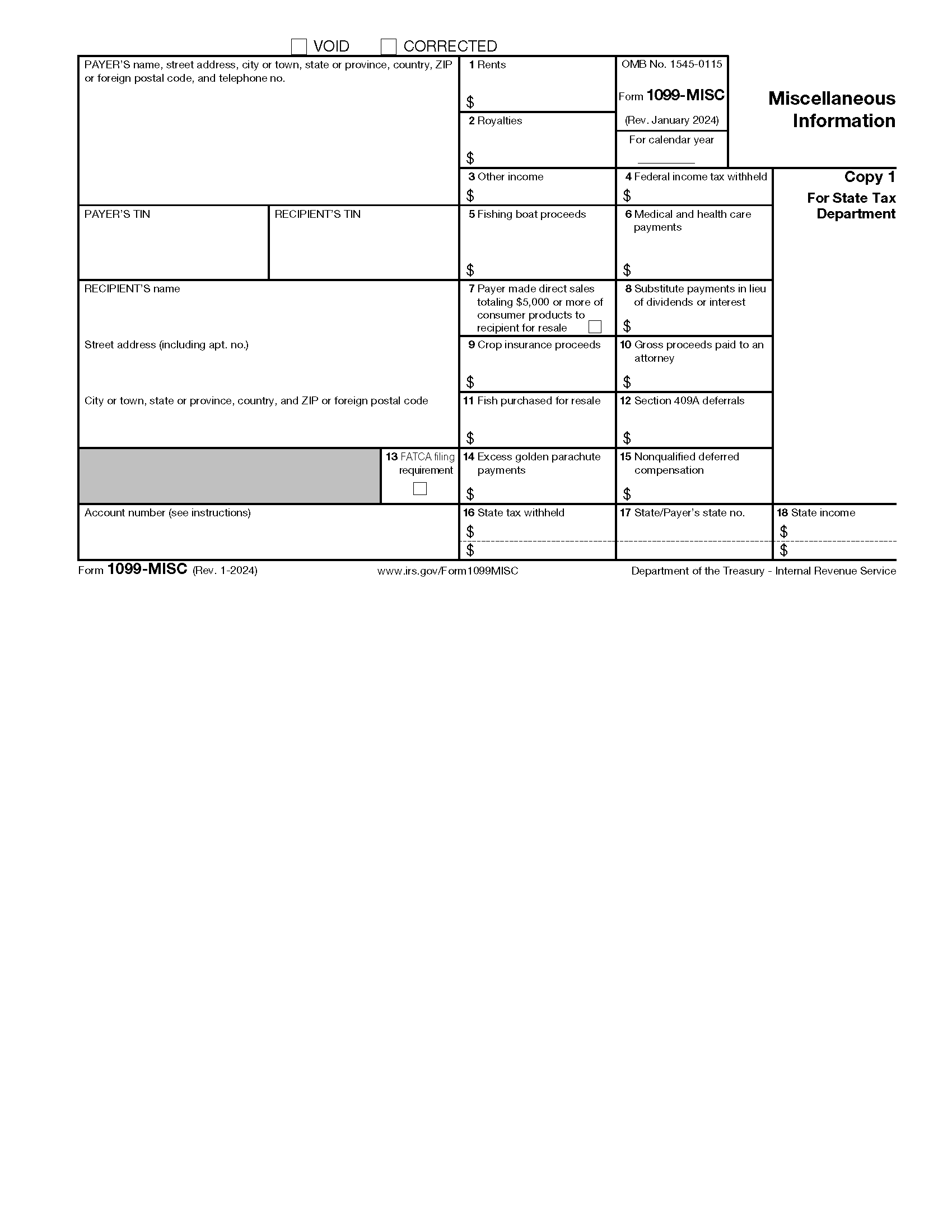

The 2025 1099 form will include details such as your name, address, and Social Security number, along with the income you’ve earned from clients or companies. This information is crucial for calculating your tax liability for the year.

Make sure to keep track of all your income throughout the year and organize any relevant documentation. This will make it easier to fill out your 1099 form accurately and avoid any potential mistakes that could lead to IRS scrutiny.

If you’re unsure about how to fill out your 1099 form or have any questions about reporting your income, consider consulting a tax professional. They can provide guidance and ensure that you’re meeting all your tax obligations in a timely and accurate manner.

As tax season approaches, it’s essential to stay organized and informed about the 2025 1099 form. By understanding its purpose and the information it requires, you can navigate the tax filing process with confidence and peace of mind.

1099 NEC Forms 2023 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 38 108 Forms ONGULS

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

An Overview Of The 1099 NEC Form

Form 1099 Reporting Non Employment Income

Free IRS Form 1099 MISC PDF EForms