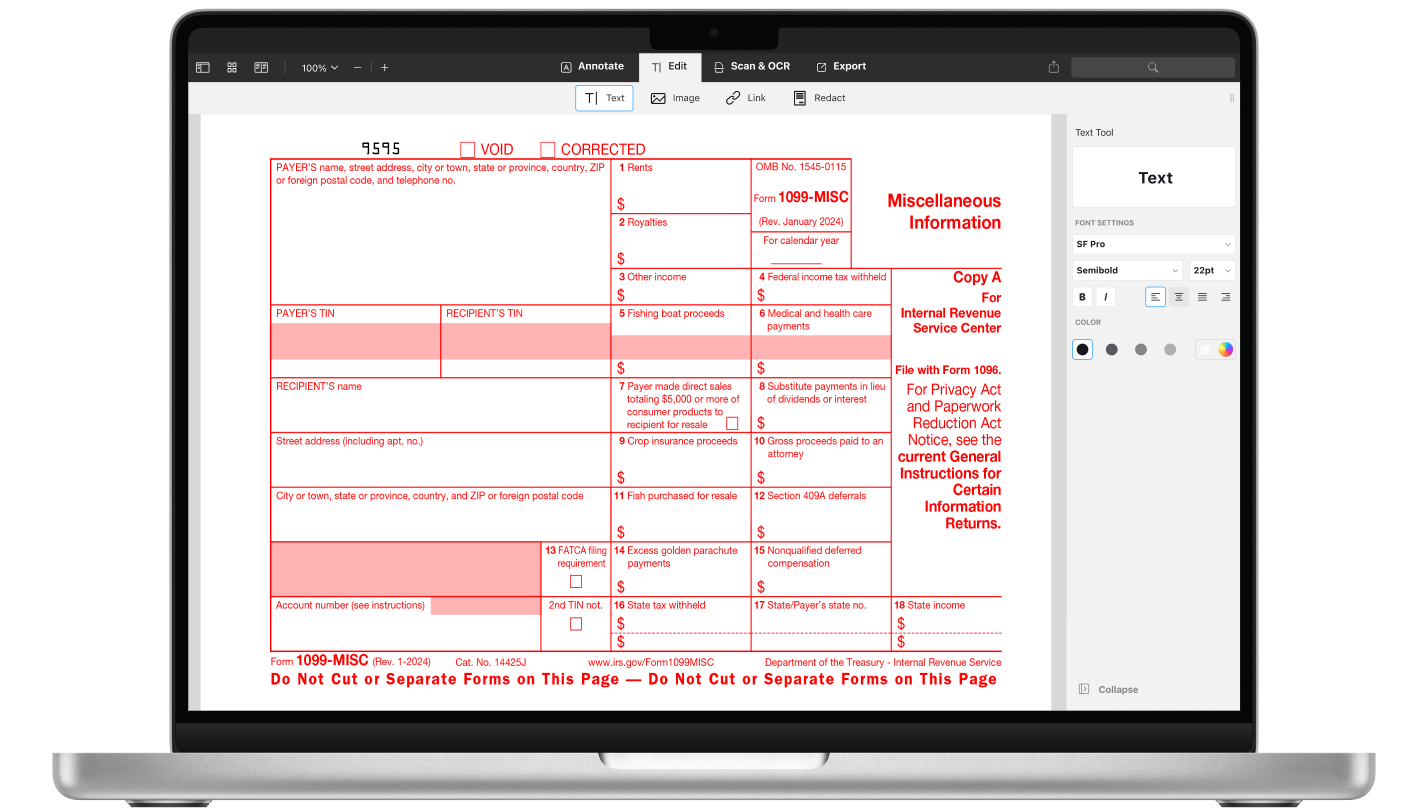

Are you feeling overwhelmed by tax season approaching? Don’t worry, we’ve got you covered! Understanding the 1099 Form 2025 Instructions is key to making the process easier.

Whether you’re a freelancer, independent contractor, or small business owner, the 1099 form is essential for reporting income. Knowing how to fill it out correctly can save you time and stress.

Demystifying the 1099 Form 2025 Instructions

Firstly, make sure you have all the necessary information handy, such as your Social Security Number and any income documentation. Next, carefully follow the instructions provided by the IRS to avoid any errors.

Remember to report all income accurately and on time to avoid penalties. If you’re unsure about anything, don’t hesitate to seek help from a tax professional. By staying organized and informed, tax season doesn’t have to be a headache.

So, take a deep breath and tackle those 1099 Form 2025 Instructions with confidence. With the right guidance and a positive attitude, you’ll have your taxes sorted in no time!