2025 Form 1040-ES

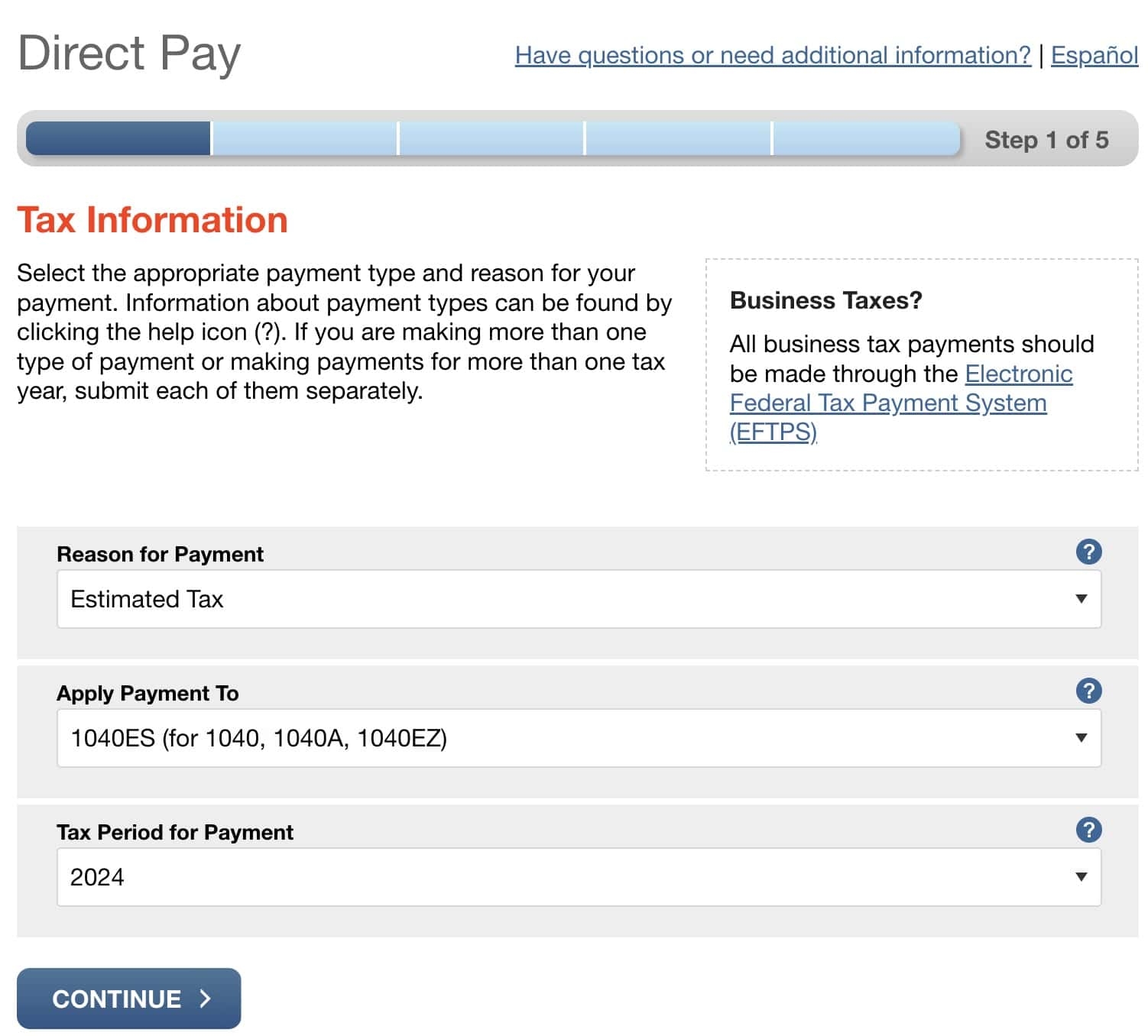

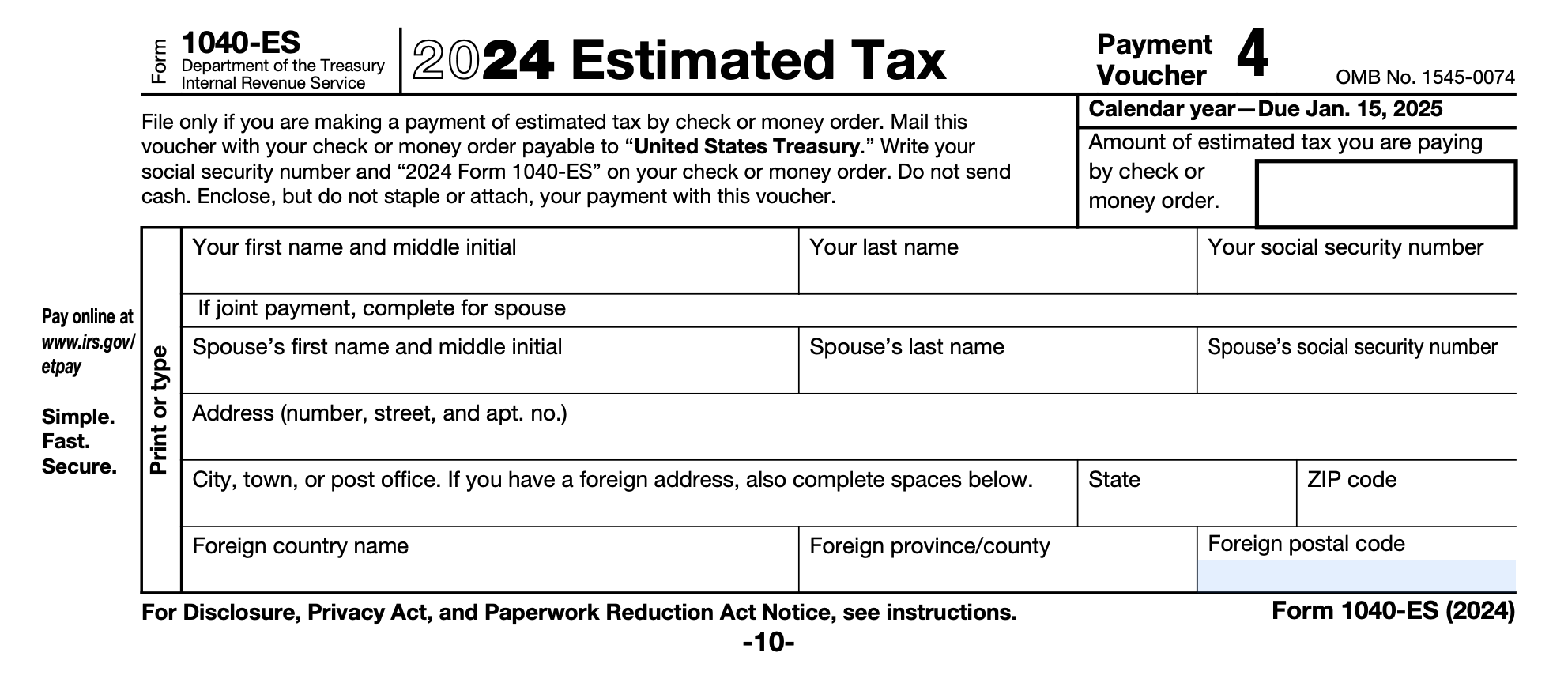

Are you ready for the changes coming to the 2025 Form 1040-ES? The IRS has announced updates to the tax form that will impact how individuals estimate their quarterly tax payments.

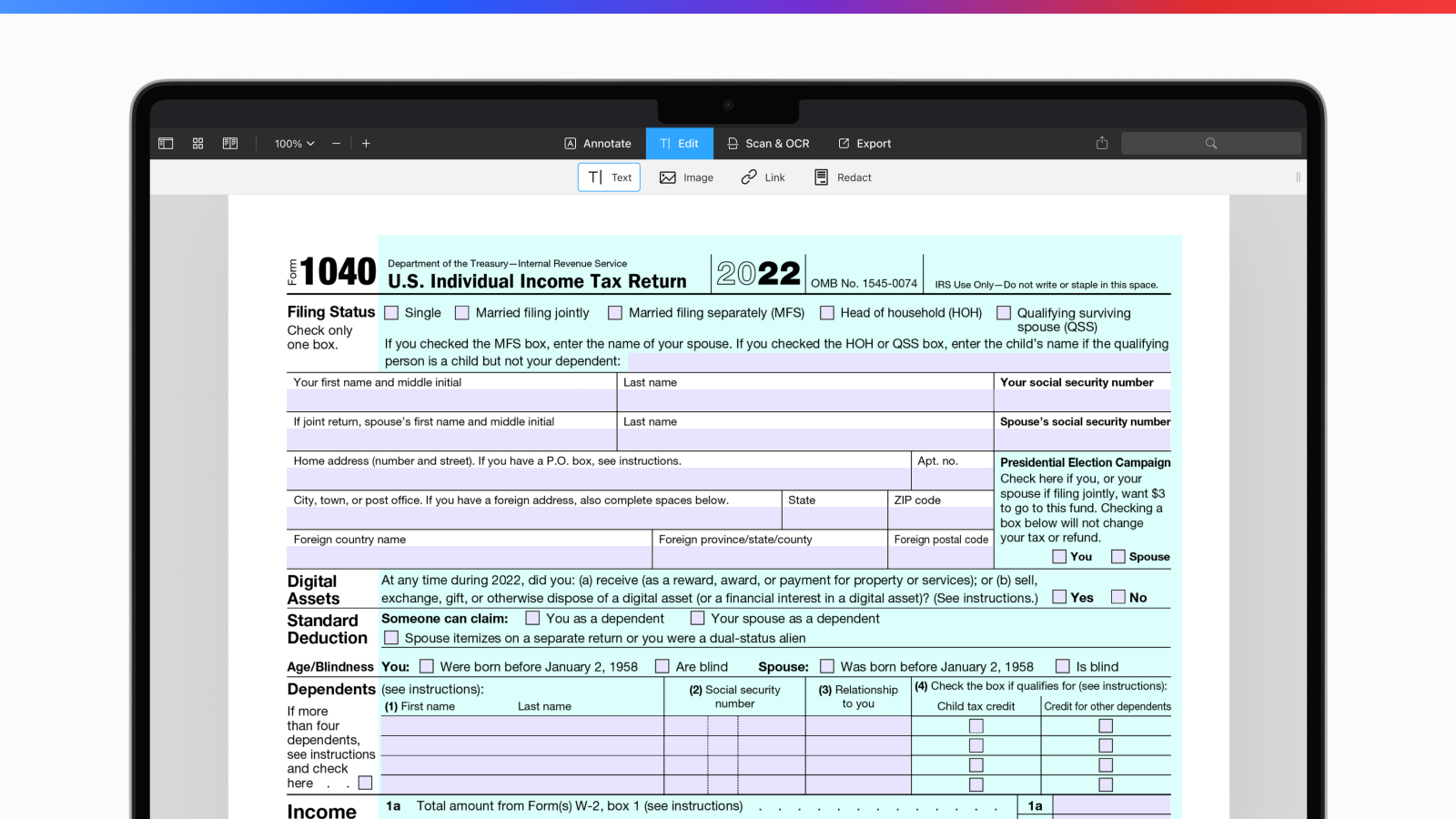

With the new changes, taxpayers will need to pay close attention to the updated instructions and calculations to ensure they are accurately reporting their income and deductions.

2025 Form 1040-ES

Understanding the Updates to the 2025 Form 1040-ES

One key change to the 2025 Form 1040-ES is the revised tax brackets and rates, which may affect how much you need to withhold each quarter. It’s important to stay informed about these updates to avoid any surprises come tax season.

Additionally, the IRS has made adjustments to the standard deduction and various credits, which could impact your overall tax liability. Be sure to review the updated form carefully to take advantage of any available deductions or credits.

As you prepare to file your taxes for the upcoming year, it’s essential to familiarize yourself with the changes to the 2025 Form 1040-ES. By staying informed and proactive, you can ensure a smooth and accurate tax-filing process.

Stay tuned for more updates and tips on navigating the 2025 Form 1040-ES as the tax season approaches. Remember, staying informed and prepared is key to successfully managing your tax obligations.

IRS Form 1040 ES Instructions Estimated Tax Payments

How To Fill Out IRS Tax Forms PDF Templates Instructions

2025 Tax Guide Key Documents And Steps To File Your 2024 Taxes Marca

Form 1040 U S Individual Tax Return Definition Types And Use

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting