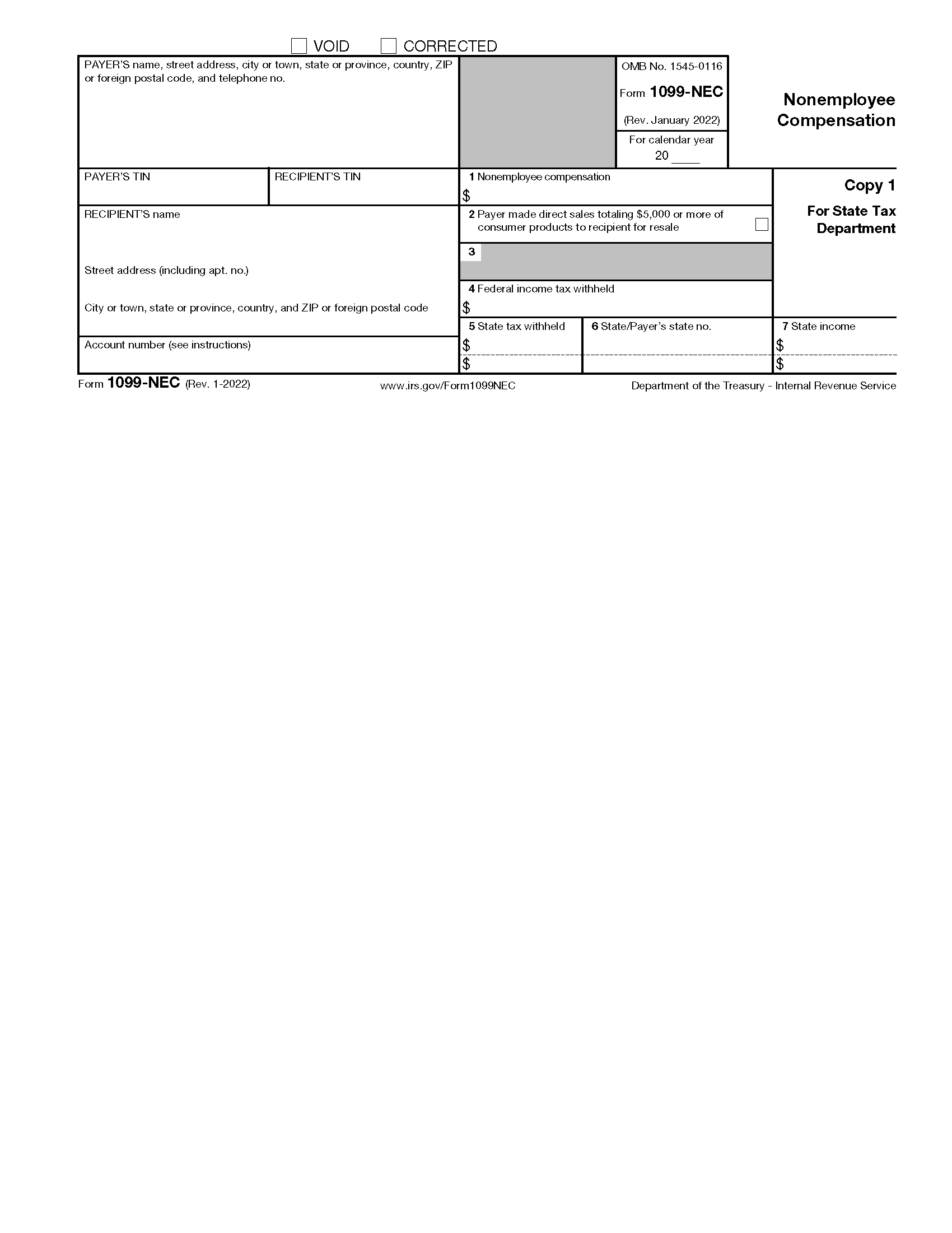

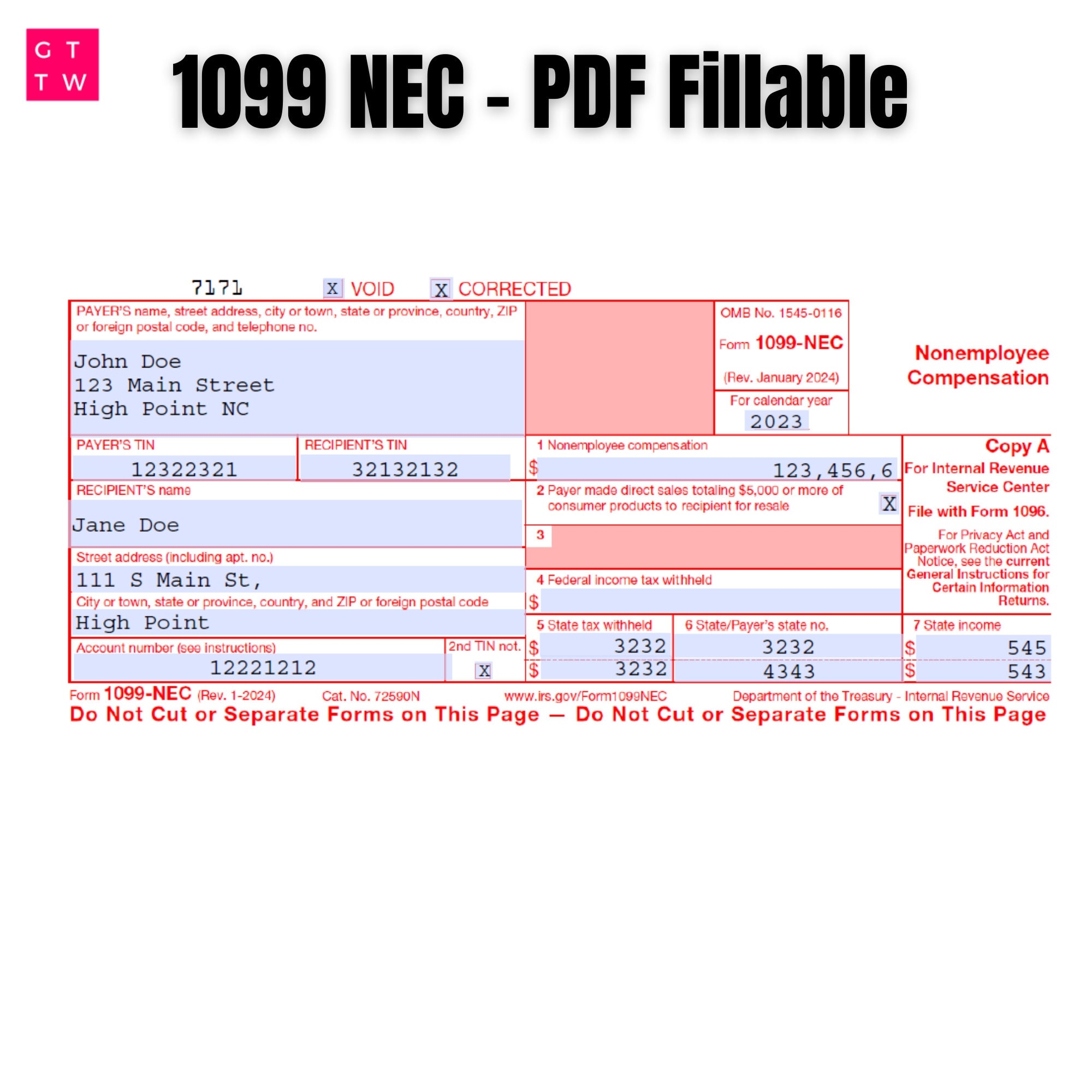

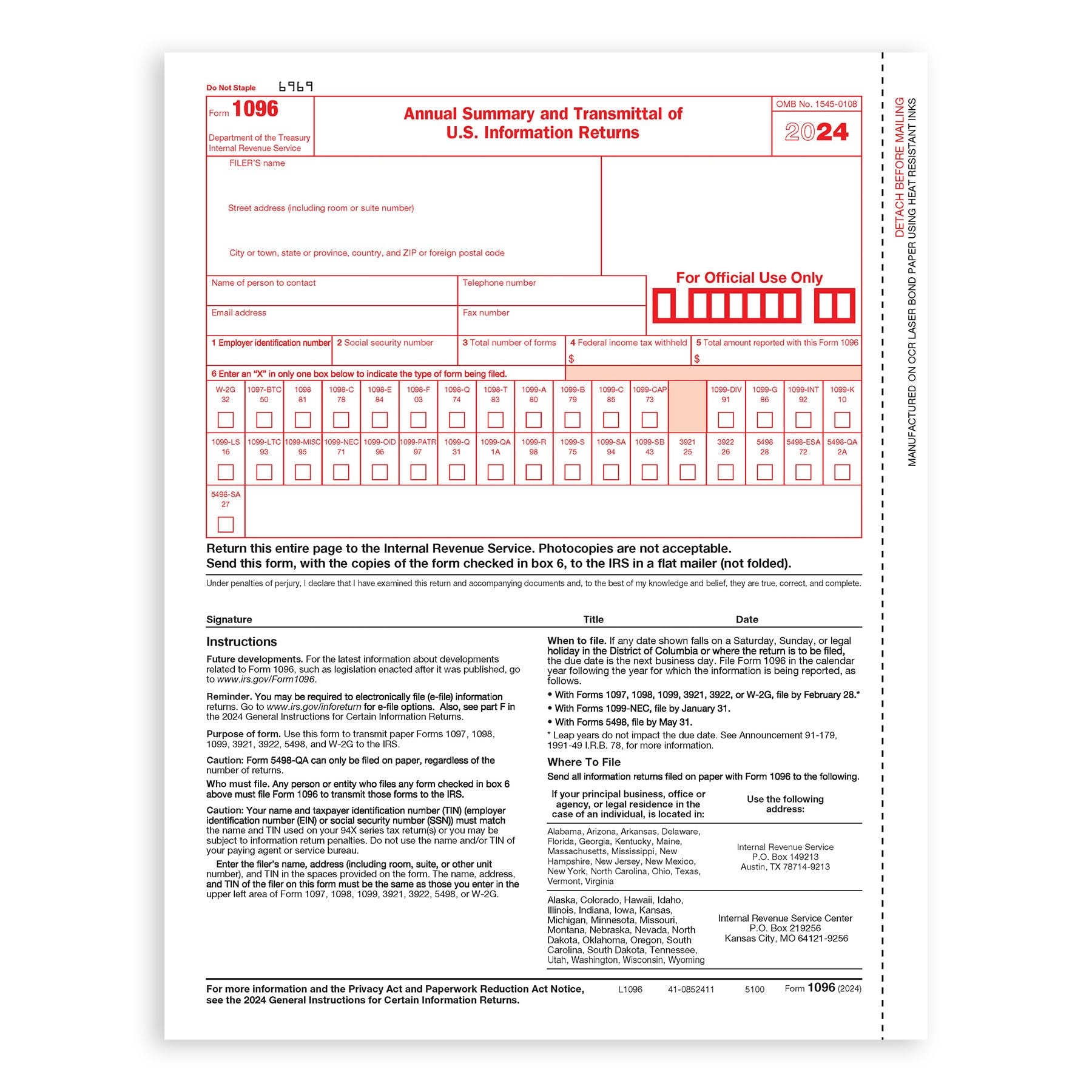

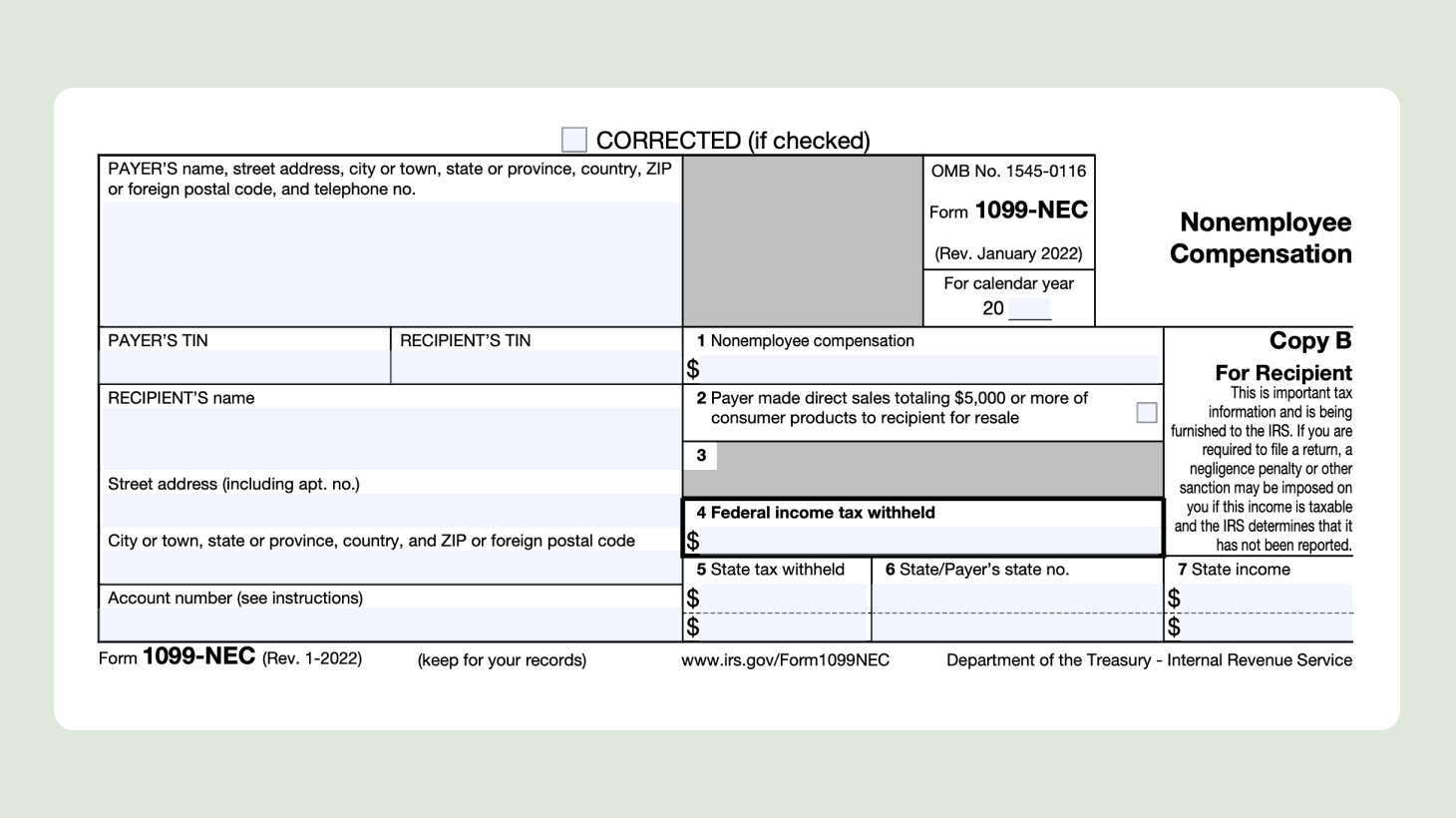

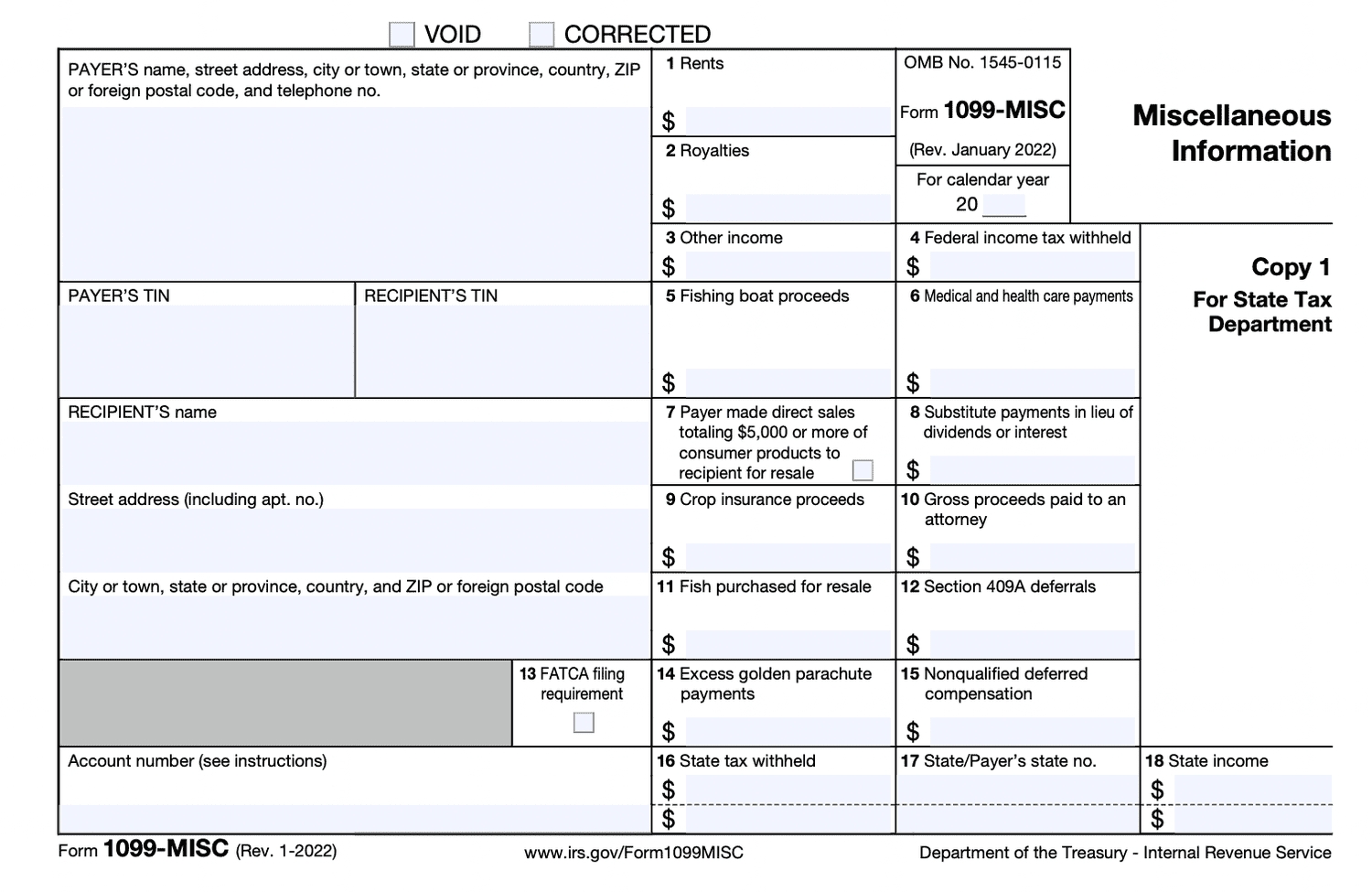

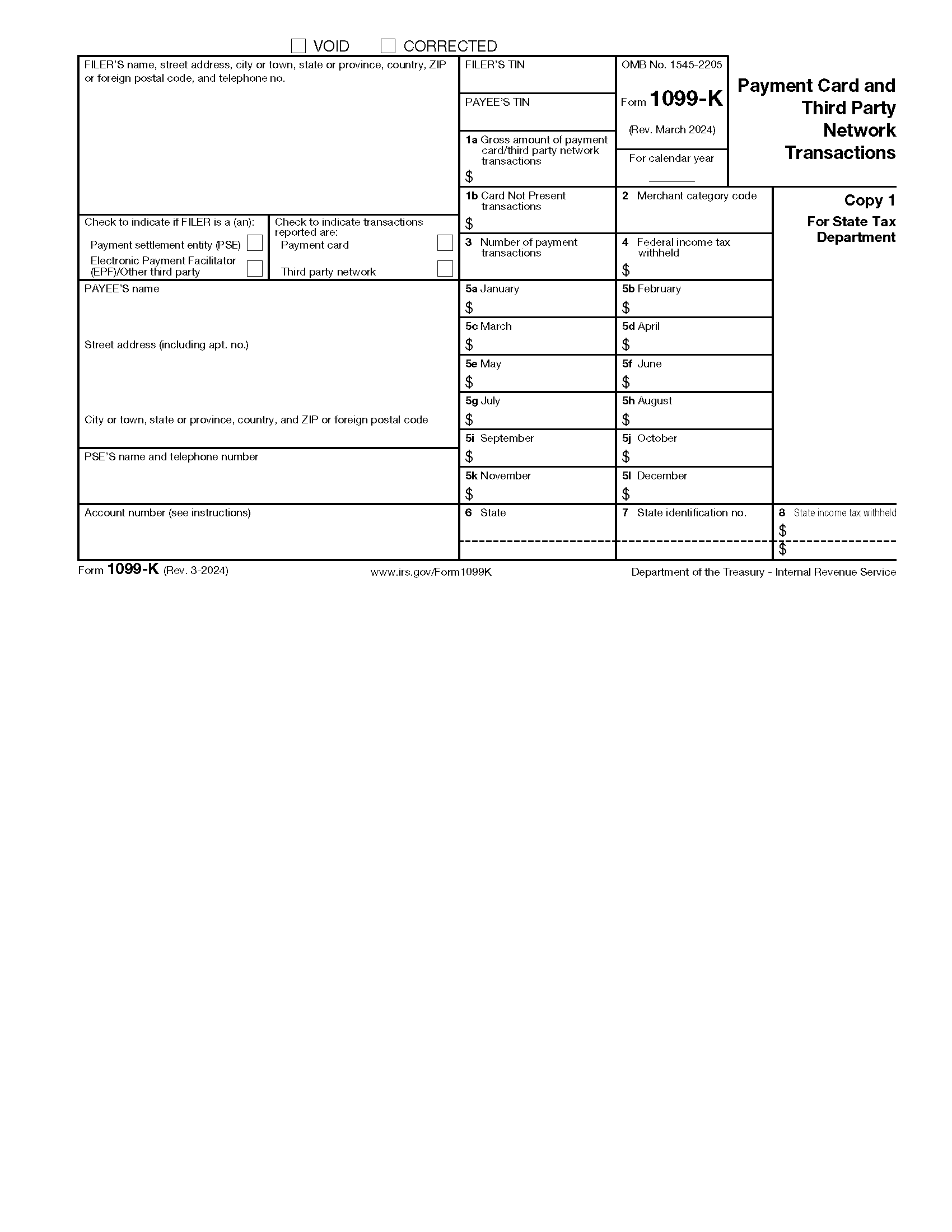

Are you a freelancer or independent contractor looking to file your taxes for the year 2025? One essential document you’ll need is the Blank 1099 Form 2025.

Having a Blank 1099 Form 2025 handy makes it easy to report your income accurately and avoid any potential IRS penalties. It’s a simple yet crucial piece of paperwork for self-employed individuals.

Why Blank 1099 Form 2025 is Important

The Blank 1099 Form 2025 allows you to detail your earnings from clients throughout the year. By filling it out correctly, you ensure that you comply with tax regulations and demonstrate transparency in your financial transactions.

Make sure to keep track of all your income and expenses to fill out the Blank 1099 Form 2025 accurately. It’s a straightforward process that can save you time and hassle when tax season rolls around.

Don’t wait until the last minute to gather your documents and fill out the Blank 1099 Form 2025. Stay organized, stay on top of your finances, and make tax season a breeze!