2025 1099 Tax Form

Are you a freelancer or independent contractor wondering about the 2025 1099 tax form? Don’t worry, we’ve got you covered with all the information you need to know.

As of 2025, the 1099 tax form is used by businesses to report payments made to independent contractors or freelancers. This form is essential for individuals who receive income outside of traditional employment.

2025 1099 Tax Form

Understanding the 2025 1099 Tax Form

When you receive a 1099 form, it’s important to report this income on your tax return. The form includes details about the payments you received throughout the year, helping you calculate your tax liability accurately.

Keep in mind that if you earned $600 or more from a client, they are required to send you a 1099 form. Make sure to review the information on the form carefully and report it accurately on your tax return to avoid any issues with the IRS.

Freelancers and independent contractors should be proactive in tracking their income and expenses throughout the year to make tax season a breeze. By staying organized and keeping detailed records, you can ensure a smooth filing process and potentially reduce your tax liability.

In conclusion, understanding the 2025 1099 tax form is crucial for freelancers and independent contractors. By familiarizing yourself with this form and reporting your income accurately, you can navigate tax season with ease and avoid any potential penalties from the IRS.

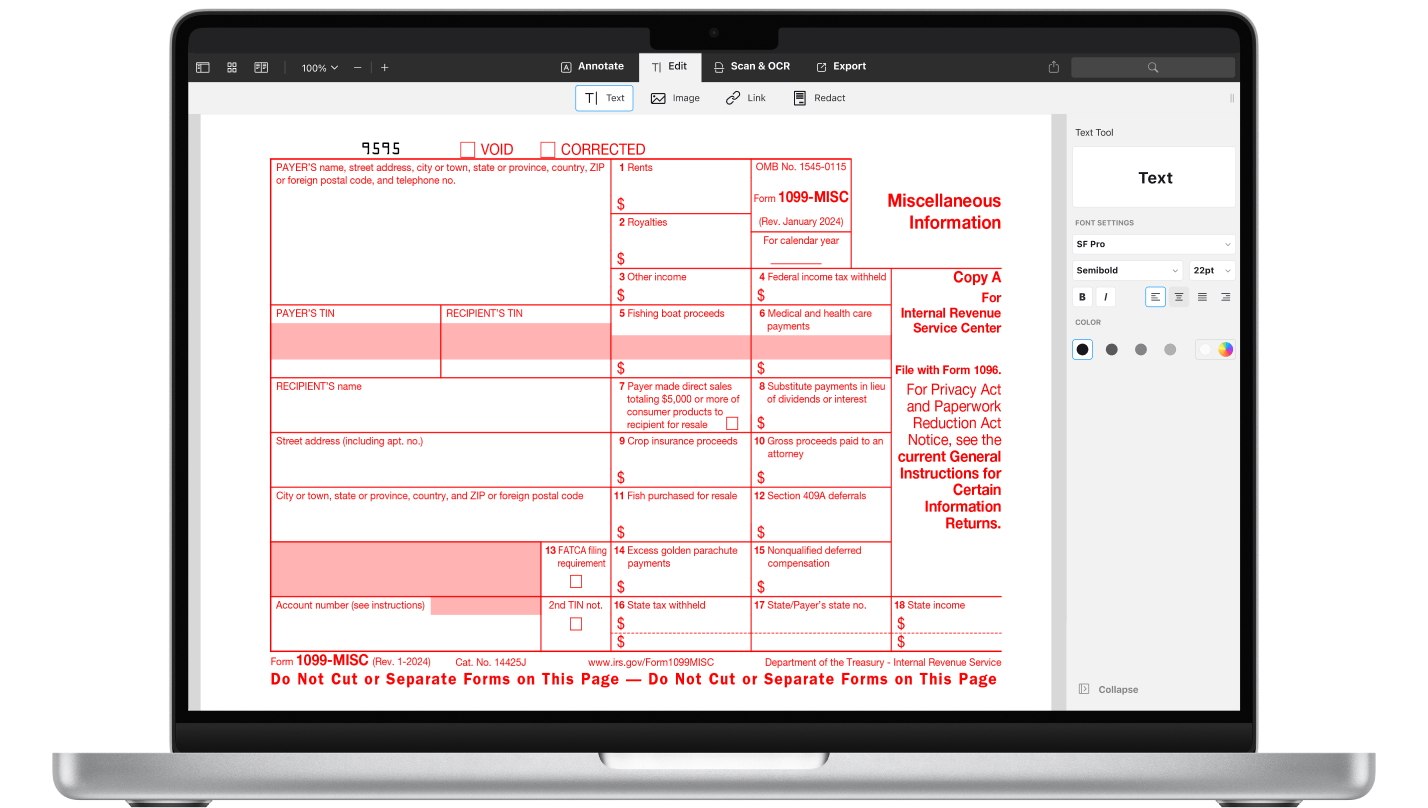

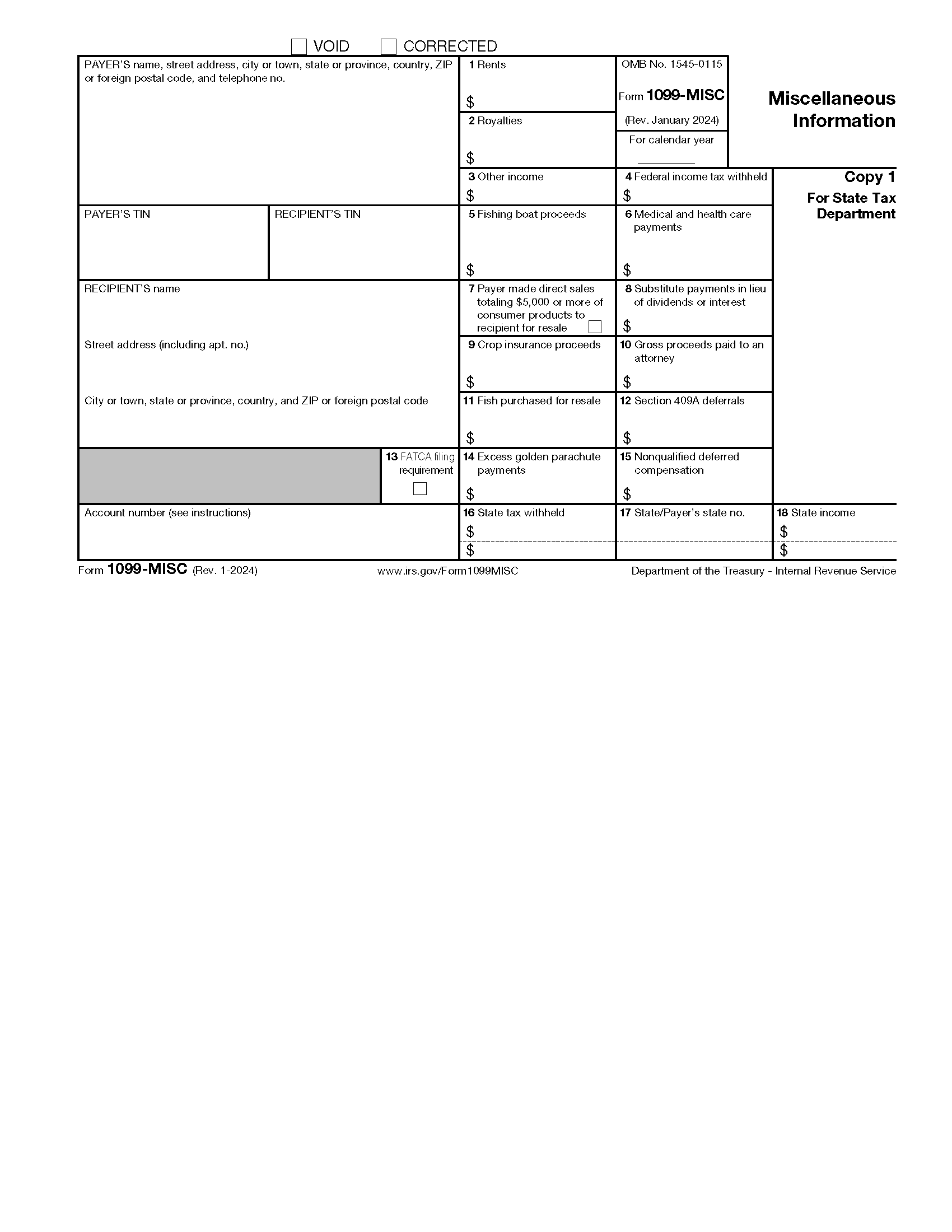

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

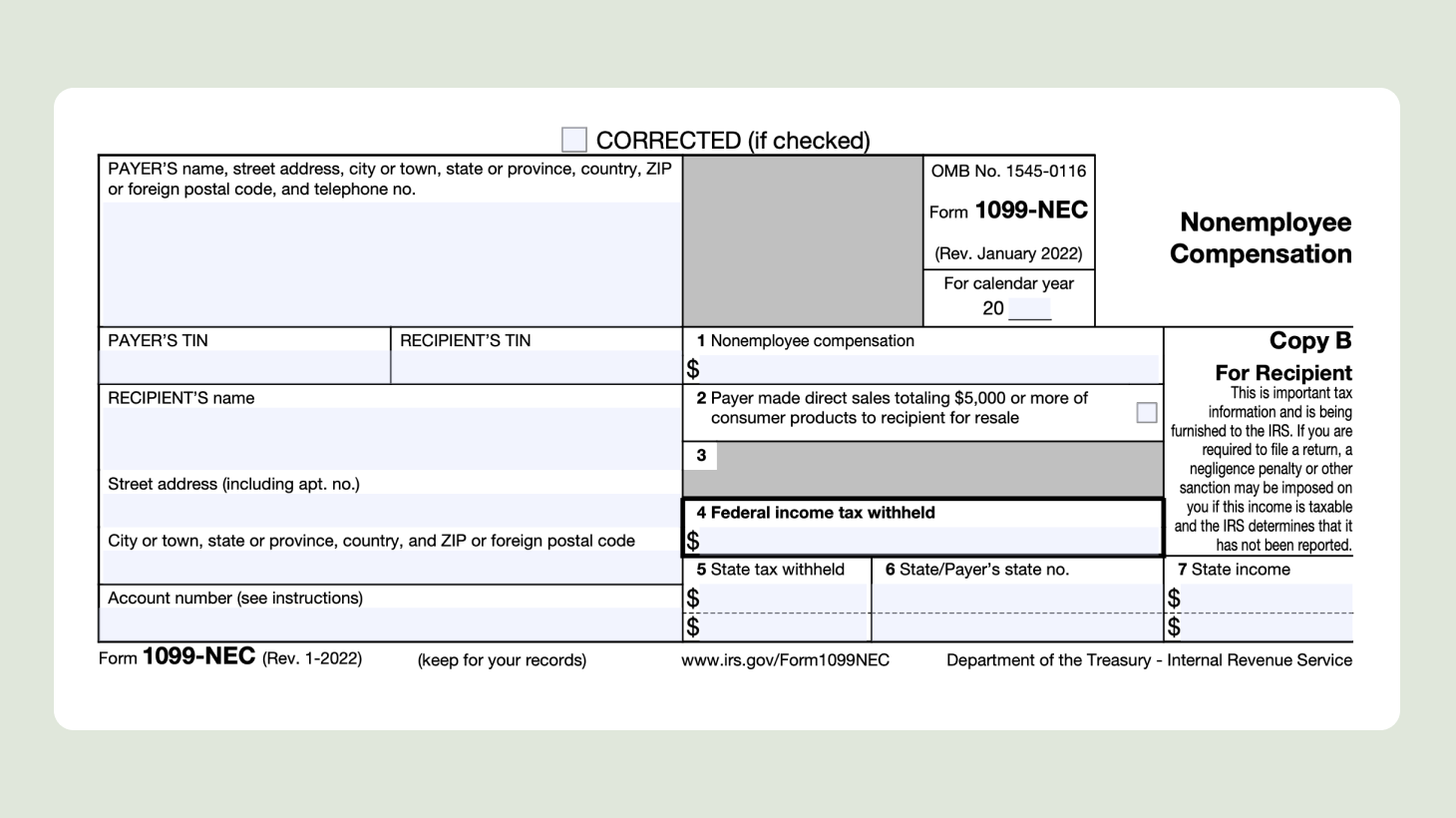

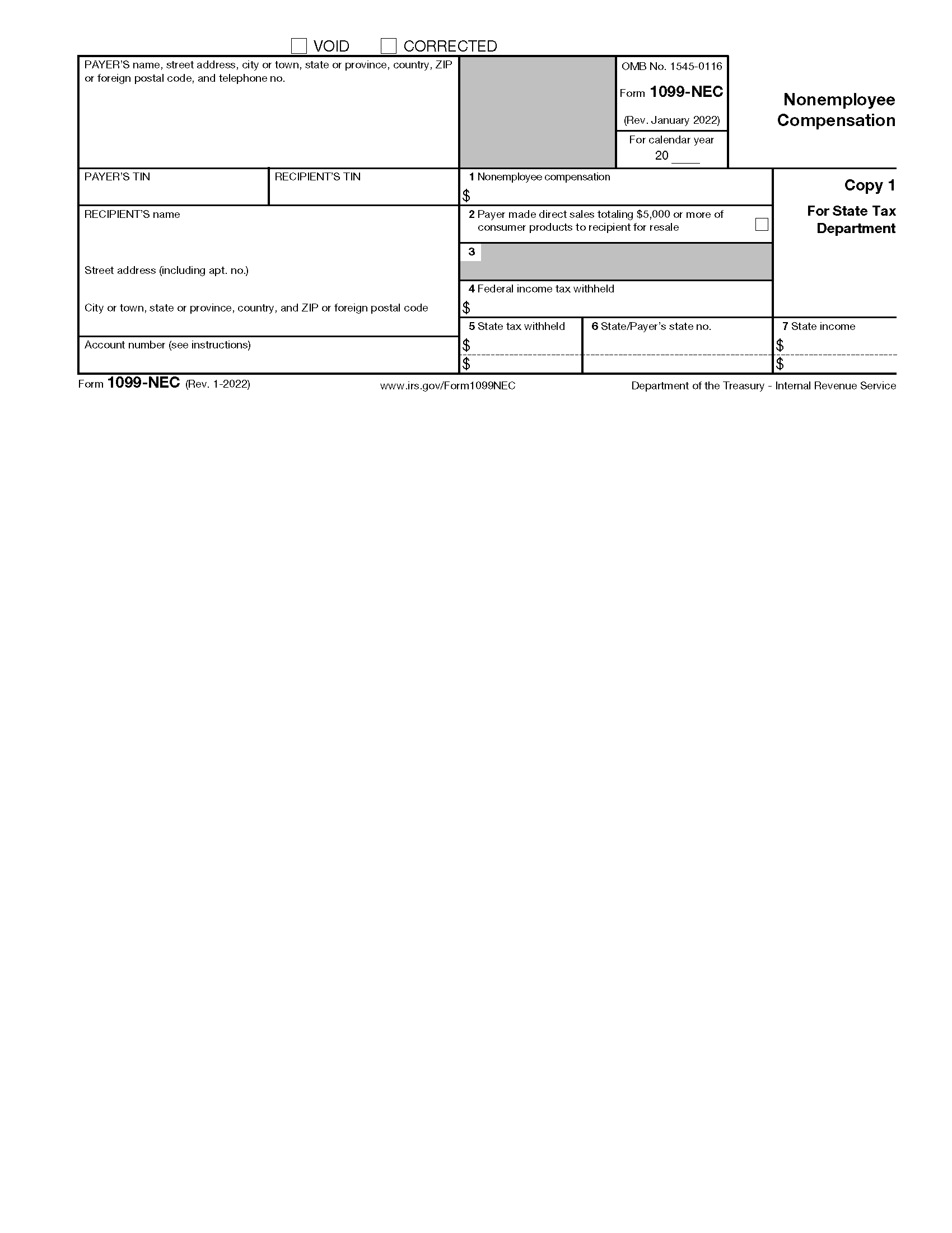

An Overview Of The 1099 NEC Form

Form 1099 Reporting Non Employment Income

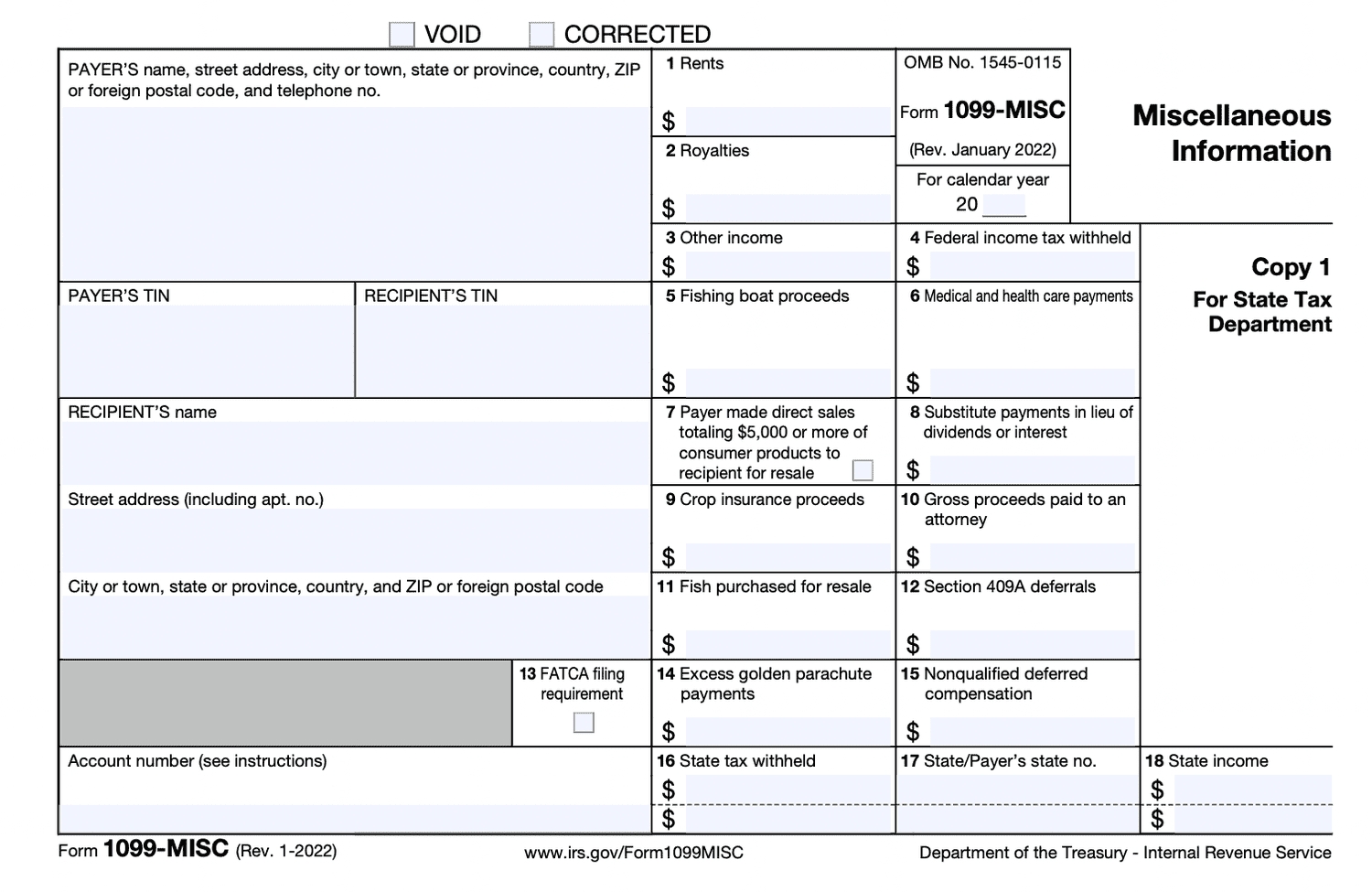

Free IRS 1099 Form PDF EForms

Free IRS Form 1099 MISC PDF EForms