2025 Form 1099

Are you ready for tax season in 2025? One key form to keep in mind is the Form 1099. This document is essential for reporting various types of income to the IRS.

Whether you’re a freelancer, independent contractor, or business owner, understanding the 2025 Form 1099 is crucial. It’s used to report income from sources other than wages, such as freelance work, rental income, or investment dividends.

2025 Form 1099

What to Know About the 2025 Form 1099

When you receive a Form 1099, make sure to review it for accuracy. Check that the income reported matches your records and be prepared to report it on your tax return. Failure to do so could result in penalties from the IRS.

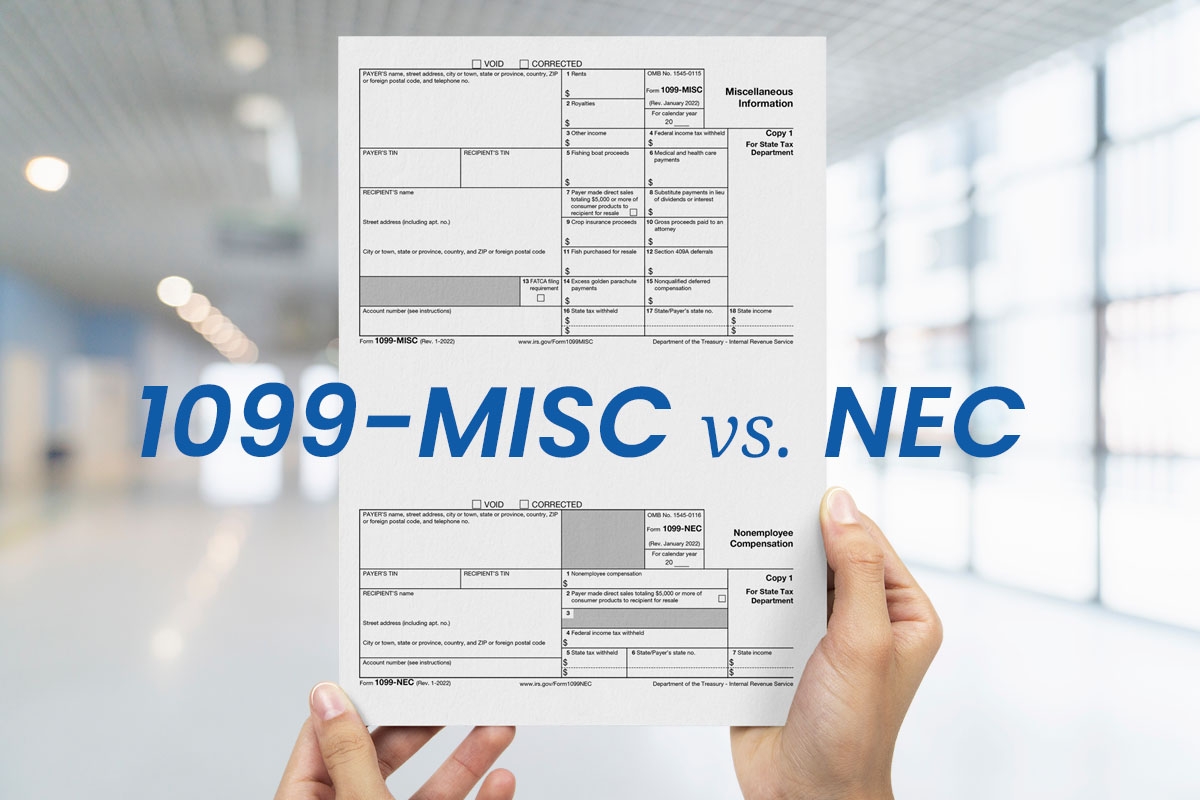

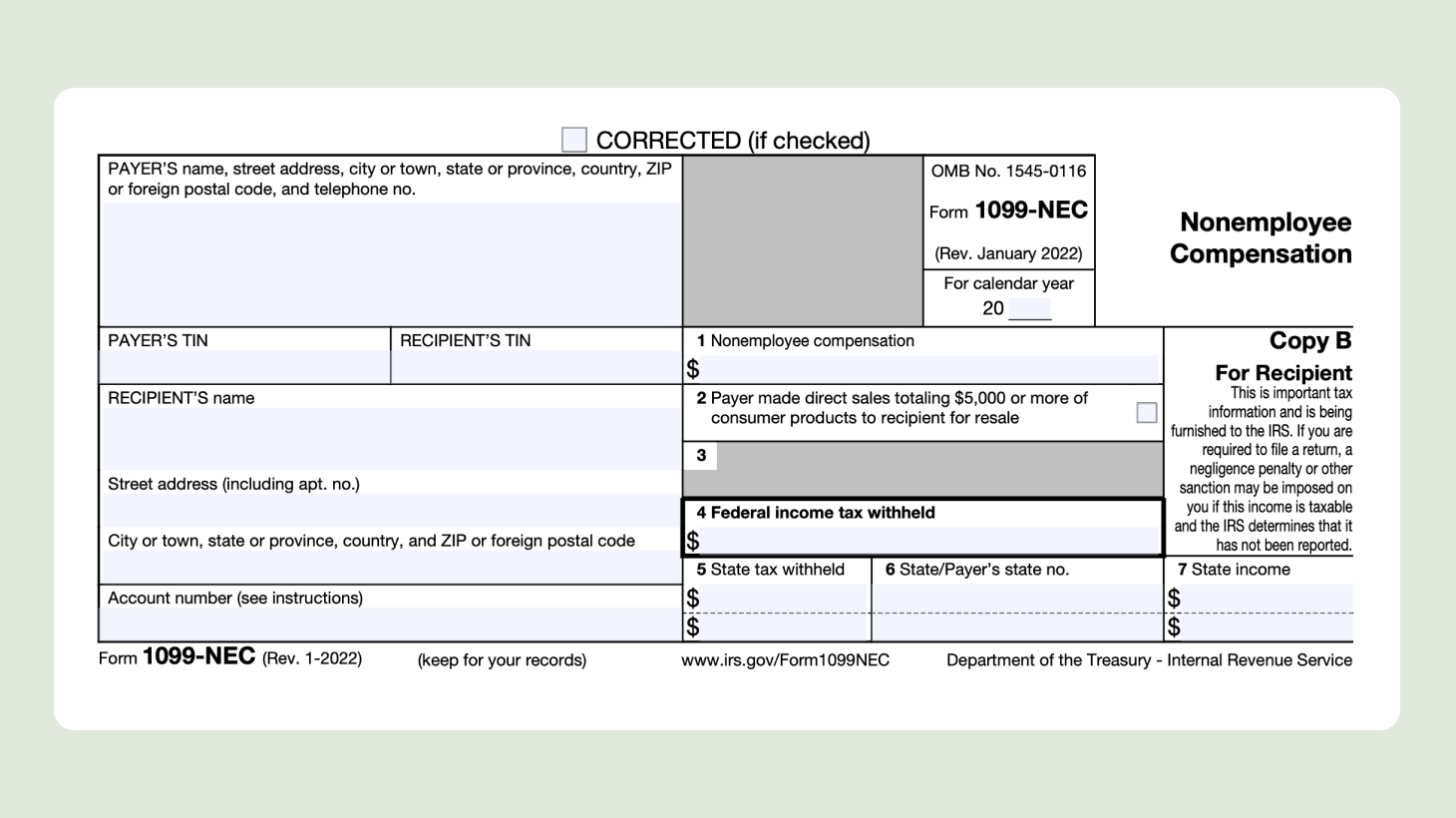

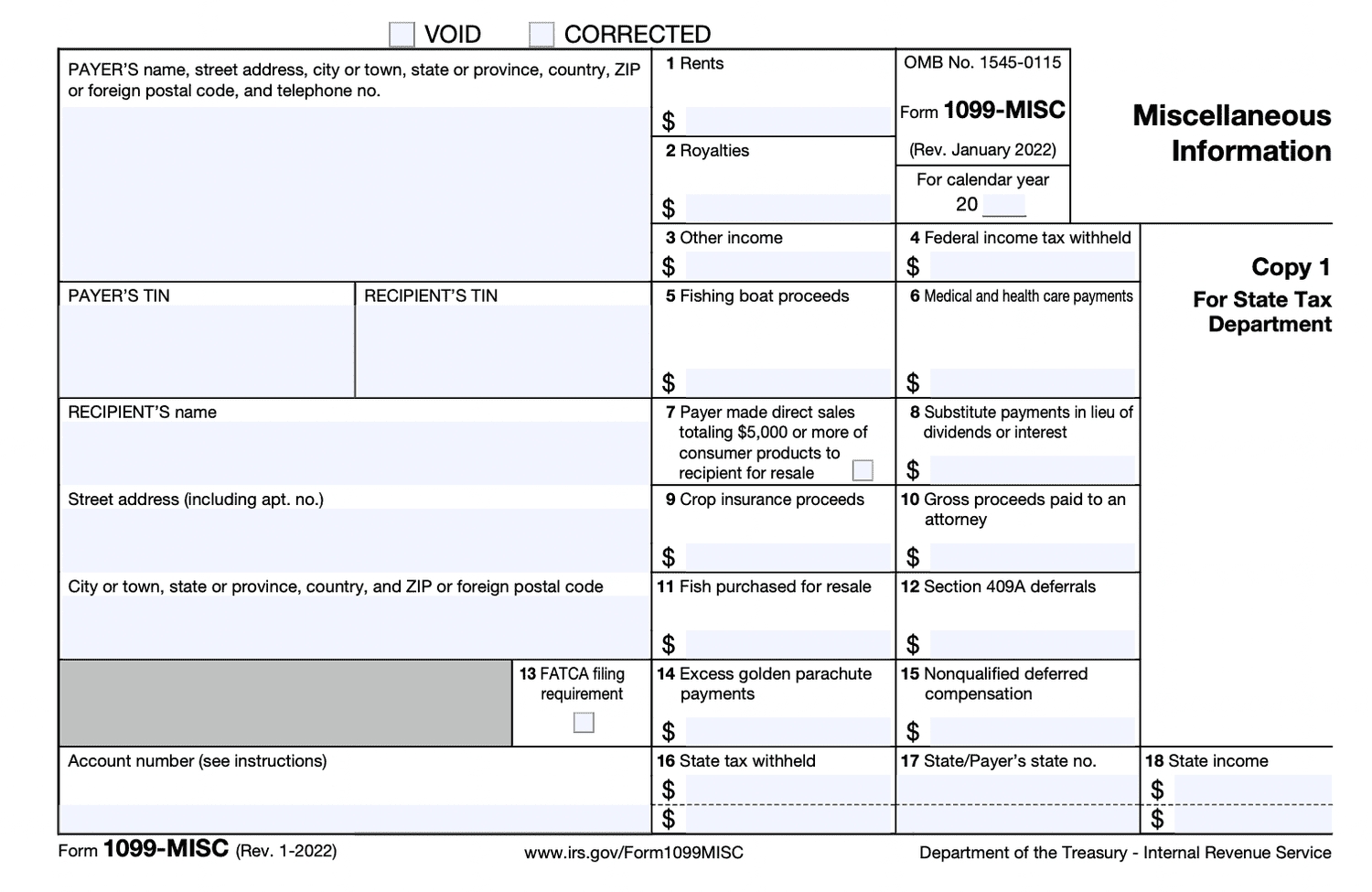

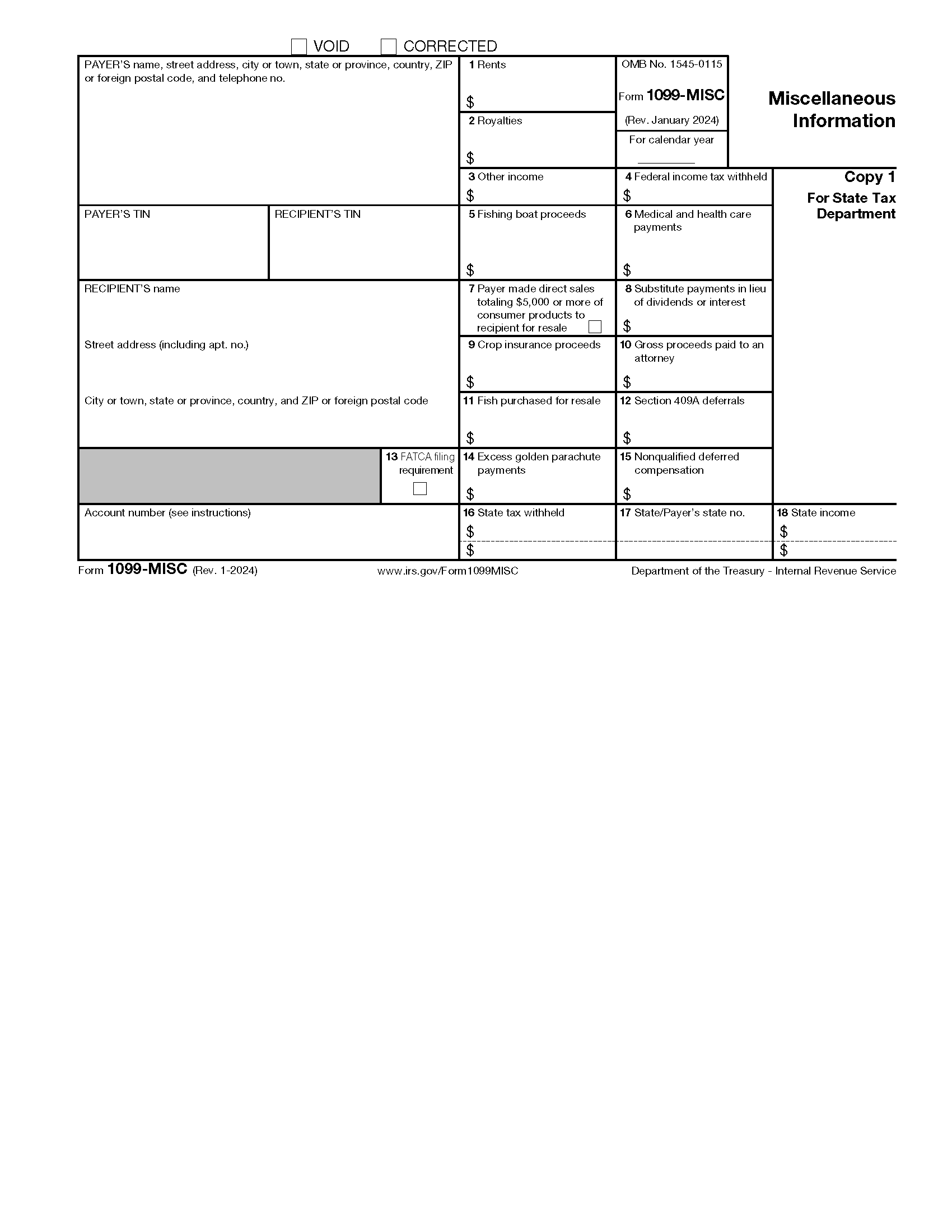

Keep in mind that there are different types of Form 1099, such as 1099-NEC for nonemployee compensation and 1099-MISC for miscellaneous income. Each form has its own set of rules and requirements, so it’s essential to understand which one applies to you.

If you have any questions about the 2025 Form 1099 or how to report the income it represents, don’t hesitate to seek help from a tax professional. They can provide guidance on how to accurately report your income and avoid any potential issues with the IRS.

As tax season approaches, make sure to stay organized and keep track of any income you receive throughout the year. By understanding the 2025 Form 1099 and its requirements, you can ensure a smooth and hassle-free tax filing process.

Form 1099 MISC Vs 1099 NEC What You Need To Know Form Pros

Itemize Deductions Or Take The Standard Deduction Which Is Right For You

An Overview Of The 1099 NEC Form

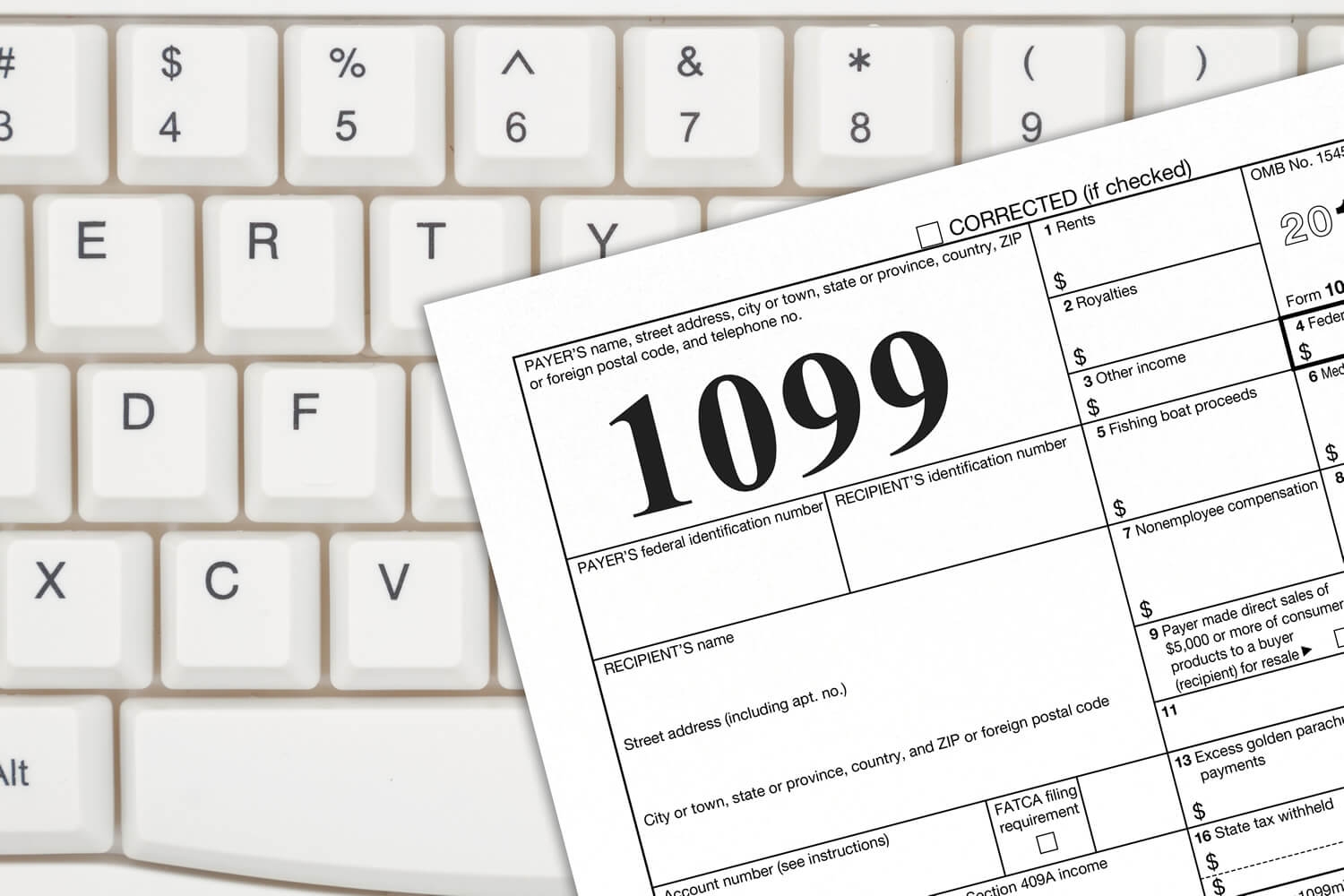

Form 1099 Reporting Non Employment Income

Free IRS Form 1099 MISC PDF EForms