2025 IRS Form 1040-ES

Are you already thinking about taxes for the year 2025? While it may seem far off, planning ahead can save you stress in the long run. One important form to consider is the 2025 IRS Form 1040-ES.

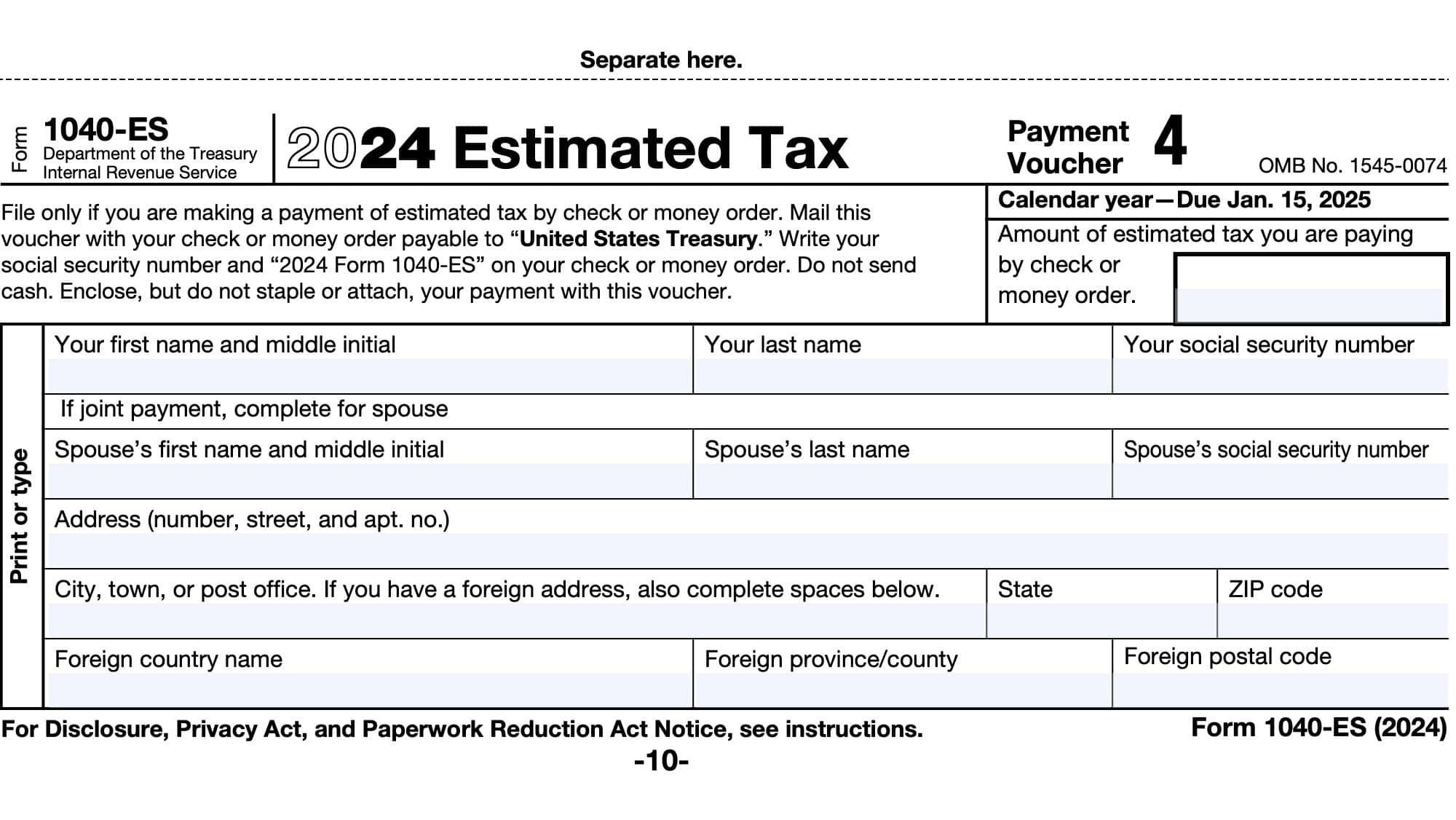

For many taxpayers, the 1040-ES is used to estimate and pay taxes on income not subject to withholding, such as self-employment income, interest, dividends, and capital gains. By making quarterly estimated payments, you can avoid penalties and interest on underpayment.

2025 IRS Form 1040-ES

Understanding the 2025 IRS Form 1040-ES

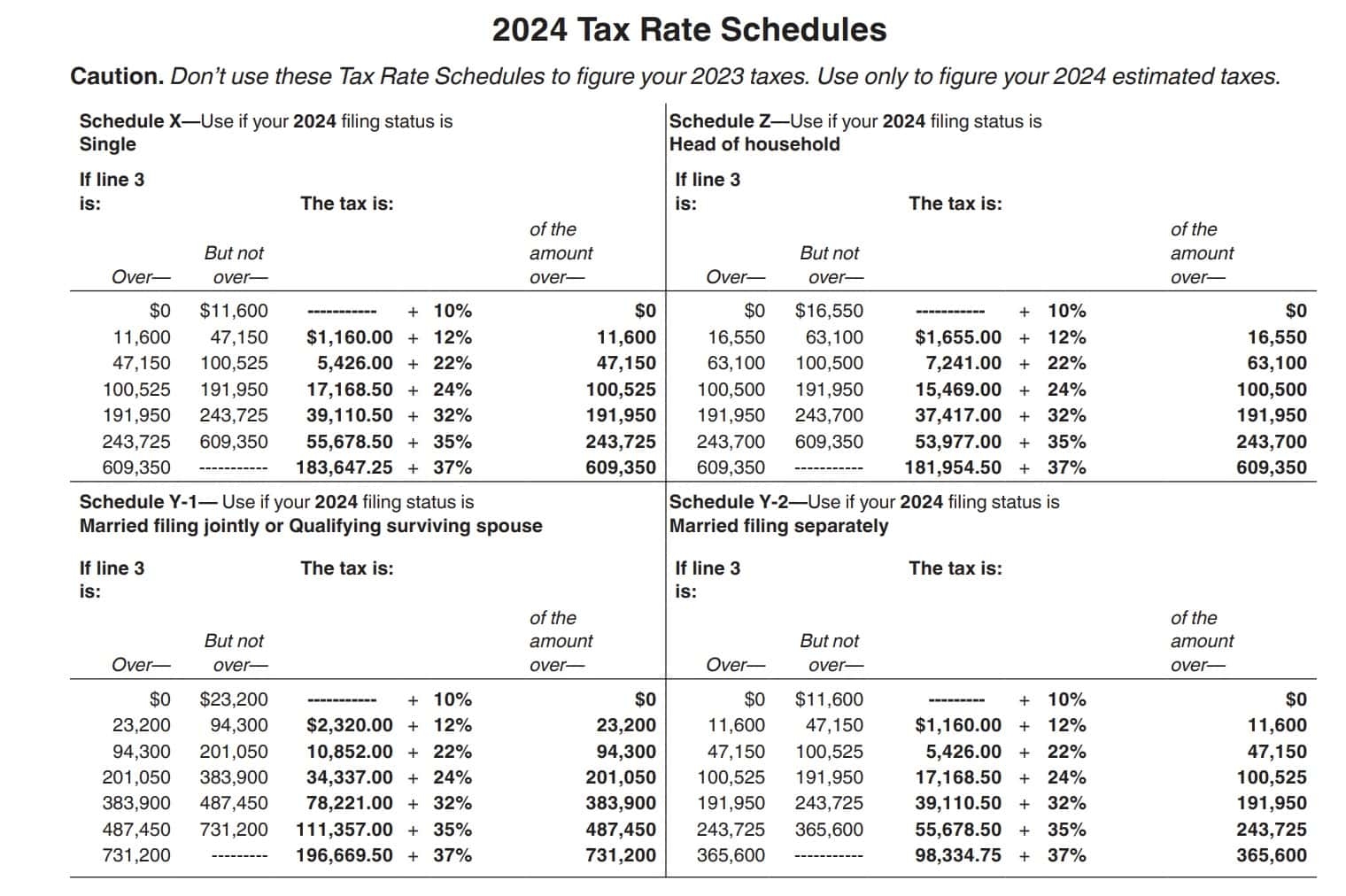

The form includes worksheets to help you calculate your estimated tax liability and determine the amount you should pay each quarter. It’s important to review your income and deductions regularly to ensure your estimates are accurate.

If your income fluctuates throughout the year, you may need to adjust your estimated payments accordingly. This can help you avoid overpaying or underpaying and ensure you meet your tax obligations without any surprises come tax time.

Keep in mind that the 1040-ES is just one piece of the tax puzzle. Working with a tax professional can help you navigate the complexities of the tax code, maximize deductions, and minimize your tax liability. Don’t hesitate to seek guidance if you’re unsure about how to proceed.

Planning ahead for your taxes can give you peace of mind and help you avoid costly mistakes. By familiarizing yourself with the 2025 IRS Form 1040-ES and staying on top of your estimated payments, you can set yourself up for financial success in the years to come.

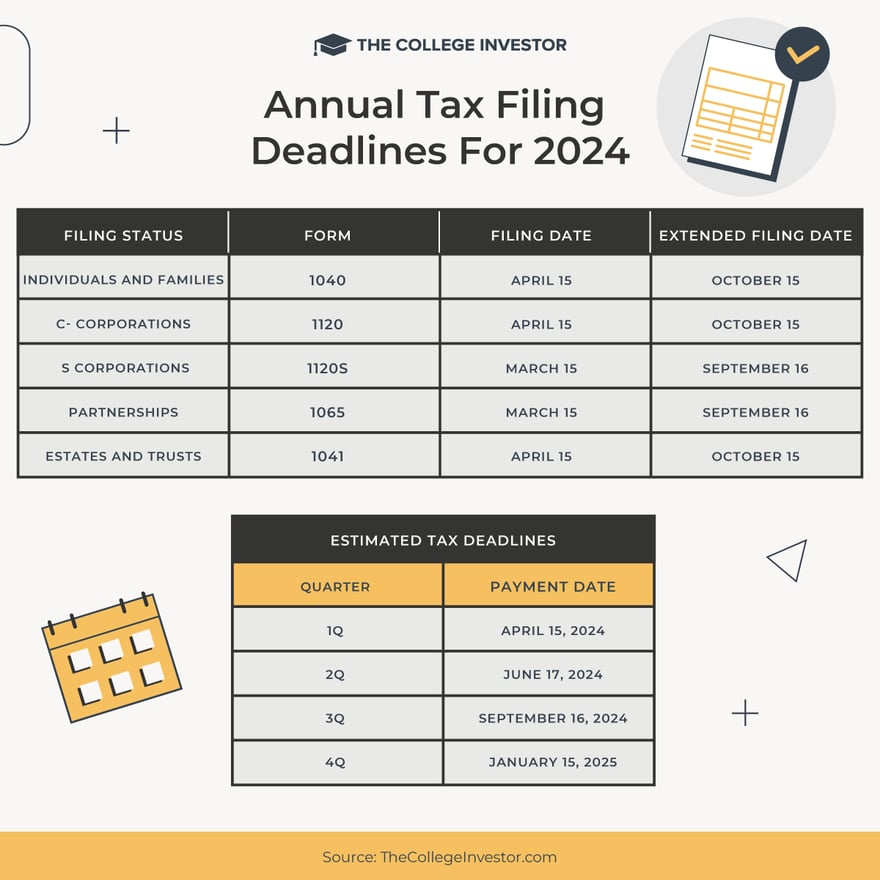

How To Pay Quarterly Estimated Taxes

2025 Tax Guide Key Documents And Steps To File Your 2024 Taxes Marca

