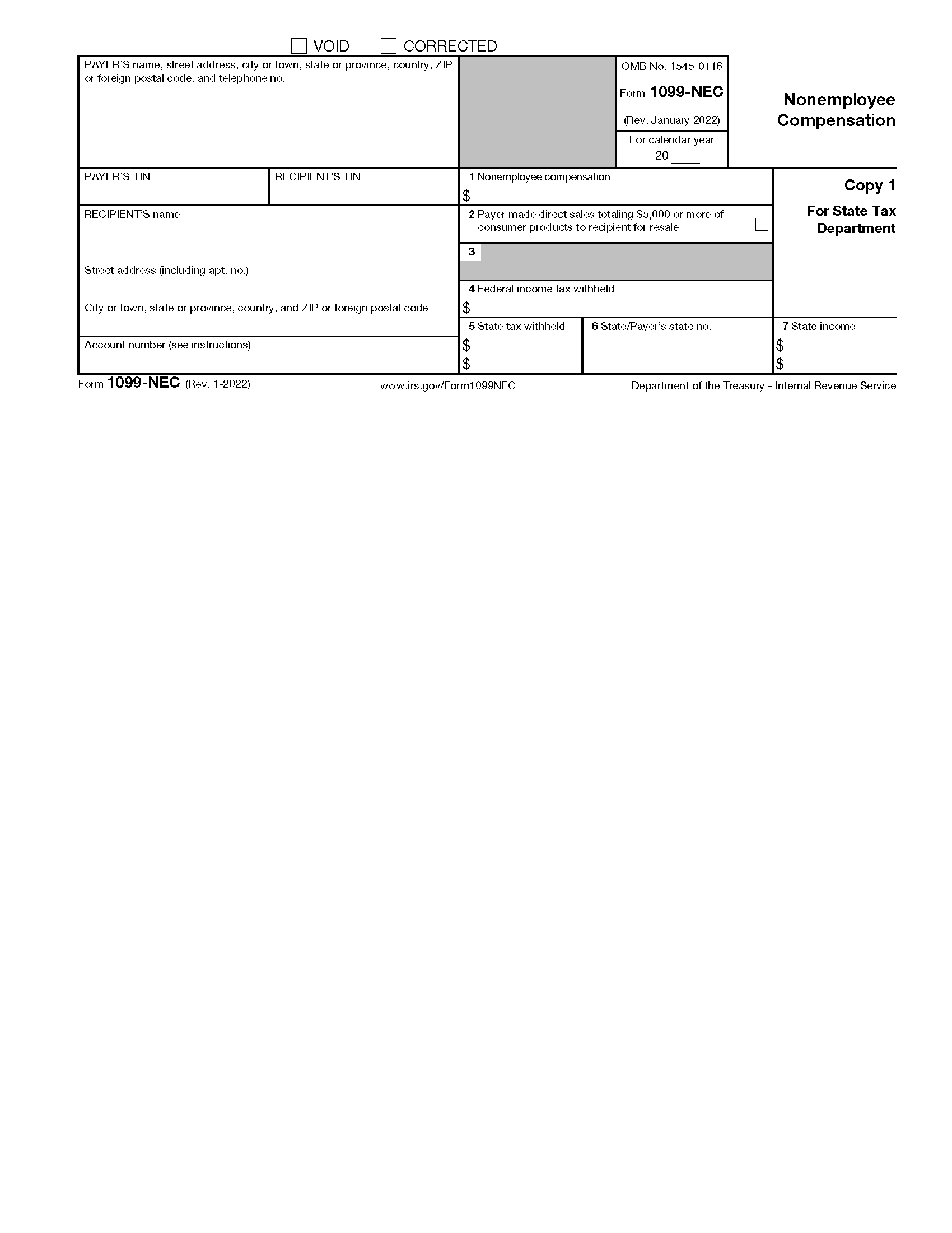

Are you ready for tax season? Understanding the 1099 Tax Form 2025 is crucial for freelancers and independent contractors.

Issued by clients who pay you $600 or more during the year, the 1099 form reports your income to the IRS. Make sure to include it in your tax filings!

What to Know About the 1099 Tax Form 2025

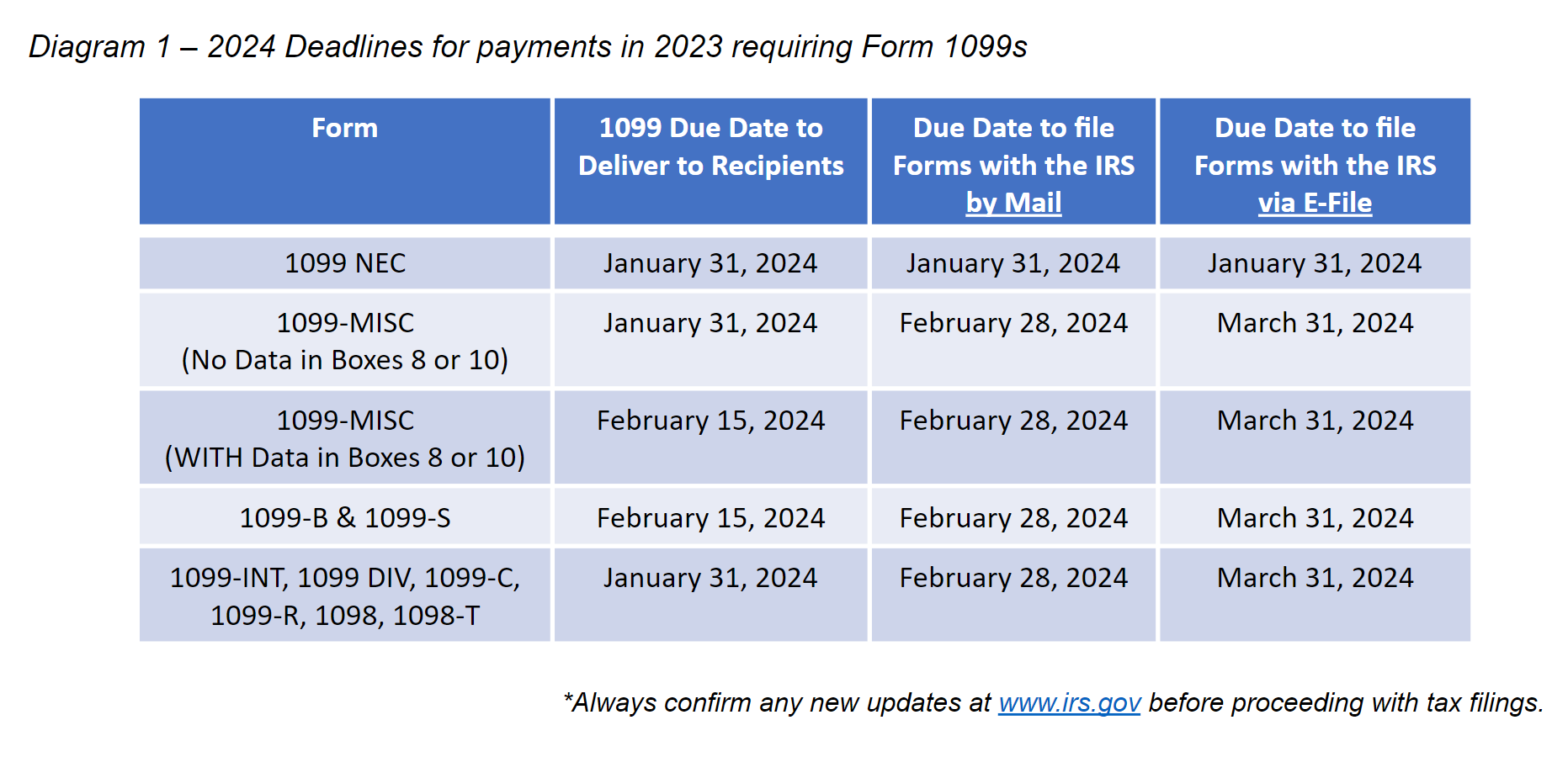

Keep track of all your income and expenses throughout the year to make tax time less stressful. Remember, filing your taxes accurately and on time is essential.

If you receive multiple 1099 forms, ensure you report each one on your tax return. Failure to do so could result in penalties from the IRS. Stay organized and informed!

Stay ahead of the game by understanding the 1099 Tax Form 2025 and its implications for your taxes. Being proactive can save you time and money in the long run.