2025 1099 Misc Form

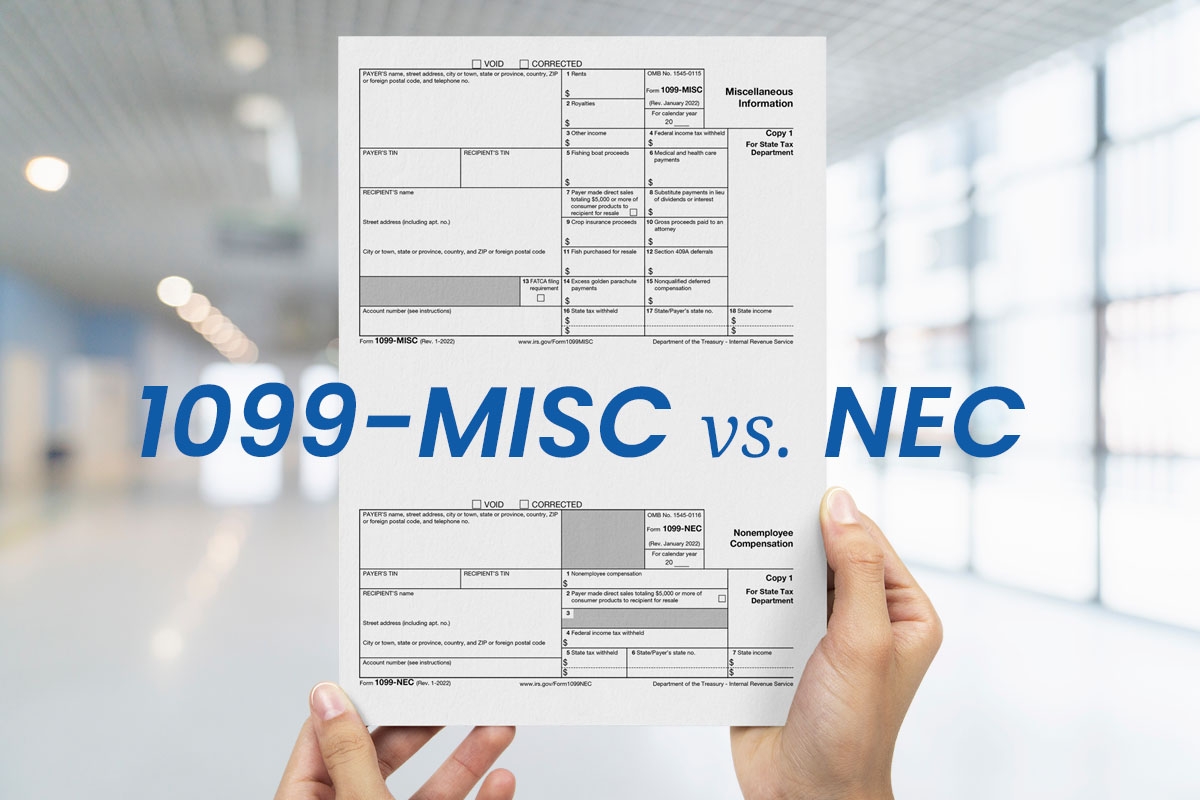

Are you a freelancer or independent contractor? If so, you’re probably familiar with the 1099-MISC form, which is used to report income earned as a non-employee. But did you know that the 2025 1099-MISC form is set to bring changes to how you report your income?

Starting in 2025, the IRS is introducing a revised 1099-MISC form that will impact how freelancers and independent contractors report their earnings. The new form aims to streamline the reporting process and make it easier for taxpayers to accurately report their income.

2025 1099 Misc Form

The 2025 1099-MISC Form: What You Need to Know

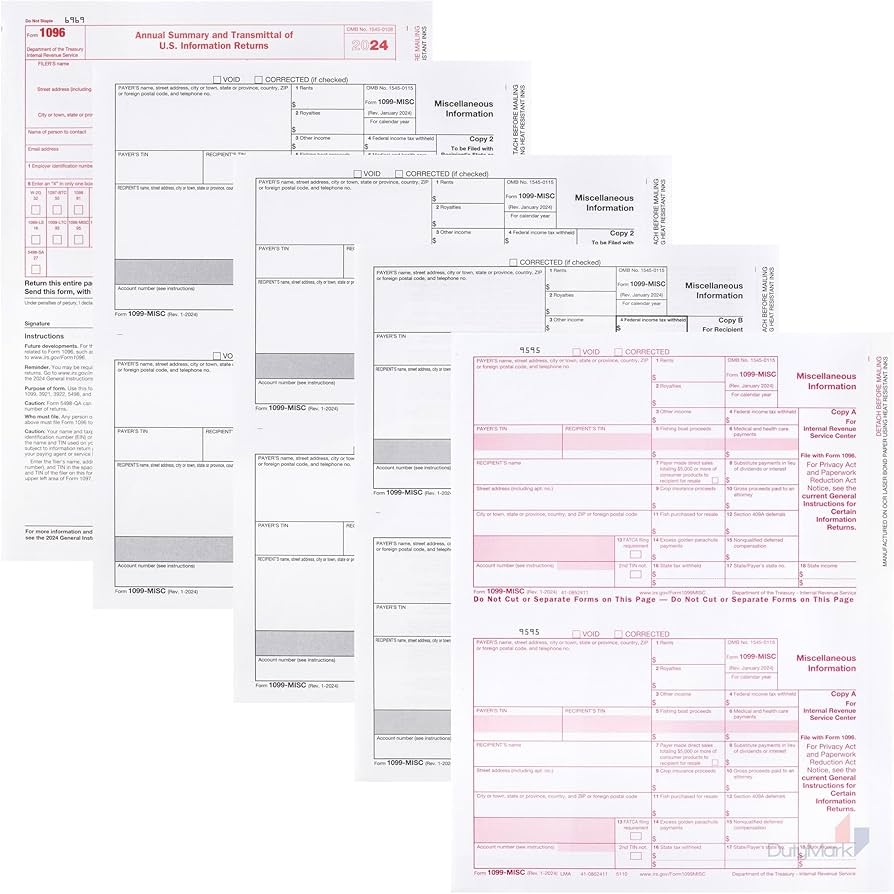

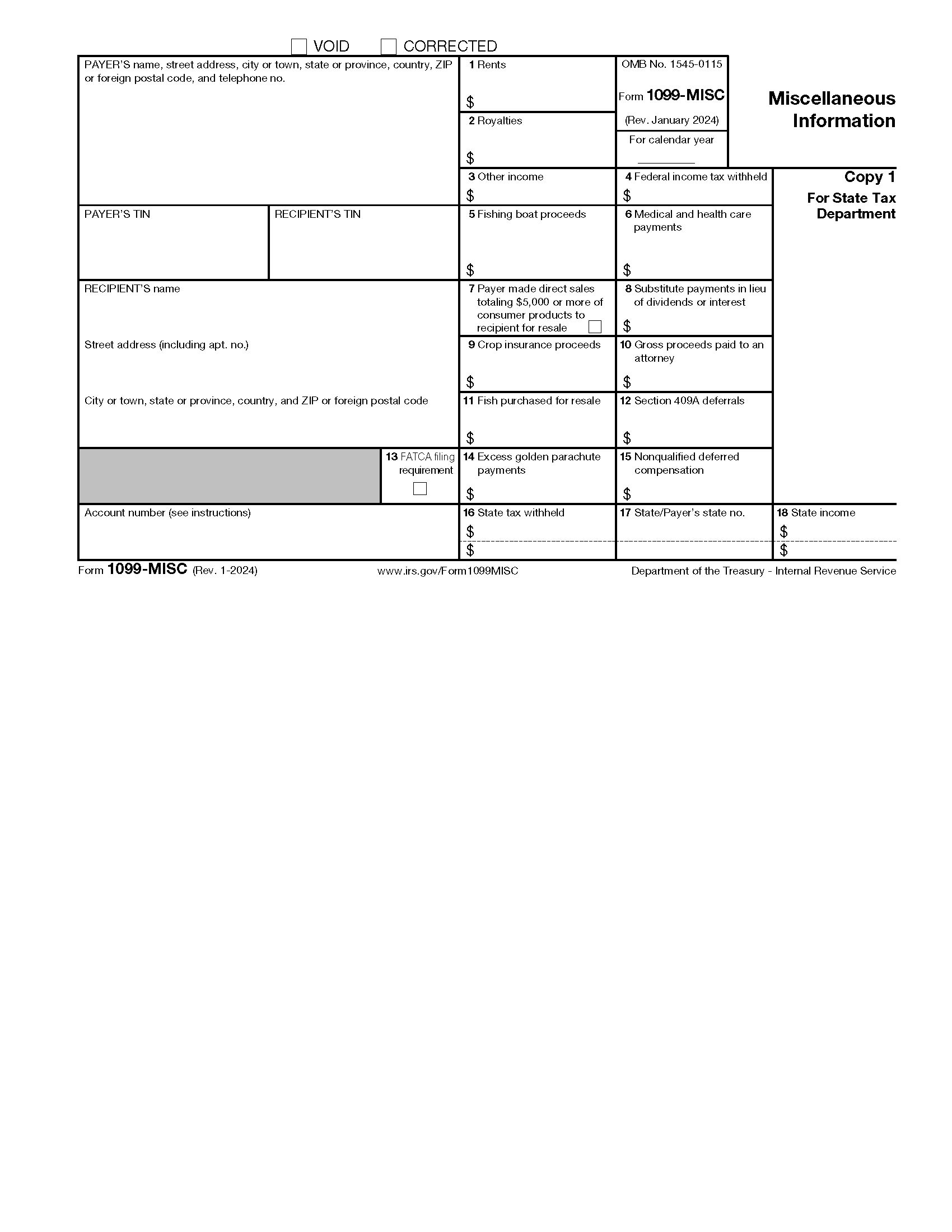

One key change to the 2025 1099-MISC form is the addition of new boxes to report income and expenses separately. This will make it easier for freelancers and independent contractors to track their earnings and deductions accurately.

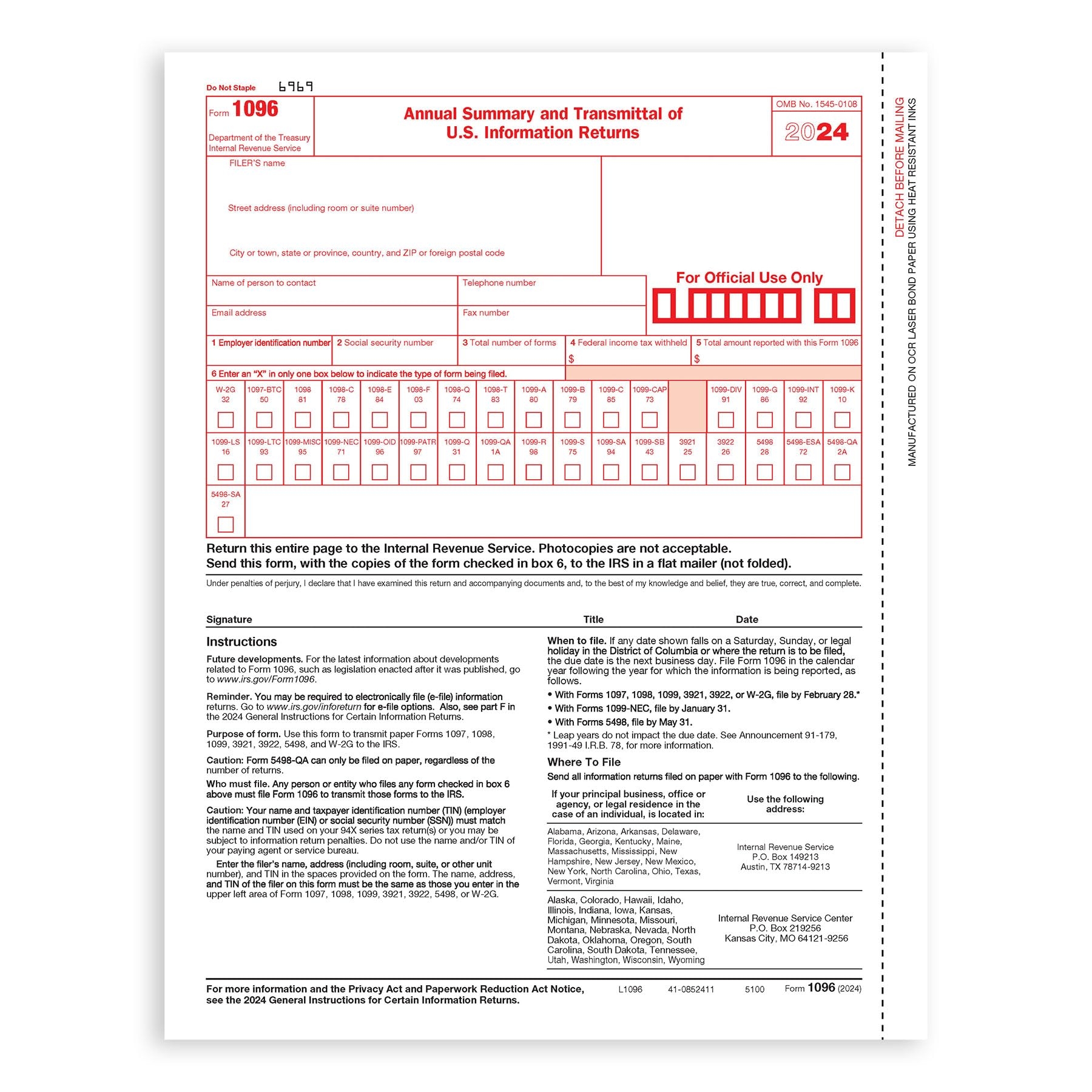

Additionally, the 2025 form will require taxpayers to provide more detailed information about their clients, including their employer identification numbers (EINs). This will help the IRS verify income reported on the form and ensure compliance with tax laws.

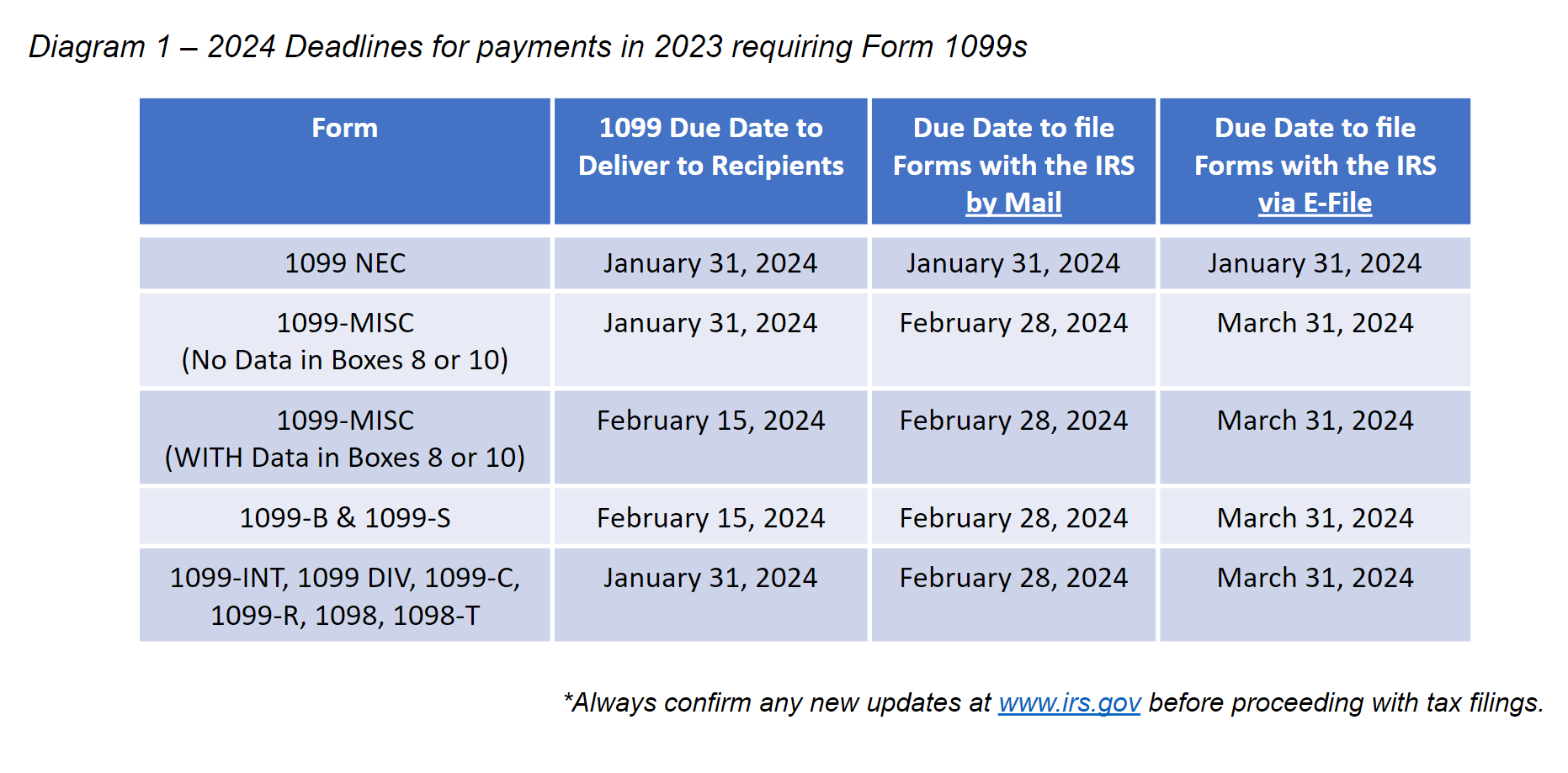

It’s important for freelancers and independent contractors to familiarize themselves with the changes to the 2025 1099-MISC form to avoid any potential errors or penalties. Be sure to stay informed about the new requirements and consult with a tax professional if you have any questions.

In conclusion, the 2025 1099-MISC form brings important changes that will impact how freelancers and independent contractors report their income. By staying informed and understanding the new requirements, you can ensure compliance with tax laws and avoid any potential issues with the IRS.

1099 Requirements For Business Owners In 2025 Mark J Kohler

Amazon 1099 MISC Forms 2024 5 Part Set Kit For 25 Vendors Complete Laser 1099 Tax Forms In Value Pack 1099 Misc 2024 NO ENVELOPES Office Products

Form 1099 MISC Vs 1099 NEC What You Need To Know Form Pros

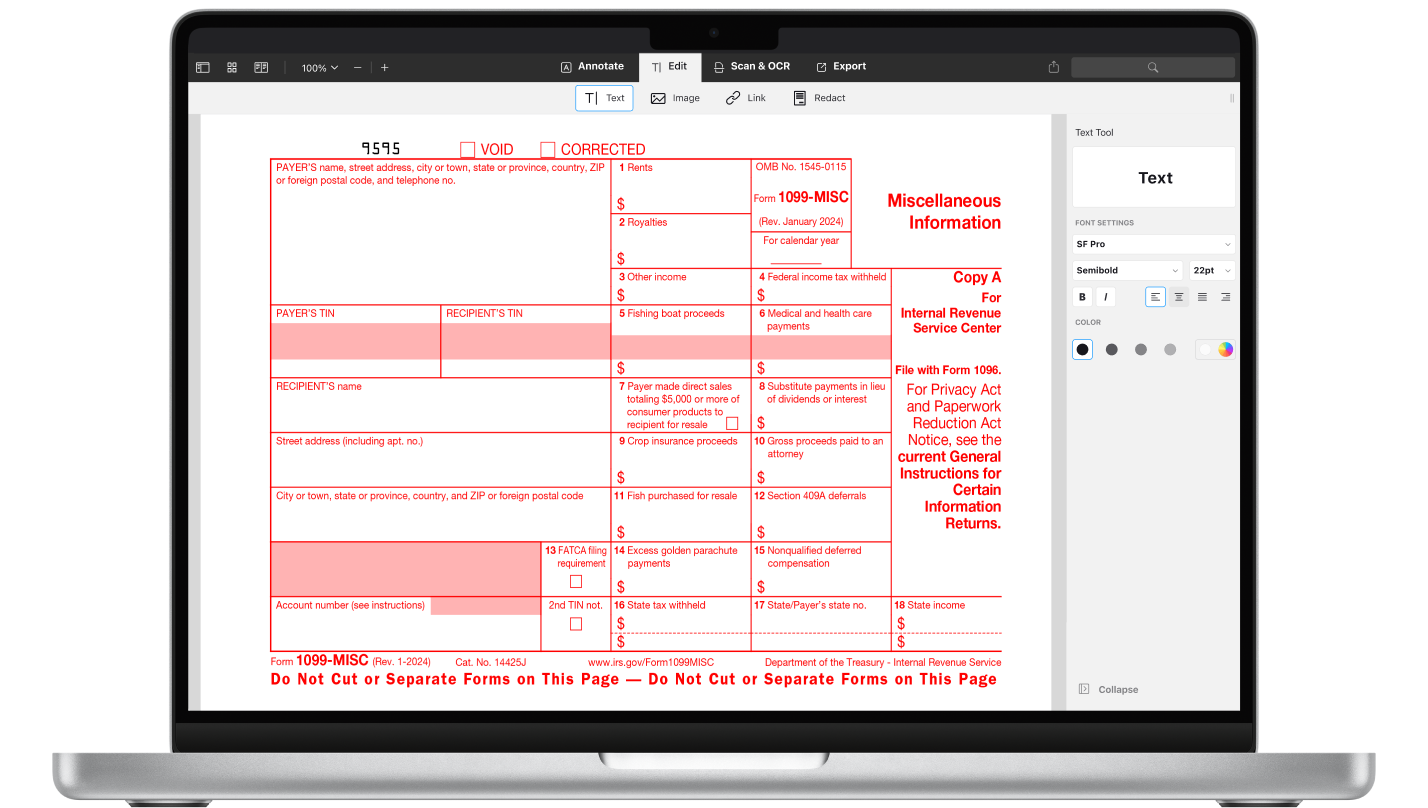

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

Free IRS Form 1099 MISC PDF EForms