Form 1040 2025

Ready or not, tax season is upon us once again. As we navigate through the world of tax forms and deductions, it’s essential to stay informed about any changes that may impact our filings.

One important form to keep an eye on is the Form 1040. Looking ahead to the year 2025, there are potential updates and revisions that taxpayers should be aware of to ensure a smooth filing process.

Form 1040 2025

Form 1040 2025: What to Expect

For the tax year 2025, the IRS may introduce new sections or modify existing ones on Form 1040. These changes could affect how you report income, claim deductions, and calculate your tax liability.

It’s crucial to stay updated on any revisions to Form 1040 to avoid errors and potential penalties. Whether you file on your own or seek the help of a tax professional, understanding the form’s requirements is key to a successful tax season.

As tax laws evolve and the economy shifts, staying informed about changes to Form 1040 is vital for accurate and timely filings. By staying proactive and educated, you can navigate the tax season with confidence and peace of mind.

So, as you prepare to tackle your taxes in 2025, be sure to keep an eye out for any updates to Form 1040. By staying informed and proactive, you can make the filing process smoother and hopefully secure the best possible outcome for your financial situation.

What Is An Extension To File Taxes In 2025 And How Do You Request It

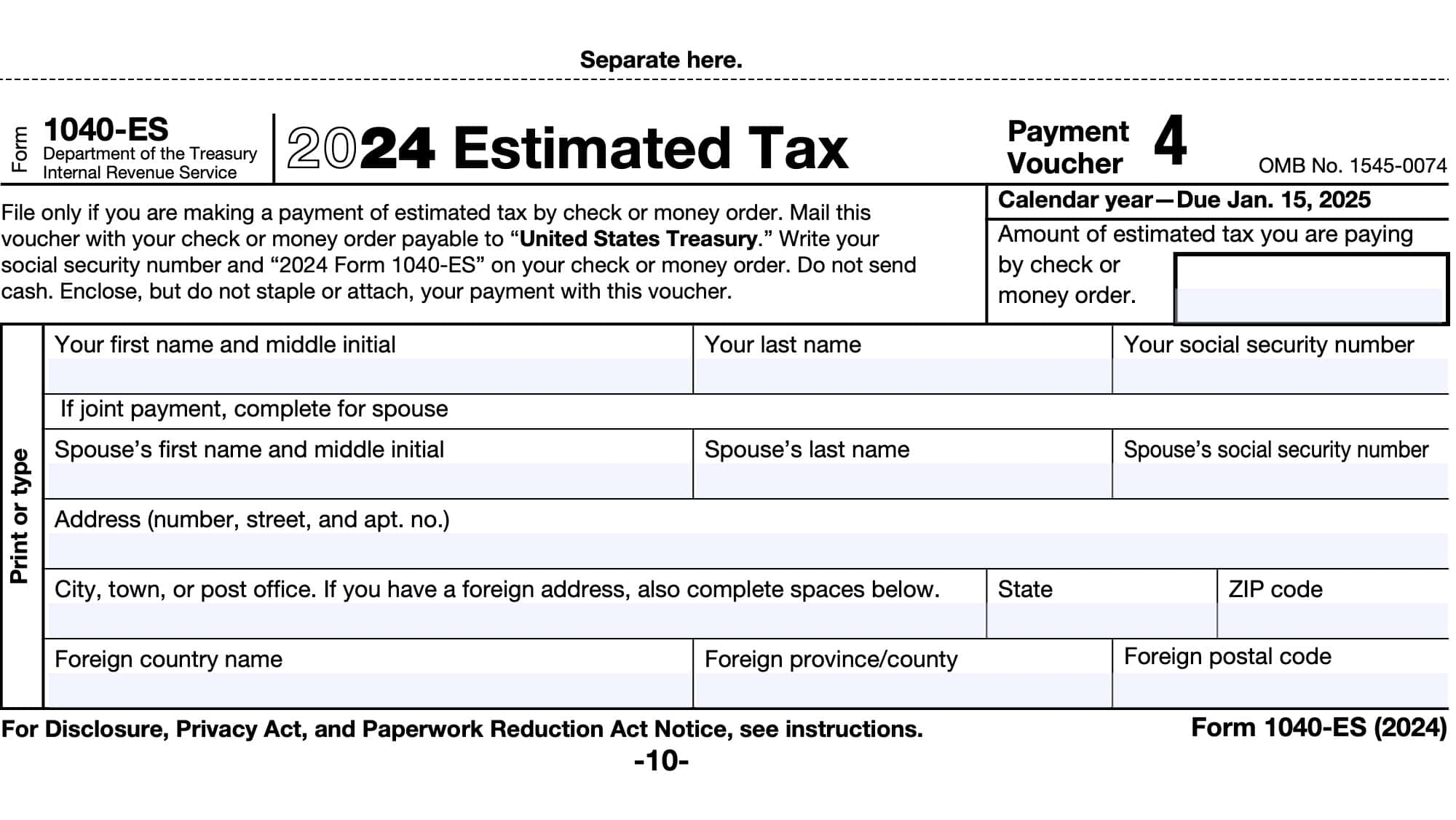

IRS Form 1040 ES Instructions Estimated Tax Payments

Form 1040 U S Individual Tax Return Definition Types And Use

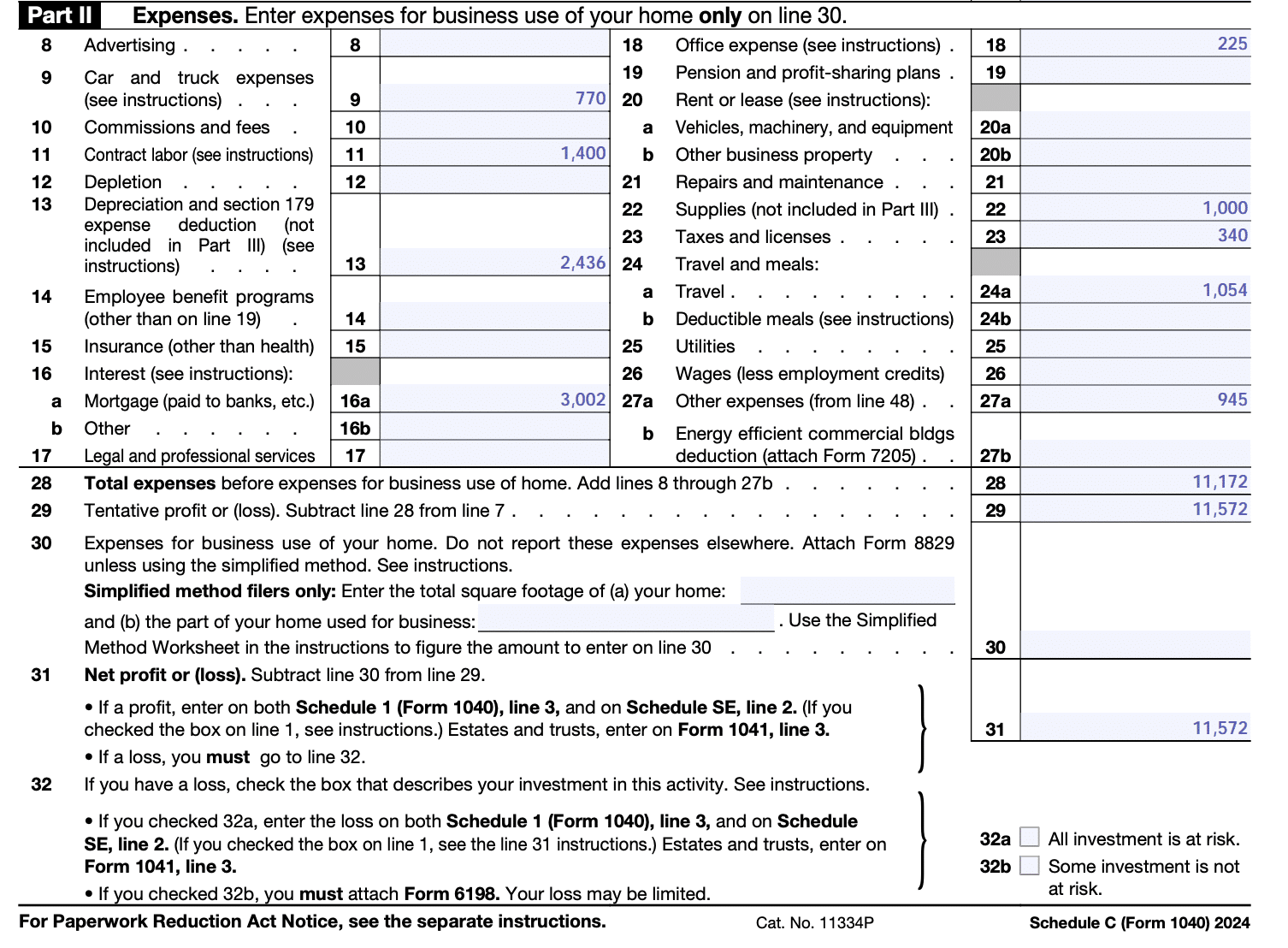

How To Fill Out Schedule C In 2025 With Example

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor