Are you a freelancer or independent contractor wondering about the IRS 1099-NEC Form 2025? You’re not alone! This form is crucial for reporting your income and taxes accurately.

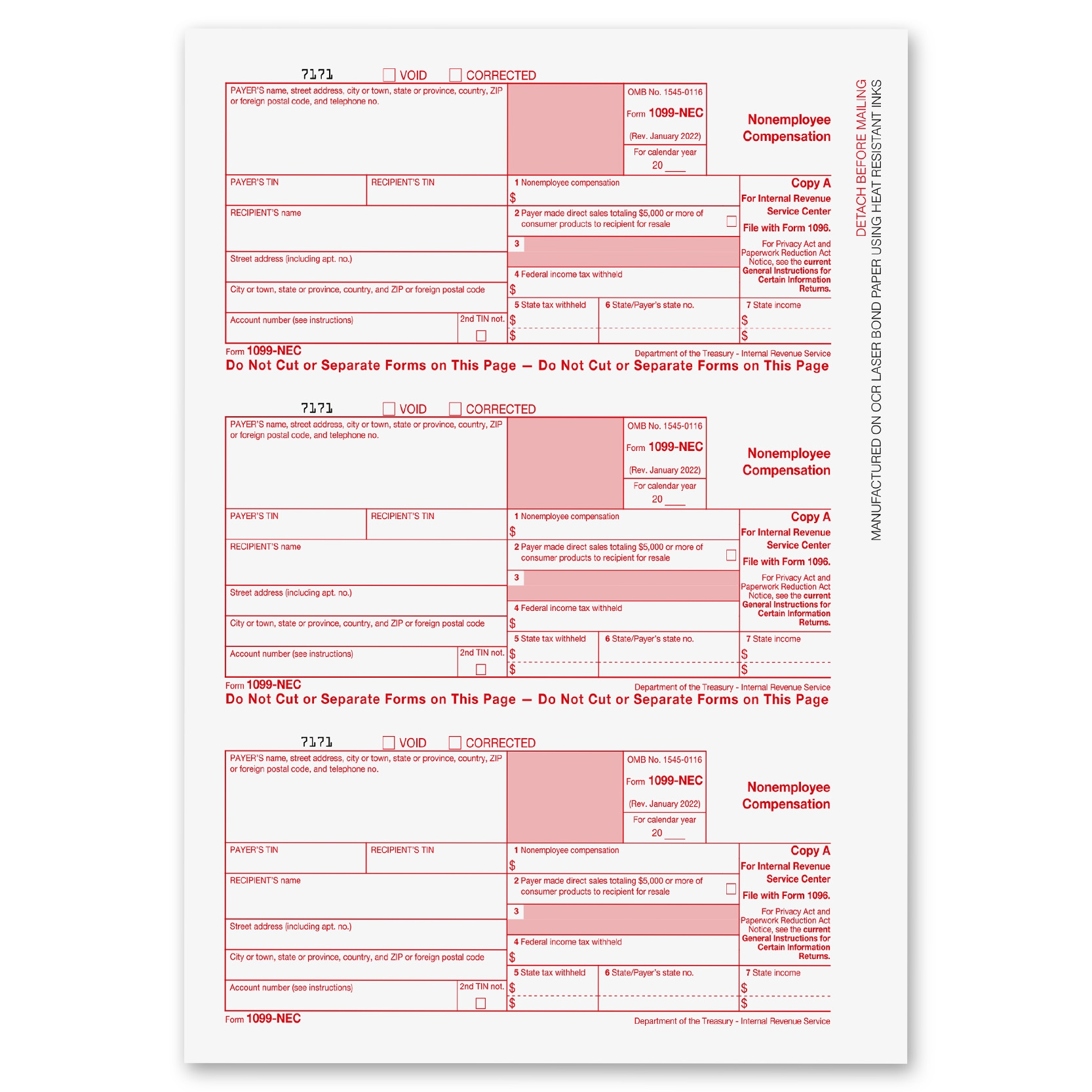

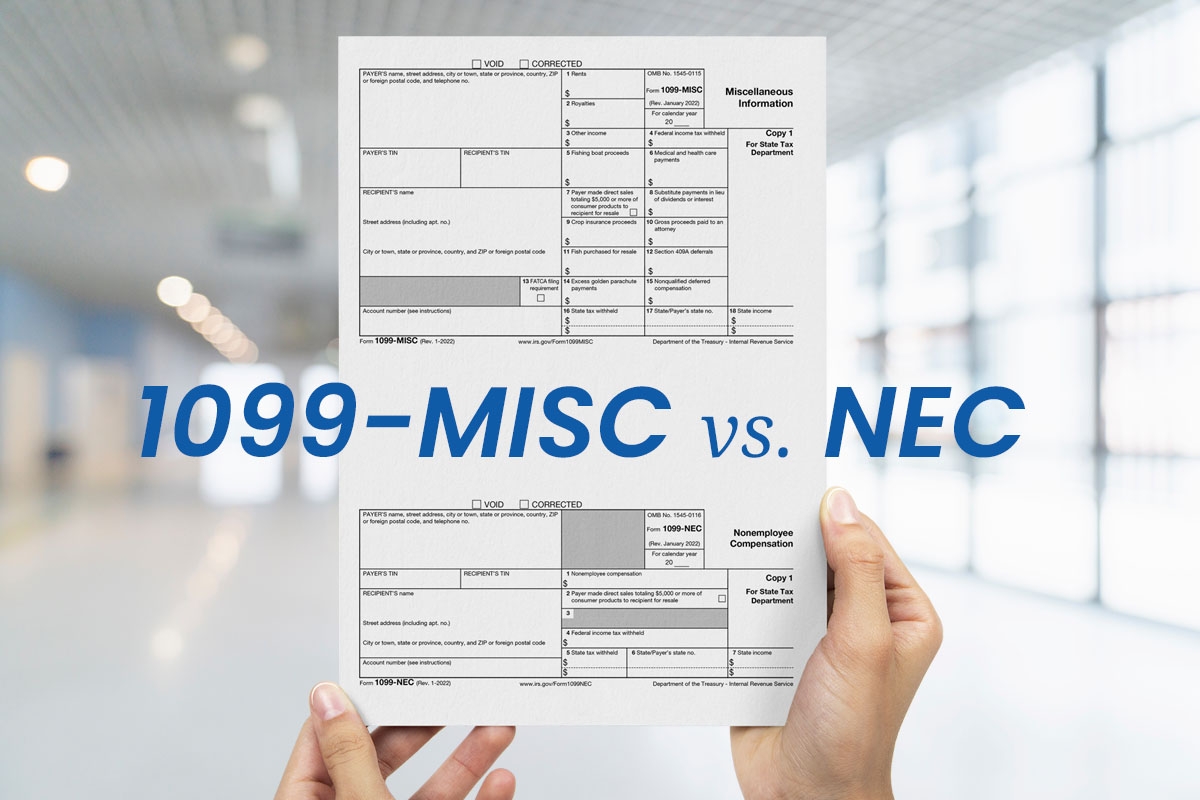

Starting in 2025, the IRS has reintroduced the 1099-NEC form to separate nonemployee compensation from other income. This change aims to streamline the reporting process for both businesses and individuals.

Understanding the IRS 1099-NEC Form 2025

When you receive payments totaling $600 or more for your services, clients will issue you a 1099-NEC form. Make sure to report this income on your tax return to avoid any penalties or audits from the IRS.

Remember to keep detailed records of all your income and expenses throughout the year. This will make it easier to fill out your tax forms accurately and ensure you’re not missing any deductions or credits you’re entitled to.

As tax season approaches, don’t forget to file your IRS 1099-NEC Form 2025 on time. By staying organized and informed, you can navigate the tax process with ease and peace of mind.