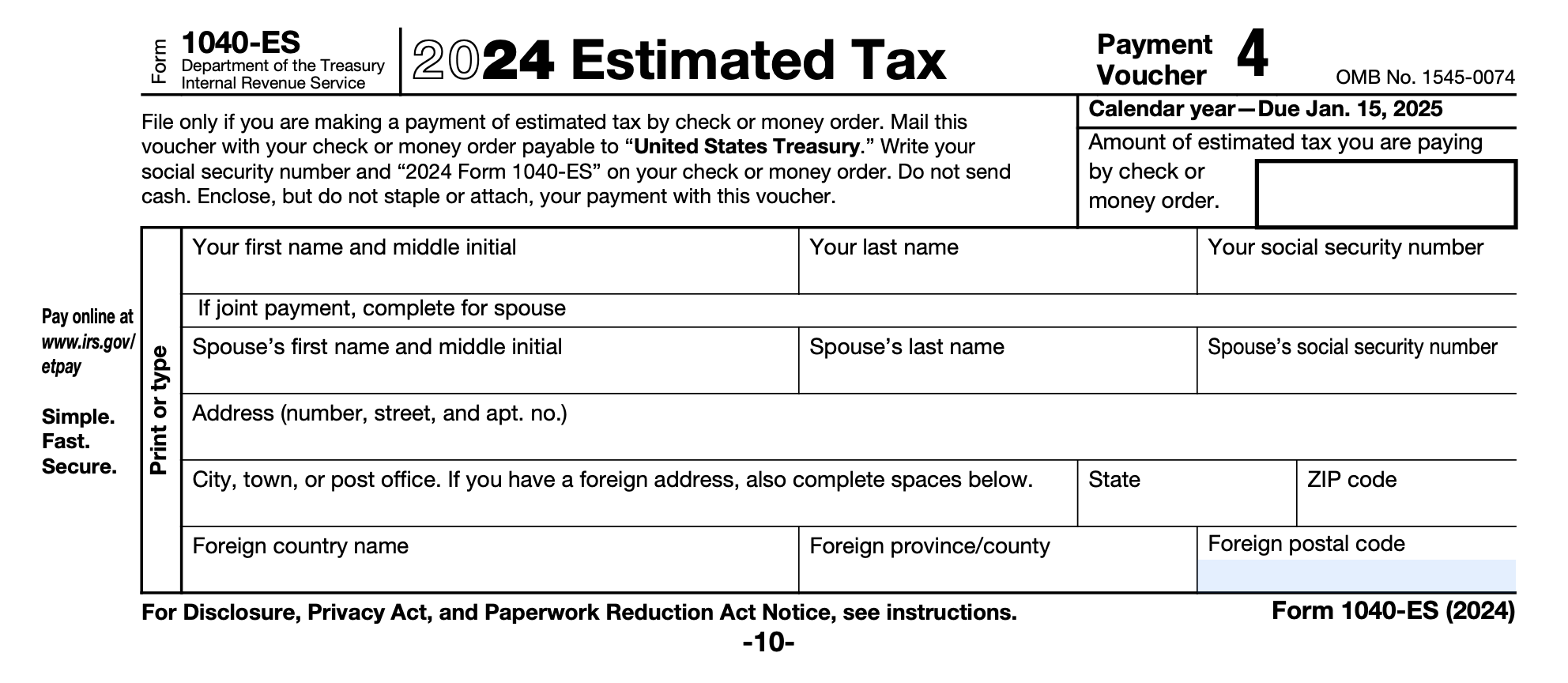

Form 1040-ES For 2025

Are you ready to tackle your taxes for 2025? Form 1040-ES is an essential tool for estimating and paying your quarterly taxes throughout the year. It helps you avoid any surprises come tax season.

Form 1040-ES For 2025 is crucial for self-employed individuals, freelancers, and small business owners. By estimating your taxes and making quarterly payments, you can avoid penalties and hefty tax bills at the end of the year.

Form 1040-ES For 2025

Understanding Form 1040-ES For 2025

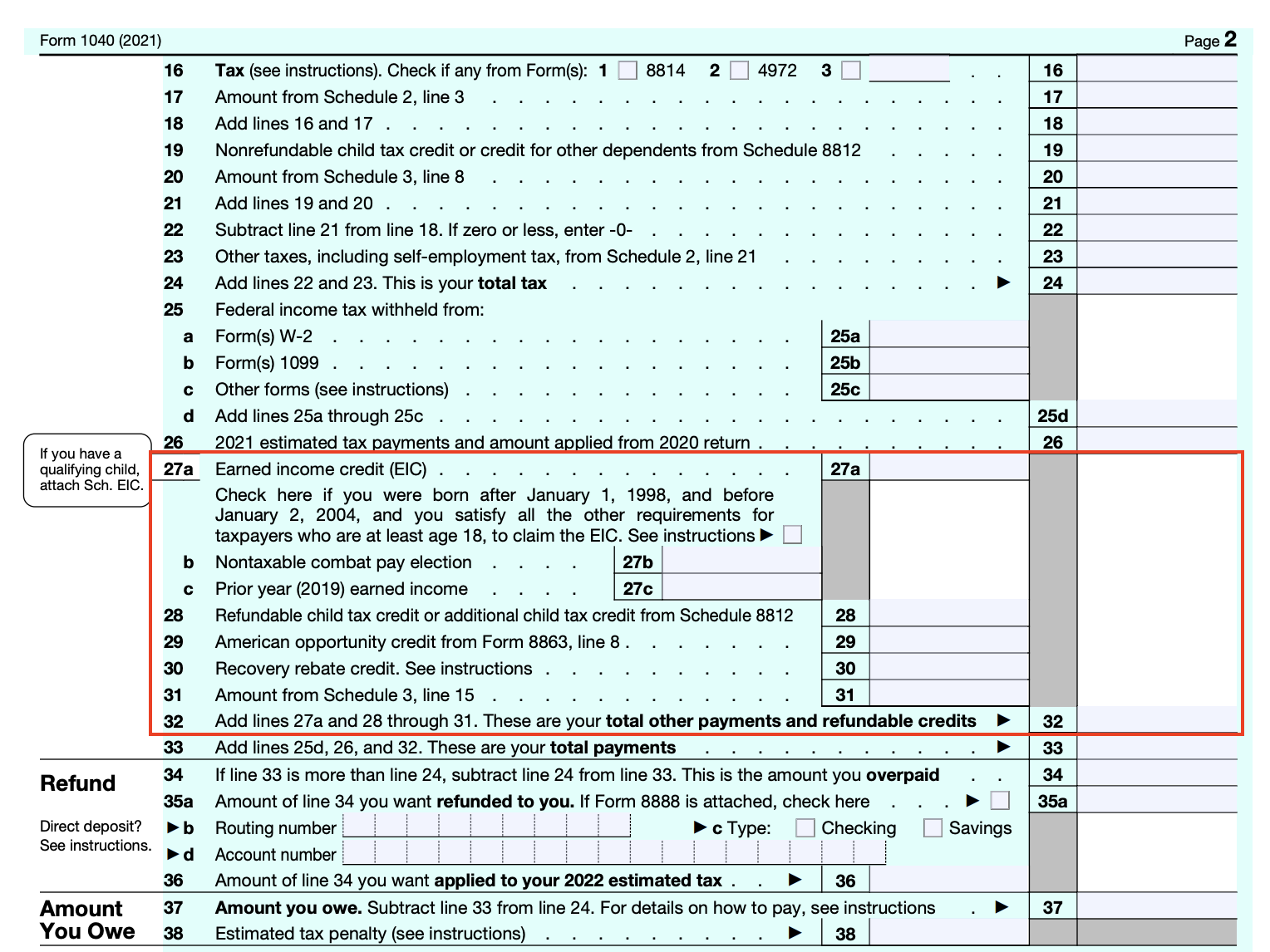

When using Form 1040-ES, you’ll need to calculate your expected income, deductions, and credits for the year. Based on these figures, you can determine how much you owe in taxes each quarter and make timely payments to the IRS.

It’s important to stay organized and keep track of your income and expenses throughout the year. By staying on top of your finances, you can accurately estimate your quarterly tax payments and avoid any potential issues with the IRS.

If you find estimating your taxes challenging, consider seeking help from a tax professional. They can provide guidance on how to complete Form 1040-ES accurately and ensure you’re meeting your tax obligations throughout the year.

Don’t wait until the last minute to start thinking about your taxes for 2025. By using Form 1040-ES and staying proactive with your tax planning, you can avoid unnecessary stress and financial burdens down the road.

Take control of your taxes and financial future by utilizing Form 1040-ES For 2025. By staying organized, estimating your taxes accurately, and making timely payments, you can set yourself up for success come tax season.

What Is IRS Form 1040 ES Estimated Tax For Individuals TurboTax Tax Tips Videos

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting

2025 Tax Guide Key Documents And Steps To File Your 2024 Taxes Marca

Form 1040 U S Individual Tax Return Definition Types And Use

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting