Are you a freelancer or independent contractor wondering about tax forms for the upcoming year? You may have heard about the Form 1099-NEC but unsure about what it entails.

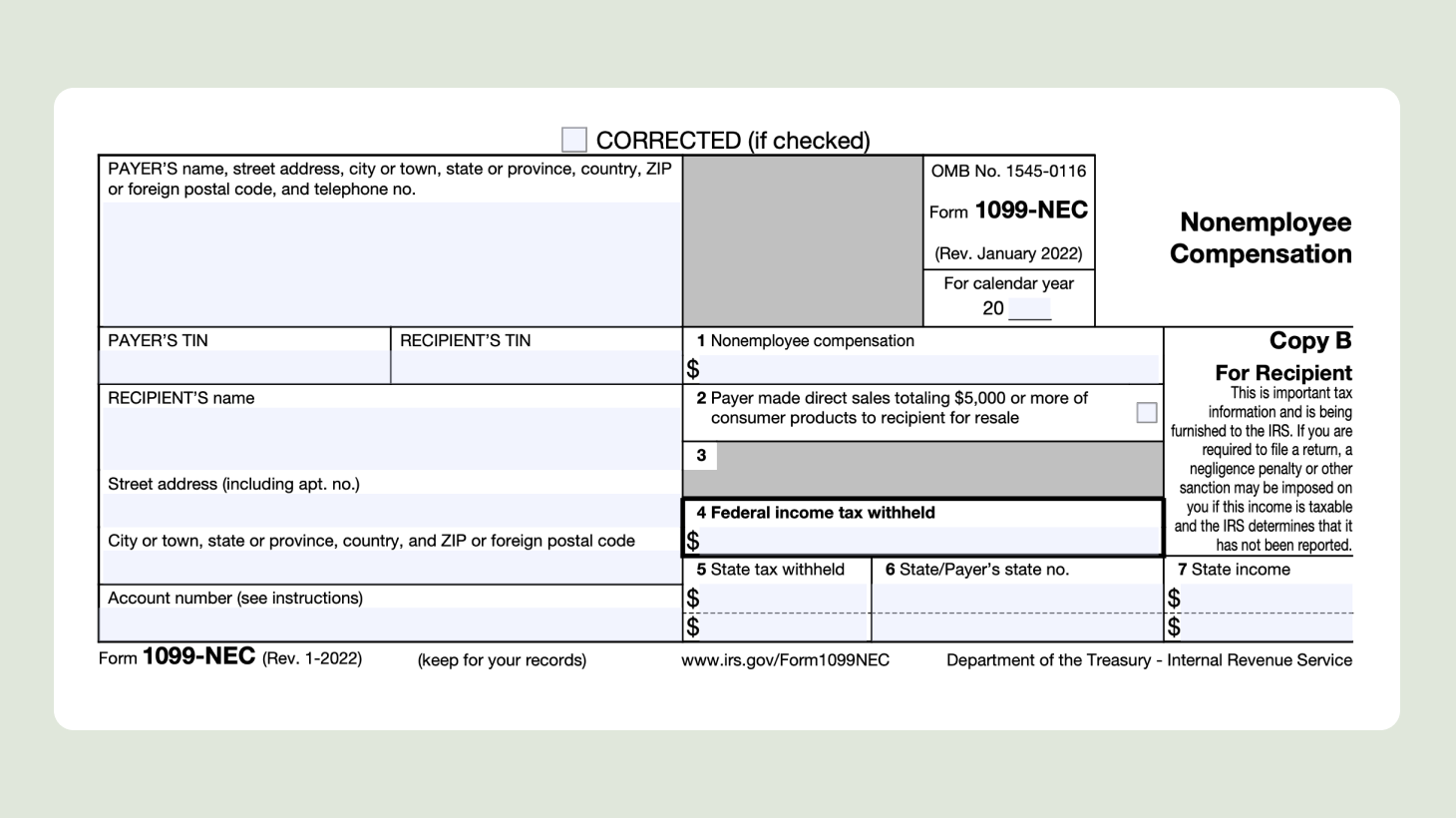

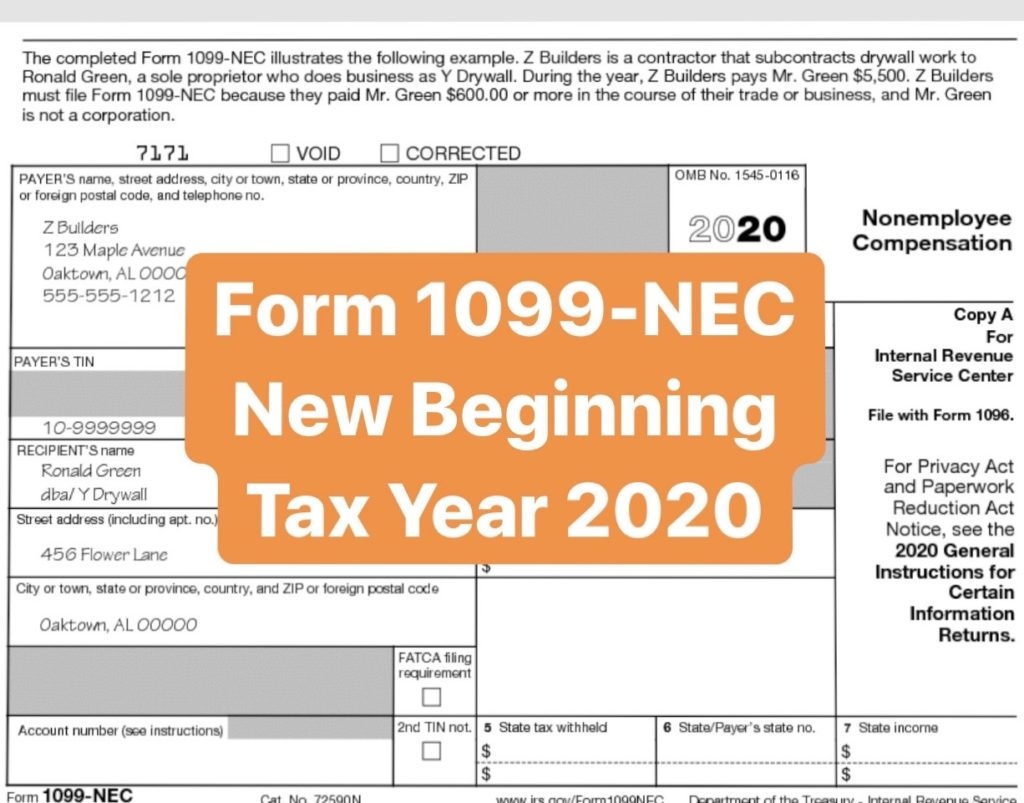

Form 1099-NEC 2025 is a tax form used to report nonemployee compensation. It is crucial for freelancers and independent contractors to understand this form to accurately report their income to the IRS.

Understanding Form 1099-NEC 2025

When you receive payments totaling $600 or more for your services, the payer will issue you a Form 1099-NEC. This form is essential for filing your taxes and ensuring compliance with IRS regulations.

Make sure to keep track of all your income and expenses throughout the year to make the tax filing process smoother. If you have any questions about Form 1099-NEC, consult with a tax professional to ensure you are following the correct procedures.

As tax season approaches, familiarize yourself with Form 1099-NEC 2025 to avoid any last-minute stress. Remember, staying organized and informed will help you navigate the tax process with ease.