2025 Tax Form 1040

Are you prepared for the changes coming to the 2025 Tax Form 1040? It’s important to stay informed about updates to tax forms to ensure you’re filing correctly and maximizing your returns.

The 2025 Tax Form 1040 is expected to have some key changes that could impact how you file your taxes. From new deductions to updated income thresholds, it’s crucial to be aware of these modifications.

2025 Tax Form 1040

What to Expect from the 2025 Tax Form 1040

One of the anticipated changes to the 2025 Tax Form 1040 is an increase in the standard deduction. This adjustment could benefit many taxpayers by reducing their taxable income and potentially lowering their overall tax liability.

Additionally, the 2025 Tax Form 1040 may introduce new credits or deductions for specific expenses, such as healthcare costs or education expenses. These changes could provide additional opportunities for taxpayers to save money on their taxes.

It’s also essential to stay updated on any changes to the tax brackets and income thresholds for the 2025 Tax Form 1040. Knowing where you fall within these brackets can help you plan your finances more effectively and ensure you’re taking advantage of any available tax breaks.

As the release date for the 2025 Tax Form 1040 approaches, be sure to familiarize yourself with the updates and changes to avoid any surprises when it’s time to file your taxes. Staying informed and proactive can help you navigate the tax season with confidence and peace of mind.

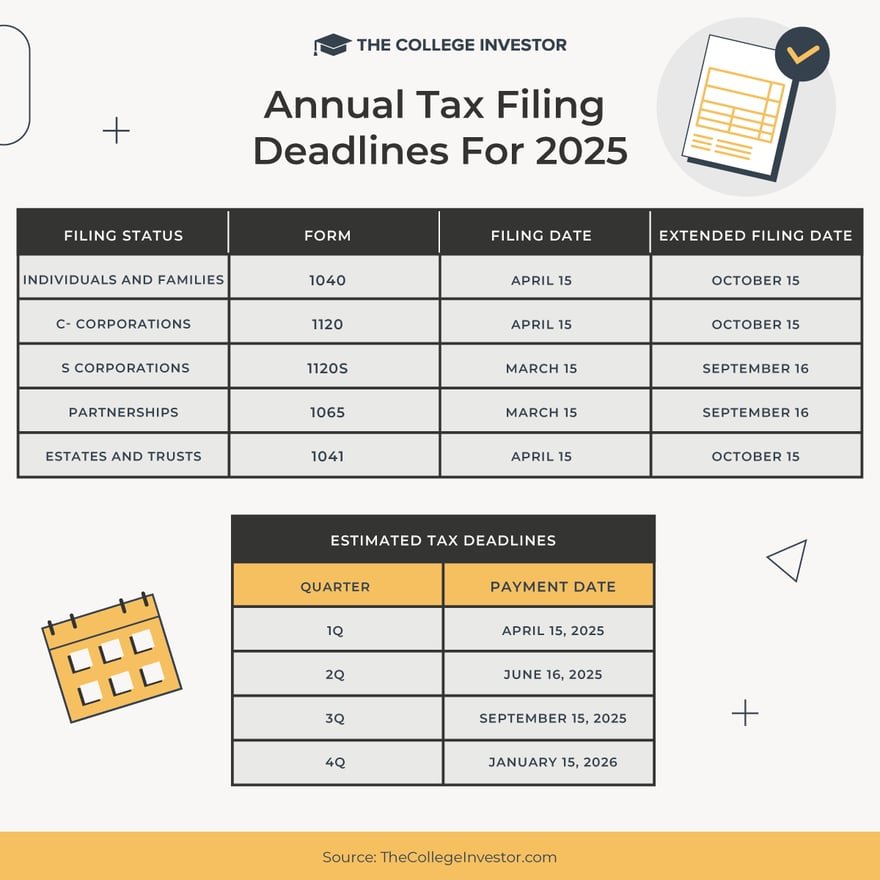

Form 1040 Review Russell Investments

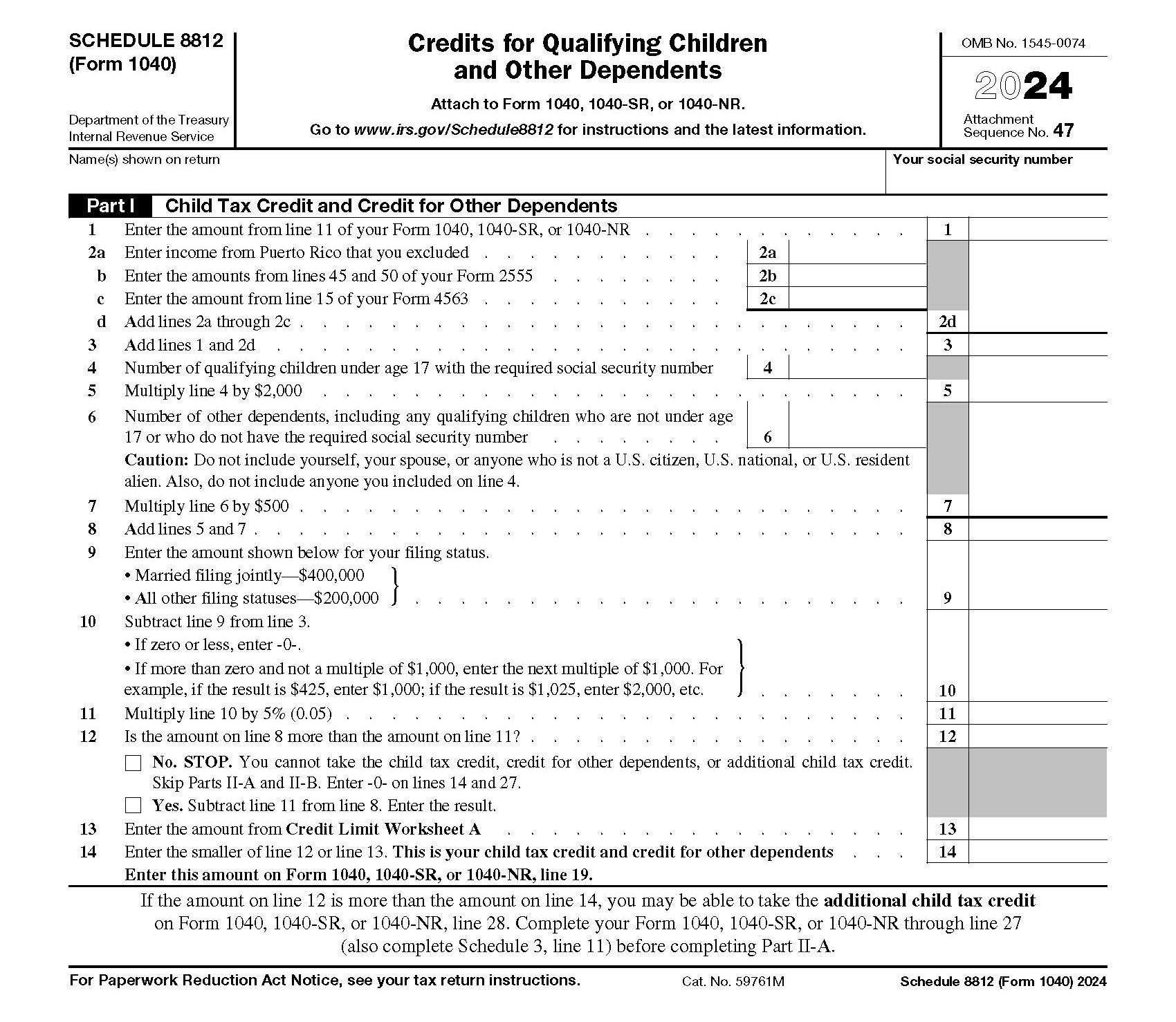

How To Complete IRS Schedule 8812

Form 1040 U S Individual Tax Return Definition Types And Use

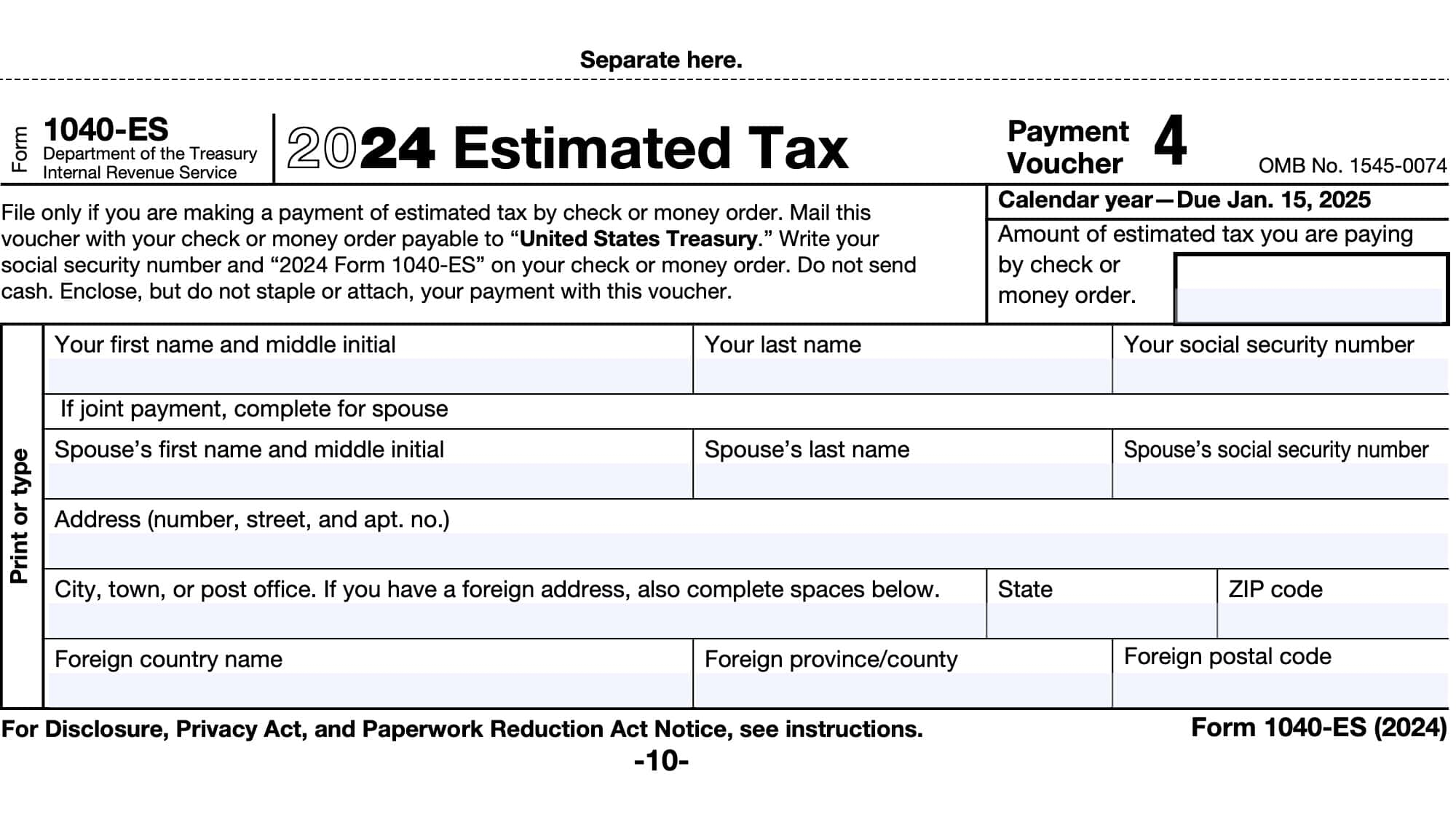

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor