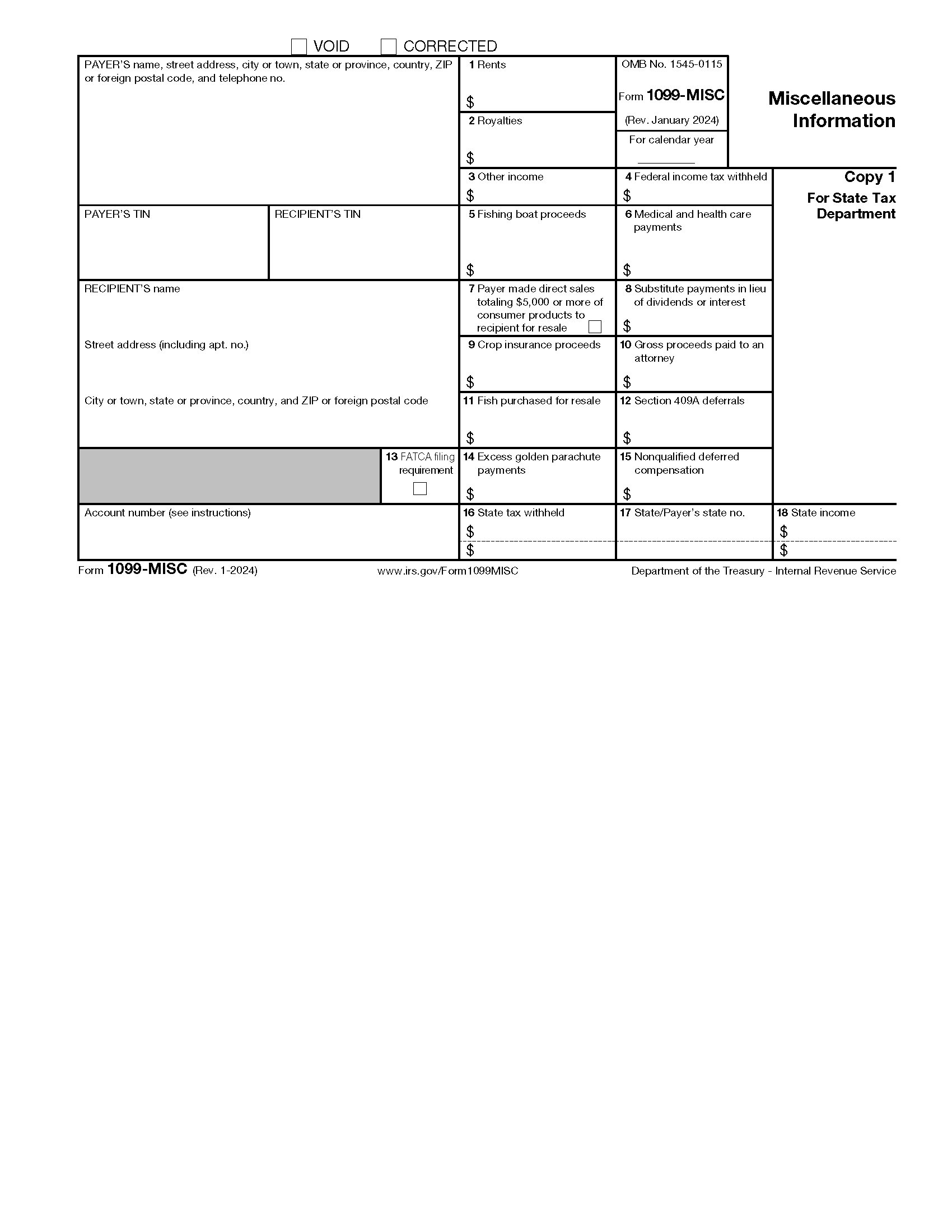

Are you a freelancer or independent contractor wondering about 1099 forms for the upcoming tax year? It’s important to stay informed about any changes that may affect you.

As we look ahead to 2025, understanding the requirements and deadlines for 1099 forms is crucial. Whether you’re receiving or issuing these forms, compliance is key to avoiding penalties.

What to Expect with 1099 Forms For 2025

In 2025, the IRS may introduce new regulations or updates to existing guidelines for 1099 forms. Keeping track of these changes will help you navigate the tax season smoothly and accurately report your income.

Make sure to gather all necessary information and documents to file your taxes correctly. Consulting with a tax professional can also provide valuable insights and ensure you meet all requirements for 1099 forms in 2025.

Stay proactive and organized when it comes to your taxes to avoid any last-minute stress. By staying informed and prepared, you can tackle tax season with confidence and peace of mind.