Form 4868: Extending Your Tax Filing Deadline

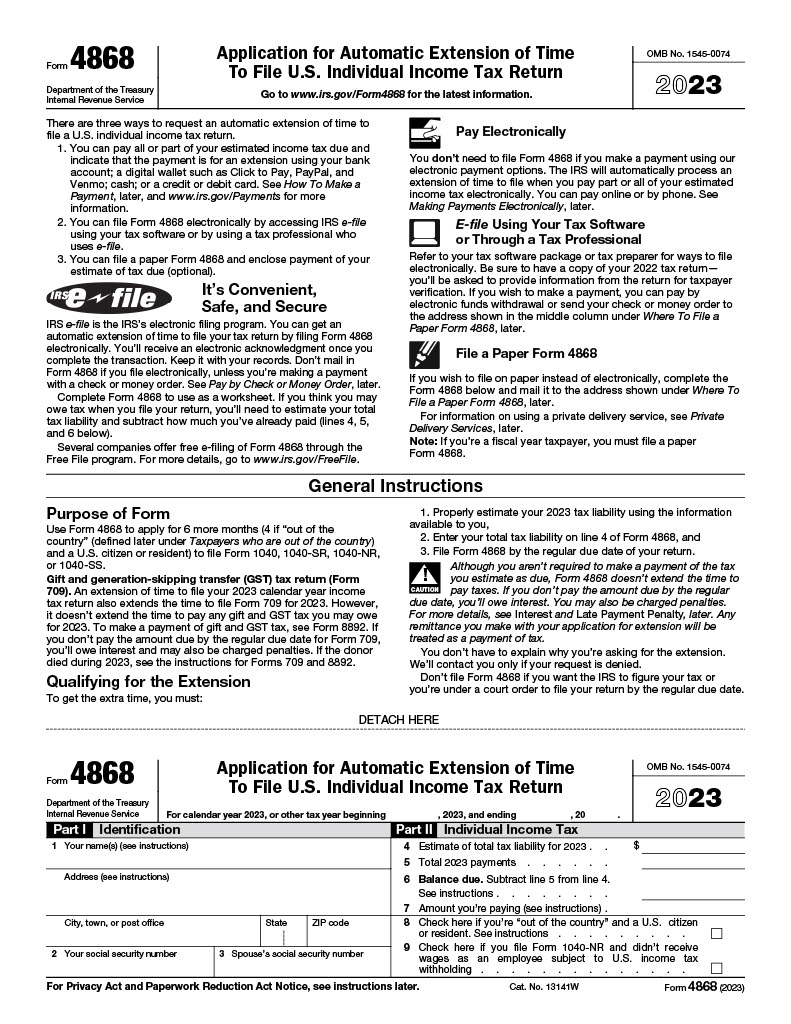

Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, is essential for taxpayers who need more time to prepare their tax returns. Filing this form grants an automatic six-month extension, moving the filing deadline from April 15 to October 15. This extension provides additional time to gather documents and ensure an accurate tax return, helping avoid filing mistakes and penalties.

While Form 4868 extends the deadline for filing your tax return, it does not extend the time to pay any taxes owed. To avoid late payment penalties and interest, it’s crucial to estimate your tax liability and pay any amount due when submitting the extension form. Download the Form 4868 PDF below and follow the instructions to secure your filing extension and stay compliant with IRS regulations.