2025 Form 1040

Are you ready for tax season in 2025? The 2025 Form 1040 is here, and it’s time to start preparing. With potential changes in tax laws and regulations, staying informed is key to avoiding any surprises.

As you gather your documents and receipts, remember that the 2025 Form 1040 may have new requirements or updates compared to previous years. It’s always a good idea to double-check the latest guidelines to ensure accuracy.

2025 Form 1040

What to Expect with the 2025 Form 1040

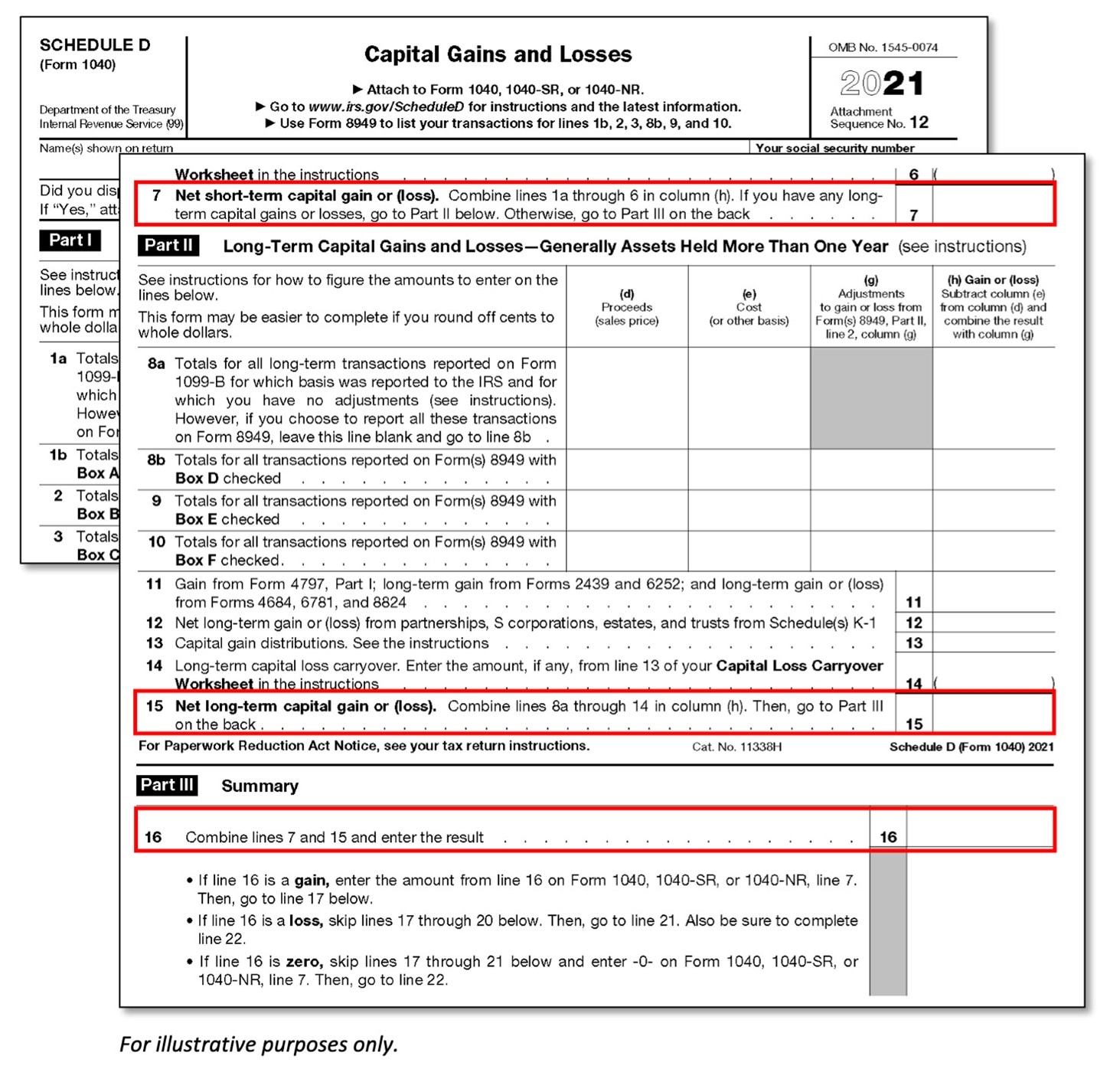

The 2025 Form 1040 may include modifications to tax brackets, deductions, or credits. Be on the lookout for any changes that could impact your filing status or tax liability. Consulting with a tax professional can offer valuable insights and guidance.

Keep track of any income sources, investments, or expenses that may affect your tax return. Organizing your financial information early can streamline the filing process and help you avoid any last-minute stress. Remember, accuracy is key when completing your tax return.

Don’t forget about important deadlines for filing your taxes. Mark your calendar and set reminders to ensure you submit your 2025 Form 1040 on time. Filing early can help you receive any potential refunds sooner and avoid penalties for late submission.

Whether you’re a seasoned taxpayer or new to the process, staying informed about the 2025 Form 1040 can help you navigate the tax season with ease. Take the time to review the latest updates and guidelines to ensure a smooth and accurate filing experience. Happy filing!

Form 1040 Review Russell Investments

These Are The New IRS Tax Brackets For 2025

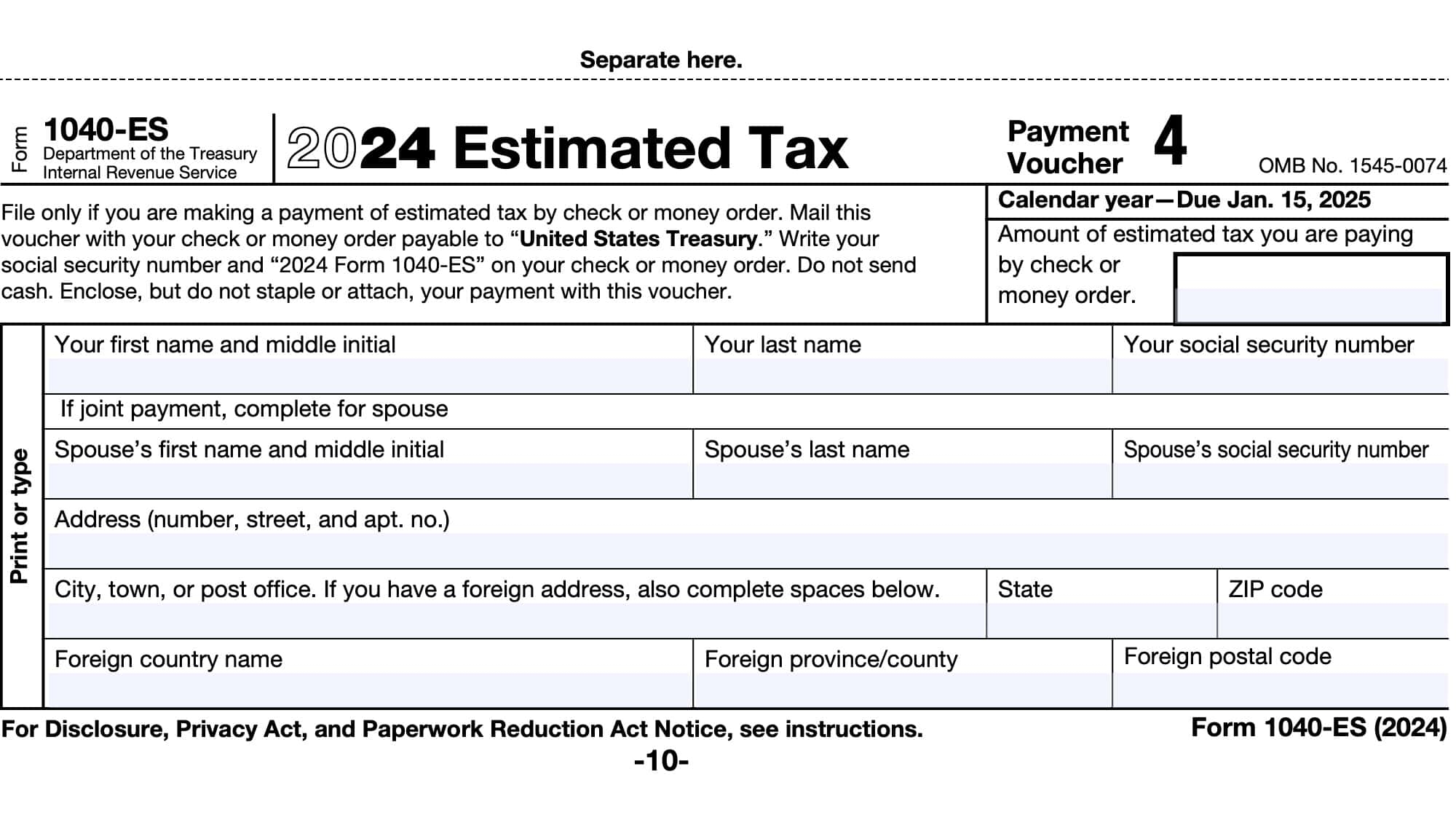

IRS Form 1040 ES Instructions Estimated Tax Payments

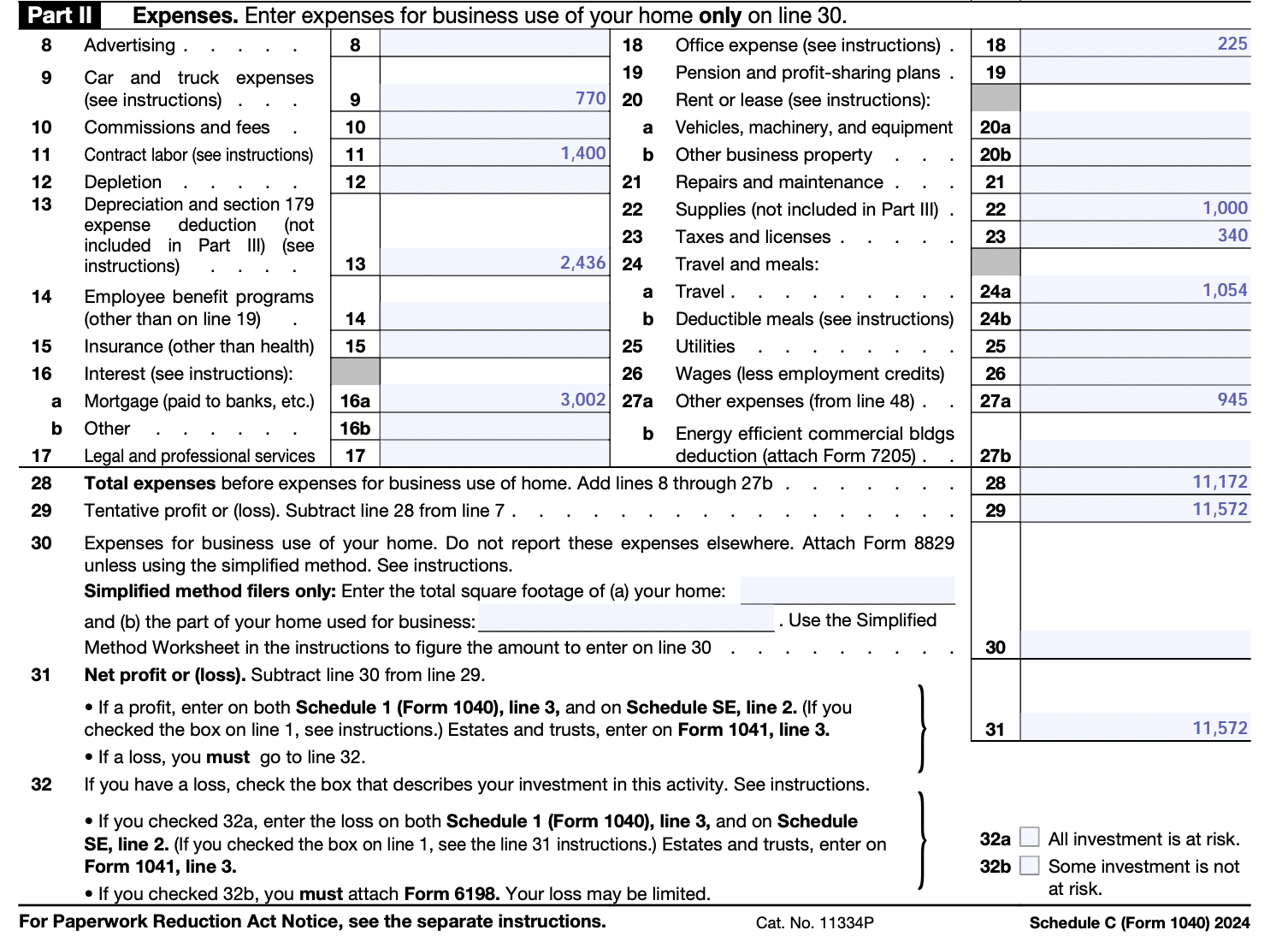

How To Fill Out Schedule C In 2025 With Example

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor