Are you a freelancer or independent contractor? If so, you’ll want to familiarize yourself with IRS Form 1099-NEC 2025. This form is used to report nonemployee compensation to the IRS.

Starting in 2025, businesses must use Form 1099-NEC to report payments of $600 or more made to nonemployees for services provided. It’s important to keep accurate records and file this form on time to avoid penalties.

What to Know About IRS Form 1099-NEC 2025

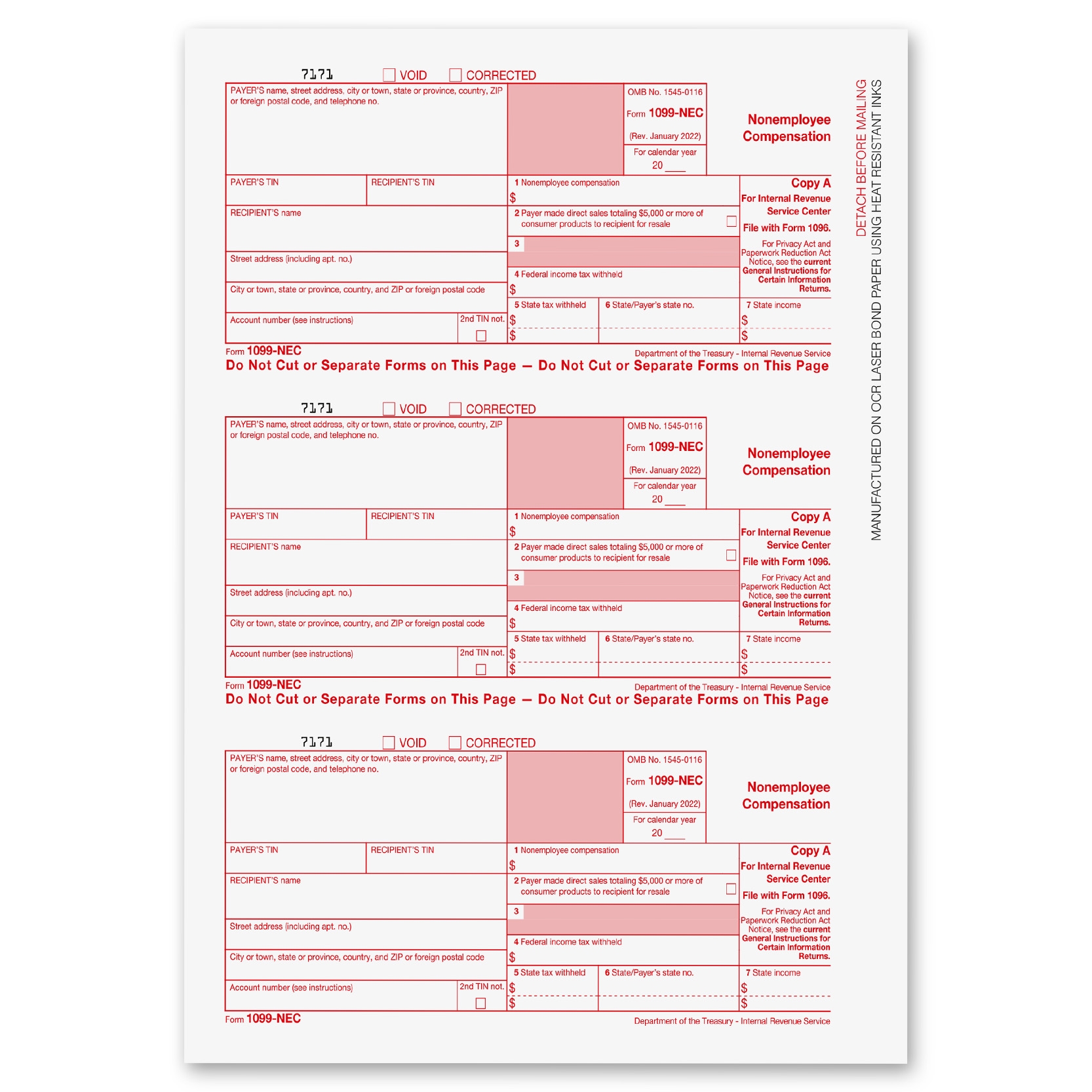

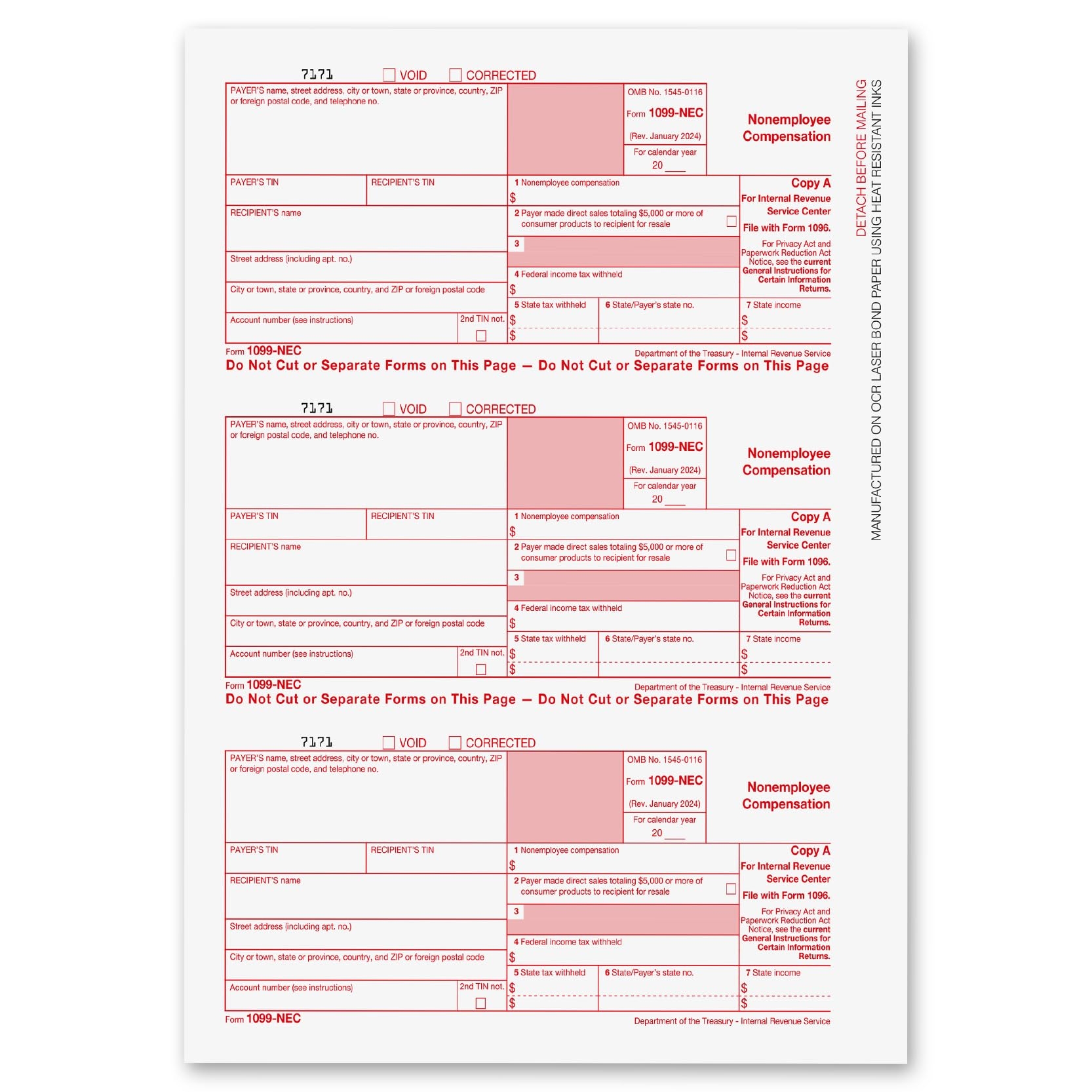

When filling out Form 1099-NEC, you’ll need to provide information such as the recipient’s name, address, and taxpayer identification number. Be sure to double-check your entries to ensure accuracy.

Failure to file Form 1099-NEC or reporting incorrect information can result in fines from the IRS. Stay organized throughout the year to make tax season a breeze and avoid any potential issues.

Understanding IRS Form 1099-NEC 2025 is essential for freelancers and businesses alike. By staying informed and compliant, you can navigate tax requirements with ease and peace of mind.