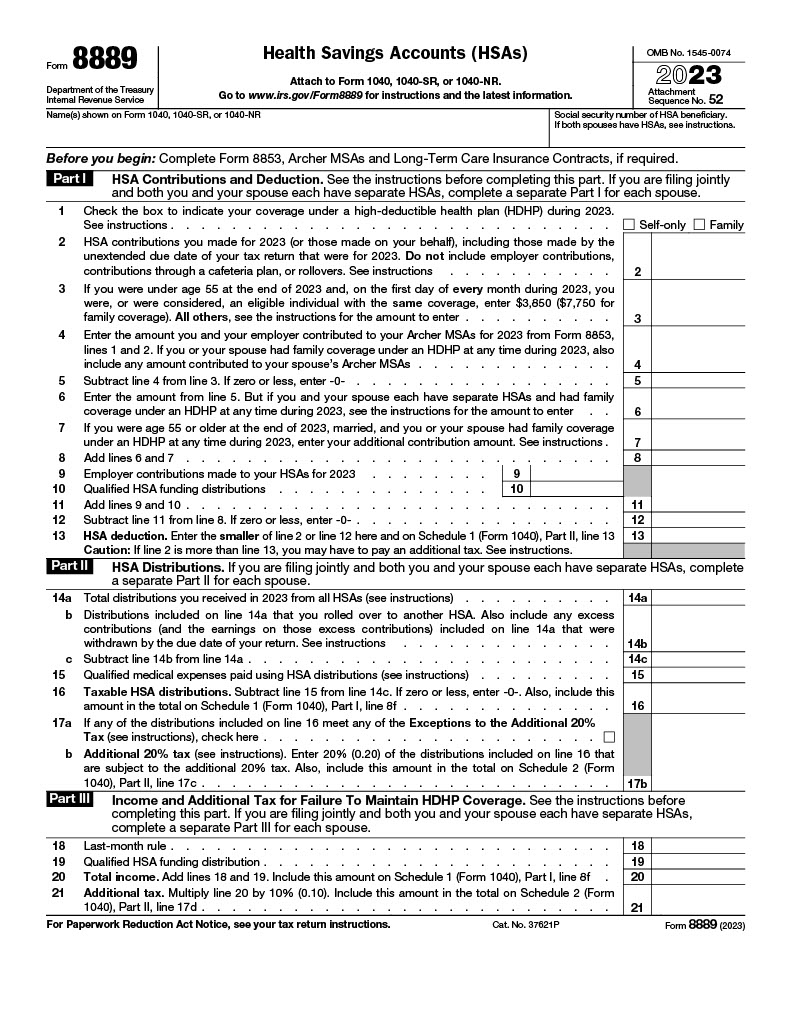

Form 8889: Reporting Health Savings Account Contributions and Distributions

Form 8889, Health Savings Accounts (HSAs), is essential for individuals who contribute to or take distributions from an HSA. This form is used to report contributions made to the account, distributions taken, and to determine the amount that can be deducted on your tax return. Filing Form 8889 correctly helps you maintain compliance with IRS regulations and take advantage of the tax benefits associated with HSAs.

Completing Form 8889 allows taxpayers to properly document qualified medical expenses paid with HSA funds and ensures that any non-qualified distributions are reported and taxed appropriately. Proper use of this form can lead to significant tax savings and better management of your healthcare costs. Download the Form 8889 PDF below to file your HSA contributions and distributions accurately.