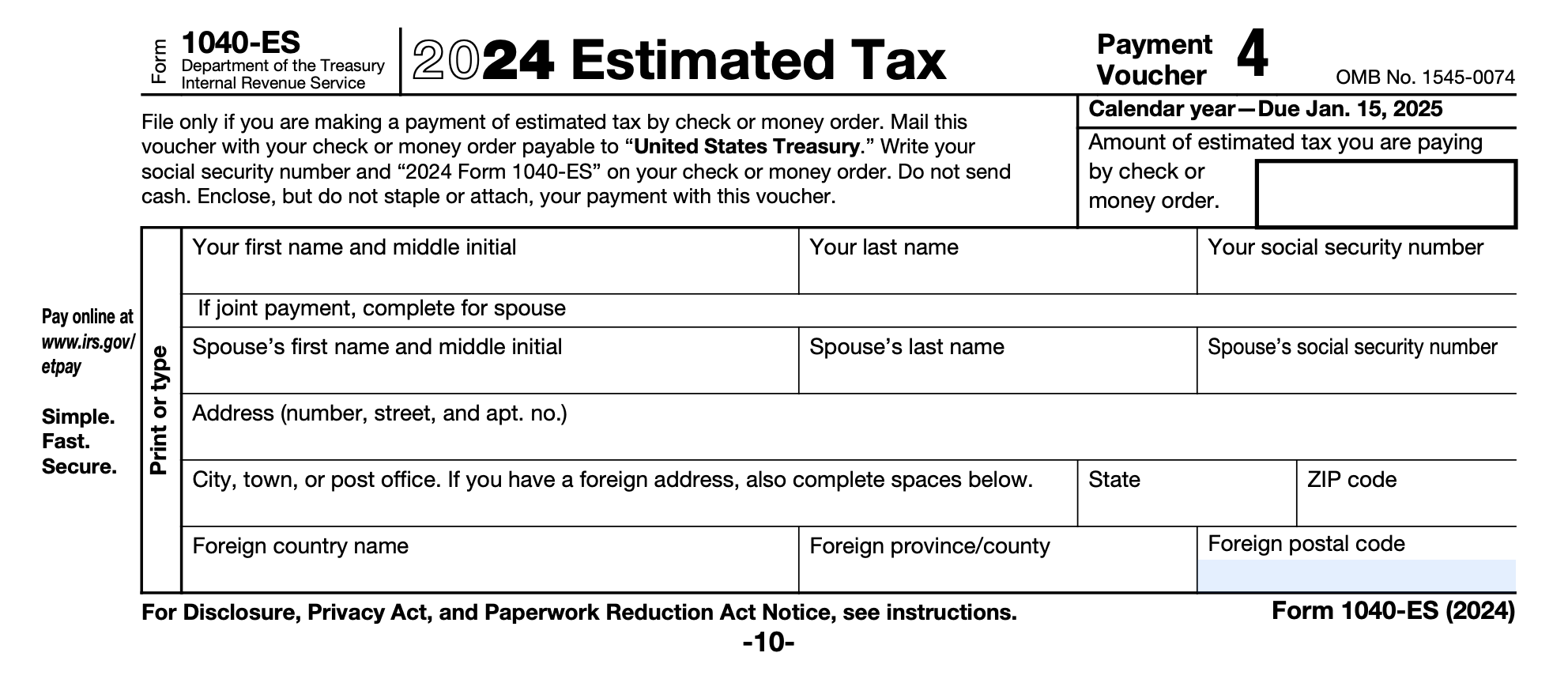

Understanding Form 1040-ES For 2025

The form includes worksheets to help you estimate your income, deductions, and credits for the year. Based on these calculations, you can determine how much you need to pay in estimated taxes each quarter. It’s a straightforward process that can save you from surprises come tax time.

Remember, paying estimated taxes is not optional if you expect to owe $1,000 or more when you file your return. Using Form 1040-ES For 2025 can help you stay organized and avoid unnecessary stress. Stay ahead of the game and tackle your taxes with confidence.

Don’t let tax season catch you off guard. Take control of your finances by using Form 1040-ES For 2025 to stay on track with your estimated tax payments. With this tool in your toolbox, you can navigate tax season like a pro.