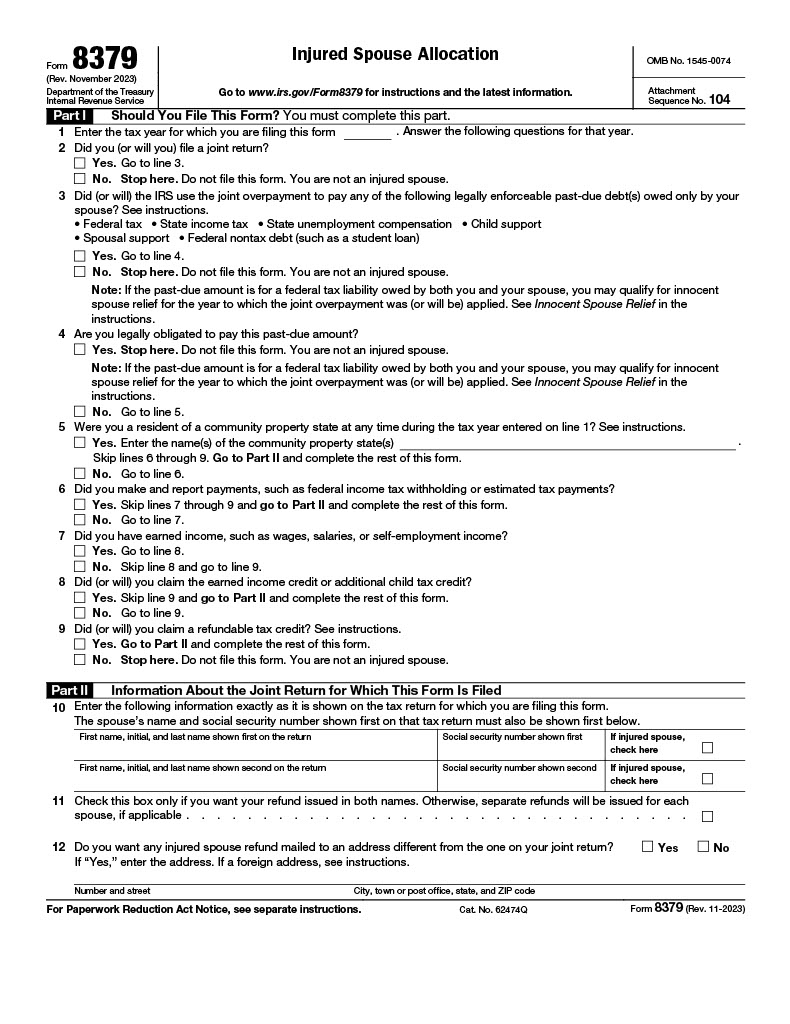

Form 8379: Injured Spouse Allocation Explained

Form 8379, the Injured Spouse Allocation, is used by individuals who want to protect their portion of a joint tax refund from being used to pay off their spouse’s past debts, such as overdue federal or state taxes, child support, or student loans. Filing this form helps ensure that your share of the refund remains intact and is allocated correctly.

Completing Form 8379 allows an injured spouse to receive their fair portion of a tax refund despite a joint tax return. It’s an essential step for couples where one spouse is not liable for the other’s financial obligations. Download the Form 8379 PDF below and follow the instructions to file your allocation accurately and safeguard your portion of the refund.