2025 IRS Form 1040

Thinking about taxes can be overwhelming, but understanding the changes coming in 2025 can help you prepare. The IRS Form 1040 is getting a makeover, so let’s dive into what you can expect.

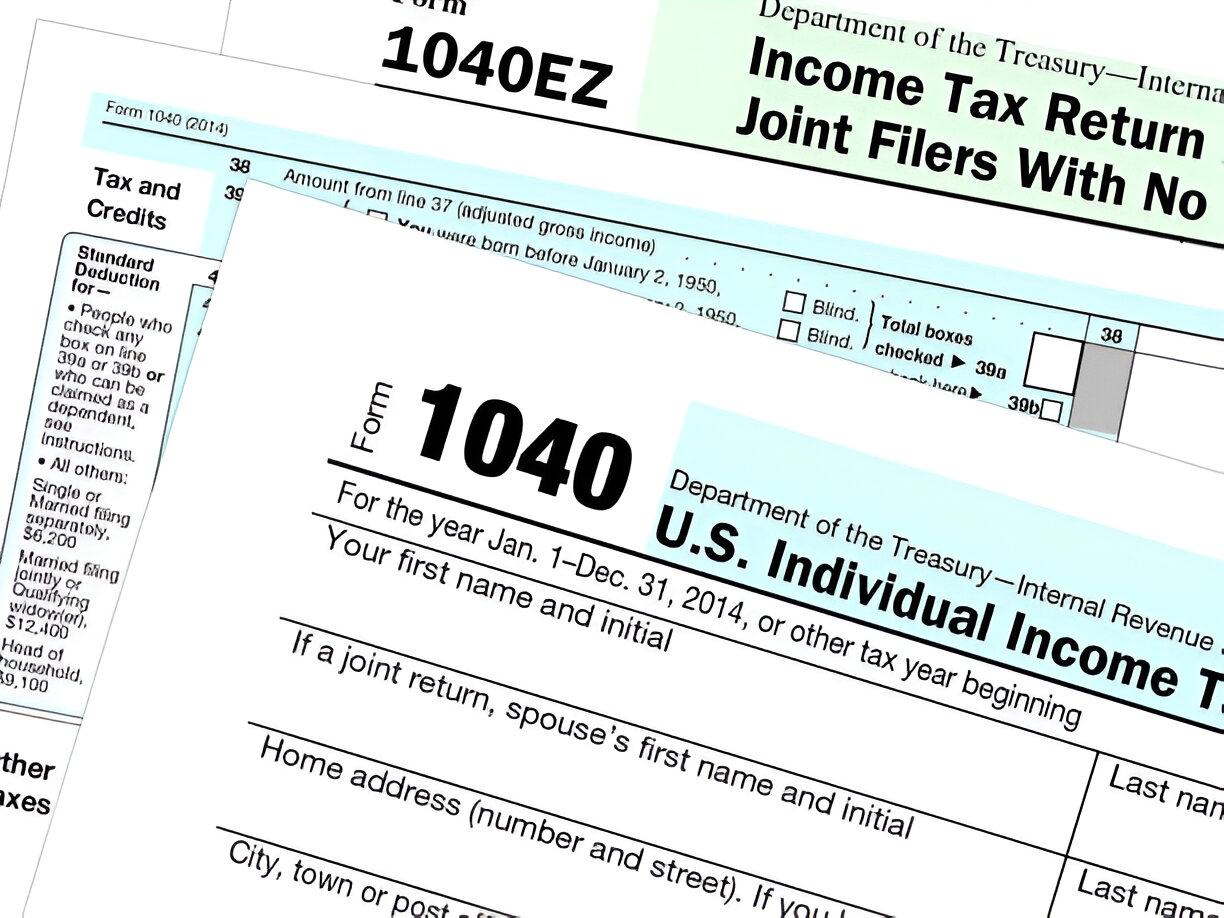

One major change for the 2025 IRS Form 1040 is the simplification of the tax filing process. This means fewer schedules and attachments, making it easier for taxpayers to navigate and complete their returns.

2025 IRS Form 1040

2025 IRS Form 1040: What You Need to Know

Another key update is the introduction of new tax credits and deductions aimed at helping middle-class families and individuals. These changes can potentially lower your tax liability and put more money back in your pocket.

Additionally, the 2025 IRS Form 1040 will include enhanced cybersecurity measures to protect taxpayers’ sensitive information. With the rise of cyber threats, these added security features are essential for safeguarding your personal data.

It’s important to stay informed about these changes to the IRS Form 1040, as they can impact your tax return and financial situation. Be sure to consult with a tax professional or utilize online resources to fully understand how these updates affect you.

As the 2025 tax season approaches, keeping up-to-date with the latest information on the IRS Form 1040 will ensure a smooth and stress-free filing process. By familiarizing yourself with these changes now, you can be better prepared when it comes time to file your taxes.

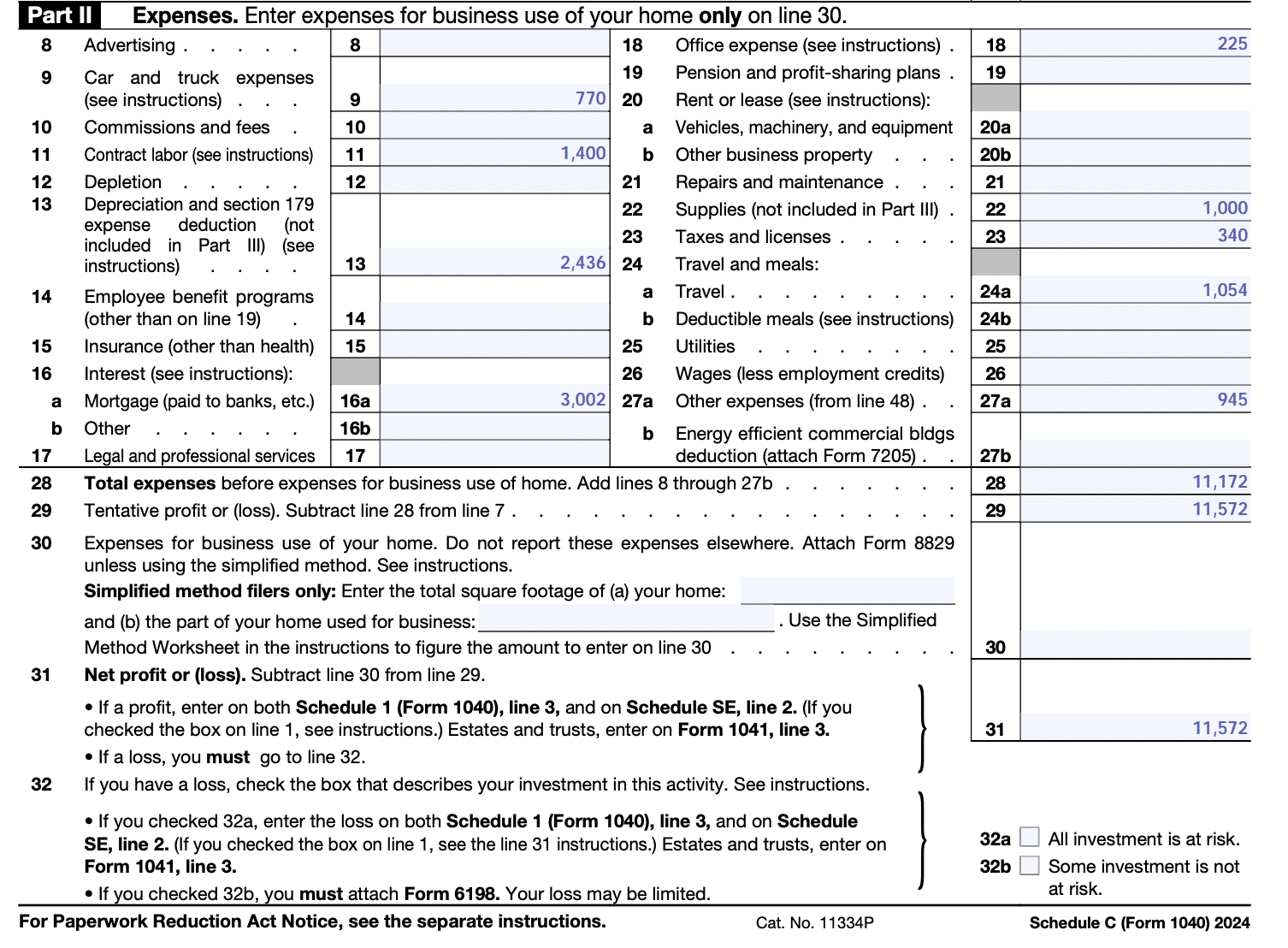

How To Fill Out Schedule C In 2025 With Example

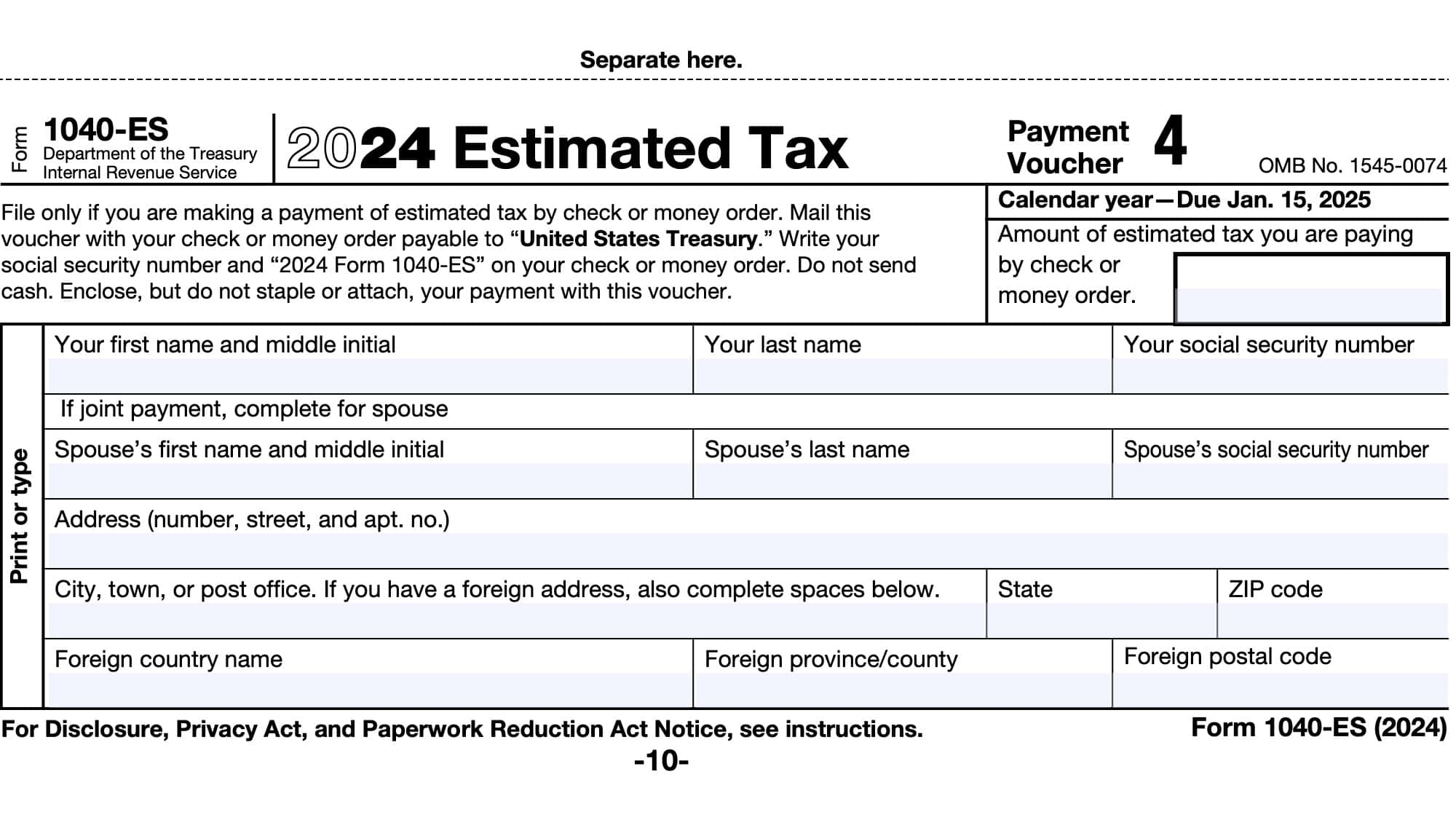

IRS Form 1040 ES Instructions Estimated Tax Payments

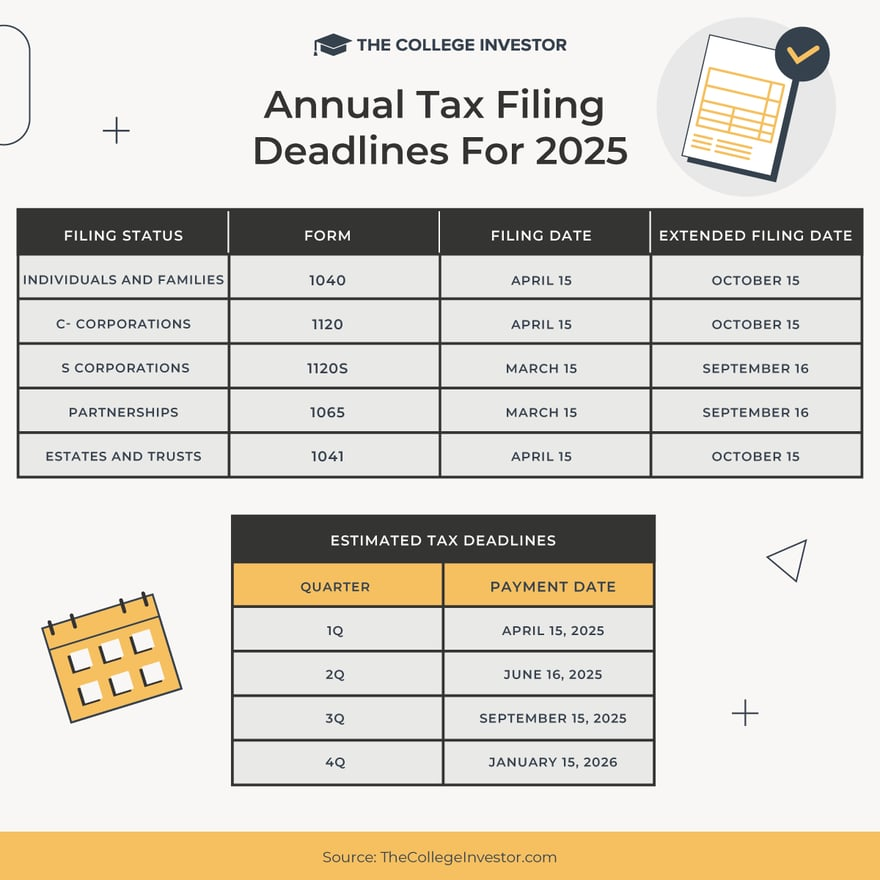

When Are Taxes Due In 2025 Including Estimated Taxes

Form 1040 U S Individual Tax Return Definition Types And Use

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor