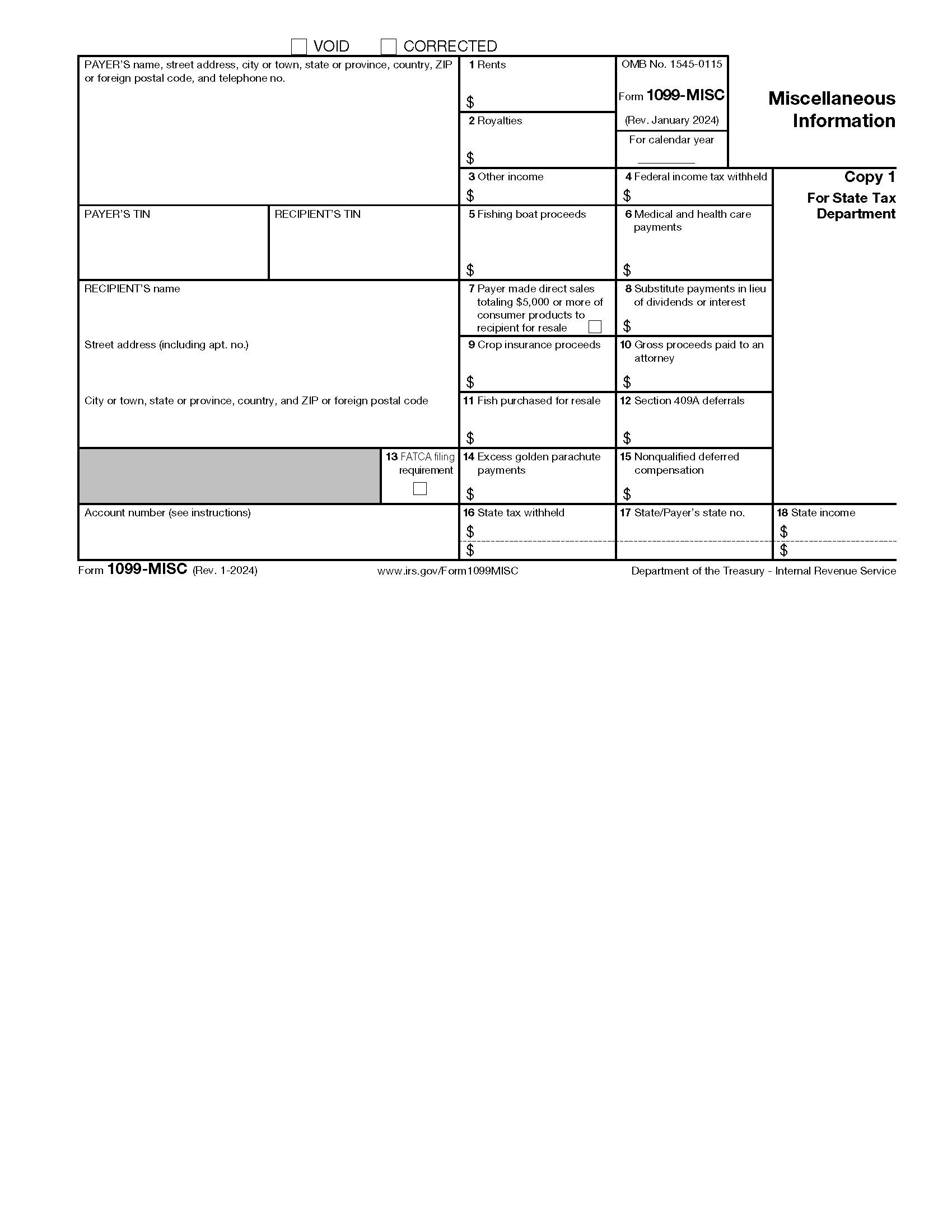

Are you a freelancer or independent contractor? If so, you’re probably familiar with the 1099 Misc Form. It’s a crucial document for reporting your income come tax season.

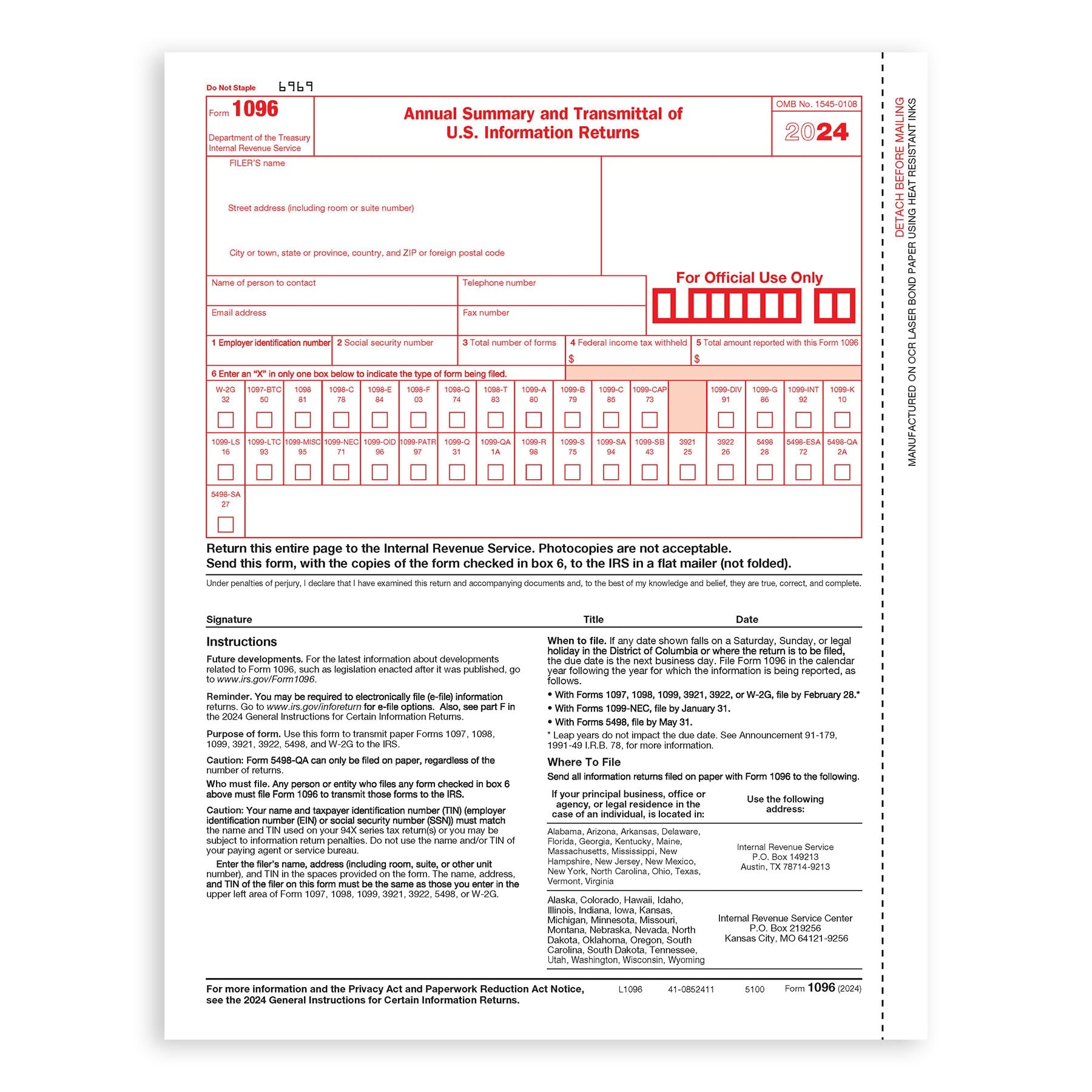

Looking ahead to 2025, it’s important to stay informed about any changes or updates to the 1099 Misc Form. Keeping track of these details can help you avoid any surprises or last-minute stress.

What to Expect for 1099 Misc Form 2025

In the upcoming year, be on the lookout for any revisions to the form or deadlines for submission. Familiarize yourself with any new regulations or requirements that may impact how you report your income.

As always, accuracy is key when filling out your 1099 Misc Form. Double-check all information before submitting to ensure everything is correct. This will help you avoid any potential issues with the IRS down the line.

Stay proactive and organized when it comes to your taxes. By staying informed and prepared for the 1099 Misc Form in 2025, you can navigate tax season with confidence.