1099 Form Instructions 2025

Are you feeling overwhelmed by the thought of filing your taxes for 2025? Don’t worry, we’ve got you covered! Understanding the 1099 form instructions is crucial for getting your taxes done right.

Whether you’re a freelancer, contractor, or small business owner, the 1099 form is essential for reporting income that doesn’t come from a traditional employer. Knowing how to fill out this form correctly can save you time and hassle in the long run.

1099 Form Instructions 2025

1099 Form Instructions 2025

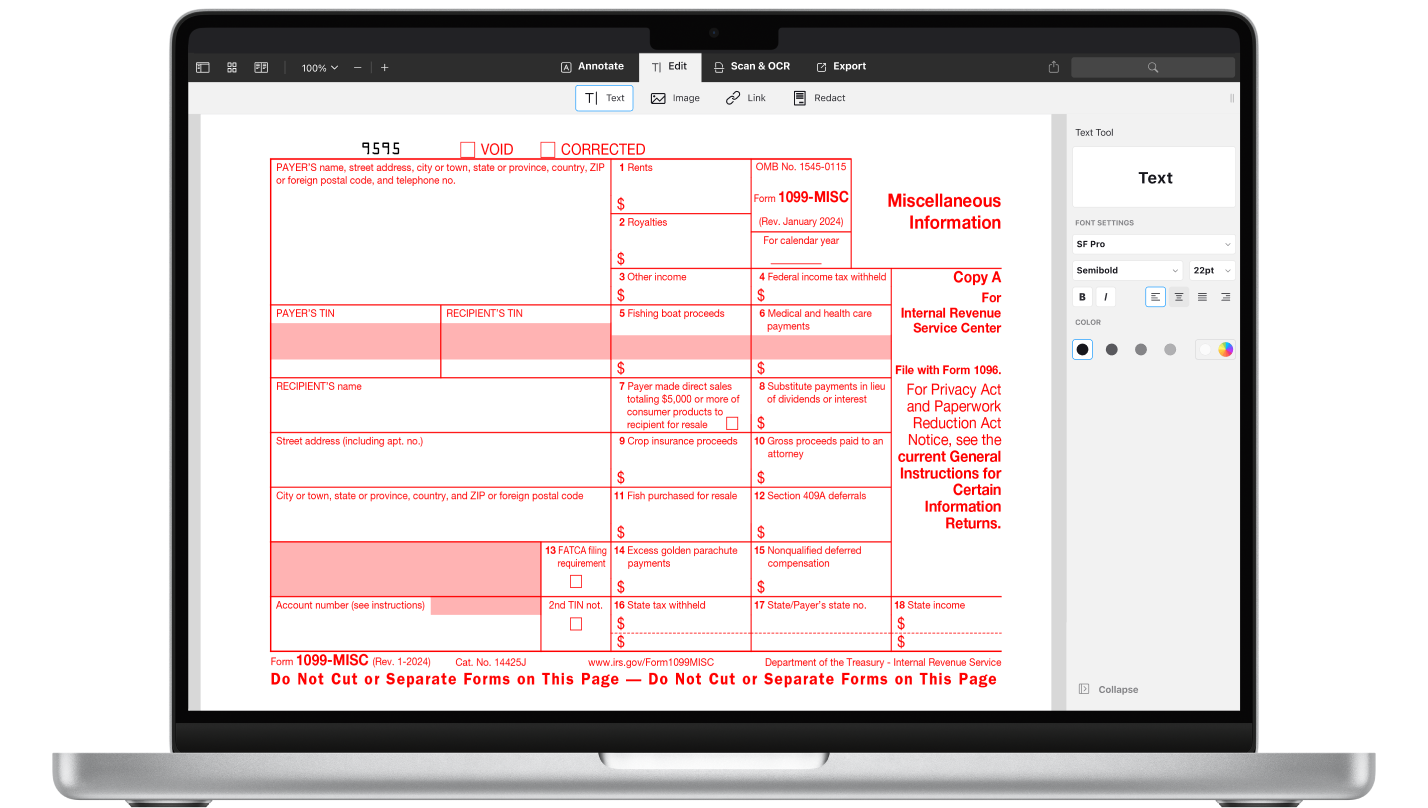

First and foremost, make sure you have all the necessary information handy before you start filling out your 1099 form. This includes details such as your name, address, taxpayer identification number, and the amount of income you received.

Next, carefully review the different boxes on the form and ensure you accurately report your income in the correct categories. Mistakes on your 1099 form can lead to delays in processing your taxes or even trigger an audit, so it’s crucial to double-check your work.

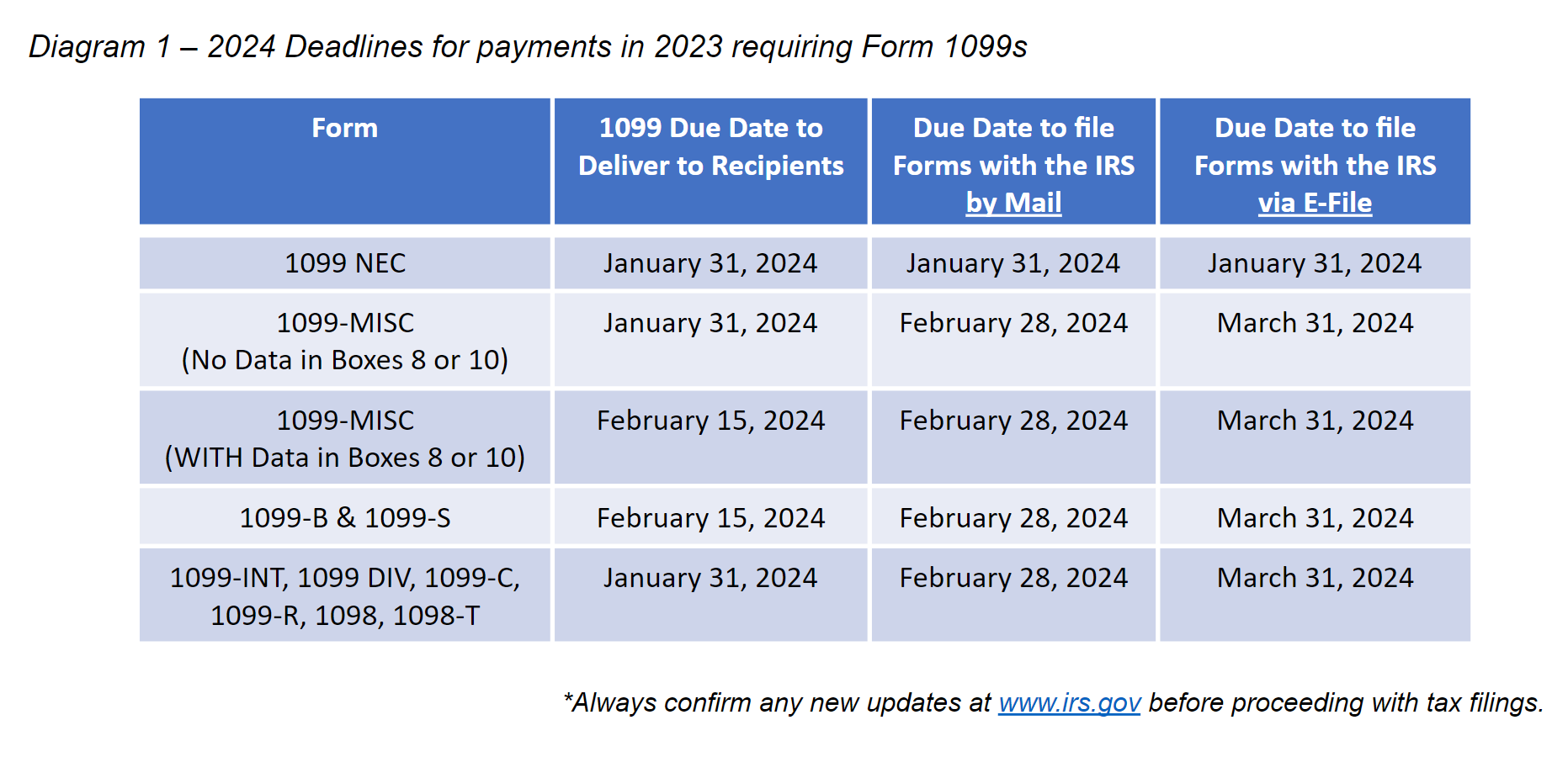

Once you’ve completed your 1099 form, make sure to submit it to the IRS by the specified deadline. Failing to file on time can result in penalties and interest charges, so it’s best to get this task done sooner rather than later.

By following these 1099 form instructions for 2025, you can streamline the tax-filing process and avoid any unnecessary stress. Remember, it’s always a good idea to consult with a professional tax advisor if you have any questions or concerns about your tax situation.

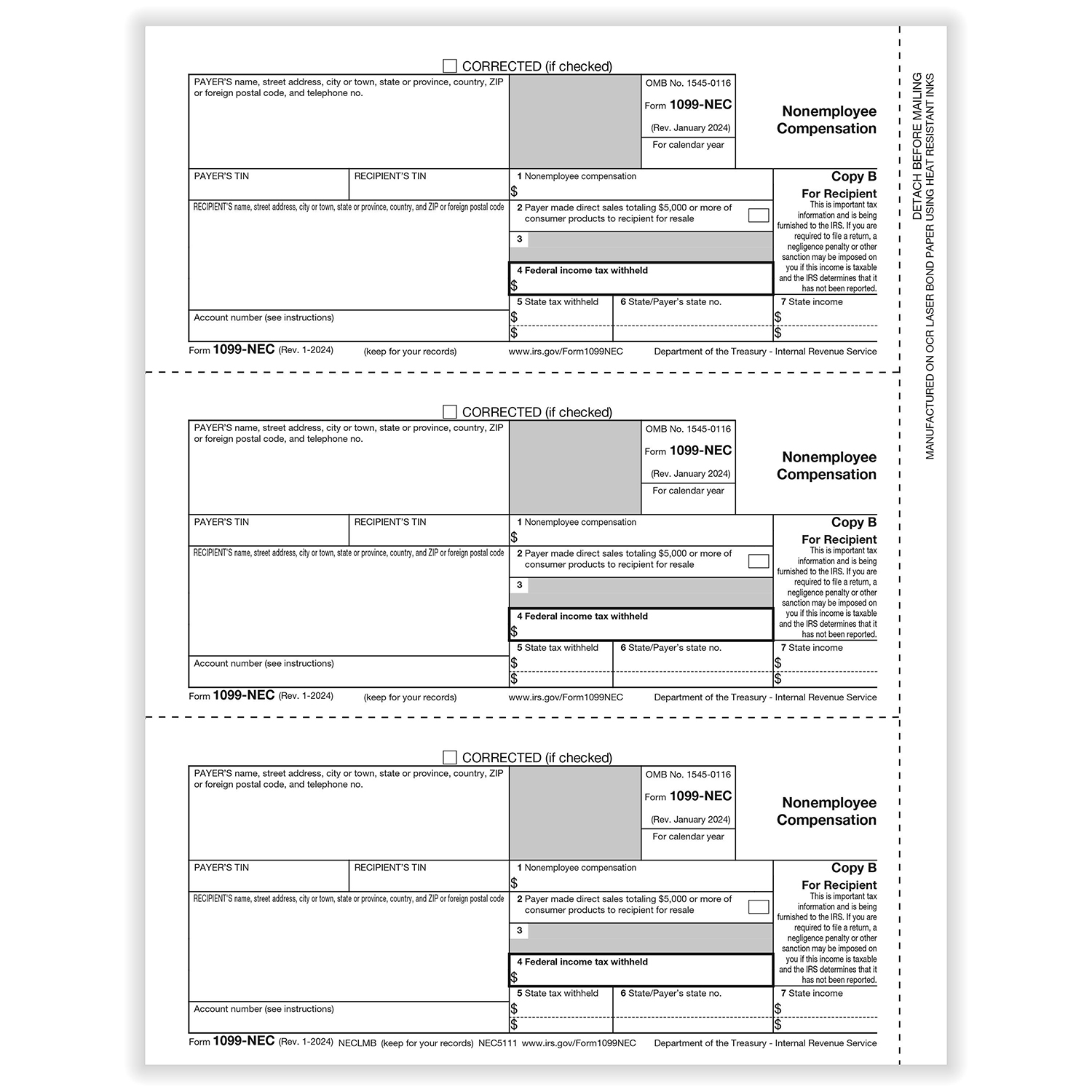

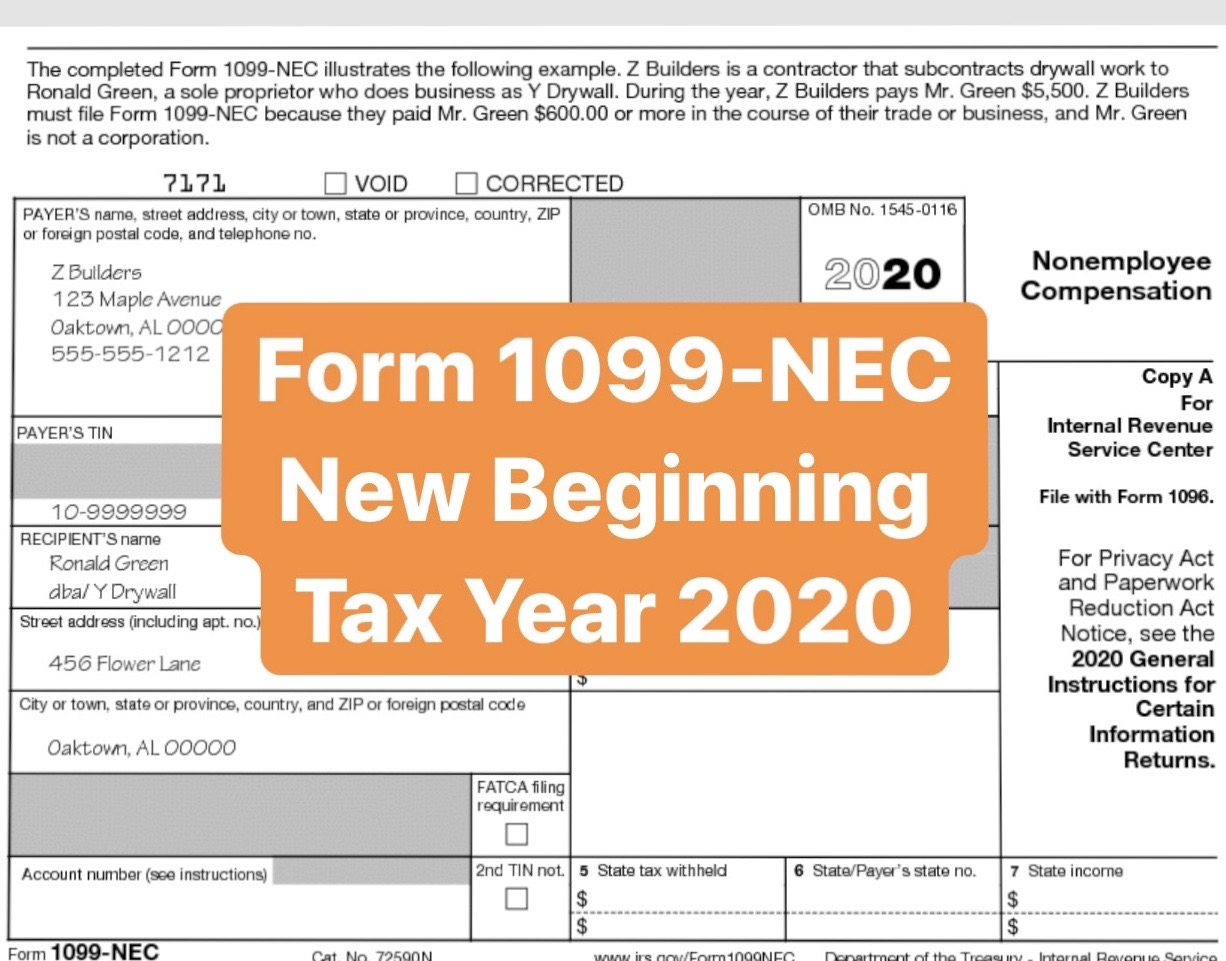

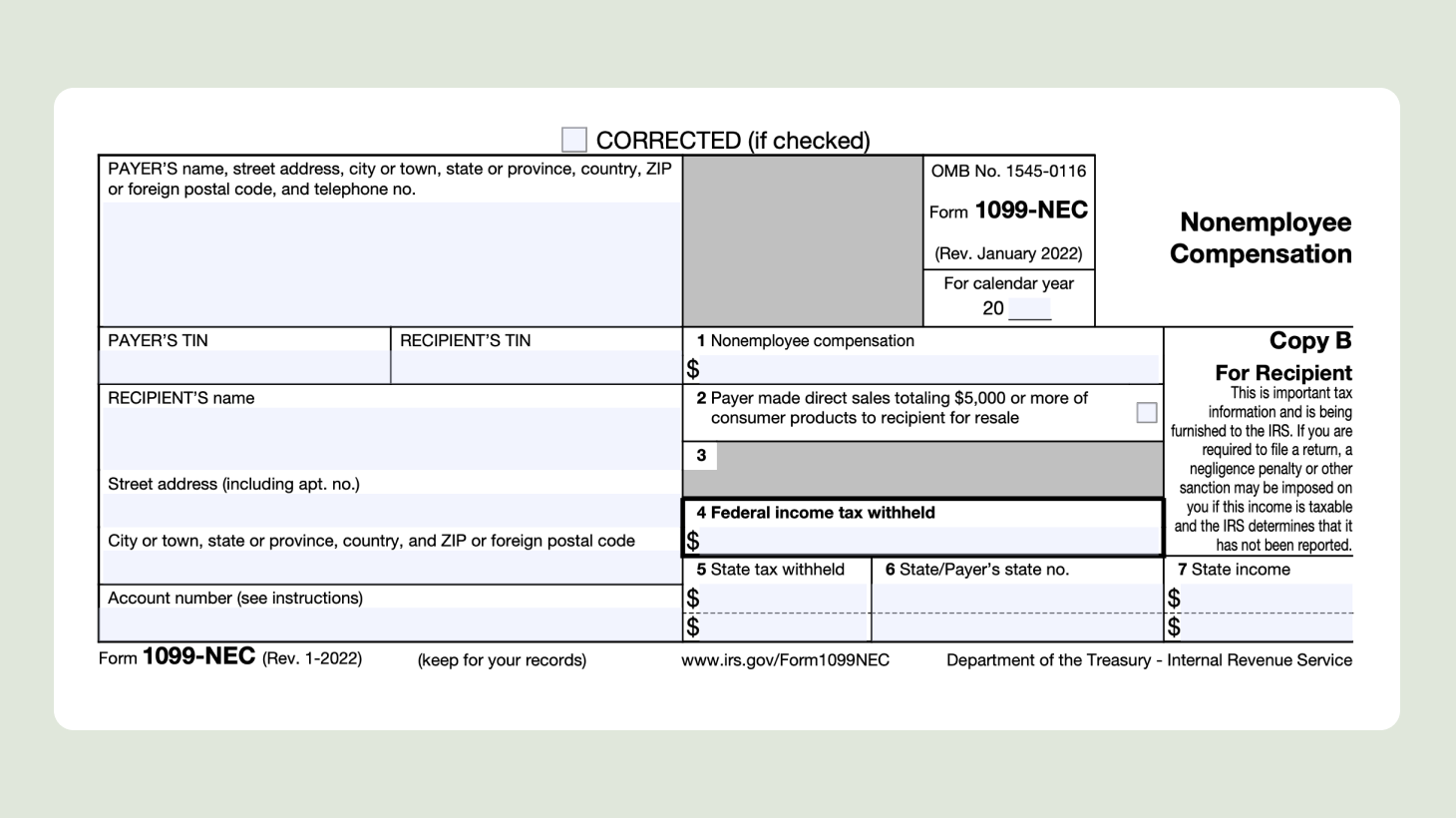

What Is Form 1099 NEC For Nonemployee Compensation

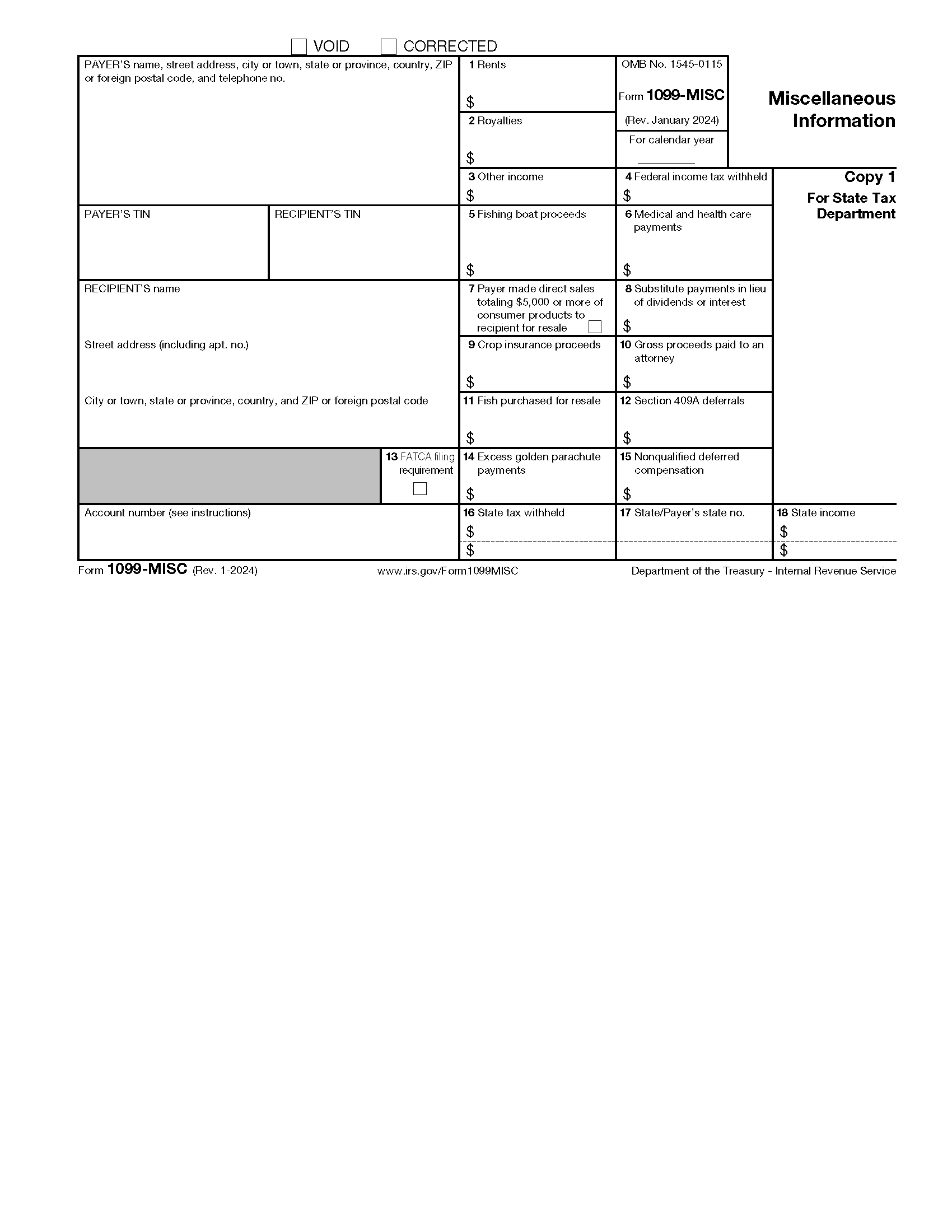

Free IRS Form 1099 MISC PDF EForms

An Overview Of The 1099 NEC Form

1099 Requirements For Business Owners In 2025 Mark J Kohler

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert