2025 1099 Forms

Have you heard about the changes coming to 1099 forms in 2025? It’s important for businesses to stay informed and prepared for these updates. Let’s take a closer look at what to expect.

Starting in 2025, the IRS will introduce new 1099 forms that will streamline reporting and make it easier for businesses to comply with tax regulations. These changes aim to simplify the process and reduce errors.

2025 1099 Forms

2025 1099 Forms: What You Need to Know

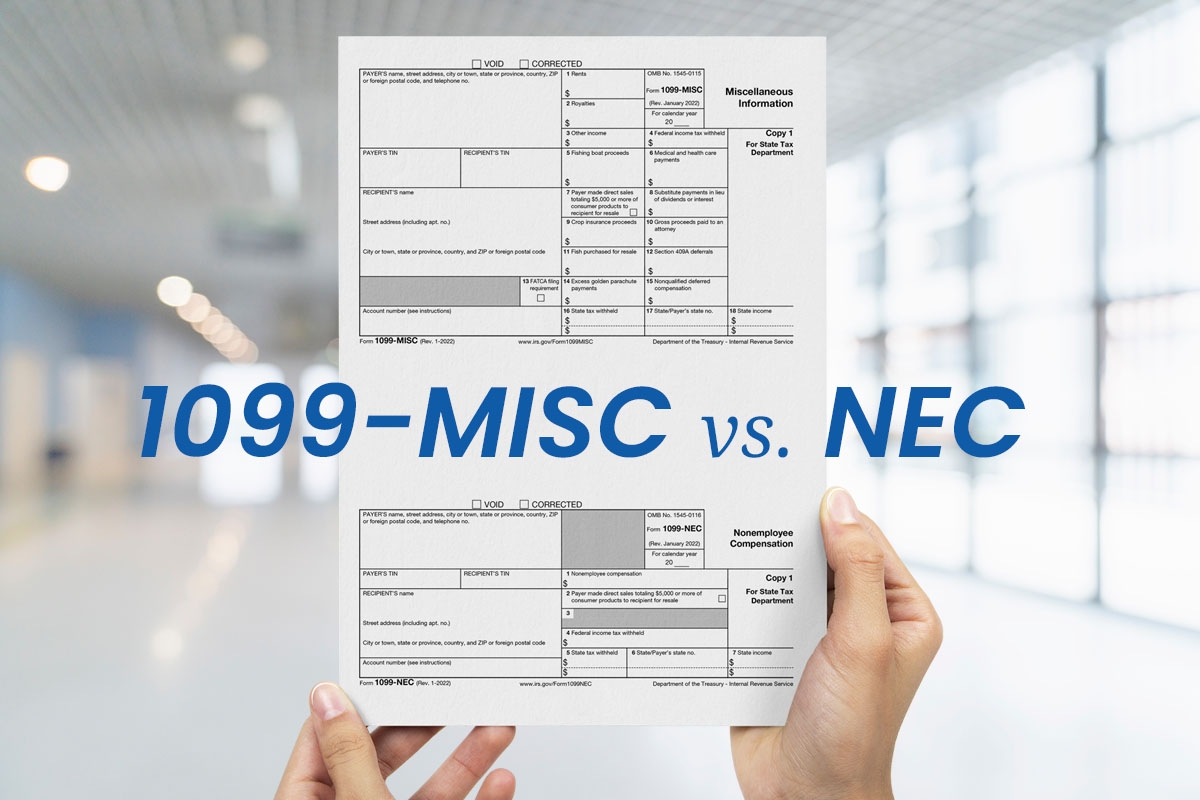

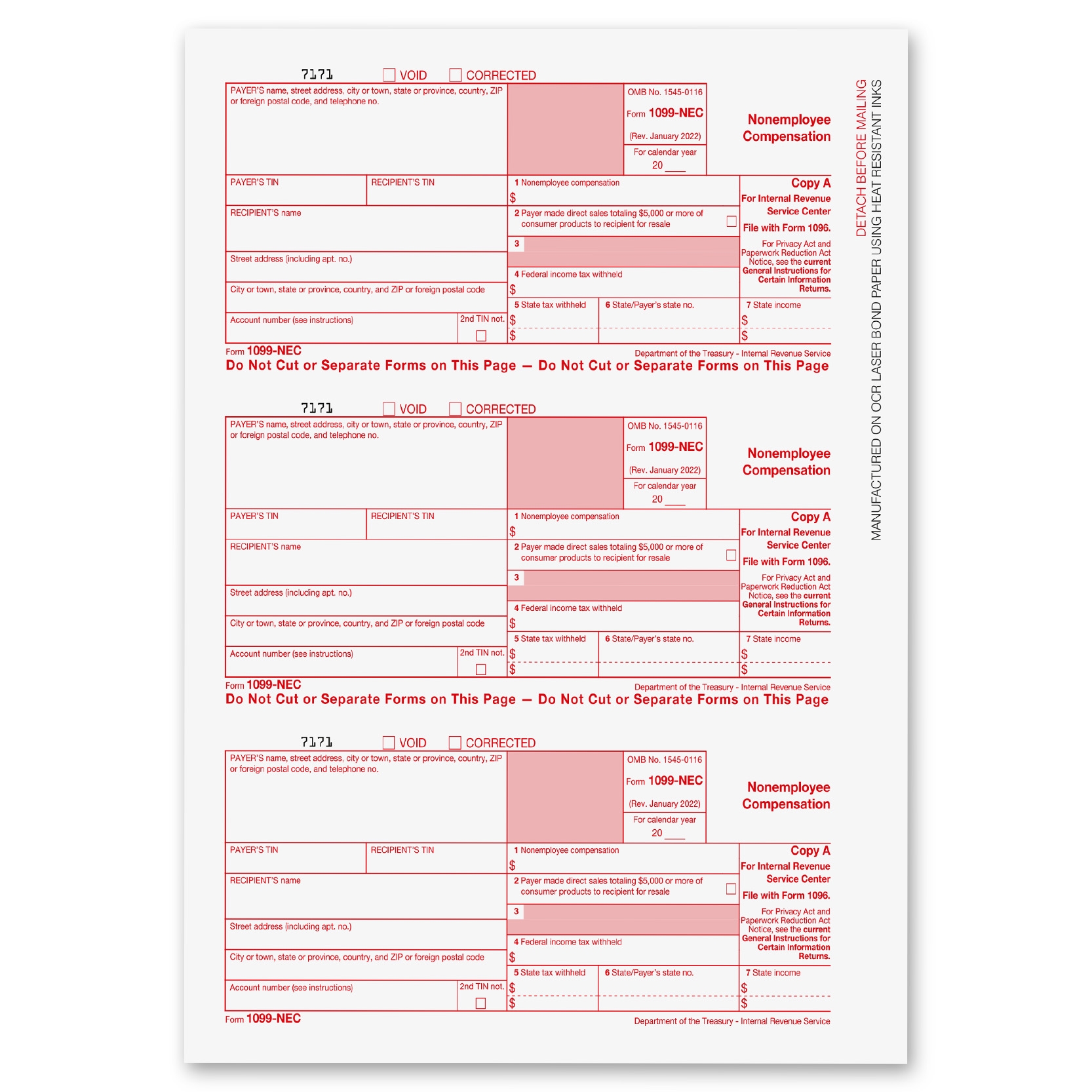

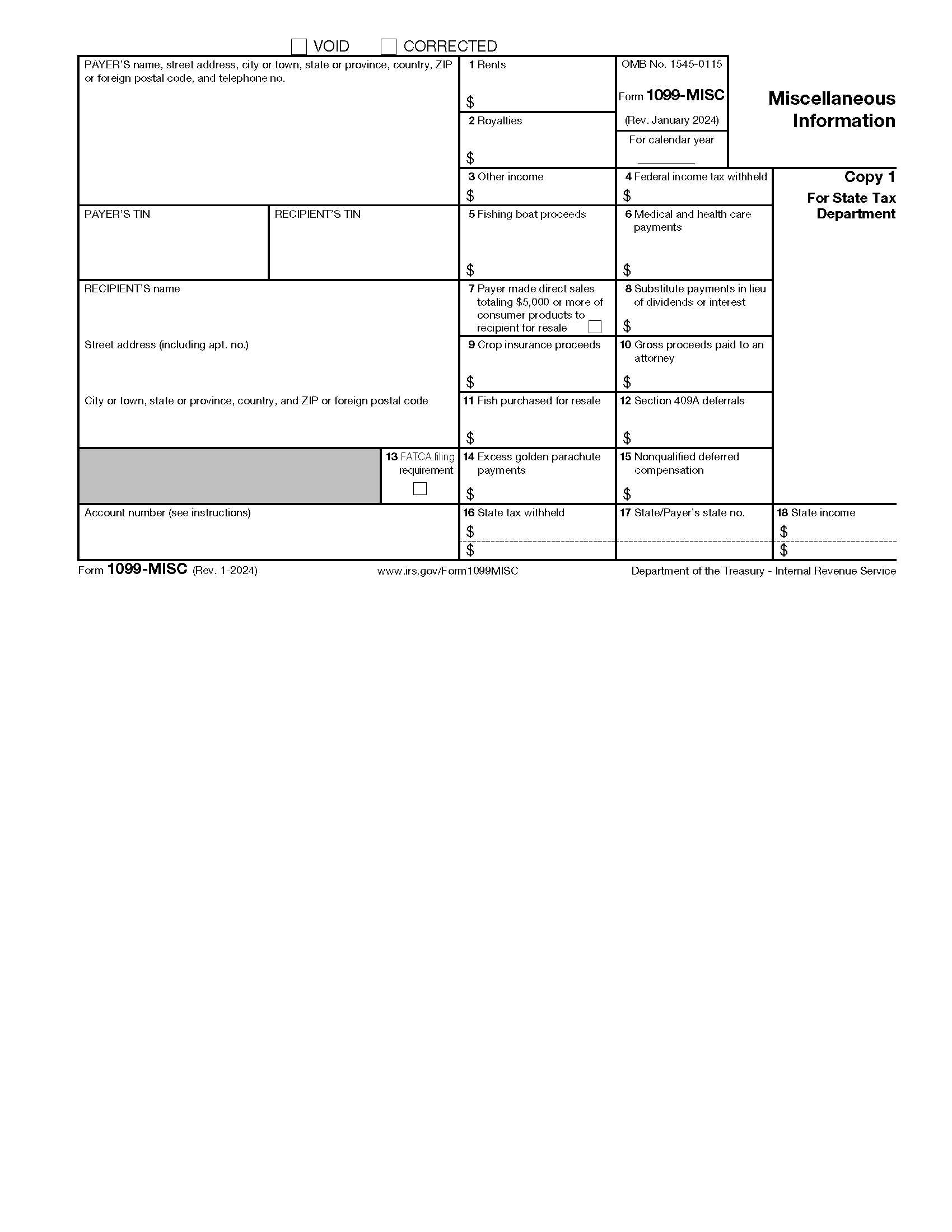

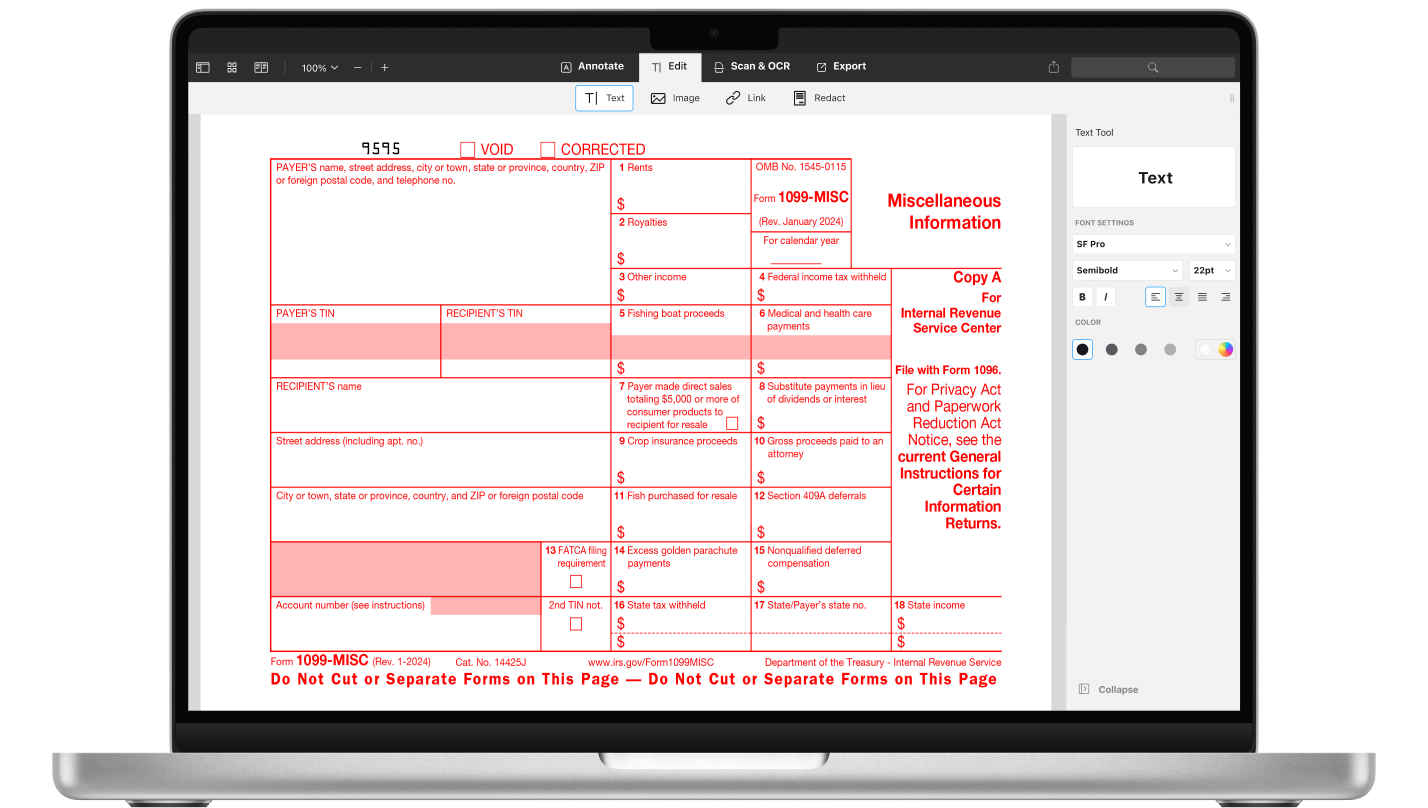

One significant change is the introduction of a single form combining all types of 1099 reporting, including 1099-NEC, 1099-MISC, and more. This consolidation will help businesses save time and resources by filing just one form.

Additionally, the new 1099 forms will feature enhanced data fields that provide more detailed information about payments made to contractors and vendors. This will improve accuracy and help prevent discrepancies in reporting.

Businesses should start familiarizing themselves with these upcoming changes and ensure their systems are ready to accommodate the new 1099 forms. It’s important to stay updated on IRS guidelines and deadlines to avoid any penalties or fines.

In conclusion, the 2025 1099 forms will bring positive changes to the reporting process, making it more efficient and user-friendly for businesses. By staying informed and proactive, organizations can smoothly transition to the new forms and comply with tax requirements effectively.

Itemize Deductions Or Take The Standard Deduction Which Is Right For You

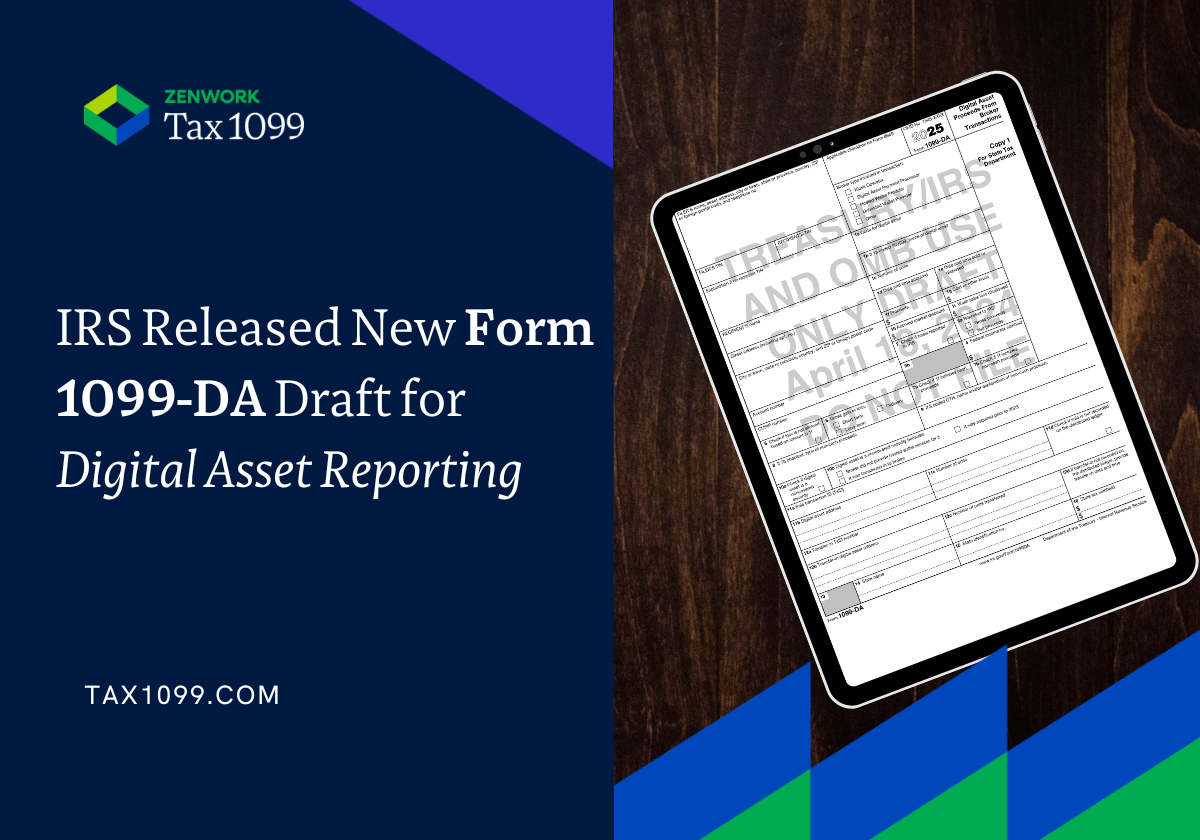

IRS Released New Form 1099 DA Draft For Digital Asset Reporting Tax1099 Blog

1099 NEC Forms 2023 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 38 108 Forms ONGULS

Free IRS Form 1099 MISC PDF EForms

Das IRS Formular 1099 MISC F r 2025 Als PDF Ausf llen