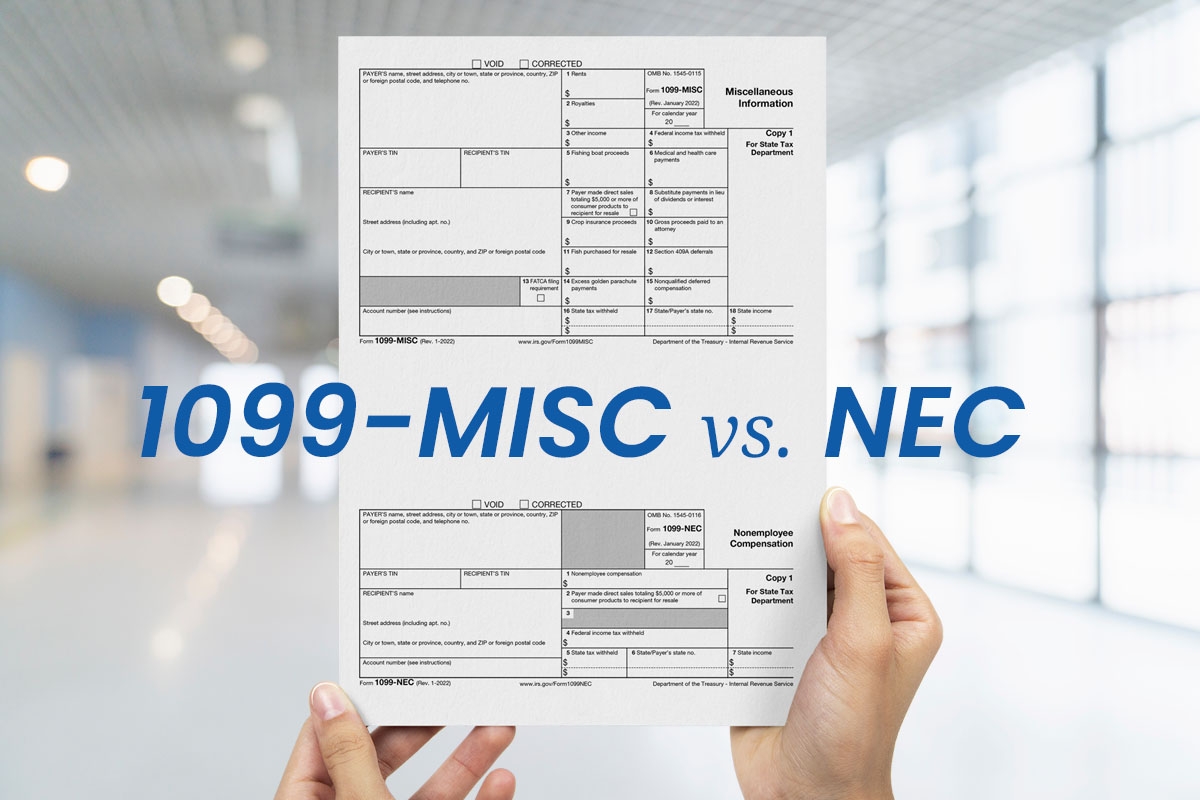

Are you a freelancer or independent contractor wondering about the 2025 1099 Misc Form? You’re in the right place! Let’s break it down for you in simple terms.

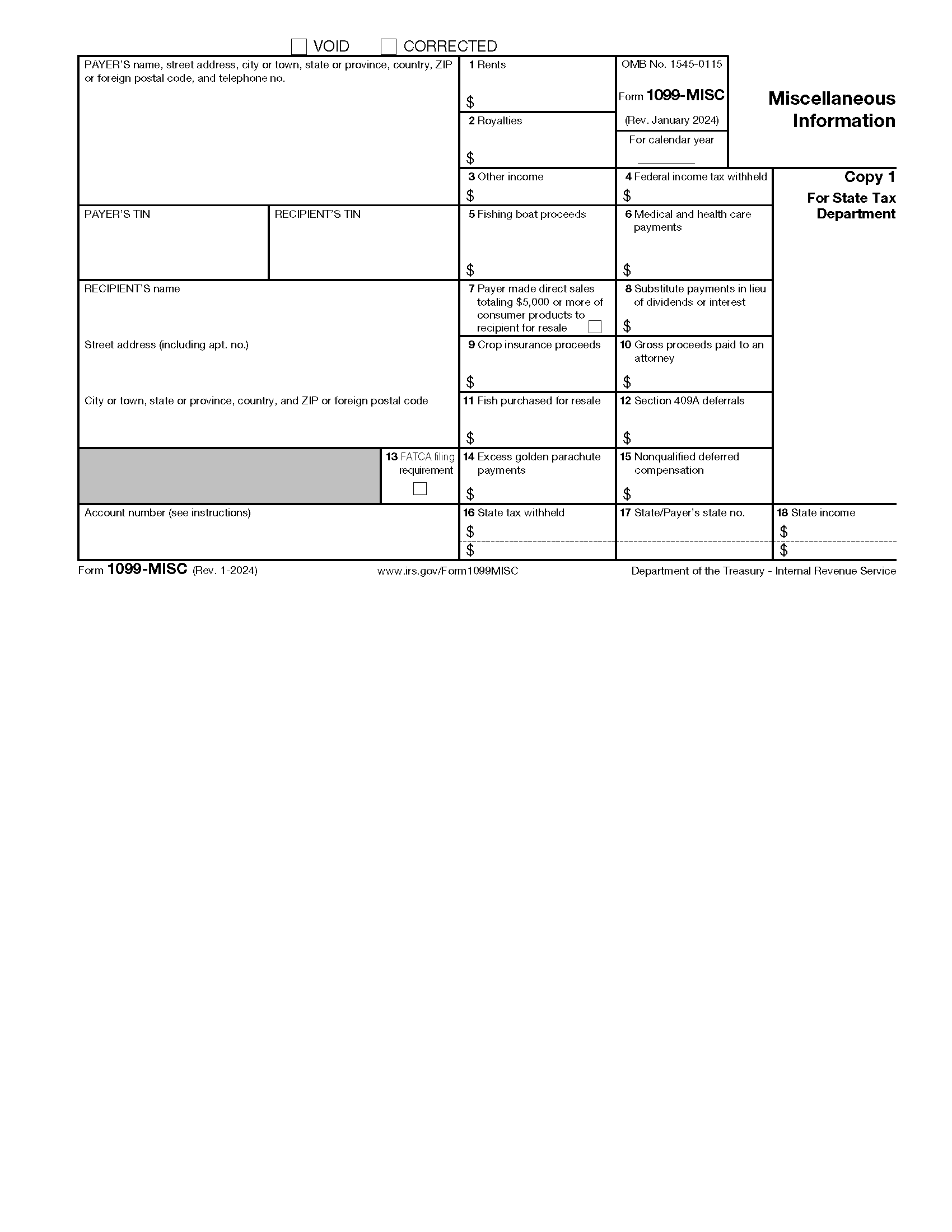

When it comes to tax season, the 1099 Misc Form is a crucial document for self-employed individuals. It reports any income earned outside of traditional employment, such as freelance work or contract jobs.

Understanding the 2025 1099 Misc Form

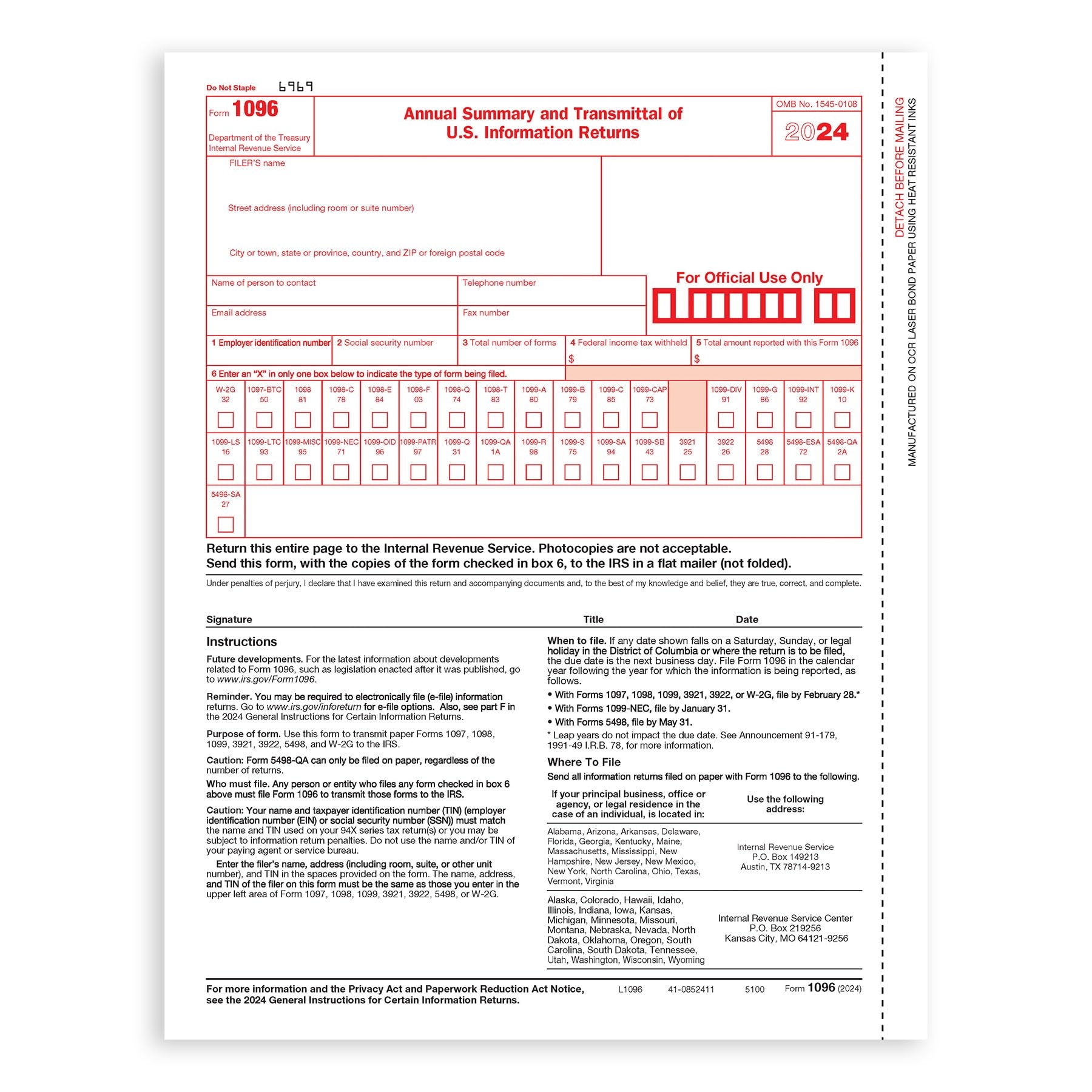

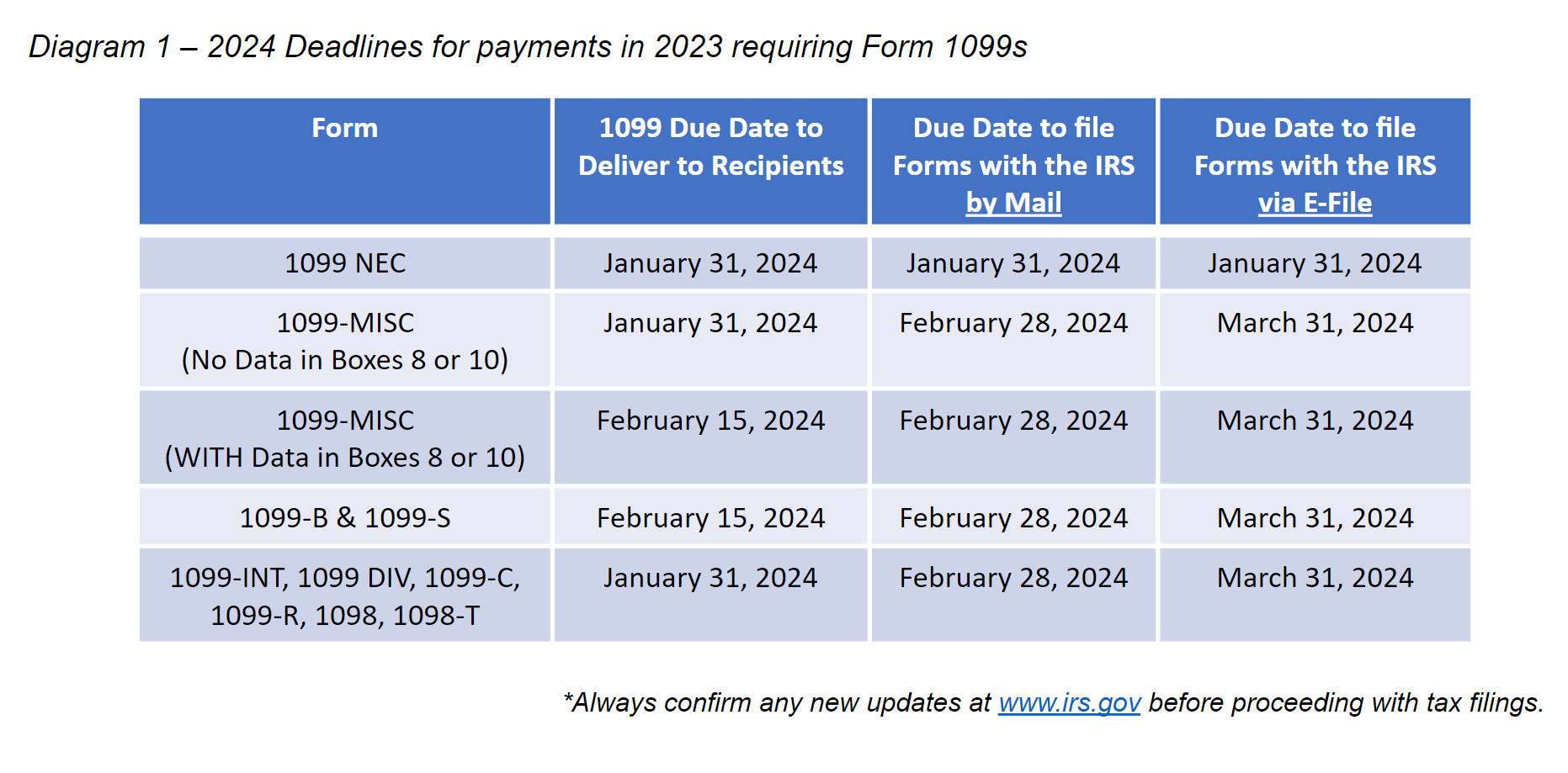

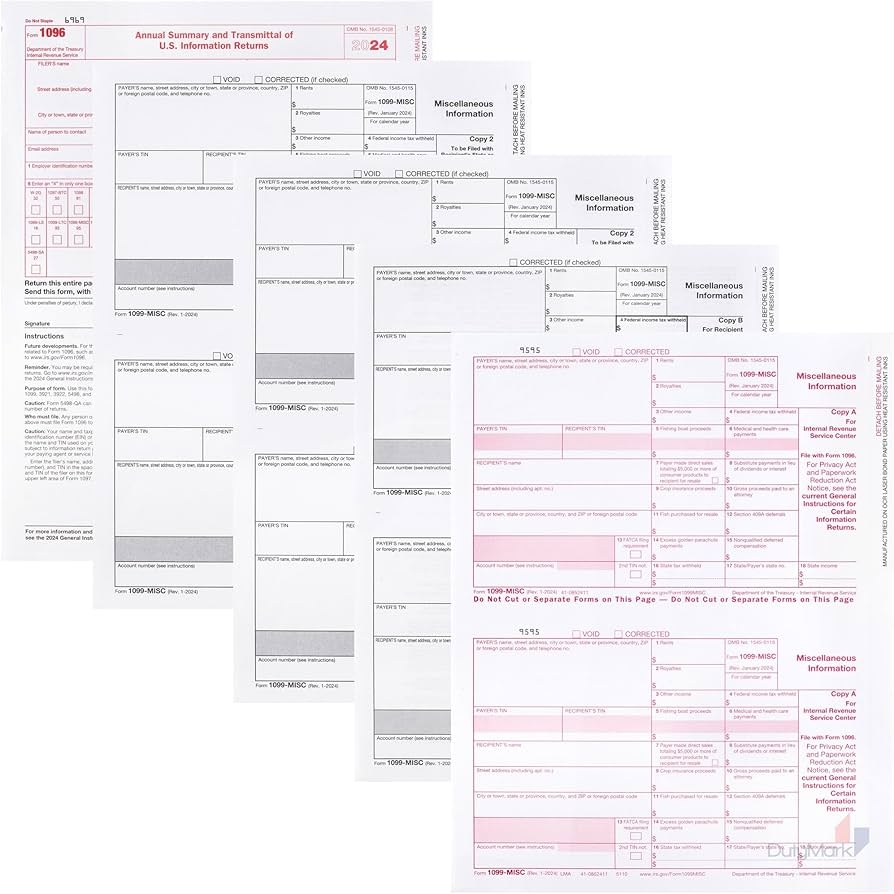

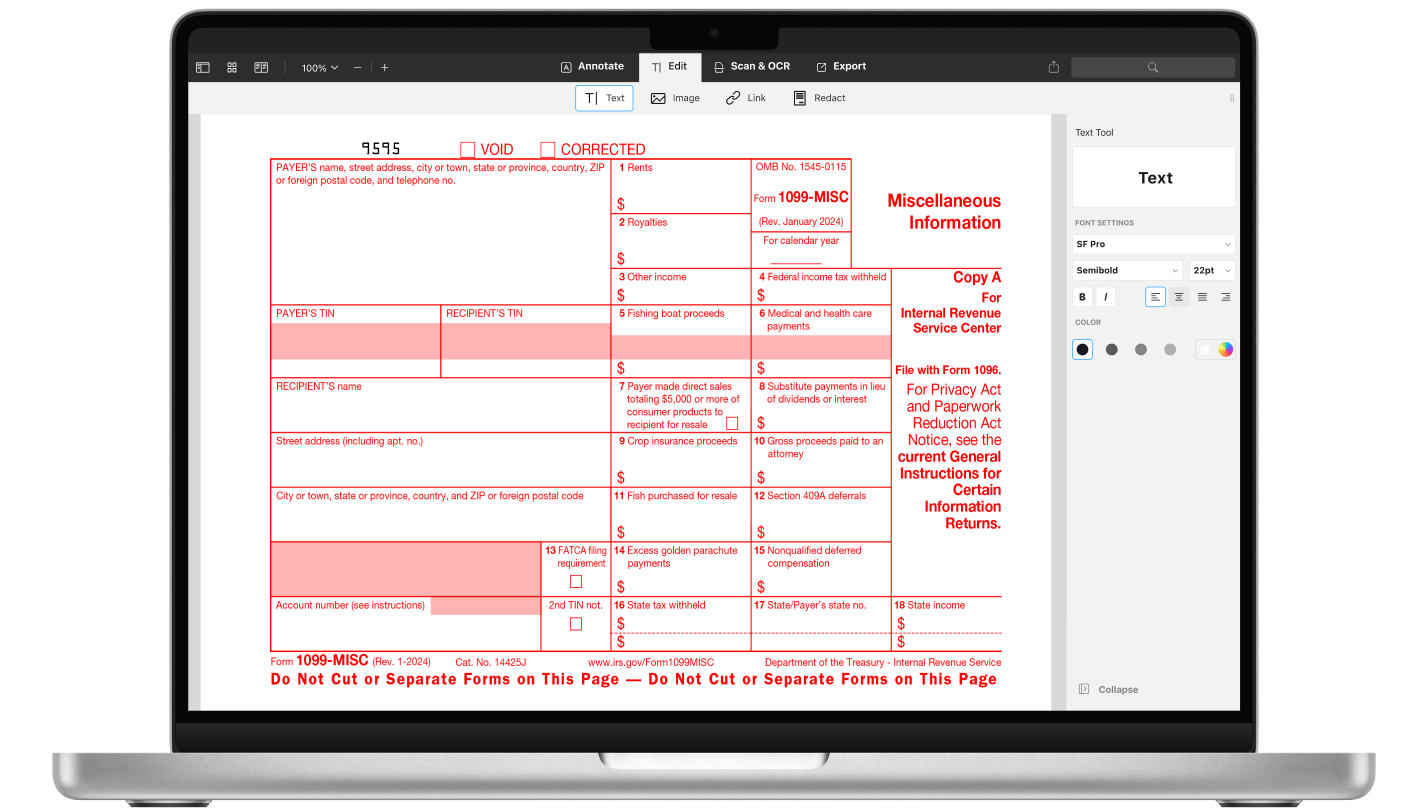

In 2025, the 1099 Misc Form will still be used to report miscellaneous income, but there may be updates to the filing requirements or deadlines. It’s important to stay informed and consult with a tax professional to ensure compliance.

Make sure to keep accurate records of all your income and expenses throughout the year to make the tax filing process smoother. By staying organized and informed, you can navigate tax season with confidence and peace of mind.

So, if you’re a freelancer or independent contractor, keep an eye out for any changes to the 2025 1099 Misc Form and stay ahead of the game. Remember, it’s always better to be prepared than caught off guard when it comes to taxes!