Are you a freelancer or independent contractor wondering about the 1099 Form IRS 2025? Well, you’ve come to the right place! Let’s break it down for you in simple terms.

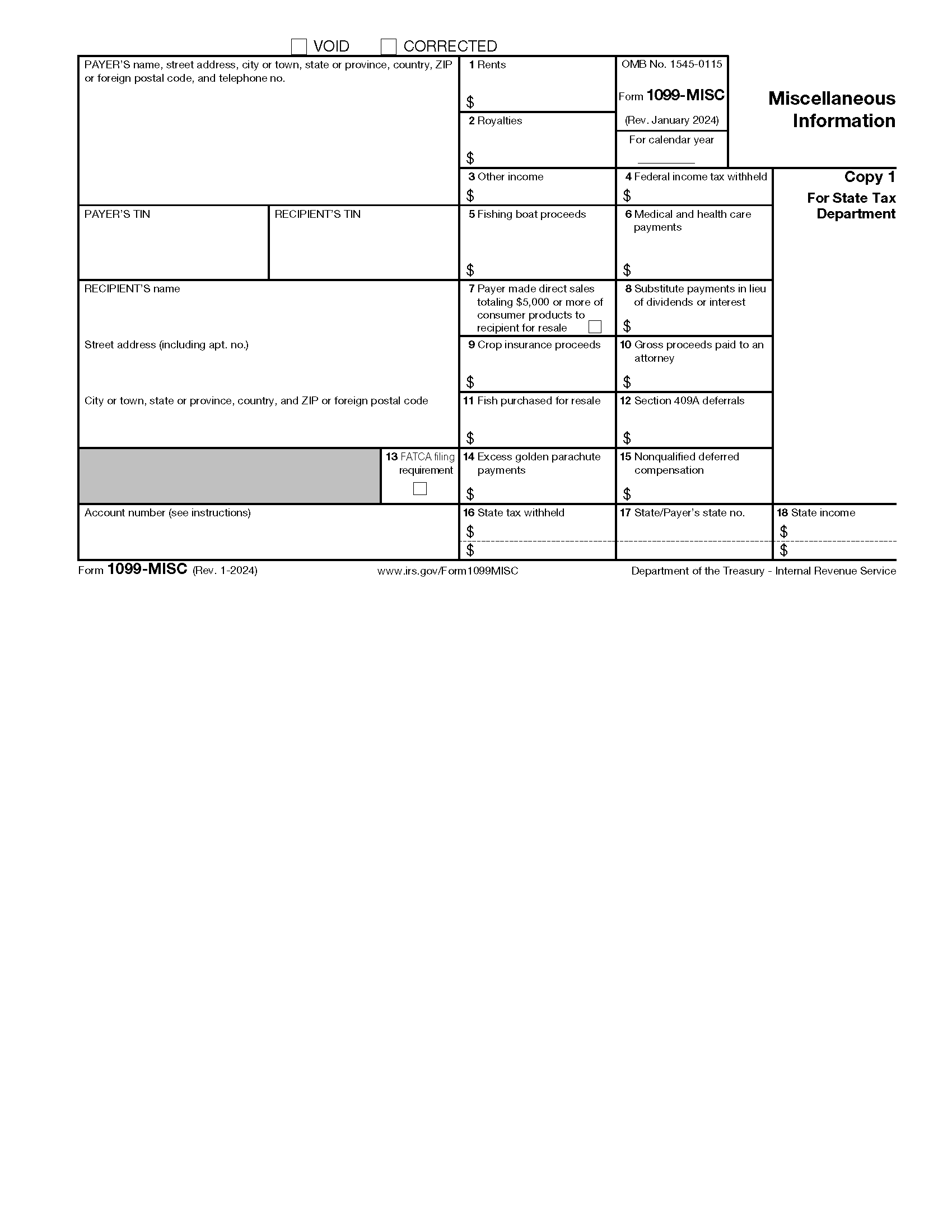

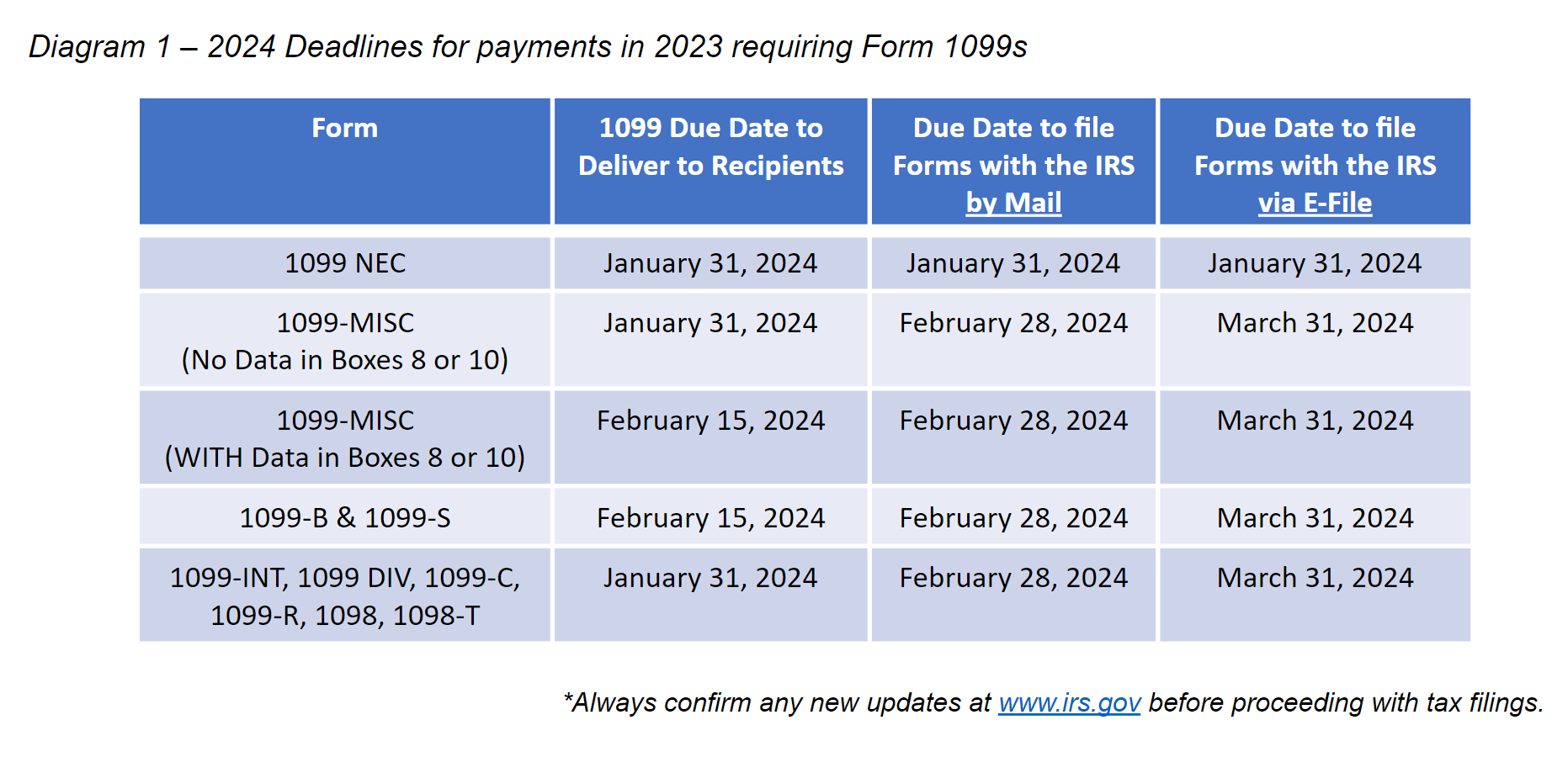

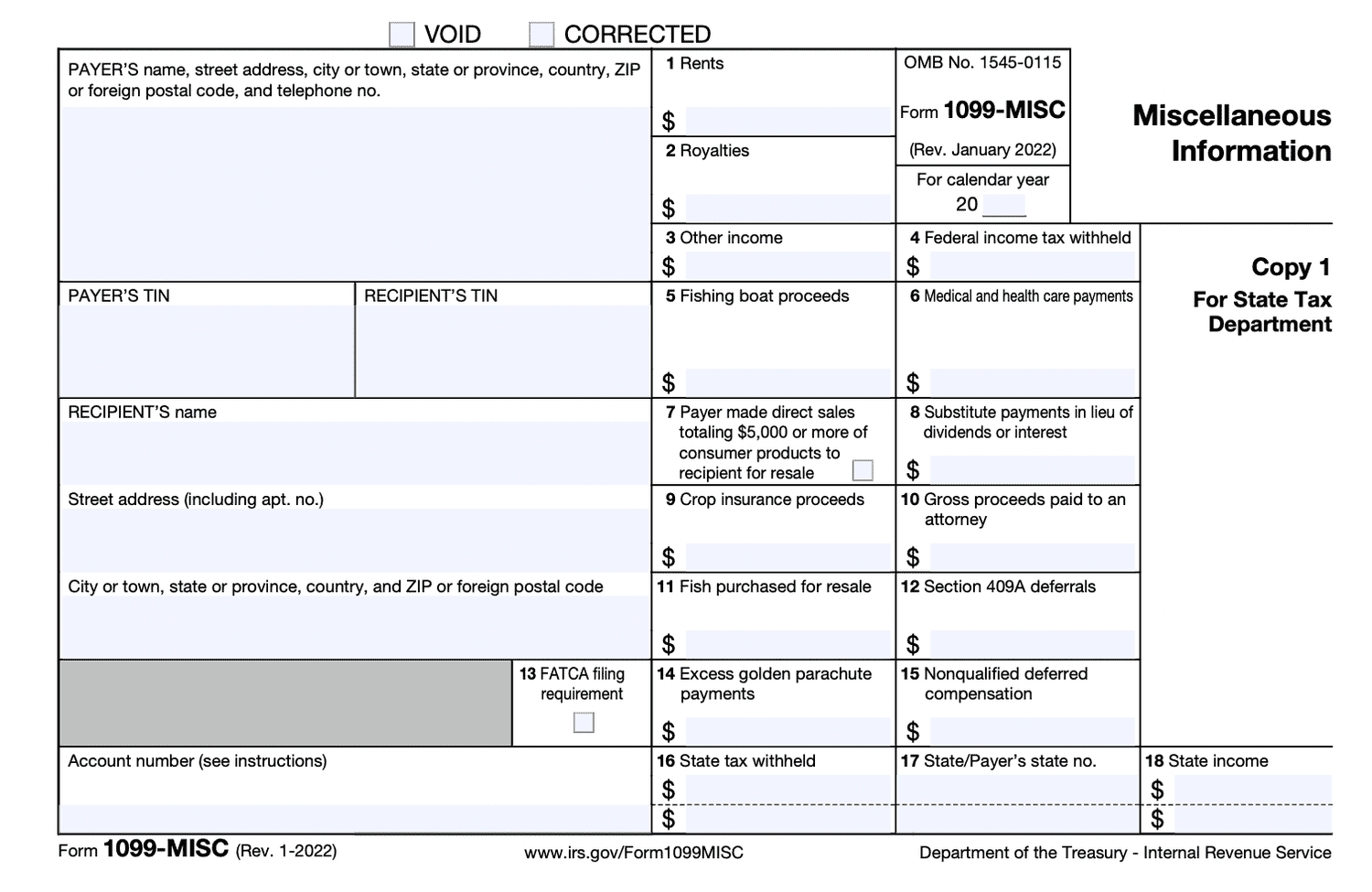

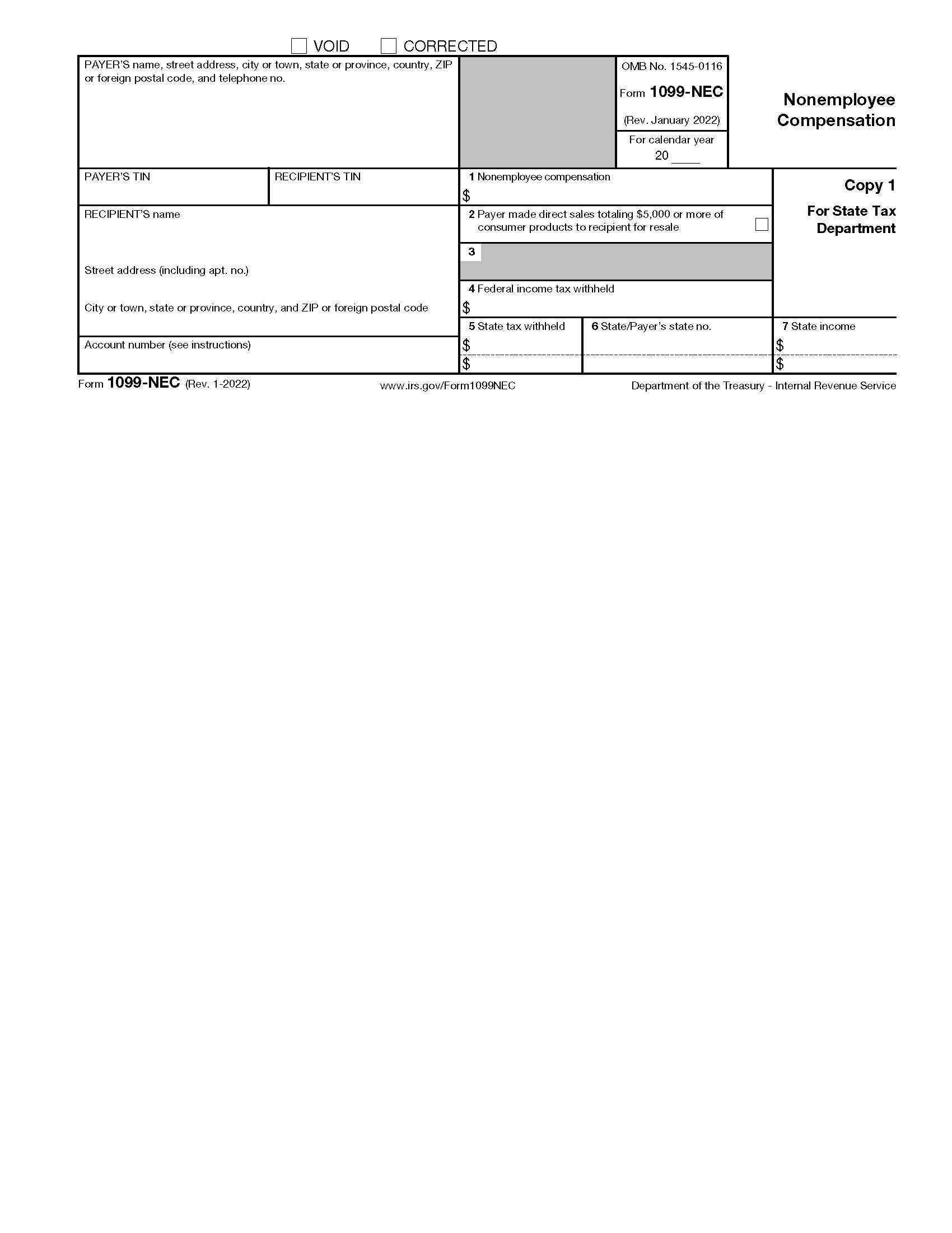

First things first, the 1099 Form IRS 2025 is a tax form used by businesses to report payments made to non-employees such as freelancers, independent contractors, and vendors. It’s important to keep track of these forms for tax purposes.

Understanding the 1099 Form IRS 2025

When you receive a 1099 Form IRS 2025, it means that a business has paid you at least $600 in a calendar year. You’ll need to report this income on your tax return and pay any applicable taxes on it.

Make sure to keep accurate records of all your 1099 forms and consult with a tax professional if you have any questions. By staying organized and informed, you can navigate tax season with ease and peace of mind.

In conclusion, the 1099 Form IRS 2025 is a crucial document for freelancers and independent contractors to report their income accurately. Stay on top of your tax responsibilities to avoid any headaches down the road!