Form 1040 Due Date 2025

As tax season approaches, it’s essential to stay informed about important deadlines. One crucial date to remember is the Form 1040 Due Date 2025. Ensuring you file your taxes on time can help you avoid penalties and stress.

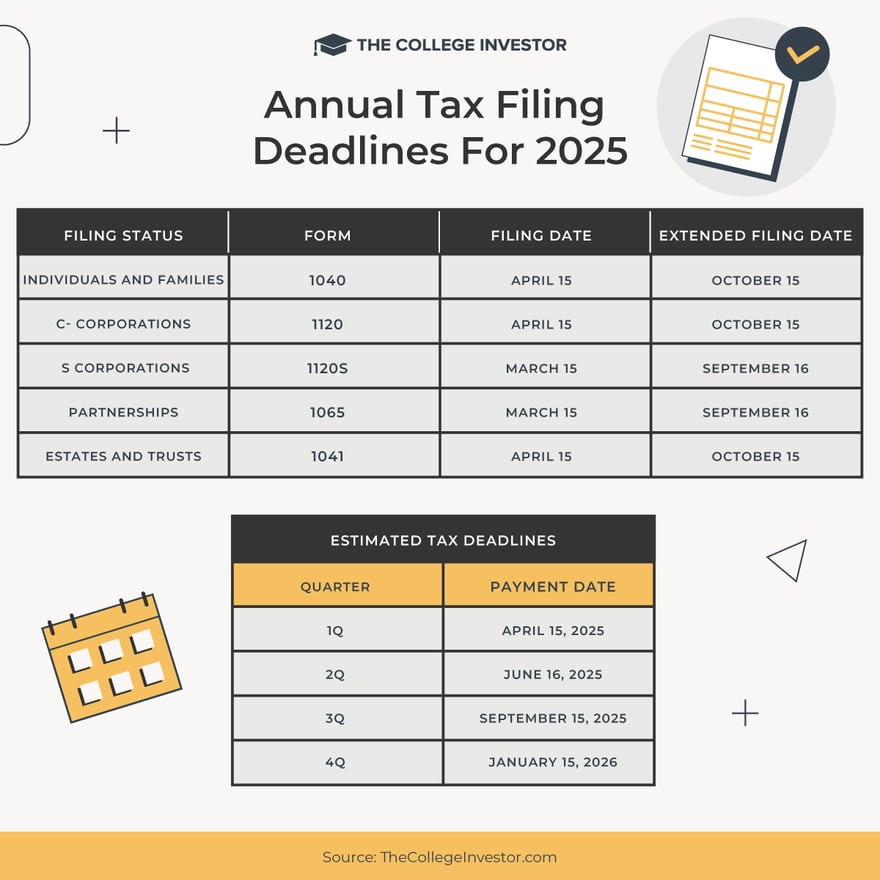

Mark your calendars for the Form 1040 Due Date 2025, which falls on April 15th. This deadline applies to most taxpayers, including individuals, sole proprietors, and freelancers. Filing your taxes by this date is crucial to avoid late fees and penalties.

Form 1040 Due Date 2025

Form 1040 Due Date 2025: Mark Your Calendars!

It’s important to gather all necessary documents and information well ahead of the Form 1040 Due Date 2025. This includes W-2 forms, 1099s, receipts for deductions, and any other relevant paperwork. Being organized can help streamline the filing process and ensure accuracy.

If you anticipate needing more time to file your taxes, you have the option to request an extension. However, it’s essential to submit this request before the Form 1040 Due Date 2025 to avoid penalties. Remember, an extension grants you more time to file, not to pay any taxes owed.

As the Form 1040 Due Date 2025 approaches, it’s a good idea to double-check your return for accuracy and completeness. Mistakes or omissions can delay processing and potentially trigger audits. Taking the time to review your tax return can help you avoid costly errors.

In conclusion, staying informed about the Form 1040 Due Date 2025 can help you navigate tax season with ease. By marking your calendars, gathering necessary documents, and reviewing your return, you can ensure a smooth filing process and avoid penalties. Remember, timely filing is key!

Form 1040 U S Individual Tax Return Definition Types And Use

2025 Tax Filing Deadlines When Does IRS Free File Begin

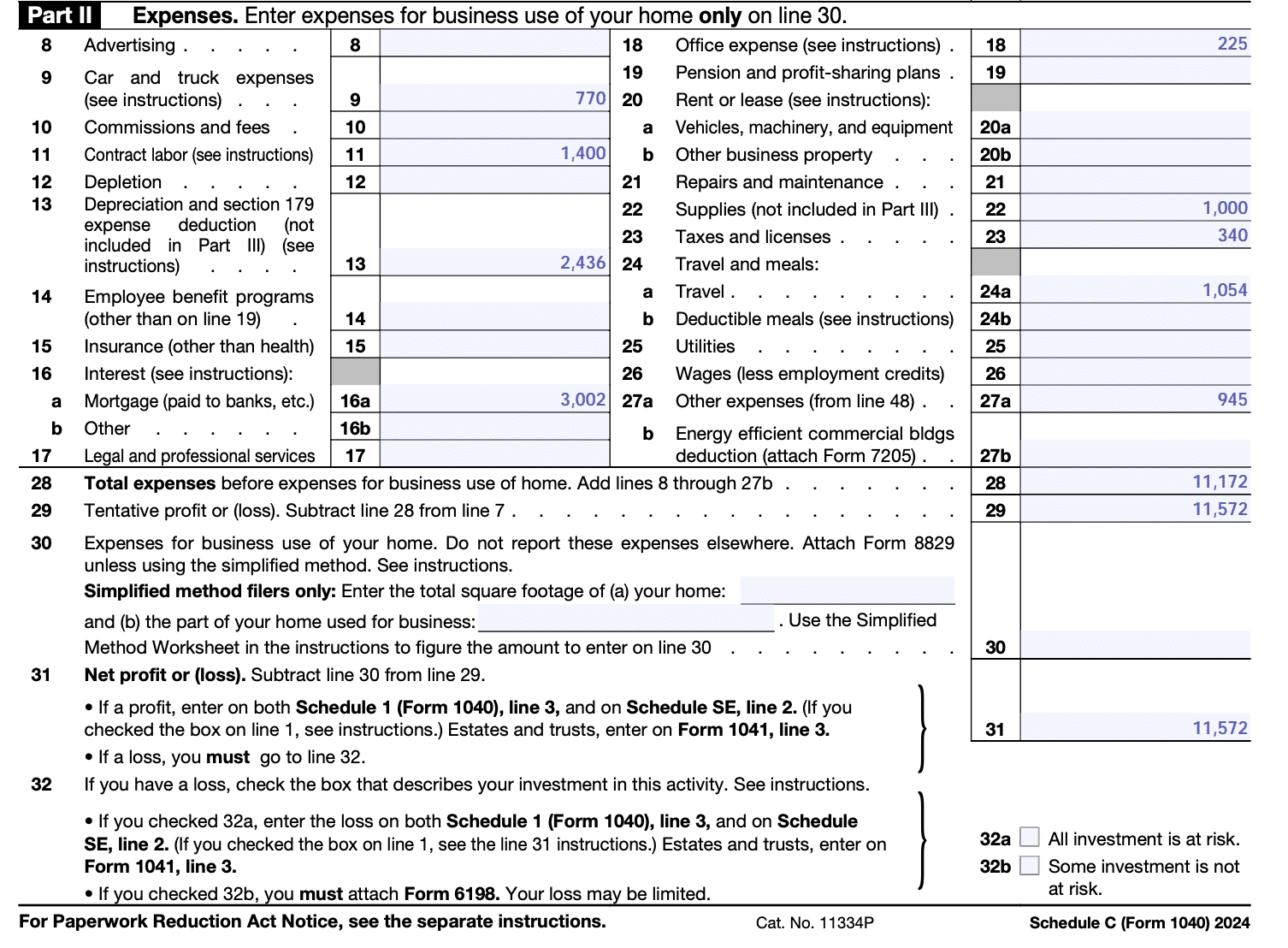

How To Fill Out Schedule C In 2025 With Example

Every Major Tax Deadline In 2025

When Are Taxes Due In 2025 Including Estimated Taxes