Comprehensive Guide to IRS Form 1099 and Its Variants

Form 1099 is an essential IRS document used to report a variety of income types earned outside of traditional employment. From interest and dividends to contractor earnings and retirement distributions, the 1099 series captures multiple sources of non-wage income. For taxpayers, correctly handling these forms is critical for ensuring accurate reporting and maintaining compliance with IRS regulations. Whether you’re an individual taxpayer or a business issuing these forms, understanding the nuances is key.

This guide covers the most common types of Form 1099, including 1099-INT for interest income, 1099-DIV for dividend income, 1099-R for retirement distributions, 1099-MISC for miscellaneous income, and 1099-NEC for non-employee compensation. Properly reporting each form helps the IRS match the income received with what is filed, preventing issues with underreporting and ensuring a smoother tax process. Read on for a closer look at these forms and their importance in your tax filings.

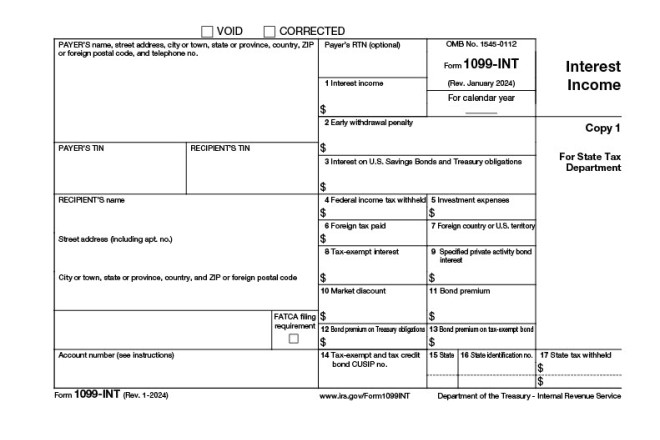

Tax Form 1099-INT

Form 1099-INT is used by financial institutions to report interest income paid to individuals. If you earned $10 or more in interest from savings accounts, certificates of deposit, or other interest-bearing accounts, you’ll receive this form. Reporting this income accurately on your tax return is crucial to avoid discrepancies with the IRS.

This form ensures that all taxable interest income is properly declared, helping taxpayers meet their obligations and avoid penalties.

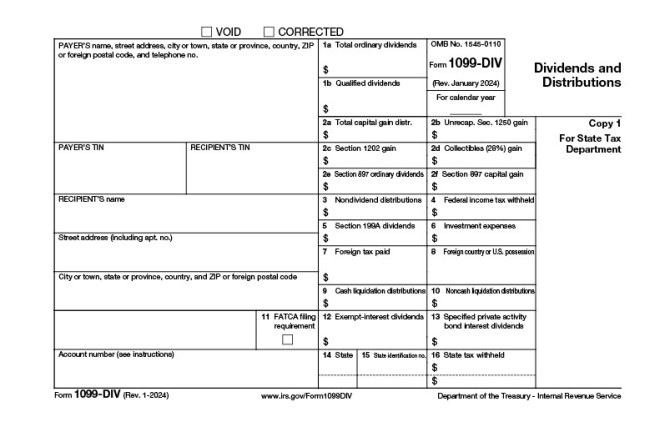

DownloadTax Form 1099-DIV

Form 1099-DIV is issued to report dividend income and capital gains distributions paid to investors by financial institutions or mutual funds. If you received $10 or more in dividends during the year, you should report this on your tax return. Filing Form 1099-DIV helps individuals stay compliant with the IRS by accurately reporting their investment earnings.

Proper reporting helps avoid underpayment penalties and ensures a smooth tax process.

Download

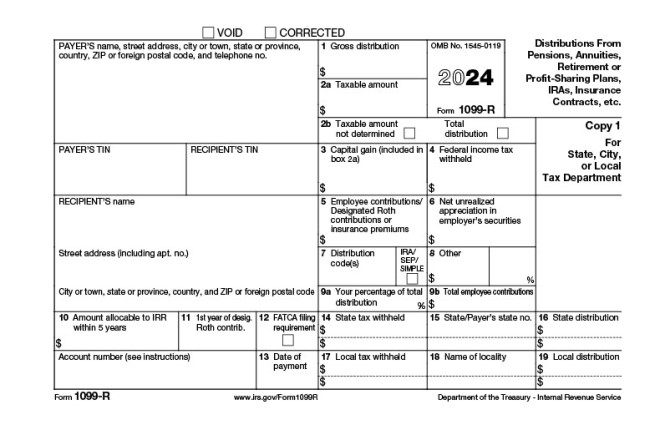

Tax Form 1099-R

Form 1099-R is used to report distributions from pensions, annuities, IRAs, insurance contracts, and other retirement plans. If you received a distribution of $10 or more, this form is essential for reporting the income during tax filing.

Properly including this information ensures compliance and helps taxpayers avoid potential fines or underreporting issues with retirement income.

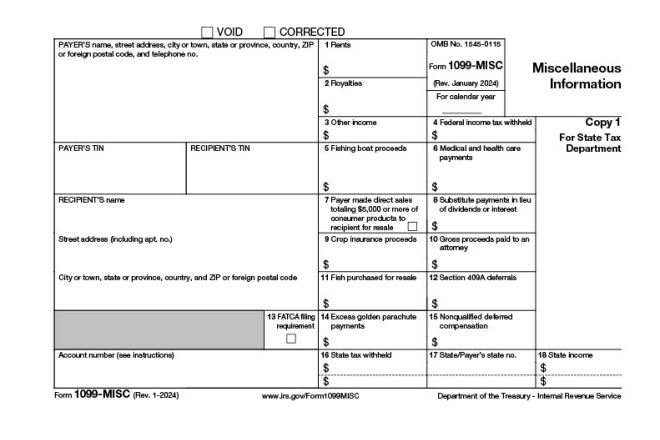

DownloadTax Form 1099-MISC

Form 1099-MISC is for reporting miscellaneous income paid to individuals who are not employees, such as rental income, prizes, or awards. This form must be filed if you received $600 or more during the tax year.

Ensuring that this form is included in your tax return helps you report all non-employee compensation and stay compliant with tax regulations.

Download

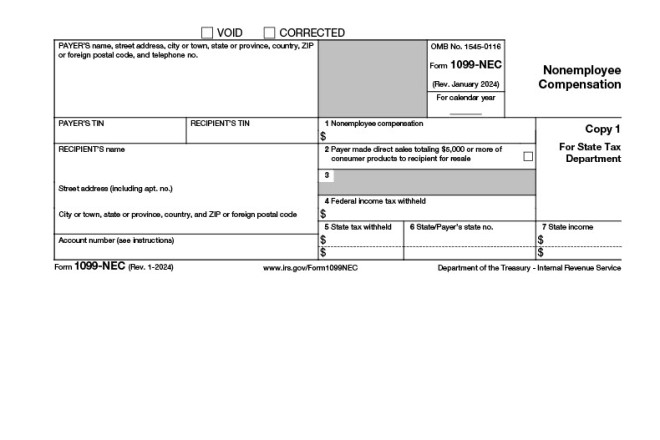

Tax Form 1099-NEC

Form 1099-NEC is specifically for reporting non-employee compensation. Independent contractors and freelancers who earned $600 or more should receive this form from their clients.

Accurate reporting of this income helps the IRS match the payer’s and recipient’s records, ensuring smooth tax processing and preventing potential issues with underreporting income.

Download