Sales Tax Returns: A State-by-State Guide for Businesses

As a business owner, filing accurate and timely sales tax returns is essential to stay compliant with state and local tax laws. Sales tax is collected from customers at the point of sale and must be remitted to the respective state or local tax authorities. Each state has its own process for filing these returns, and failing to file or pay on time can result in penalties and interest charges, which can harm your business’s bottom line.

In this comprehensive guide, we provide you with direct links to the official sales tax return pages for each state, simplifying the process for businesses across the U.S. Whether you’re operating in a single state or multiple locations, this resource ensures that you have access to the correct forms and filing instructions, helping you submit your sales tax returns accurately and on time.

| States | Link to Filing Form |

|---|---|

| Alaska | tax.alaska.gov |

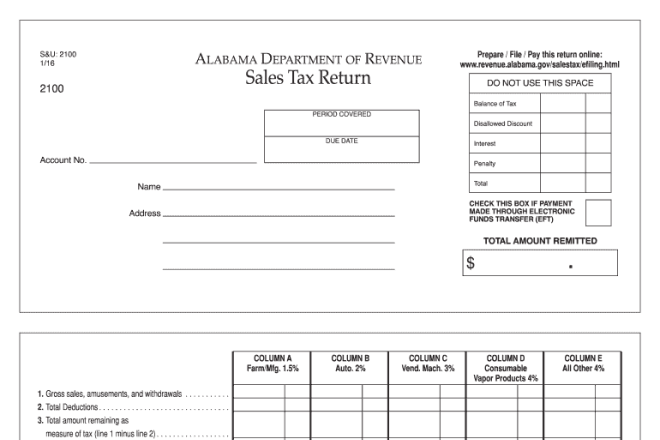

| Alabama | revenue.alabama.gov |

| Arizona | azdor.gov/business |

| Arkansas | dfa.arkansas.gov |

| California | ftb.ca.gov |

| Colorado | tax.colorado.gov |

| Connecticut | portal.ct.gov |

| Delaware | revenue.delaware.gov |

| Florida | floridarevenue.com |

| Georgia | dor.georgia.gov |

| Hawaii | tax.hawaii.gov |

| Idaho | tax.idaho.gov |

| Illinois | tax.illinois.gov |

| Indiana | in.gov |

| Iowa | tax.iowa.gov |

| Kansas | ksrevenue.gov |

| Kentucky | revenue.ky.gov |

| Louisiana | revenue.louisiana.gov |

| Maine | maine.gov |

| Maryland | marylandtaxes.gov |

| Massachusetts | mass.gov |

| Michigan | michigan.gov |

| Minnesota | revenue.state.mn.us |

| Mississippi | dor.ms.gov |

| Missouri | dor.mo.gov |

| Montana | mtrevenue.gov |

| Nebraska | revenue.nebraska.gov |

| Nevada | tax.nv.gov |

| New Hampshire | revenue.nh.gov |

| New Jersey | state.nj.us |

| New Mexico | tax.newmexico.gov |

| New York | tax.ny.gov |

| North Carolina | ncdor.gov |

| North Dakota | nd.gov |

| Ohio | tax.ohio.gov |

| Oklahoma | ok.gov |

| Oregon | oregon.gov |

| Pennsylvania | revenue.pa.gov |

| Rhode Island | tax.ri.gov |

| South Carolina | dor.sc.gov |

| South Dakota | dor.sd.gov |

| Tennessee | tn.gov |

| Texas | comptroller.texas.gov |

| Utah | tax.utah.gov |

| Virginia | tax.virginia.gov |