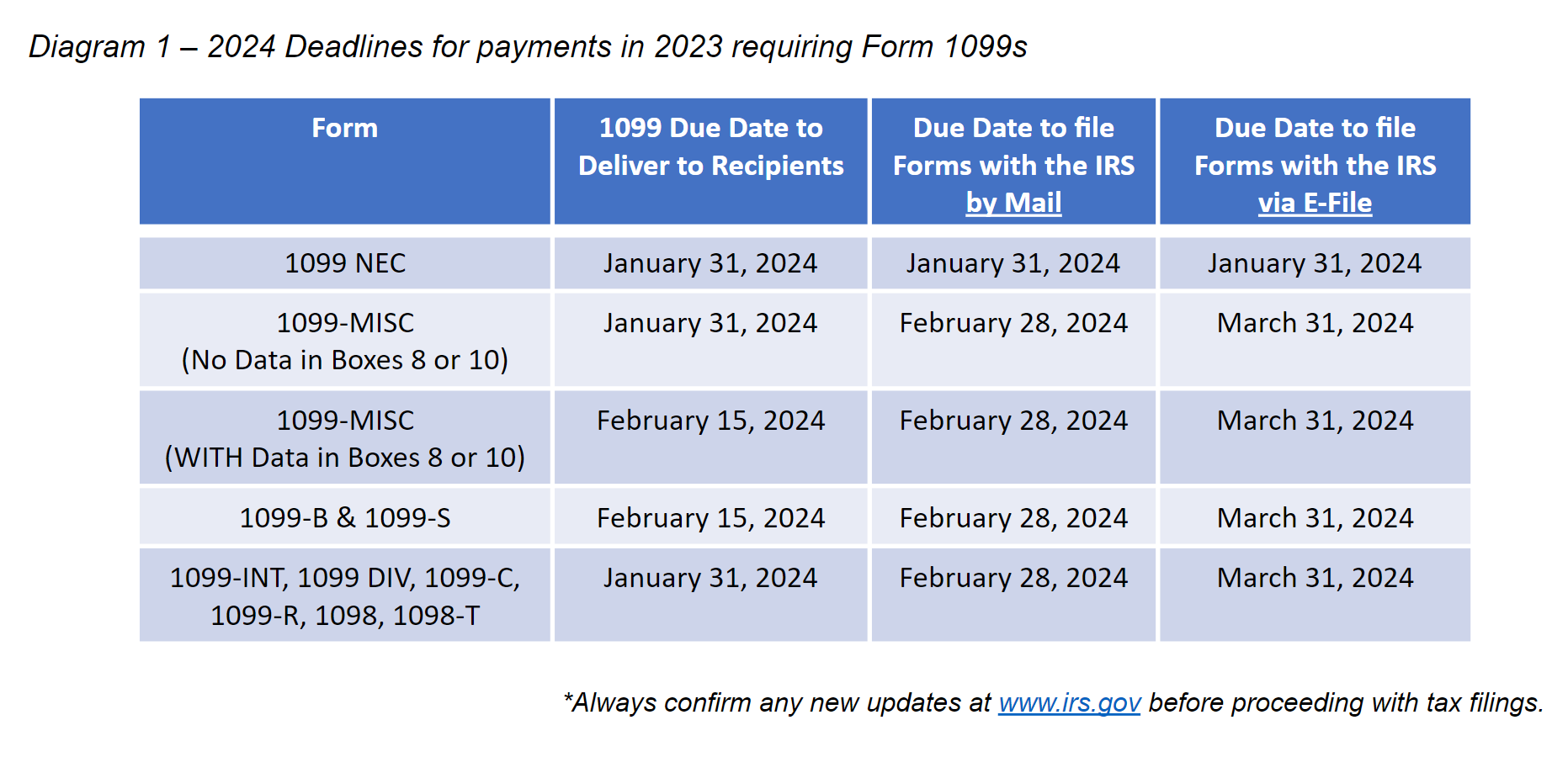

Are you a freelancer or independent contractor? If so, you’re probably familiar with Form 1099, a tax form used to report income other than wages. It’s essential to know the due date to avoid penalties.

For the tax year 2025, the Form 1099 due date is January 31, 2026. This deadline applies to both electronic and paper filings. Make sure to gather all necessary information and submit your forms on time to stay compliant with the IRS.

Form 1099 Due Date 2025

Missing the deadline can result in hefty fines, so mark your calendar and set reminders to ensure you meet the submission date. Remember, accurate and timely reporting is key to maintaining good standing with the IRS and avoiding unnecessary stress.

Whether you’re a seasoned freelancer or new to the gig economy, staying organized and informed about tax deadlines is crucial. By staying on top of important dates like the Form 1099 due date for 2025, you can streamline your tax filing process and focus on what you do best – your work.

Don’t let tax deadlines sneak up on you. Stay ahead of the game by marking your calendar and preparing your Form 1099 ahead of time. Remember, compliance is key to a smooth tax season!