A Guide To Household Employers Estimated Tax Payments

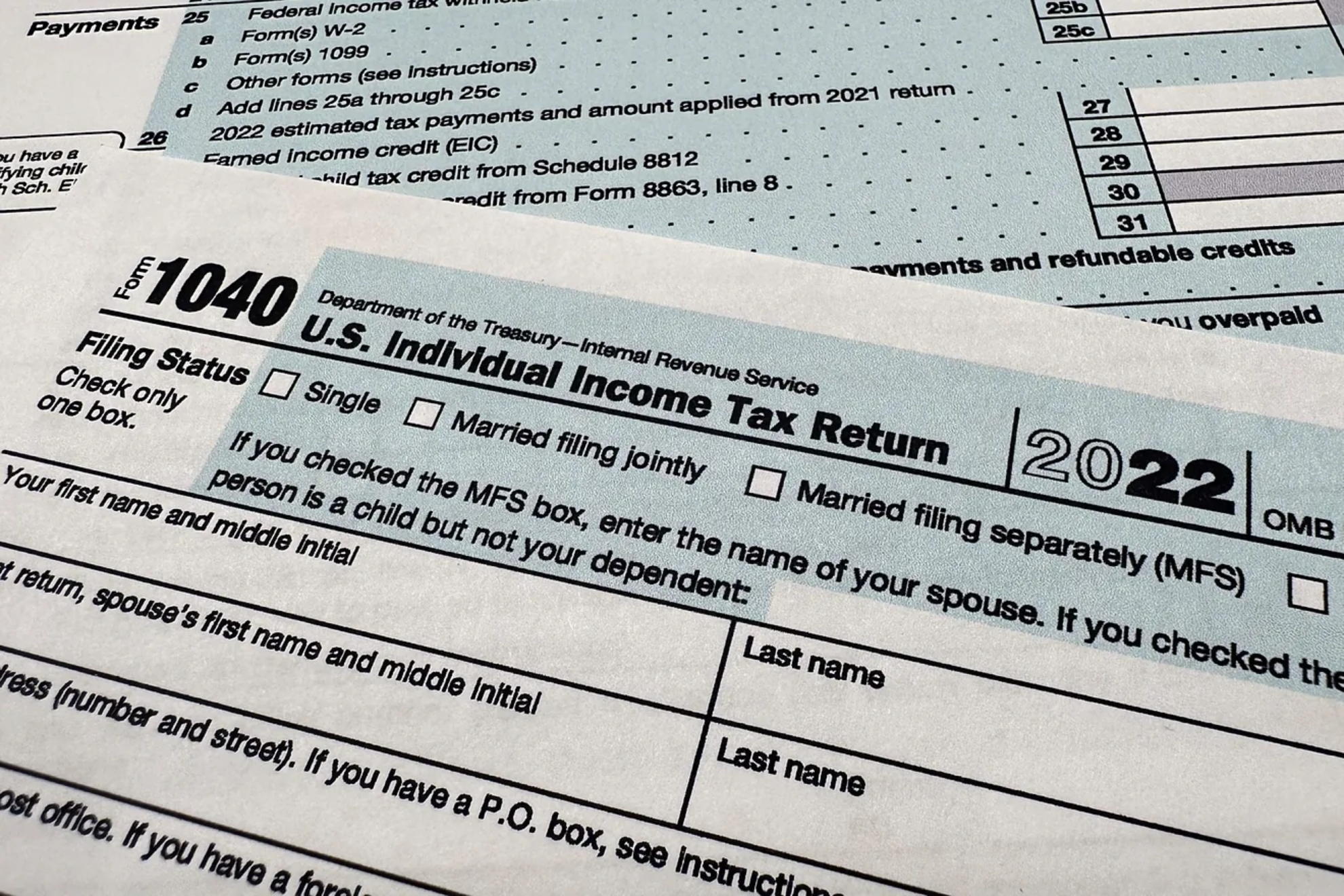

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments