Form 1040-ES 2025

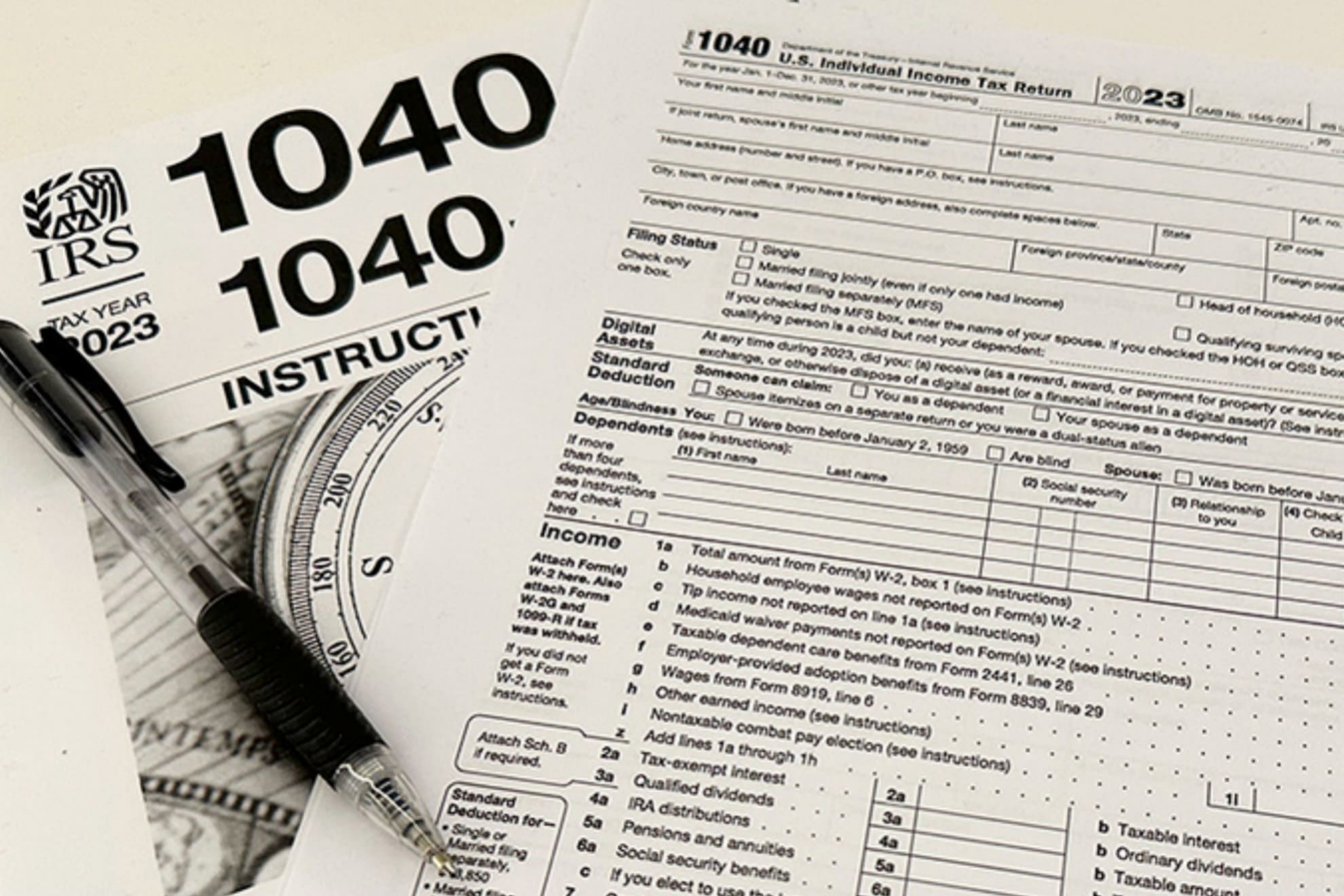

Are you looking for information on how to file your taxes for the upcoming year? If so, you may need to familiarize yourself with Form 1040-ES 2025, which is used to estimate and pay your quarterly taxes.

Form 1040-ES 2025 is essential for self-employed individuals, freelancers, and others who need to pay estimated taxes throughout the year. By using this form, you can avoid penalties and interest on underpaid taxes.

Form 1040-ES 2025

Understanding Form 1040-ES 2025

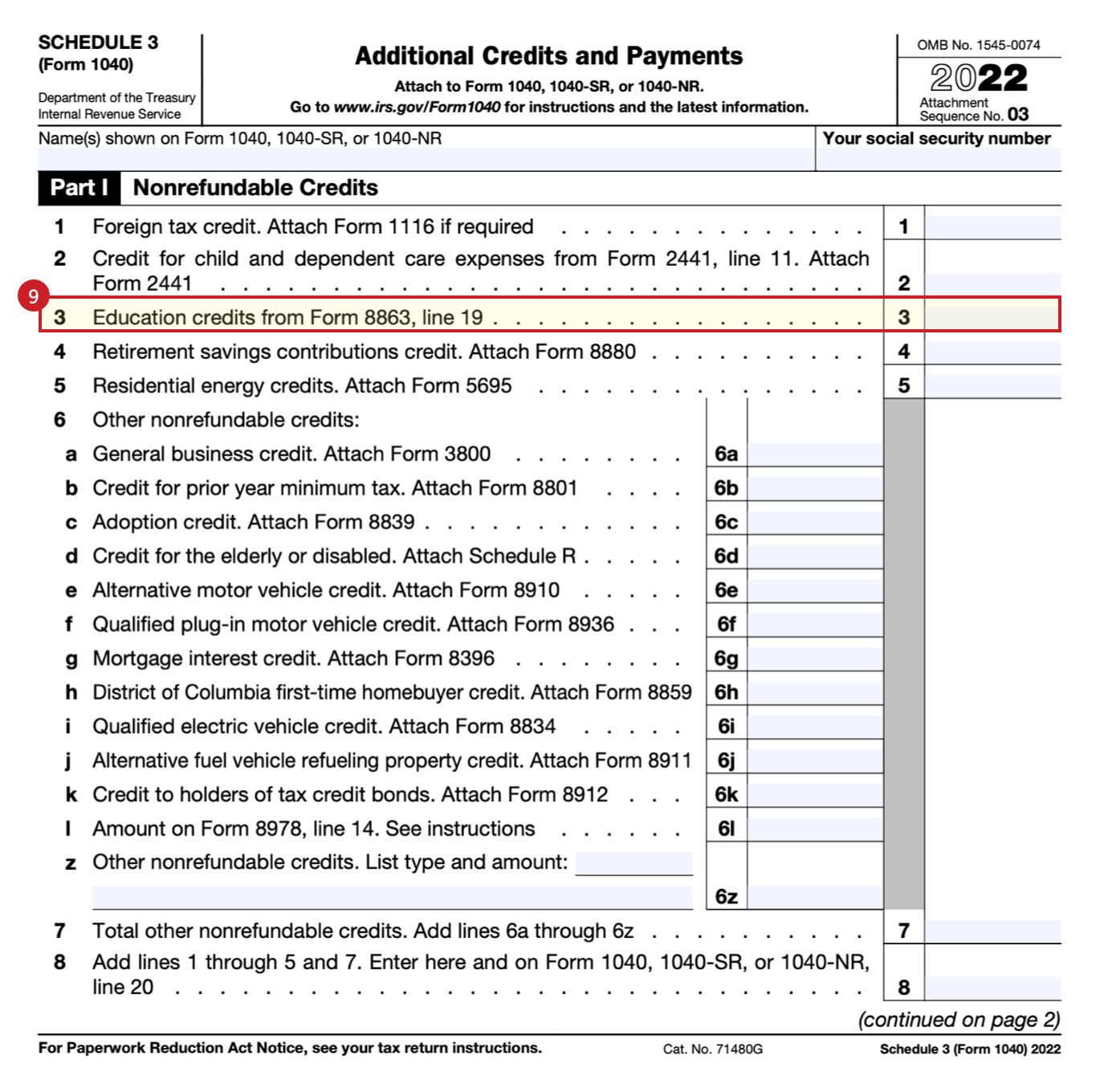

When filling out Form 1040-ES 2025, you will need to provide information such as your income, deductions, credits, and estimated tax payments. It’s crucial to accurately estimate your income to avoid any surprises when it’s time to file your annual return.

One key benefit of using Form 1040-ES 2025 is that it helps you stay organized and on top of your tax obligations. By making quarterly estimated tax payments, you can spread out the financial burden and avoid a large tax bill at the end of the year.

Remember, the deadline for filing Form 1040-ES 2025 is typically April 15th, June 15th, September 15th, and January 15th of the following year. Be sure to mark these dates on your calendar and submit your payments on time to avoid any penalties.

In conclusion, Form 1040-ES 2025 is a valuable tool for those who need to pay estimated taxes throughout the year. By understanding how to use this form correctly, you can stay compliant with the IRS and avoid any unnecessary fees. Make sure to consult with a tax professional if you have any questions or need assistance with your taxes.

When Does The 2025 Tax Season End This Is The Deadline To File Your Return Marca

What Is IRS Form 1040 ES Estimated Tax For Individuals TurboTax Tax Tips Videos

2025 Tax Guide Key Documents And Steps To File Your 2024 Taxes Marca

Form 1040 U S Individual Tax Return Definition Types And Use

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting