2025 Form 1099-NEC

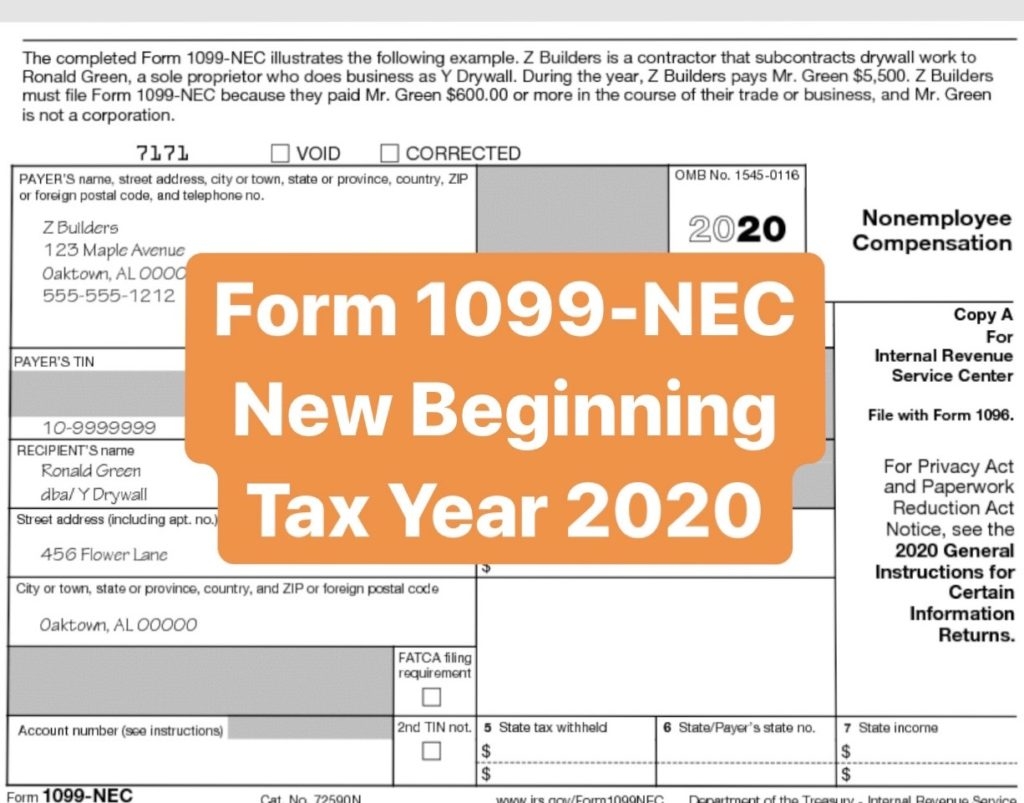

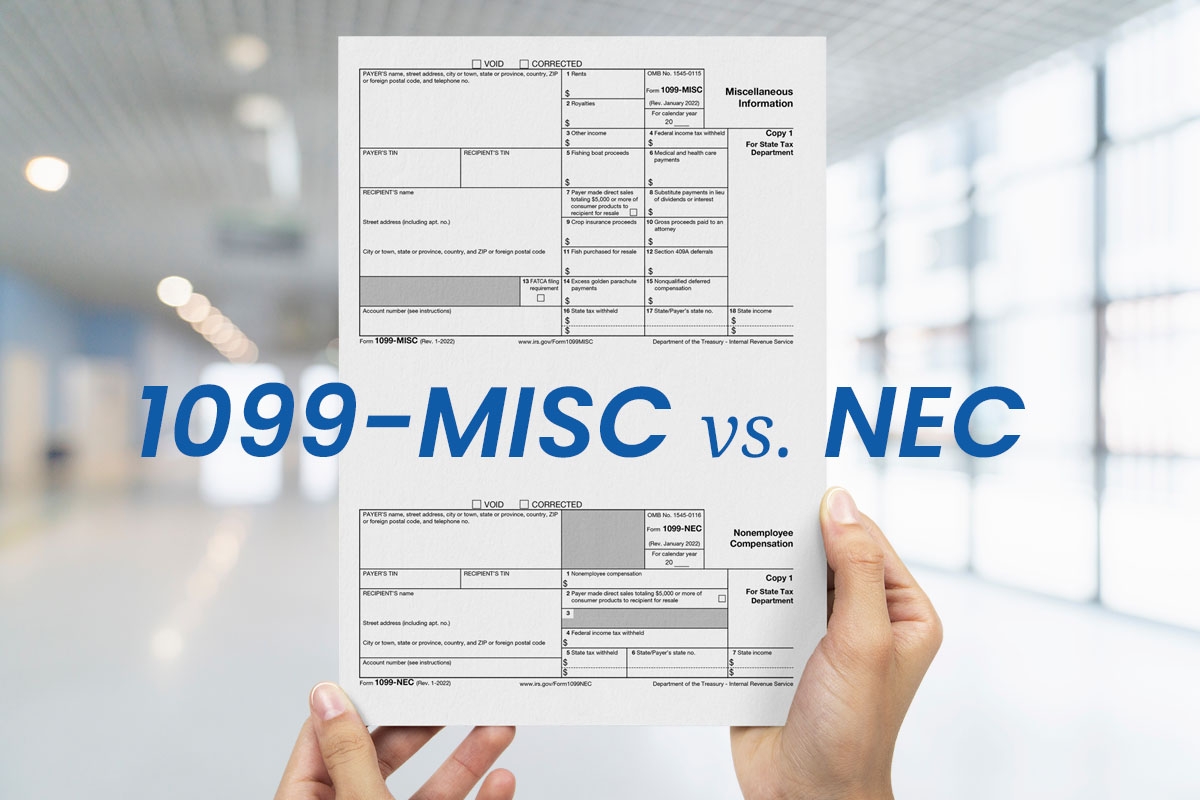

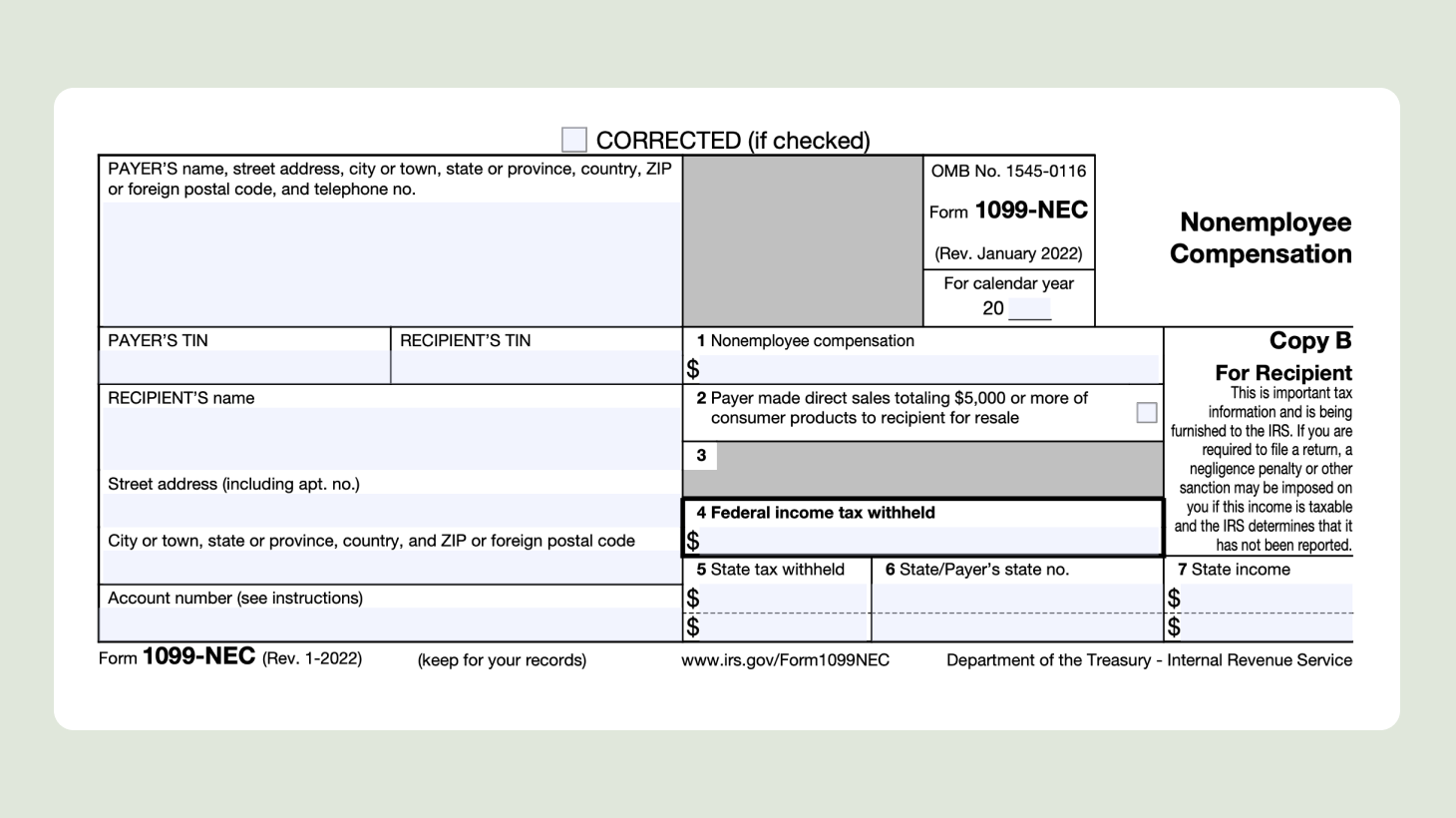

Are you a freelancer or independent contractor? If so, you may be familiar with the Form 1099-NEC used to report your income to the IRS. As of 2020, this form replaced the 1099-MISC for non-employee compensation.

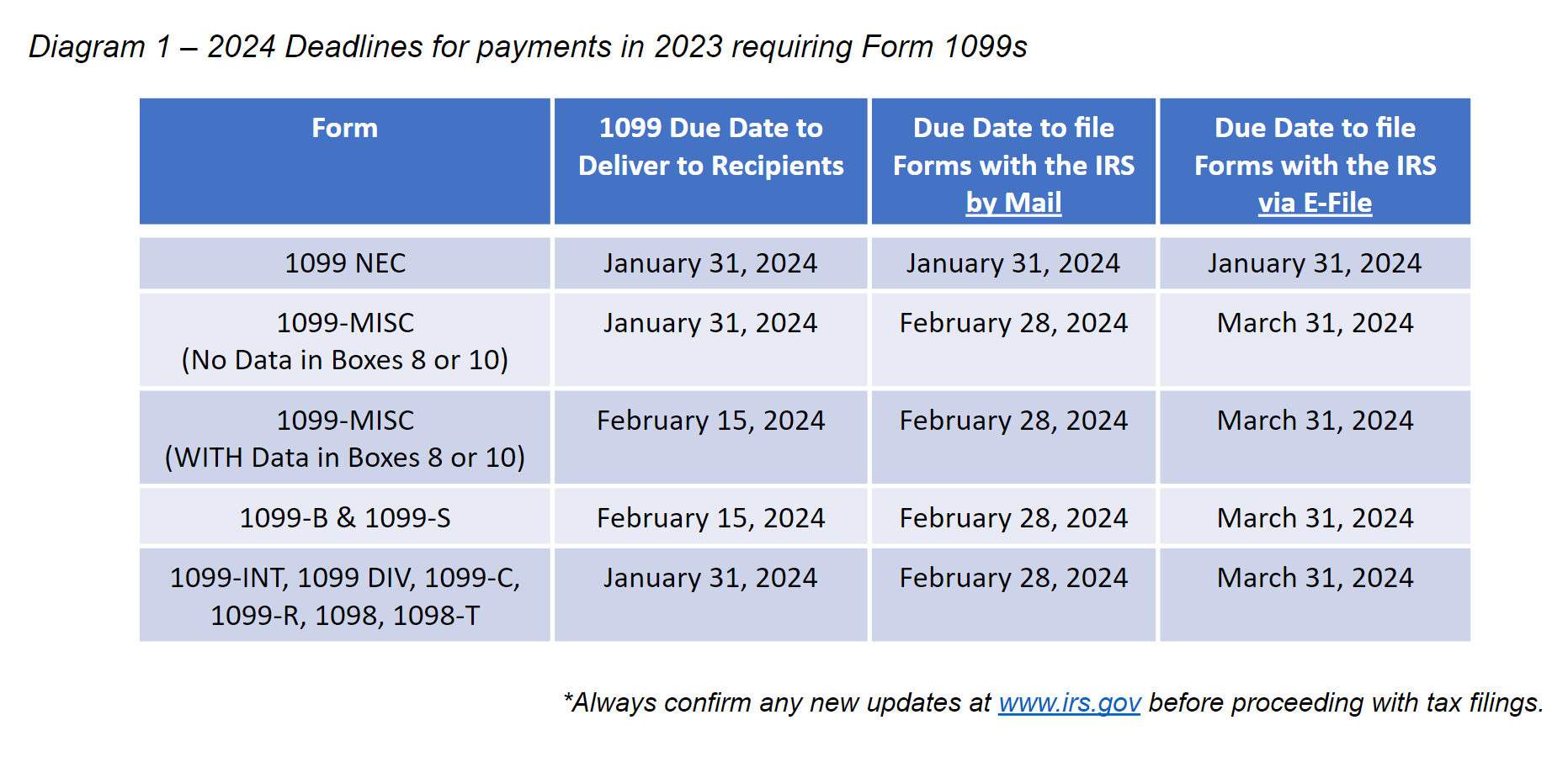

Filing taxes can be overwhelming, especially when tax forms change. Looking ahead to 2025, it’s important to stay informed about any updates or modifications to the Form 1099-NEC to ensure accurate reporting of your income.

2025 Form 1099-NEC

2025 Form 1099-NEC: What You Need to Know

When preparing your taxes, make sure to keep detailed records of your income and expenses throughout the year. This will help you accurately report your earnings on the 1099-NEC form and potentially reduce your tax liability.

It’s also essential to understand any changes to tax laws or regulations that may impact how you report your income. Staying informed and seeking guidance from a tax professional can help you navigate these complexities with confidence.

As the tax landscape evolves, it’s crucial to stay proactive and informed to avoid any potential penalties or fines for incorrect reporting. By staying organized and up-to-date on tax regulations, you can streamline the tax-filing process and ensure compliance with the IRS.

Remember, tax laws can change frequently, so it’s important to stay informed and seek guidance from a tax professional to ensure you’re accurately reporting your income. By staying proactive and informed, you can navigate tax season with ease and peace of mind.

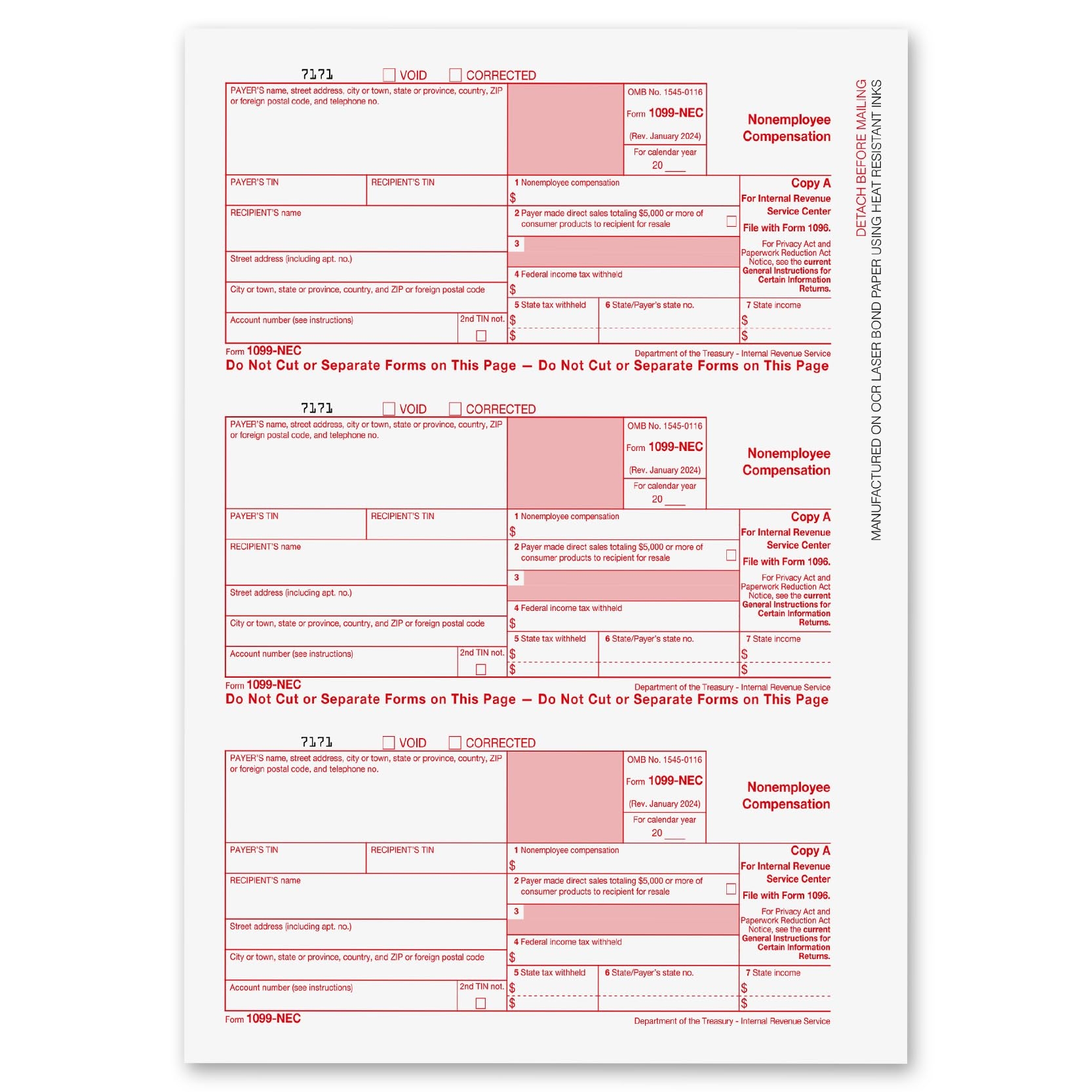

Amazon 1099 NEC Forms 2024 1099 NEC Laser Forms IRS Approved Designed For QuickBooks And Accounting Software 2024 4 Part Tax Forms Kit 25 Vendor Kit Total 38 108 Forms Office Products

1099 Requirements For Business Owners In 2025 Mark J Kohler

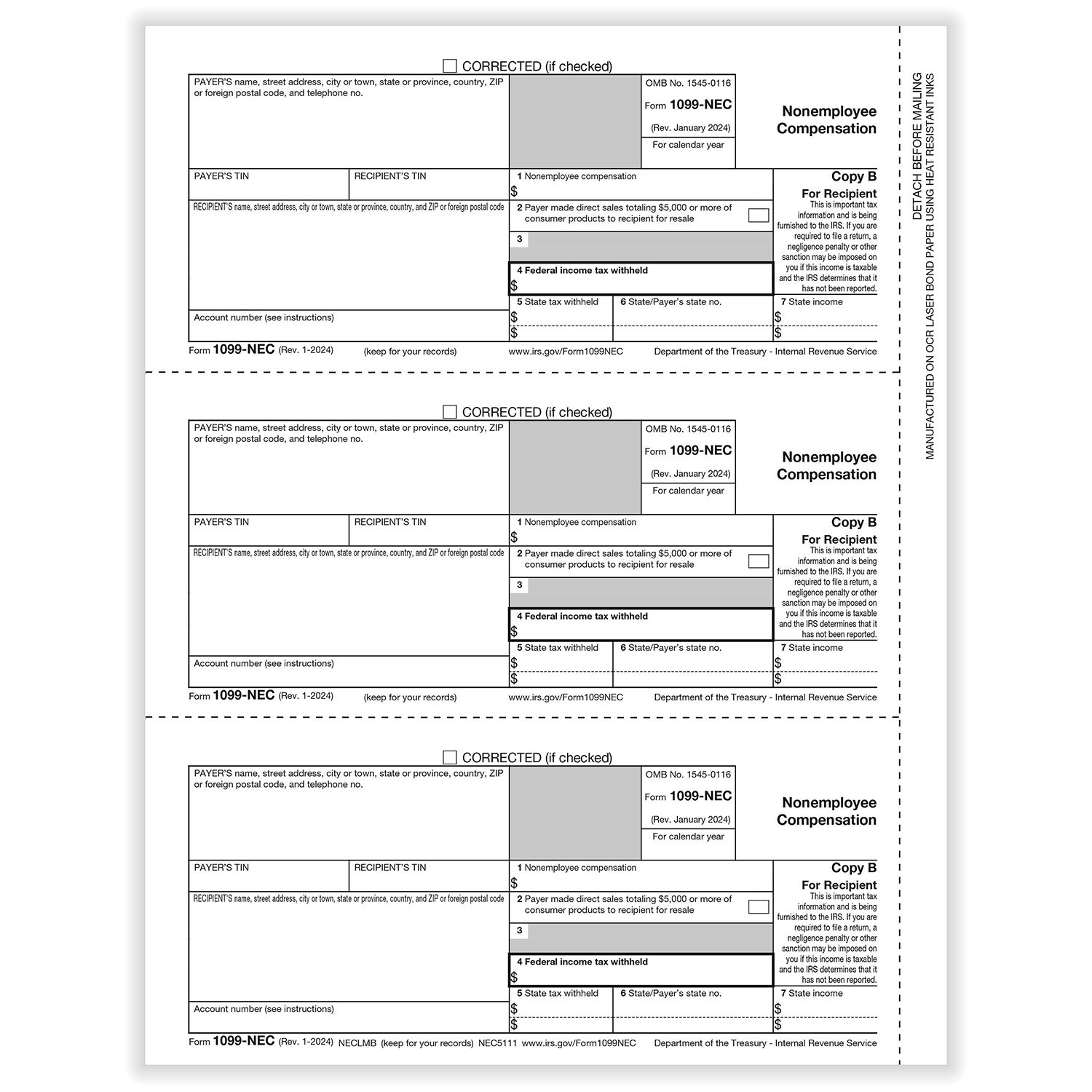

1099 NEC 3 Up Individual Recipient Copy B Formstax

Form 1099 MISC Vs 1099 NEC What You Need To Know Form Pros

An Overview Of The 1099 NEC Form